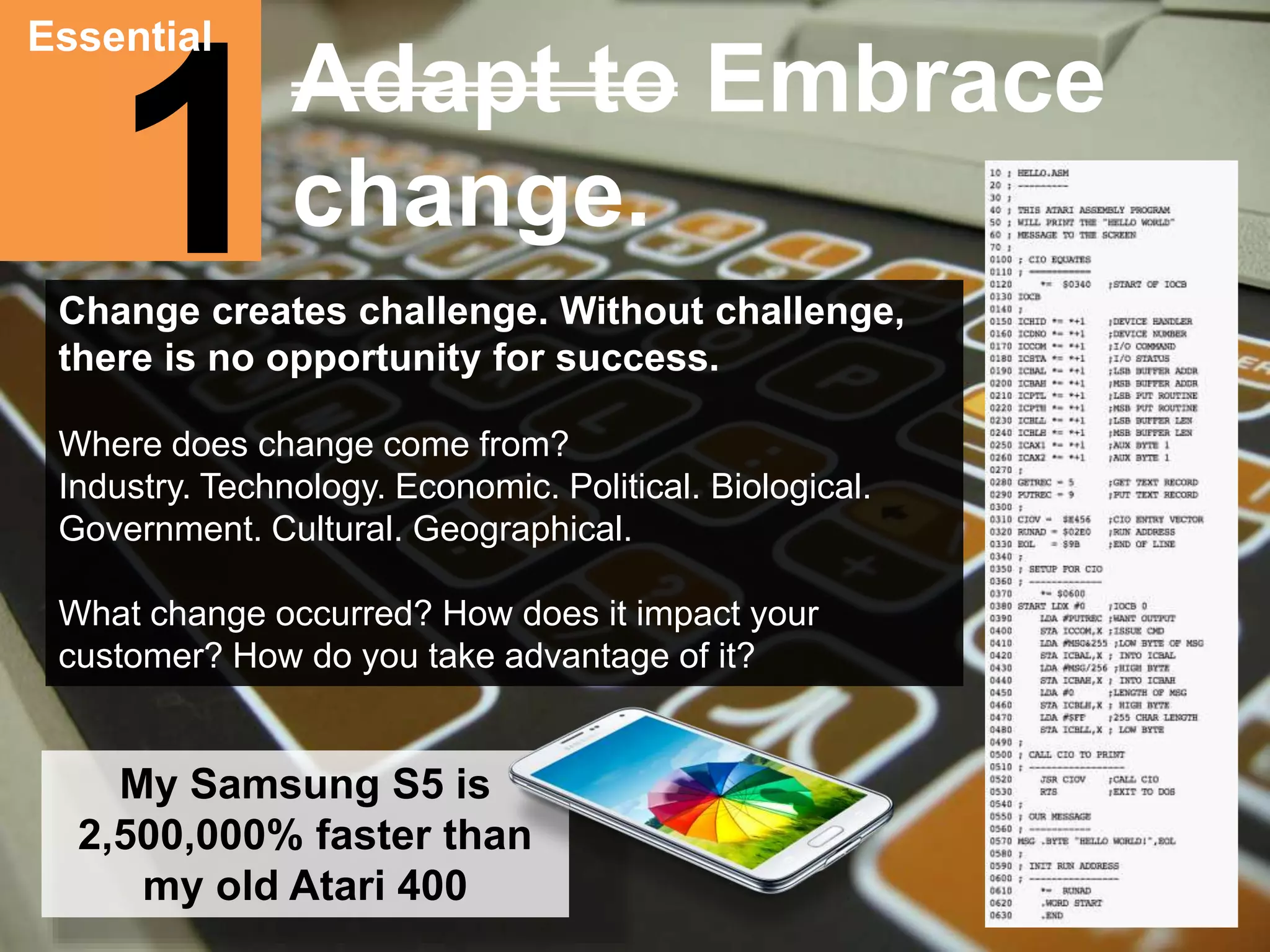

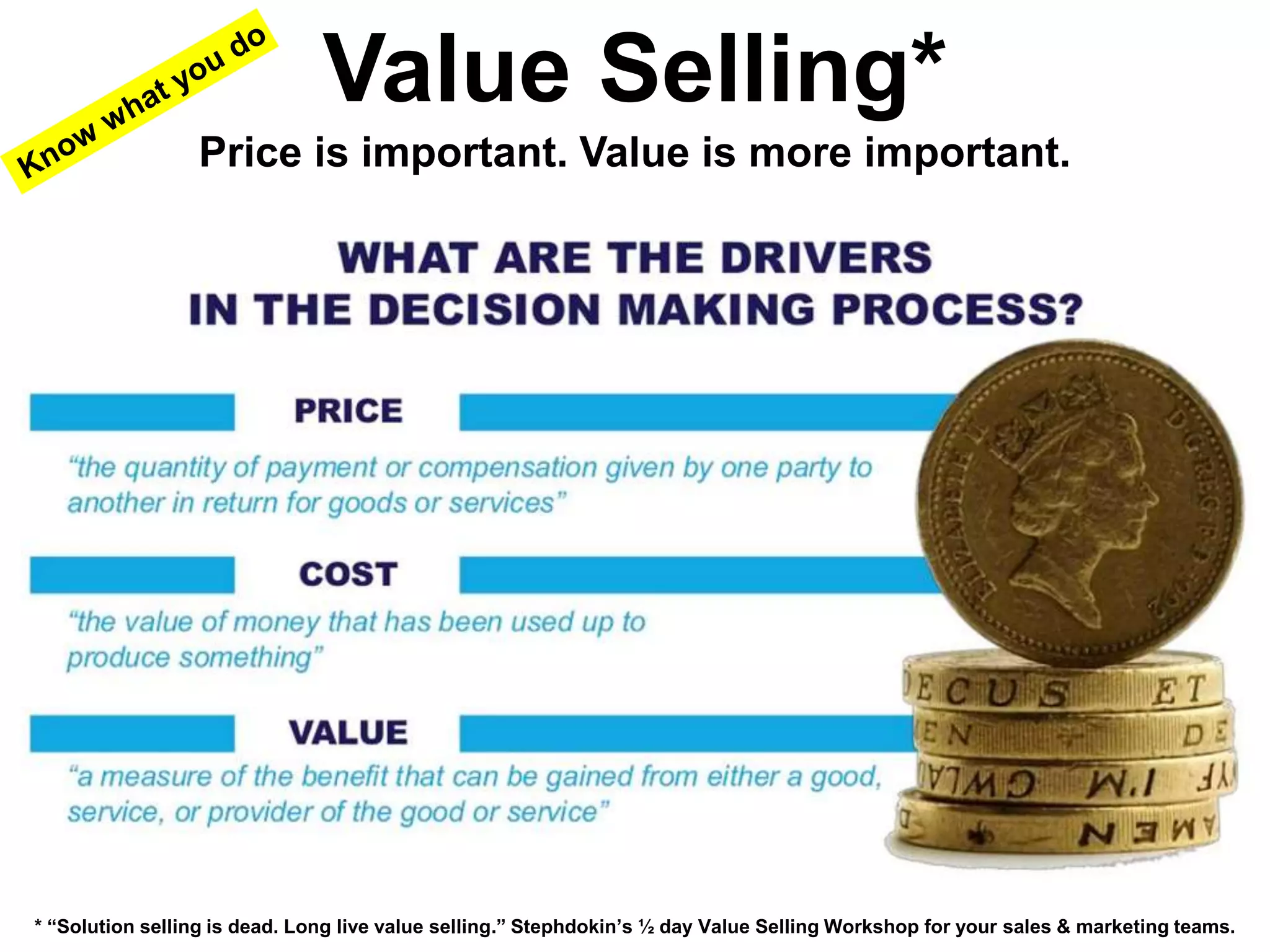

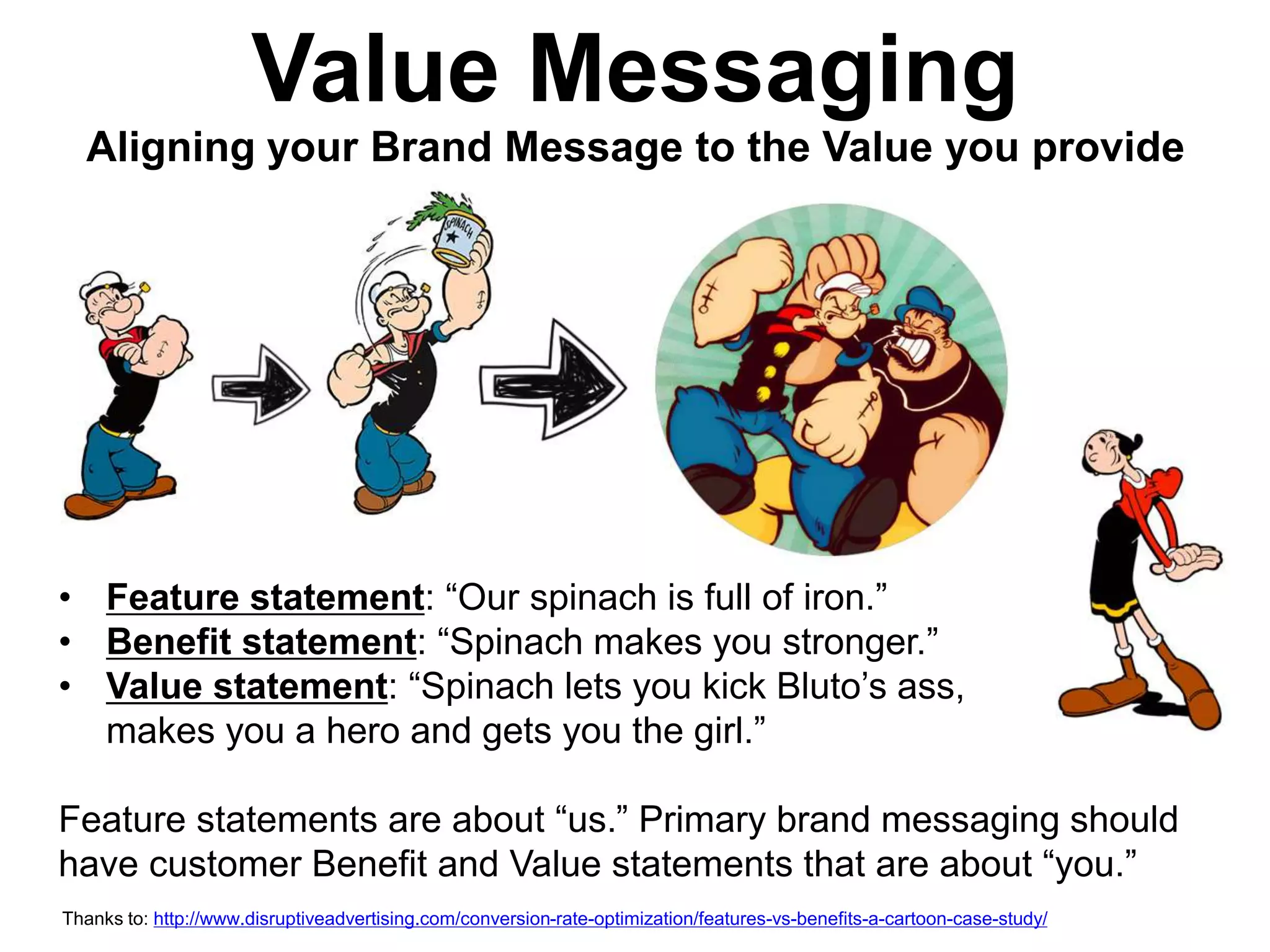

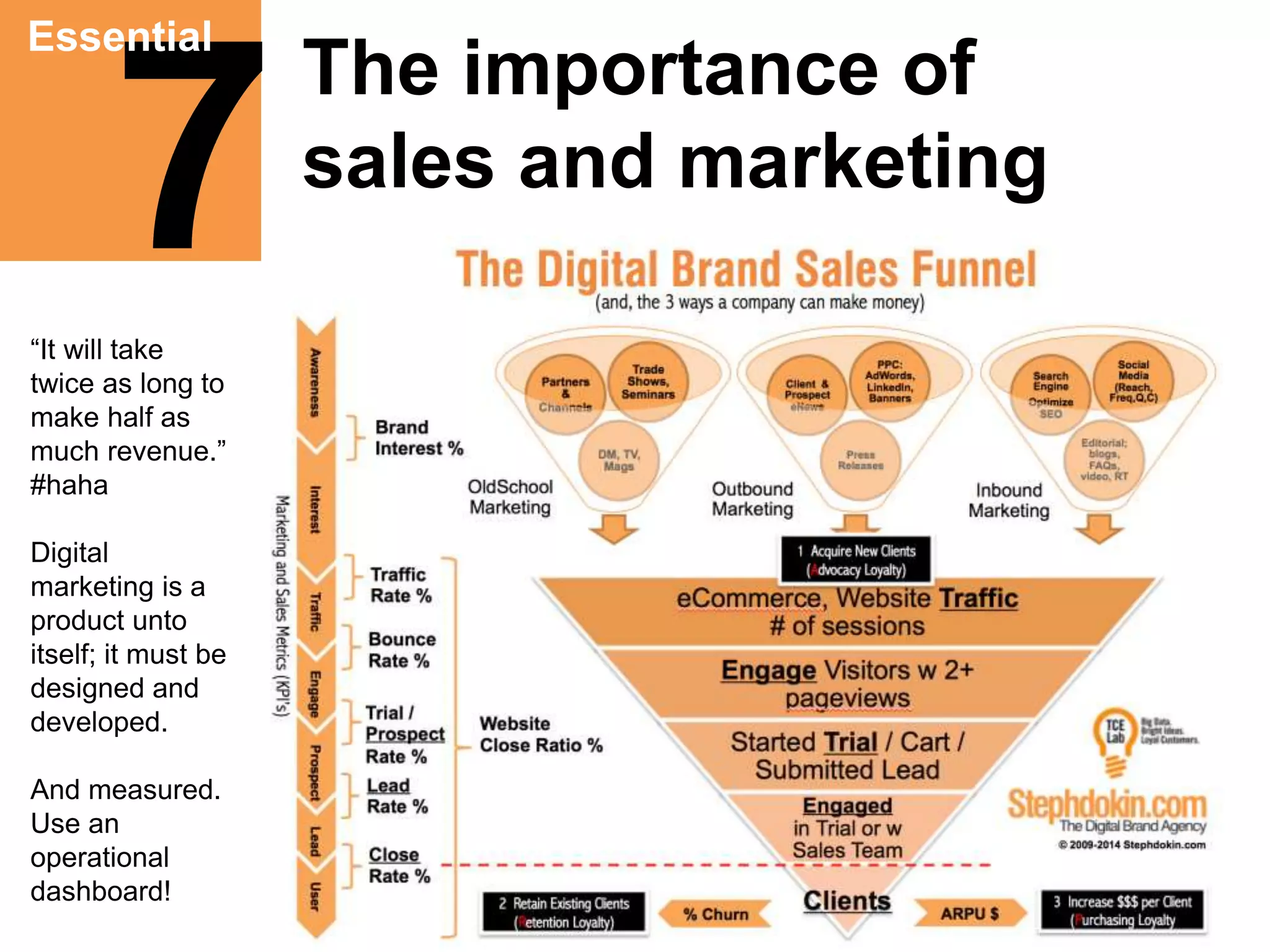

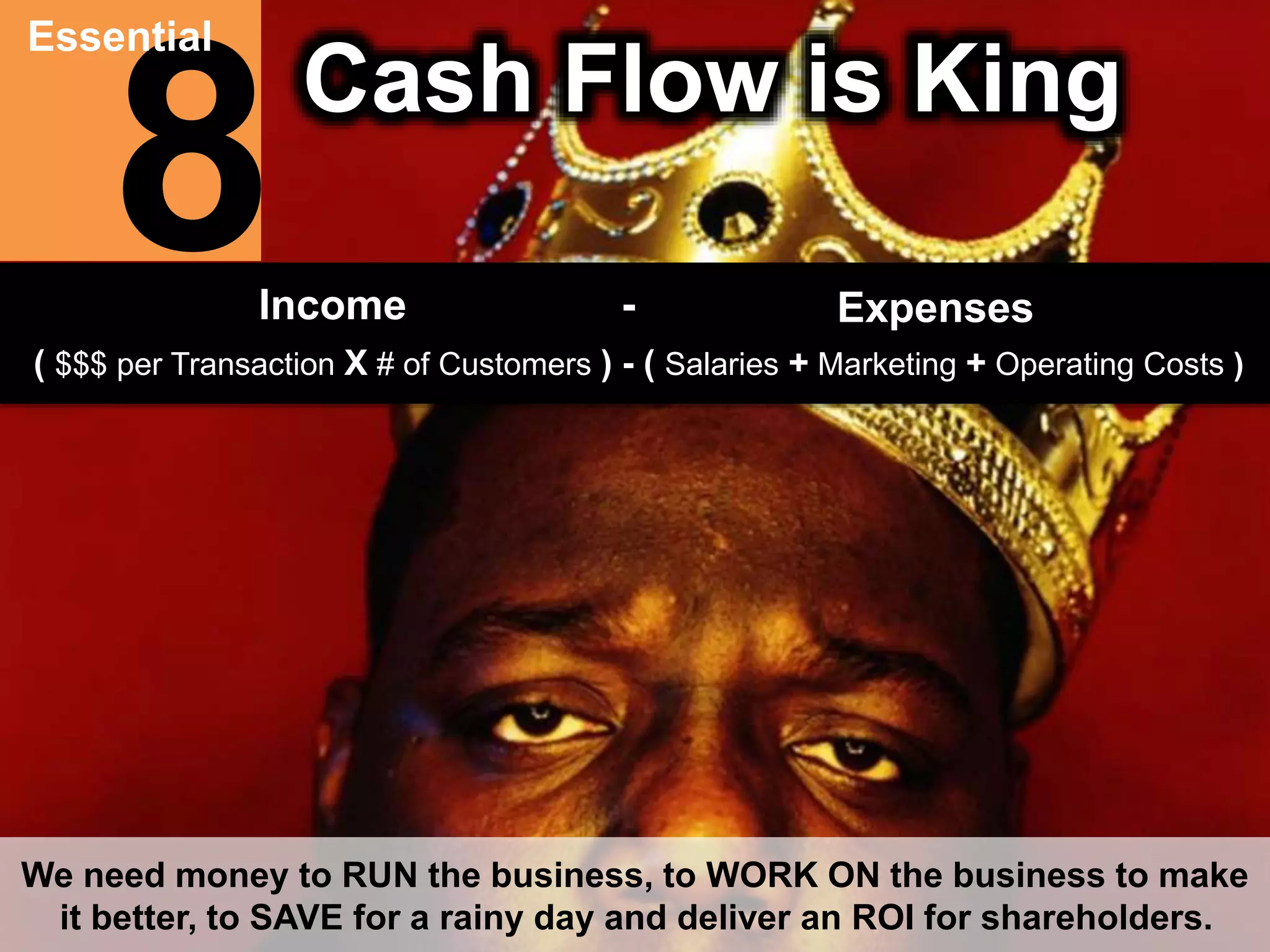

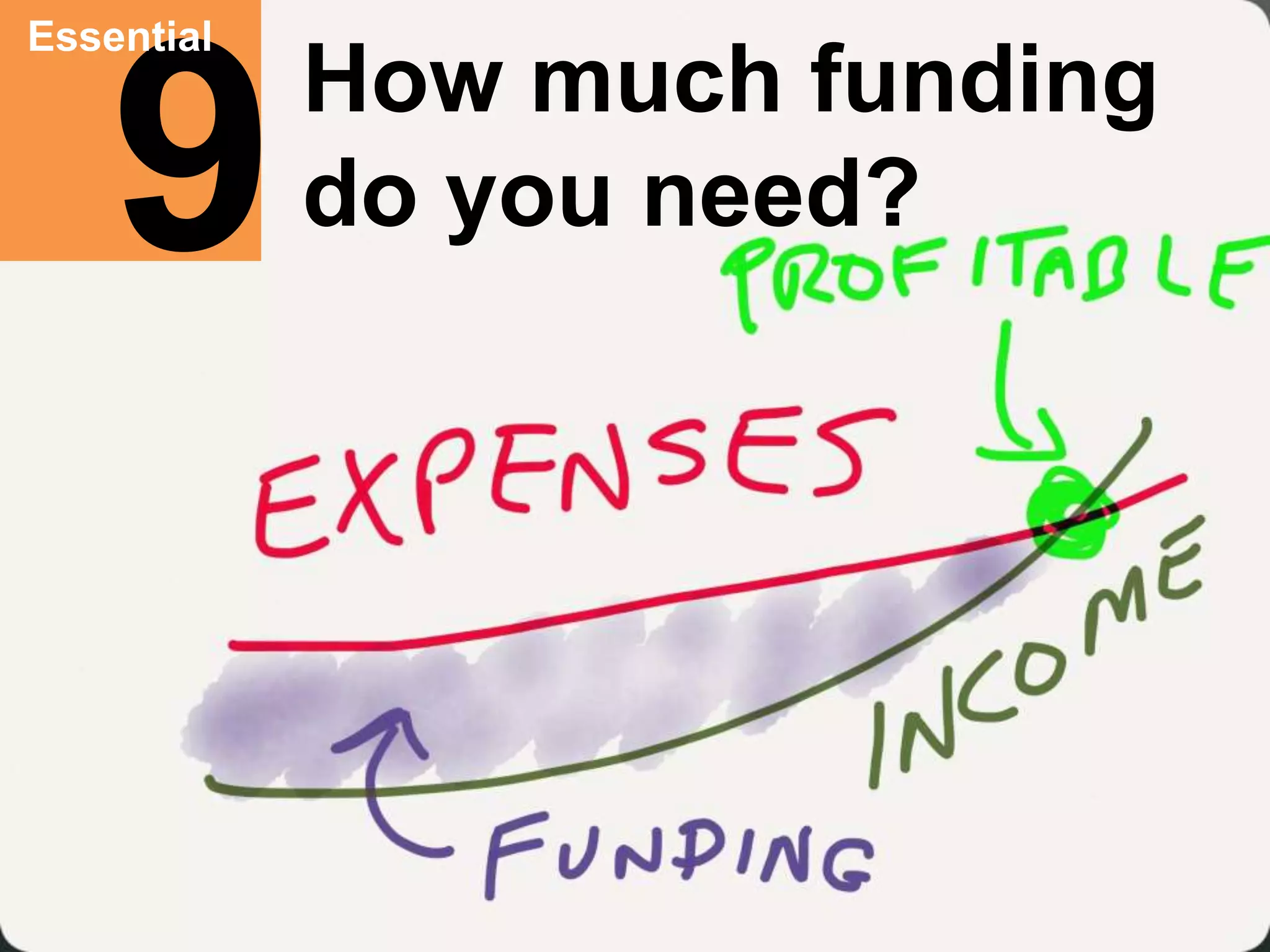

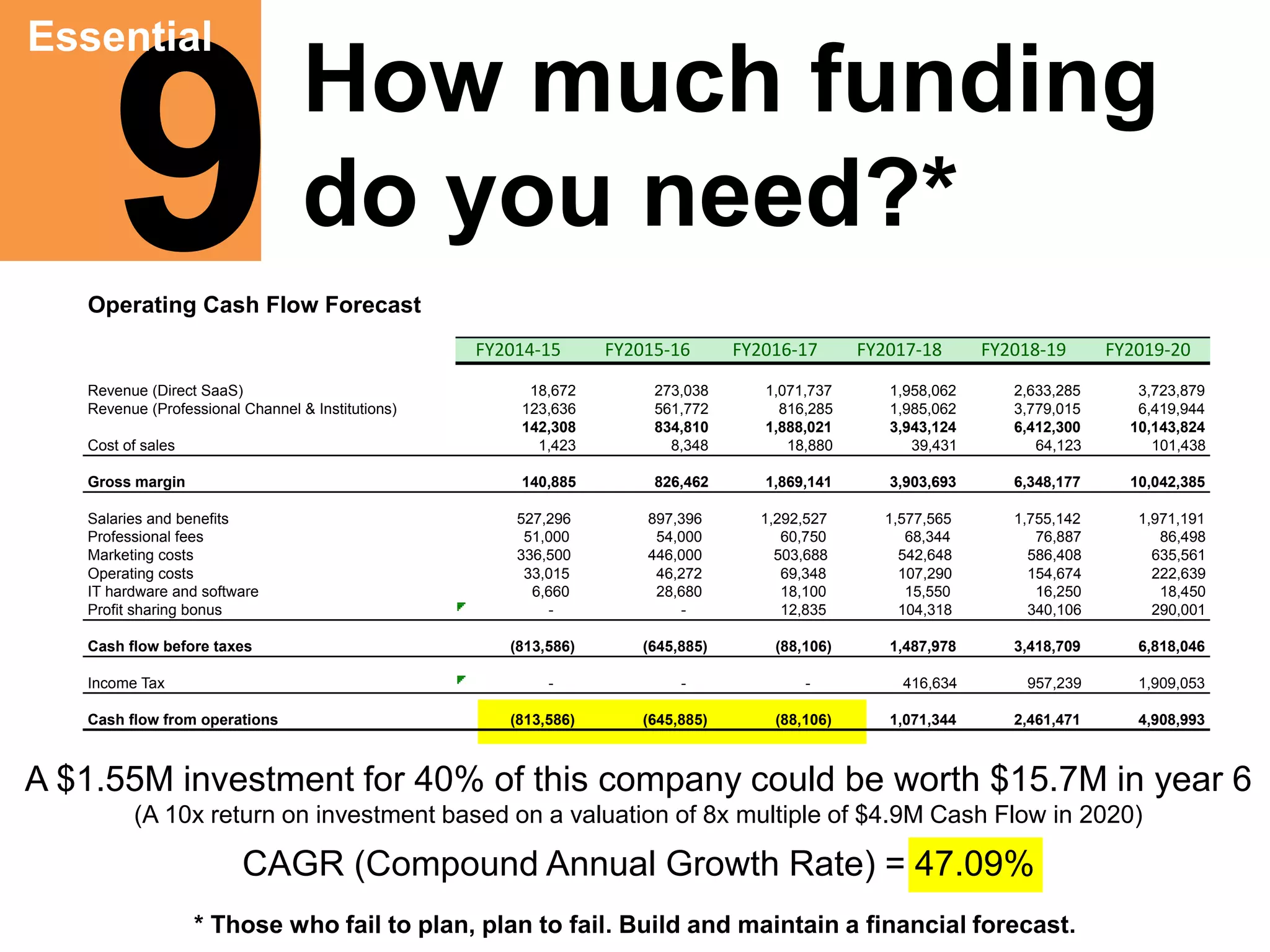

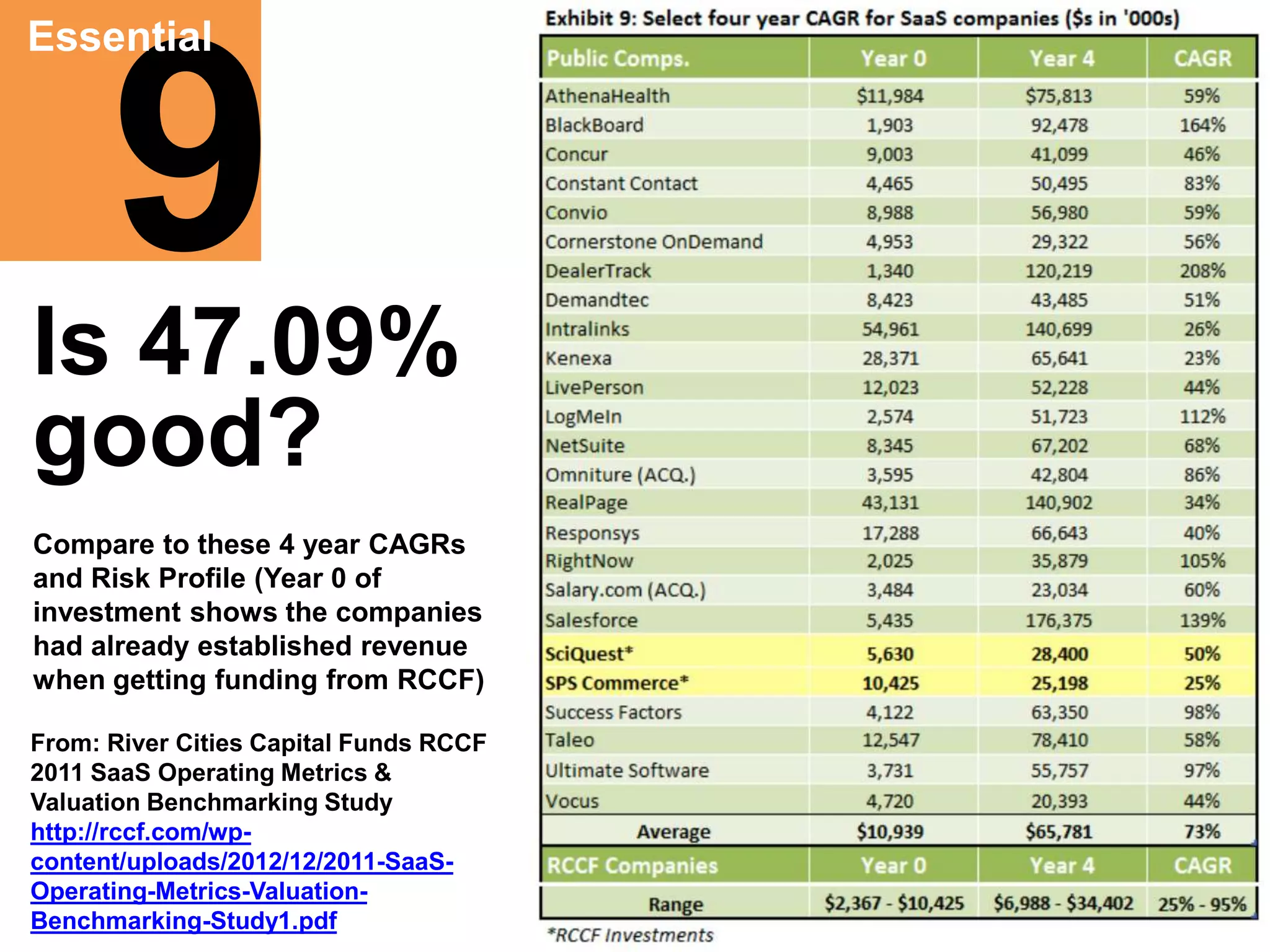

The document outlines eleven essential principles for fiscal excellence aimed at entrepreneurs, emphasizing the importance of adaptability, understanding customer needs, and the difference between value selling and traditional pricing. It also highlights critical financial management practices like cash flow awareness, proper funding strategies, and operational efficiency. The author, Stephen King, encourages entrepreneurship that focuses on generating revenue while maintaining compliance and effective accounting practices.