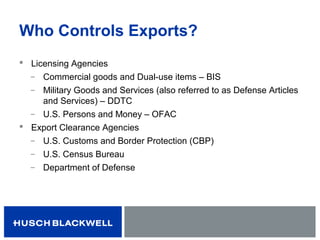

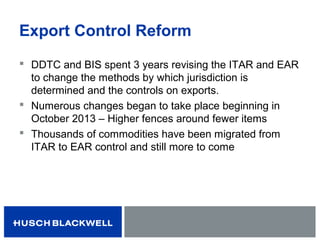

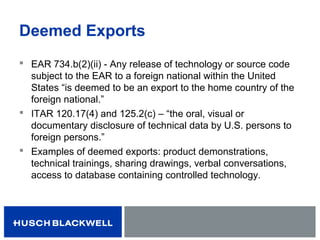

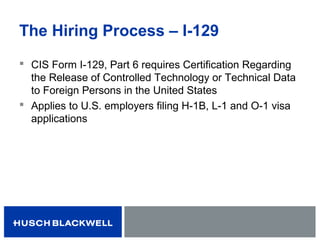

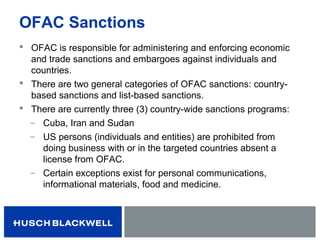

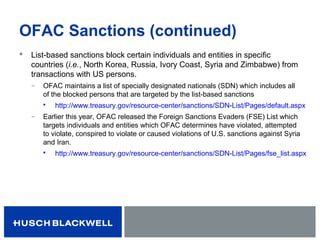

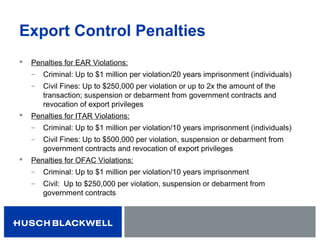

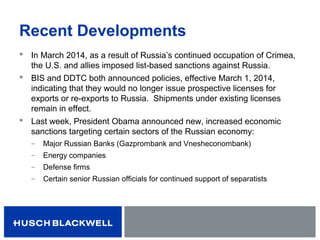

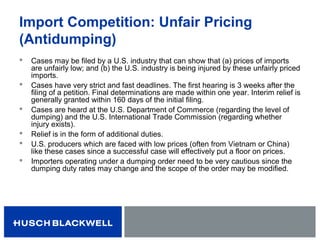

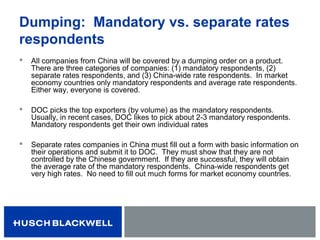

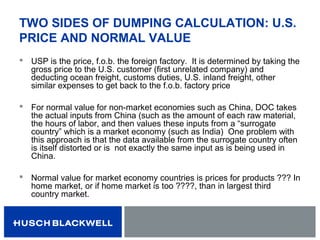

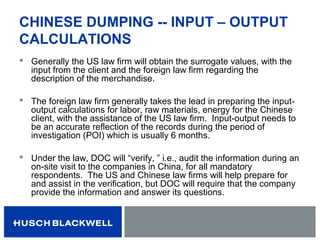

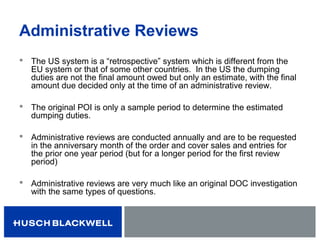

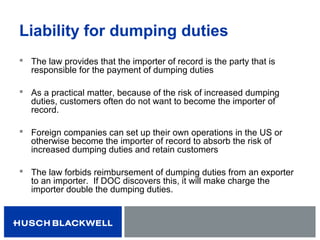

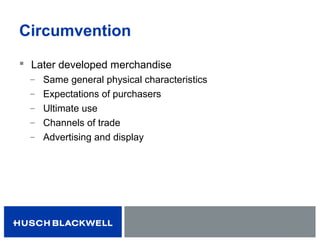

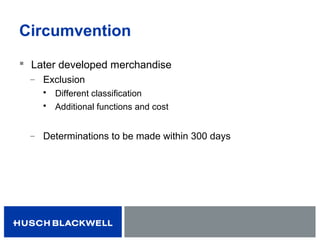

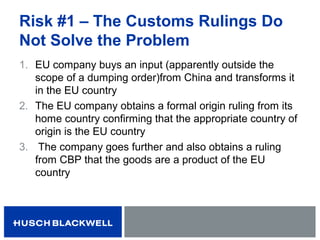

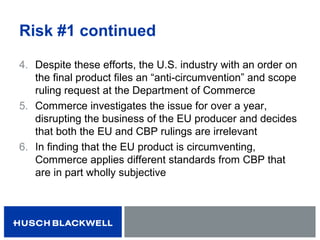

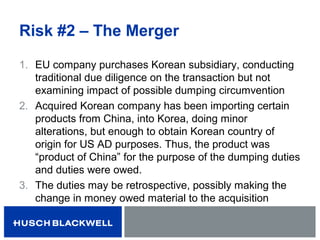

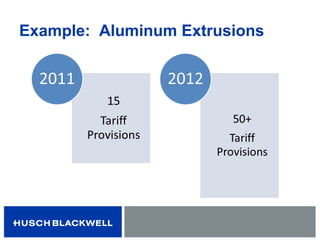

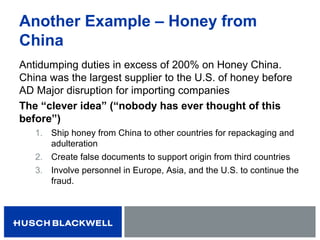

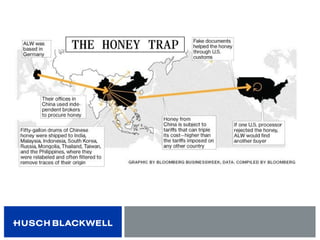

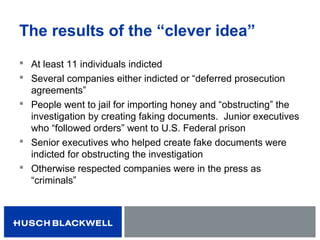

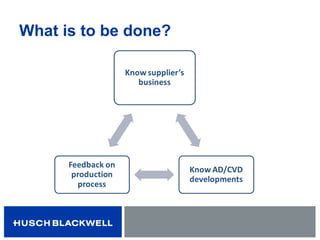

This document summarizes key aspects of international trade regulation and how it impacts supply chains. It covers areas such as export controls, trade remedies, intellectual property cases, and other provisions. It discusses the US agencies that regulate exports, export control regulations, what constitutes an export, reexport, deemed exports, and recent reforms. It also summarizes trade remedy cases on dumping, subsidies, and anti-circumvention efforts.