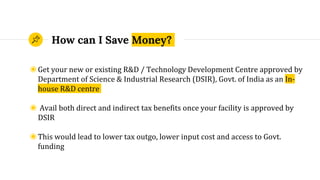

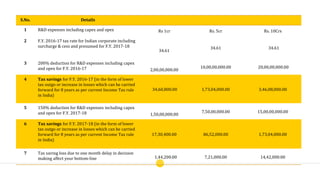

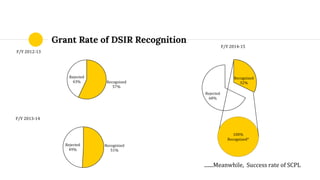

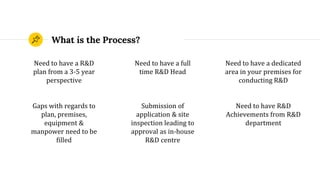

The document provides information about how a company called Scinnovation can help businesses get their research and development centers approved and recognized by the Department of Science and Industrial Research (DSIR) in India, which would provide direct tax benefits like increased tax deductions for R&D expenses as well as indirect tax benefits and access to government funding opportunities. Scinnovation offers a turnkey solution to help companies navigate the application and approval process to receive these benefits with a high success rate.