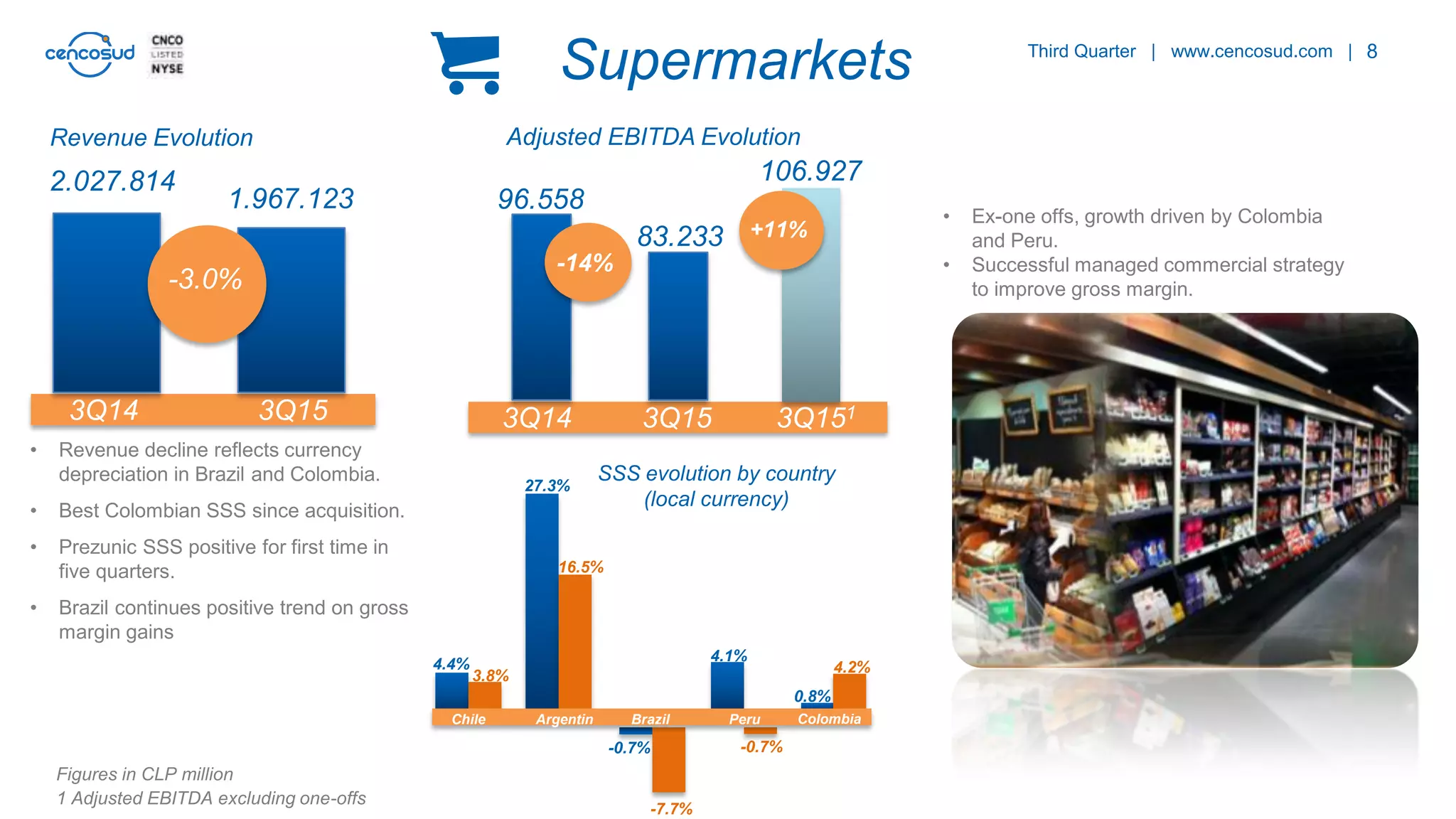

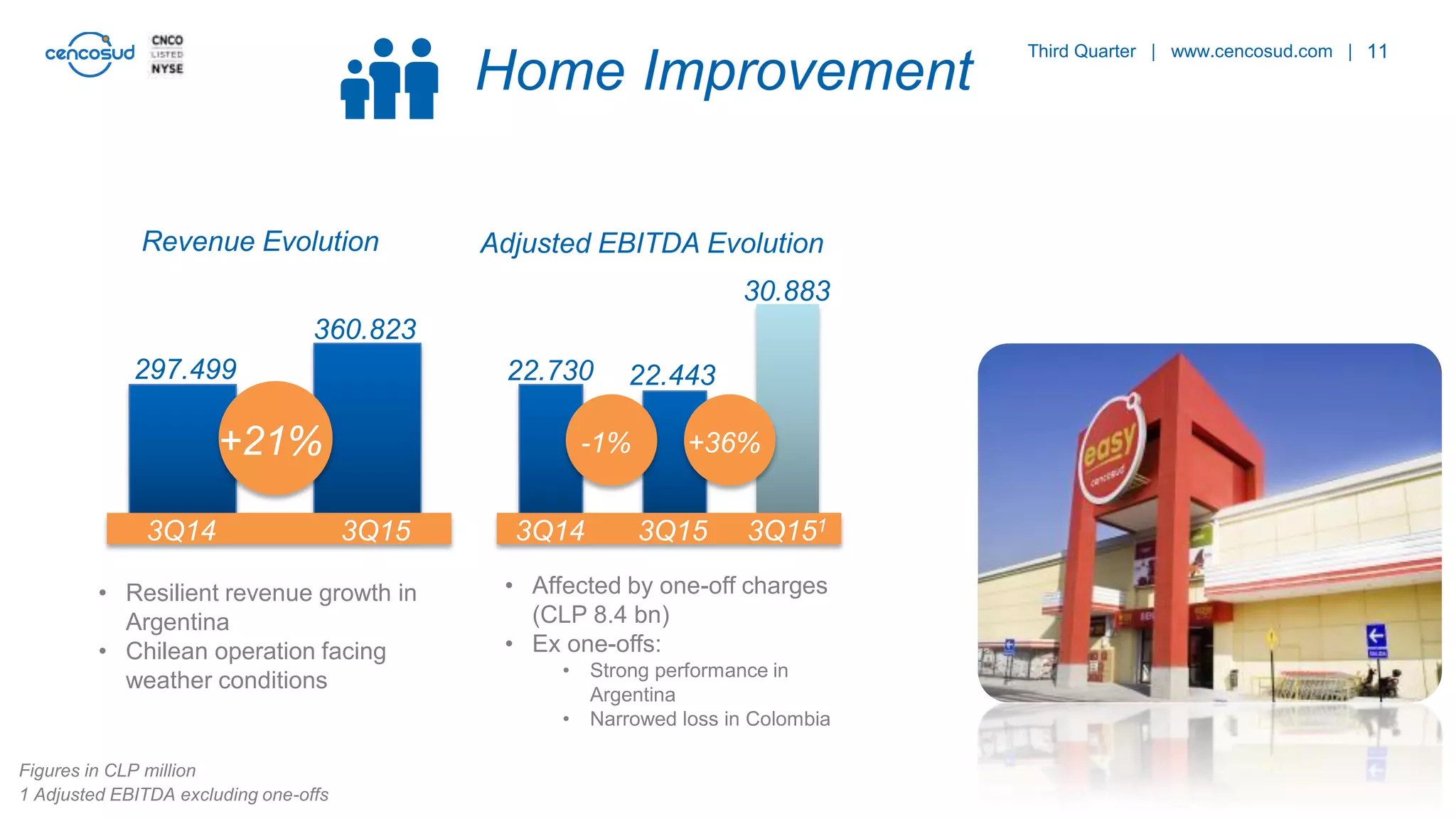

Cencosud reported financial results for the third quarter of 2015. While revenue growth was modest due to currency depreciation, most businesses saw positive same-store sales growth in local currencies. Adjusted EBITDA increased year-over-year excluding one-time severance and inventory charges totaling $49 million. The company is adjusting its asset base to focus on core retail operations and improving margins through cost controls and inventory management. Cencosud is also considering an IPO of its shopping center business and selling non-core assets in Colombia.