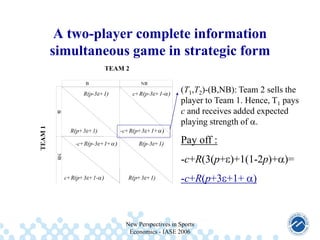

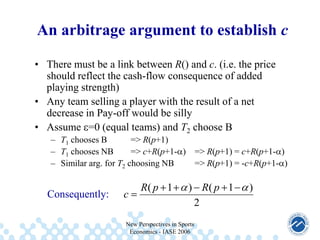

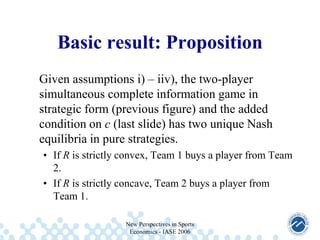

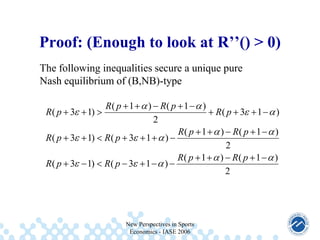

This document presents an economic model of player trades between two sports teams (T1 and T2) using a game theoretic approach. It assumes the teams are marginally different in playing strength and must simultaneously decide whether to buy the other team's player. The model finds there are two Nash equilibria - if revenue from points scored is convex, T1 buys from T2, and if revenue is concave, T2 buys from T1. This preserves competition given revenue is typically assumed to be concave. Further work could expand the model to include more teams, a league structure, incomplete information, or apply it to other labor markets.

![A two-player simultaneous game: Assumptions

i.

ii.

iii.

iv.

v.

vi.

vii.

2 teams (T1, T2) engaged in a future match, each team has put up one

(“identical”) player for sale at a fixed price c.

Marginally different playing strengths - T1 slightly “better” than T2

(meaning [P(Win), P(Loose), P(Draw)]=[p+ , p- , 1-2p] for T1 , > 0)

Actions for each team, buy the player (B) or not buy (NB)

Buying decisions made simultaneously (or without information on other

teams buying decision)

Teams maximize Pay off (defined below). A parameter (assumed small)

increases (or decreases) expected point score conditioned on the buying

decision. Expected point score calculated by a 3-1-0 award system

A revenue function R(expected point score) is present converting playing

strength to cash flow (i.e Pay off = cash flow + R(expected point score)

R’’() is either > 0 or < 0, and all information above is known by both

teams. (A game of complete information)

New Perspectives in Sports

Economics - IASE 2006](https://image.slidesharecdn.com/iase-2006-131112021436-phpapp02/85/Iase-2006-4-320.jpg)

![A little trick to move on….

A linear Taylor expansion: R(x

and some algebra yields:

)

R(x)

0

[ R' ( p 1 3 ) R' ( p 1)]

0

[ R' ( p 1 3 ) R' ( p 1)]

0

R’(x)

[ R' ( p 1) R' ( p 1 3 )]

If R’’> 0, these inequalities are satisfied (QED)

New Perspectives in Sports

Economics - IASE 2006](https://image.slidesharecdn.com/iase-2006-131112021436-phpapp02/85/Iase-2006-9-320.jpg)