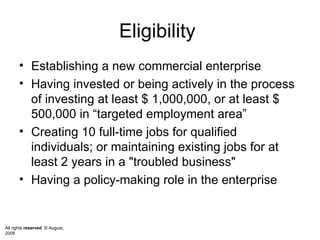

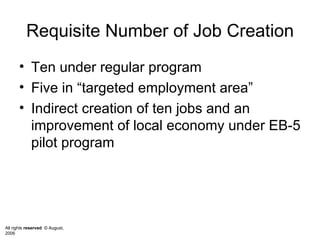

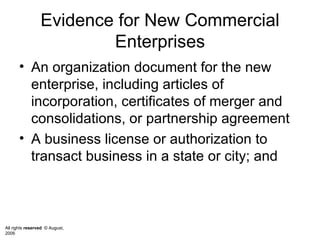

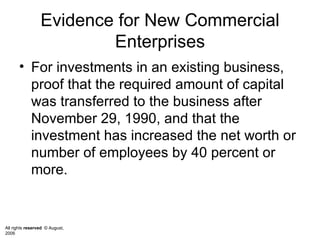

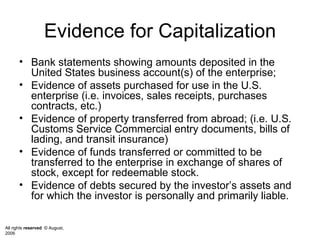

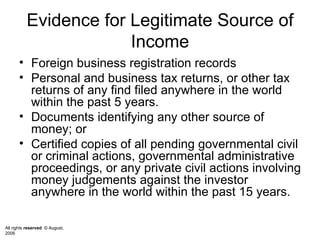

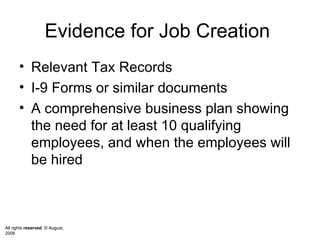

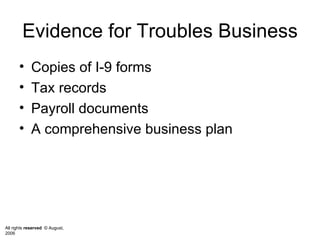

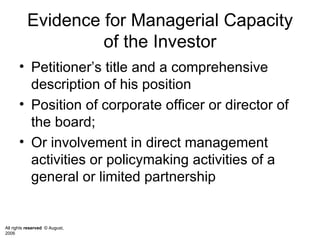

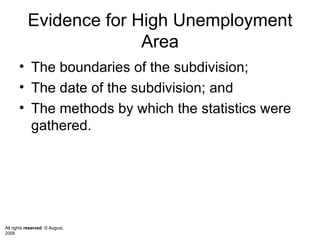

This document summarizes visa options for foreign investors in the United States, including the E-2 visa for treaty investors and immigrant visas for investors investing $1 million or more. It outlines the requirements for these visas such as investment amount, business ownership percentage, and job creation. It also provides details on evidencing the legitimate source of investment funds, capitalization of the business, and managerial control as required by the applications.