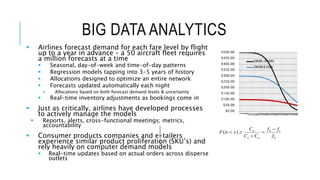

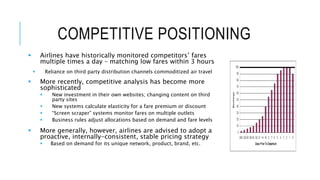

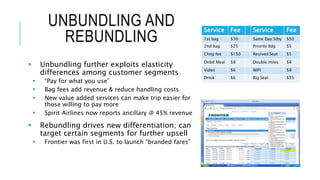

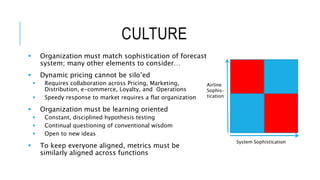

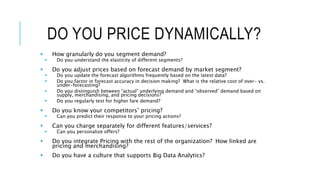

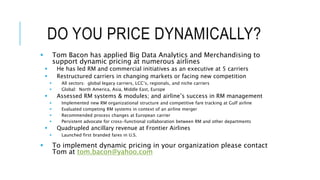

Dynamic pricing is practiced across industries to personalize prices based on customer data analytics. Pioneered by airlines in the 1980s as revenue management, it involves segmenting customers, adjusting prices based on demand forecasts, and unbundling/rebundling services. Tom Bacon has applied these techniques at several airlines, leading to increased ancillary revenue and competitive fare positioning through integrated pricing, merchandising, and operations.