The document discusses the globalization of soccer, highlighting Arsenal's record of fielding a team with players from 11 nationalities. It outlines a game-theoretic model exploring player migration and the financial implications of buying foreign versus local players, along with analyzing win-maximization versus profit-maximization in European and US sports contexts. The findings suggest that while clubs may prefer foreign players for income generation, other factors, such as club wealth and regional differences, impact player acquisition strategies.

![Not a very revolutionary result…

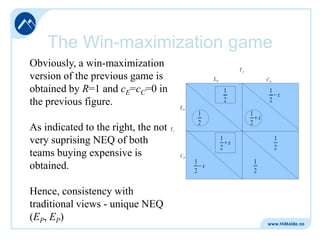

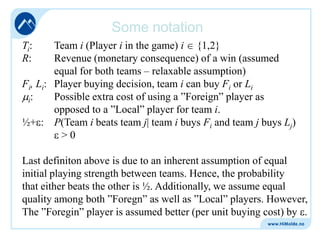

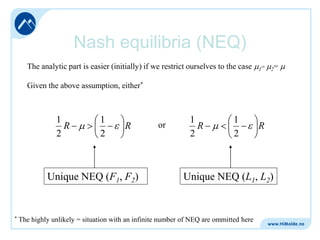

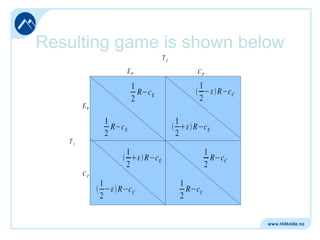

Some (ridiculously) simple algebra:

1

R

2

1

2

R

R

or in plain english: If the expected marginal revenue gain by choosing a

”Foreign player” (εR) is larger than the marginal extra cost (μ), then both

teams choose the ”Foreign Player” in equilibrium.

Note however, that the R-values are typically very big (CL-premium). So

a relatively small ε may lead to significant εR-values that may superseed

most μ-values.

Note also the inherent Prisoner’s Dilemma structure [both teams would

actually prefer the (L1, L2) outcome given coordination possibilities].](https://image.slidesharecdn.com/easm-2008-131112021423-phpapp01/85/Easm-2008-10-320.jpg)

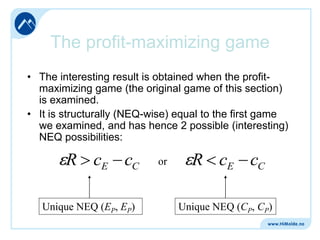

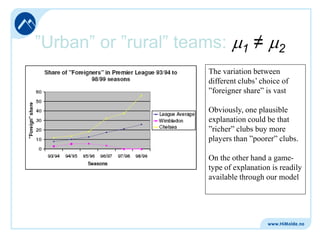

![”Urban” or ”rural” teams

It is perhaps not unlikely that making a brazilian player perform

(happily) in say Barcelona – Spain, is easier (and cheaper) than

say Tromsø Norway

The consequence is: (modelwise)

Tromsø

Barcelona

It is (relatively) straightforward to show [algebra omitted here]

That if:

P

{1,2}

i

j i, j

Then ”pooling” or ”separating” NEQs exist.](https://image.slidesharecdn.com/easm-2008-131112021423-phpapp01/85/Easm-2008-12-320.jpg)

![Profit vs. Win-maximization

• Some (sports economic) authors [Késenne among

others] claim objective funtion differences between

US and European sports.

• Some say that US sports producers maximise profits

while European sports producers (at least to a

greater extent) maximise the probability of winning.

• If this is correct, one should expect larger

financial/economic problems in European compared

to US sports.

• This kind of problem can be easily analyzed at micro

level through the modelling framework we apply.](https://image.slidesharecdn.com/easm-2008-131112021423-phpapp01/85/Easm-2008-16-320.jpg)