This document summarizes various regulations that financial firms and contractors must follow regarding political contributions:

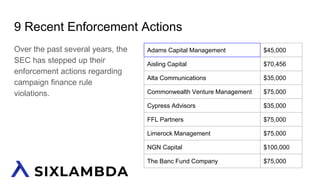

- The SEC, FINRA, MSRB, and CFTC all have rules that limit or prohibit political contributions from regulated entities to officials who control government funds to prevent pay-to-play practices.

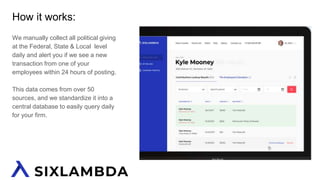

- Firms must have compliance programs to monitor employees' contributions and prevent violations, but manually searching donation records can be time-consuming.

- Six Lambda's tools automatically scrape contribution data daily from 50+ sources to identify any new donations from an employee that would violate rules, alerting firms within 24 hours.

- They currently serve large asset managers, private equity firms, and politically active companies to help safeguard them