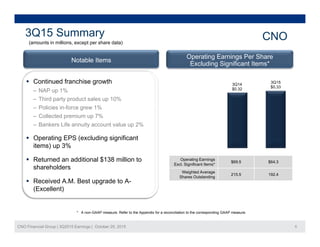

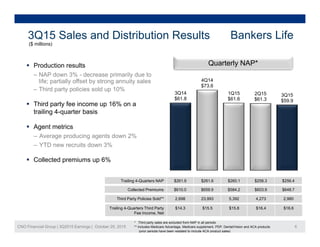

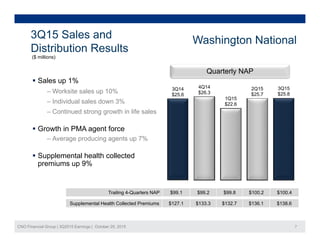

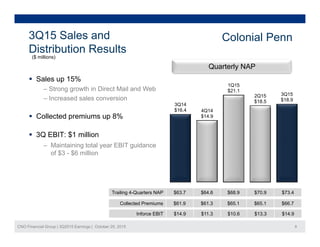

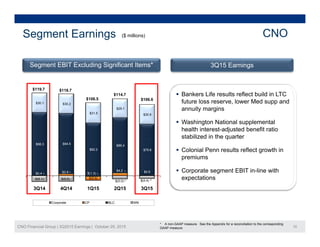

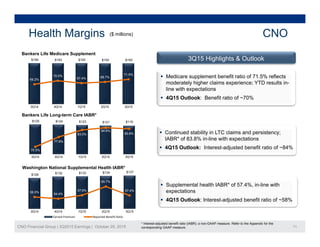

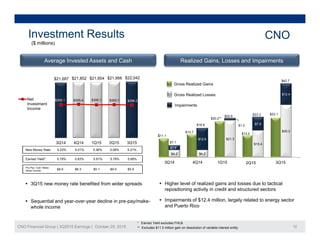

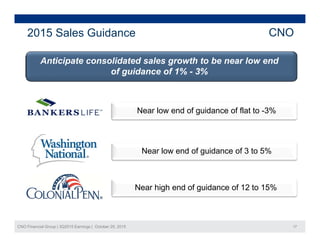

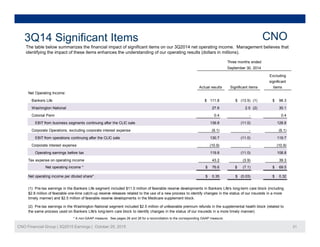

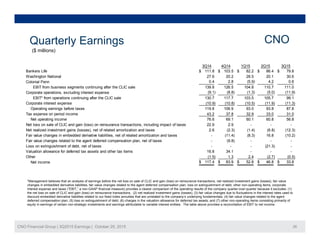

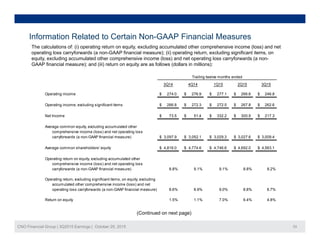

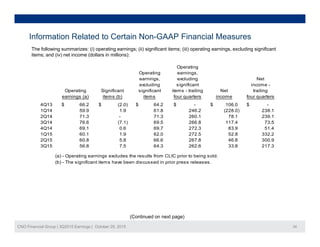

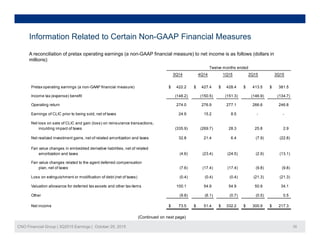

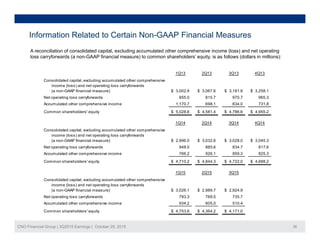

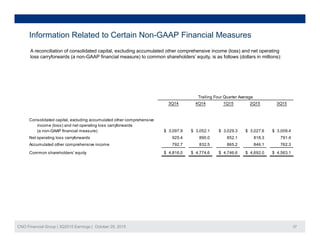

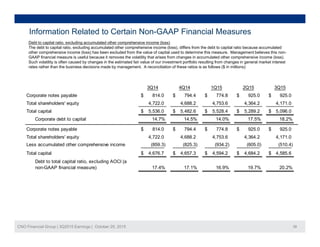

- CNO Financial Group reported financial and operating results for Q3 2015 with comparisons to Q3 2014. Key highlights included continued growth in new annualized premiums and third party product sales, as well as increased collected premiums and annuity account values. Operating EPS excluding significant items increased 3% to $0.33 per share. Capital levels remained strong with a risk-based capital ratio of 440% and leverage ratio of 20.2%.