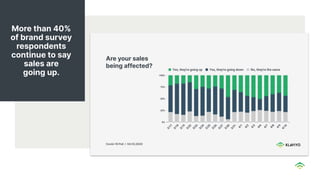

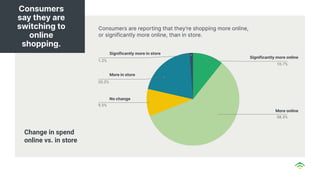

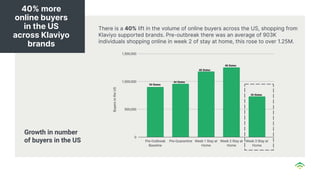

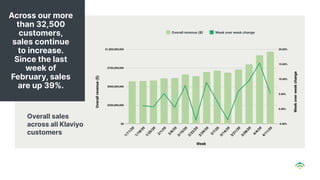

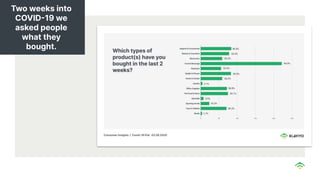

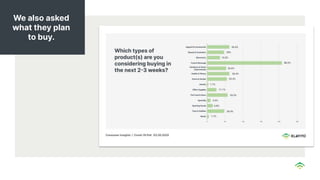

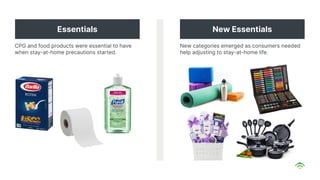

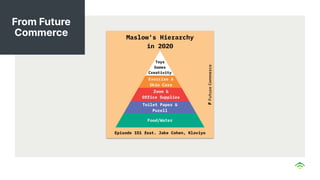

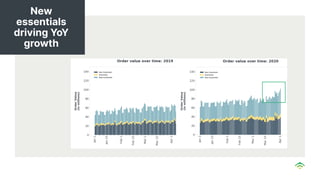

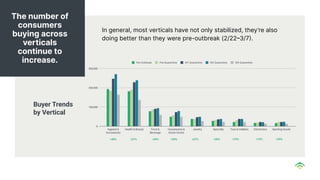

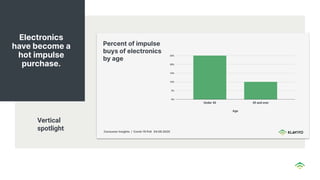

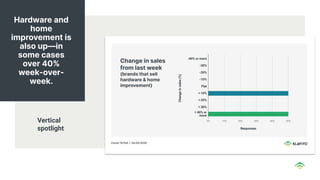

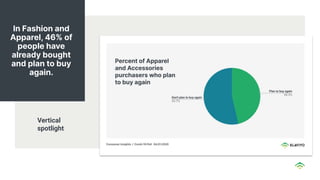

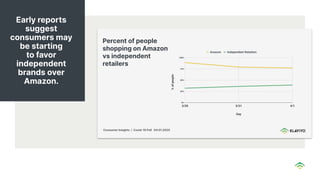

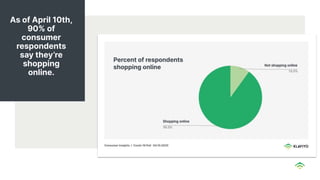

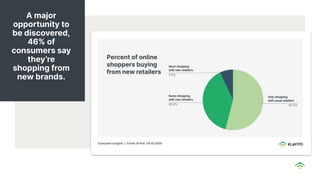

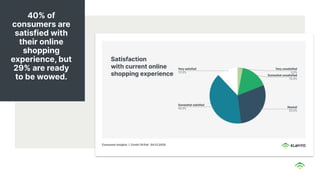

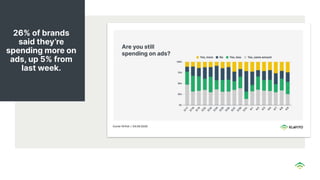

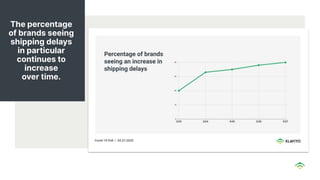

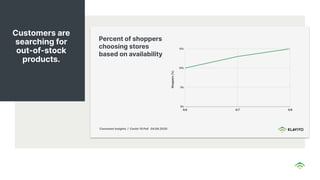

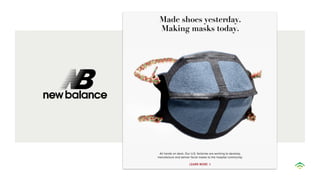

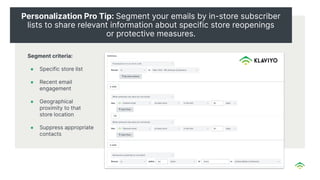

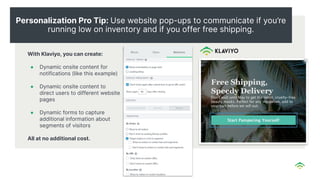

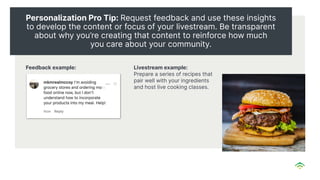

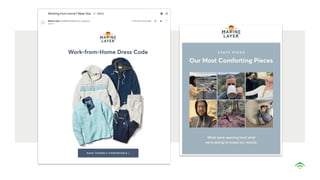

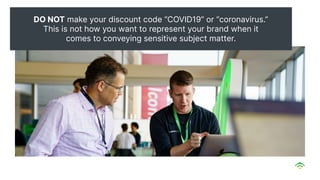

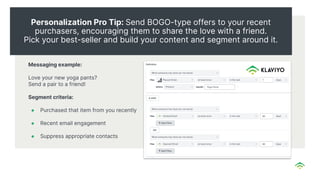

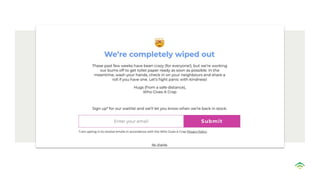

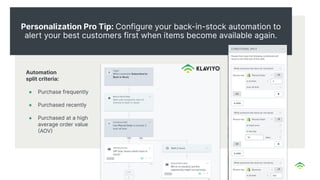

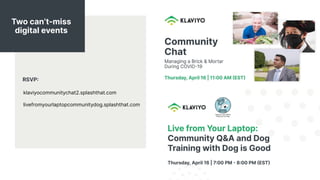

The document discusses the changes in consumer behavior and trends in ecommerce during the COVID-19 pandemic, highlighting a shift towards online shopping and the emergence of new essential categories. It notes that while some brands experience record sales, issues like supply chain delays remain a concern. Recommendations for brands include adapting marketing strategies, communicating transparently, and leveraging community engagement to navigate the new normal.