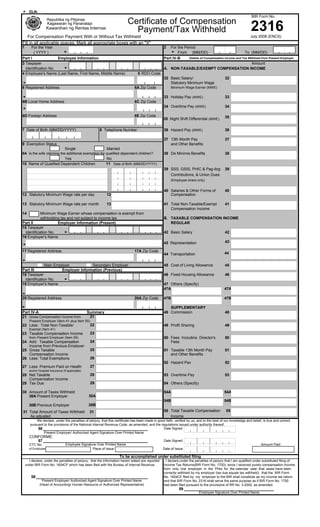

This document is a Certificate of Compensation from the Philippine Department of Finance for an employee. It contains information about the employee such as name, address, tax ID number, employer details, compensation income from the employer which is categorized as taxable and non-taxable, exemptions, taxes withheld, and signatures of the employer and employee to certify the accuracy of the compensation details.