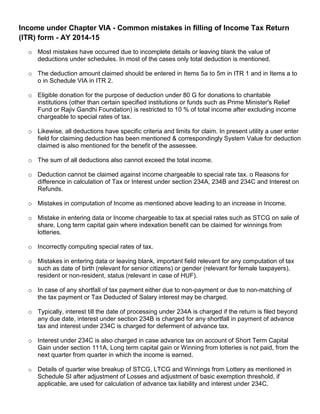

The document discusses common mistakes made in filing income tax returns in India for the 2014-15 assessment year. Some key mistakes include leaving deductions blank without providing amounts, incorrectly claiming deductions by not meeting criteria or limits, and exceeding the total income amount with deductions. Mistakes can also occur from incorrectly computing income subject to special tax rates like capital gains. Providing inaccurate personal details like date of birth or gender can also impact tax computations. Failure to fully pay taxes due by the due date or having a shortfall in advance tax payments can result in interest charges under various sections.