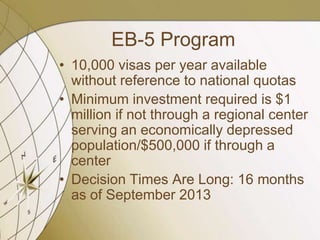

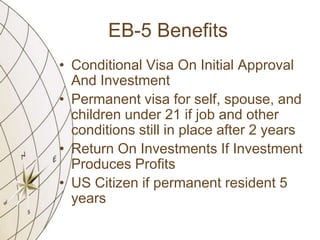

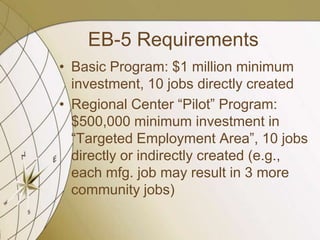

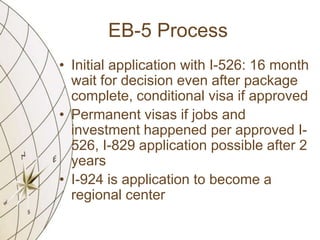

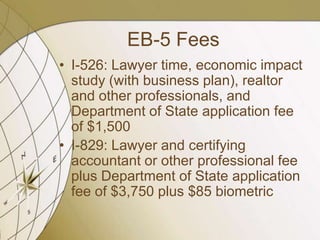

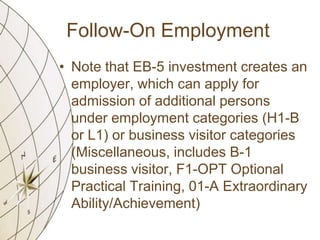

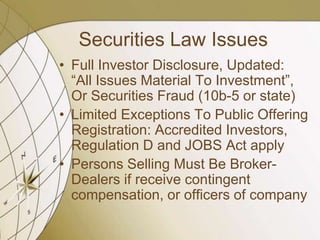

The EB-5 program allows for 10,000 visas annually, requiring a minimum investment of $1 million or $500,000 through a regional center for targeted employment areas. It provides a pathway to permanent residency for investors and their immediate family after two years if job creation conditions are met. The document outlines EB-5 application procedures, legal obligations including securities laws, and potential pitfalls such as deceptive promoters.