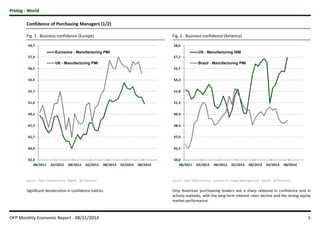

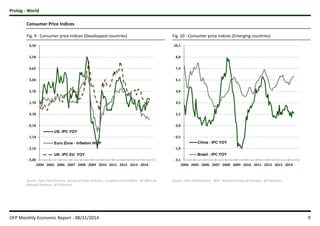

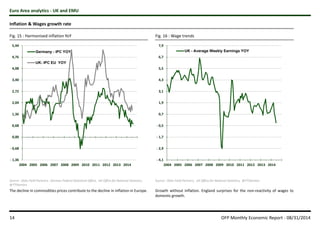

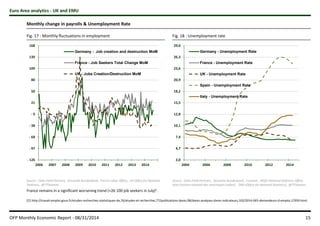

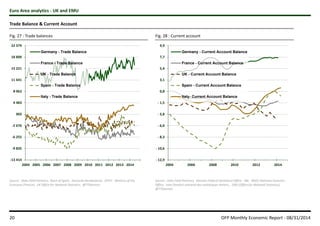

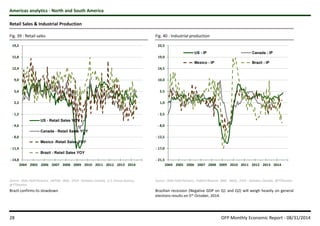

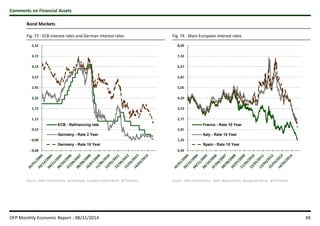

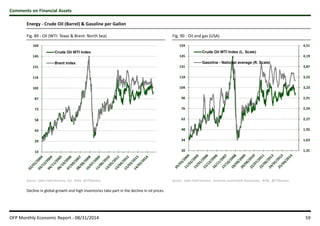

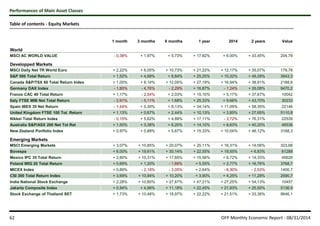

The August 2014 economic report highlights a slowdown in global growth, particularly in the eurozone and BRIC countries, with significant decreases in long-term interest rates and rising international political tensions. Unemployment is rising in France, while the U.S. sees an upward GDP revision, indicating some regional disparities in economic performance. Commodities prices have shifted, particularly oil, reflecting broader economic conditions and global inventory levels.