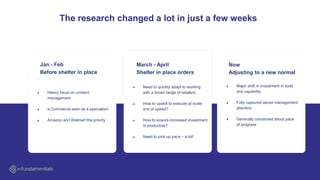

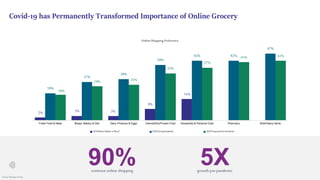

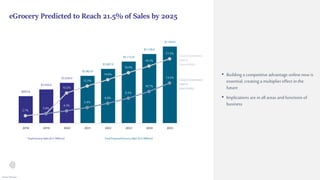

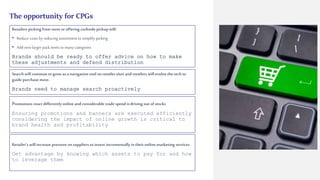

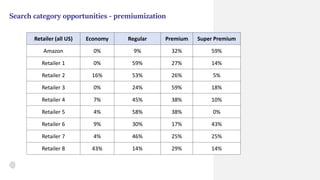

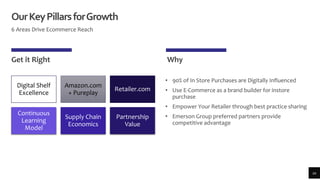

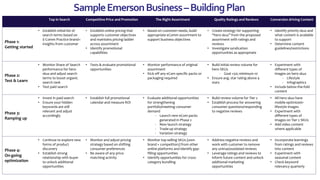

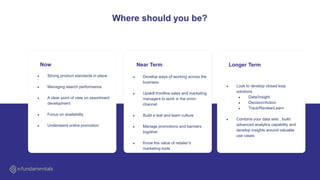

The Emerson Group's webinar highlights significant shifts in consumer packaged goods (CPG) strategies and e-commerce dynamics during and post-COVID-19, emphasizing the need for brands to adapt quickly to digital retail landscapes. It underscores the increasing importance of online grocery shopping, projected to reach 21.5% of sales by 2025, and the necessity for brands to manage search and promotions efficiently in an evolving market. Additionally, effective collaboration with retailers and leveraging data insights are essential for driving profitable growth in the competitive e-commerce environment.