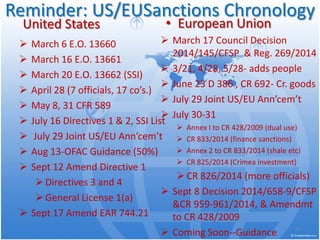

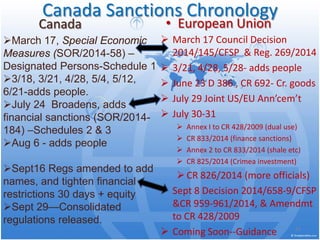

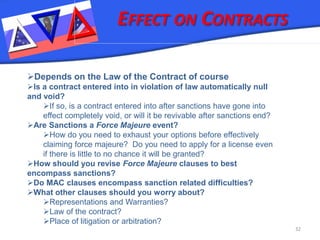

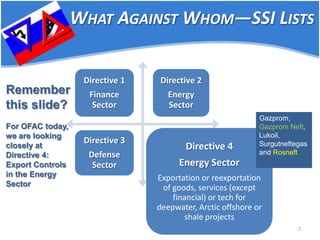

The document discusses various economic sanctions directives, particularly focusing on U.S. OFAC and BIS regulations concerning the export of goods and services related to energy sectors and military end uses involving Russia. It outlines the prohibitions on U.S. persons and entities against providing support for deepwater, arctic offshore, or shale oil projects that could potentially impact the Russian Federation's oil production capabilities. Additionally, it compares U.S. sanctions with those imposed by the EU, UK, Canada, Switzerland, Japan, and Australia, highlighting key differences and compliance requirements.

![3

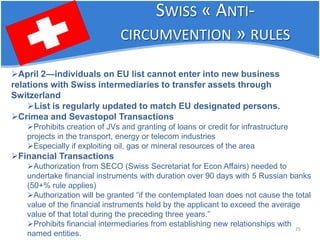

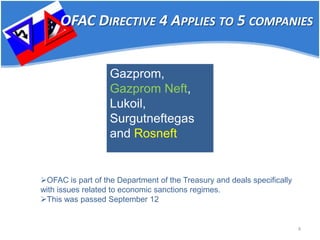

Directive 4 The following activities by a U.S. person or within the United States are prohibited except to the extent provided by law or unless licensed or otherwise authorized by [OFAC]: The provision, exportation or reexportation, directly or indirectly, of goods, services (except for financial services) or technology in support of exploration or production for deepwater, Arctic offshore or shale projects [hereinafter DWAOSP] that have the potential to produce oil in the [RF] or in the maritime area claimed by the [RF] and extending from its territory, and that involve any person deemed to be subject to this Directive, its property or its interests in property. [+ the usual evasion and conspiracy prohibitions]](https://image.slidesharecdn.com/economicsanctions-day3edited-141215041317-conversion-gate01/85/Part-3-Perfect-overview-on-economic-sanctions-US-EU-other-countries-3-320.jpg)

![BIS SIMILAR YET DIFFERENT 6

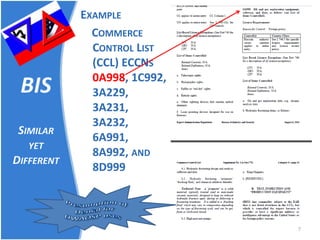

EAR 746.5 [A] license is required to export, reexport or transfer (in-country) any item subject to the EAR listed in Supplement No. 2 to this part and items specified in ECCNs 0A998, 1C992, 3A229, 3A231, 3A232, 6A991, 8A992, and 8D999 when you know that the item will be used directly or indirectly in exploration for, or production of, oil or gas in Russian deepwater (greater than 500 feet) or Arctic offshore locations or shale formations in Russia, or are unable to determine whether the item will be used in such projects.](https://image.slidesharecdn.com/economicsanctions-day3edited-141215041317-conversion-gate01/85/Part-3-Perfect-overview-on-economic-sanctions-US-EU-other-countries-6-320.jpg)

![13

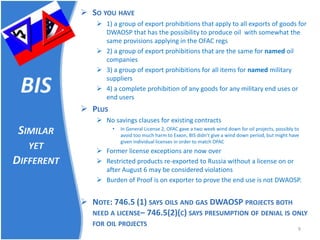

OFAC Directive 4 The following activities by a U.S. person or within the United States are prohibited except to the extent provided by law or unless licensed or otherwise authorized by [OFAC]: The provision, exportation or reexportation, directly or indirectly, of goods, services (except for financial services) or technology in support of exploration or production for deepwater, Arctic offshore or shale projects [DWAOSP] that have the potential to produce oil in the [RF] or in the maritime area claimed by the [RF] and extending from its territory, and that involve any person deemed to be subject to this Directive, its property or its interests in property. [+ the usual evasion and conspiracy prohibitions]

RECALL OFAC DIRECTIVE 4?](https://image.slidesharecdn.com/economicsanctions-day3edited-141215041317-conversion-gate01/85/Part-3-Perfect-overview-on-economic-sanctions-US-EU-other-countries-13-320.jpg)