DLF Q1FY15: Buy for a a target of Rs252

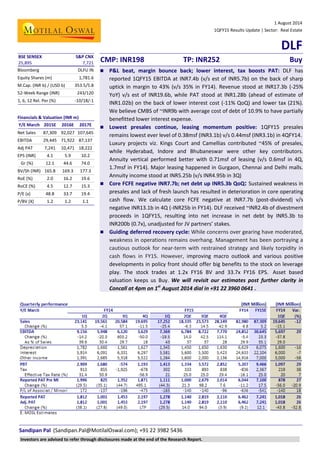

- 1. 1 August 2014 1QFY15 Results Update | Sector: Real Estate DLF Sandipan Pal (Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436 BSE SENSEX S&P CNX CMP: INR198 TP: INR252 Buy25,895 7,721 Bloomberg DLFU IN Equity Shares (m) 1,781.6 M.Cap. (INR b) / (USD b) 353.5/5.8 52-Week Range (INR) 243/120 1, 6, 12 Rel. Per (%) -10/18/-1 Financials & Valuation (INR m) Y/E March 2015E 2016E 2017E Net Sales 87,309 92,027 107,645 EBITDA 29,445 71,922 87,137 Adj PAT 7,241 10,471 18,222 EPS (INR) 4.1 5.9 10.2 Gr (%) 12.1 44.6 74.0 BV/Sh (INR) 165.8 169.3 177.3 RoE (%) 2.0 16.2 19.6 RoCE (%) 4.5 12.7 15.3 P/E (x) 48.8 33.7 19.4 P/BV (X) 1.2 1.2 1.1 P&L beat, margin bounce back; lower interest, tax boosts PAT: DLF has reported 1QFY15 EBITDA at INR7.4b (v/s est of INR5.7b) on the back of sharp uptick in margin to 43% (v/s 35% in FY14). Revenue stood at INR17.3b (-25% YoY) v/s est of INR19.6b, while PAT stood at INR1.28b (ahead of estimate of INR1.02b) on the back of lower interest cost (-11% QoQ) and lower tax (21%). We believe CMBS of ~INR9b with average cost of debt of 10.9% to have partially benefitted lower interest expense. Lowest presales continue, leasing momentum positive: 1QFY15 presales remains lowest ever level of 0.38msf (INR3.1b) v/s 0.44msf (INR3.1b) in 4QFY14. Luxury projects viz. Kings Court and Camellias contributed ~45% of presales, while Hyderabad, Indore and Bhubaneswar were other key contributors. Annuity vertical performed better with 0.71msf of leasing (v/s 0.6msf in 4Q, 1.7msf in FY14). Major leasing happened in Gurgaon, Chennai and Delhi malls. Annuity income stood at INR5.25b (v/s INR4.95b in 3Q) Core FCFE negative INR7.7b; net debt up INR5.3b QoQ: Sustained weakness in presales and lack of fresh launch has resulted in deterioration in core operating cash flow. We calculate core FCFE negative at INR7.7b (post-dividend) v/s negative INR13.1b in 4Q (-INR25b in FY14). DLF received ~INR2.4b of divestment proceeds in 1QFY15, resulting into net increase in net debt by INR5.3b to INR200b (0.7x), unadjusted for JV partners’ stakes. Guiding deferred recovery cycle: While concerns over gearing have moderated, weakness in operations remains overhang. Management has been portraying a cautious outlook for near-term with restrained strategy and likely torpidity in cash flows in FY15. However, improving macro outlook and various positive developments in policy front should offer big benefits to the stock on leverage play. The stock trades at 1.2x FY16 BV and 33.7x FY16 EPS. Asset based valuation keeps us Buy. We will revisit our estimates post further clarity in Concall at 4pm on 1st August 2014 dial in +91 22 3960 0641 . Investors are advised to refer through disclosures made at the end of the Research Report.

- 2. 1 August 2014 2 DLF P&L beat, margin bounce back; lower interest, tax boosts PAT DLF has reported 1QFY15 EBITDA at INR7.4b (v/s est of INR5.7b) on the back of sharp uptick in margin to 43% (v/s 35% in FY14). While we await clarity on the same from management, higher revenue mix from Rent co (lower POCM booking) could be an attributable reason. Revenue stood at INR17.3b (-25% YoY) v/s est of INR19.6b, while PAT stood at INR1.28b (ahead of estimate of INR1.02b) on the back of lower interest cost (- 11% QoQ) and lower tax (21%). We believe CMBS of ~INR9b with average cost of debt of 10.9% to have partially benefitted lower interest expense. Lowest presales continue, leasing momentum positive 1QFY15 presales was at 0.38msf (INR3.1b) v/s 0.44msf (INR3.1b) in 4QFY14. These are the lowest ever quarterly presales run-rate in foreseeable history. No major new launches and torpidity in Gurgaon market were the key reasons. Luxury projects viz. Kings Court and Camellias contributed ~45% of presales, while Hyderabad, Indore and Bhubaneswar were other key contributors. Management guidance was cautious for next couple of quarters, albeit amidst incrementally improving outlook. It expects normalcy to revive only in FY16. Annuity vertical performed better with 0.71msf of leasing (v/s 0.6msf in 4Q, 1.7msf in FY14). Major leasing happened in Gurgaon, Chennai and Delhi malls. Annuity income stood at INR5.25b (v/s INR4.95b in 3Q) in line with management guidance for FY15 was at INR21b (at par with est) EBITDA margin posted sharp bounce back (%) 52 42 50 48 39 48 25 45 46 40 30 49 37 7 33 40 30 30 18 43 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 Source: Company, MOSL Lowest ever quarterly presales continue 6.4 3.6 - - 1.1 3.0 2.8 - 4.2 5.0 1.3 0.5 1.77 1.4 1.5 0 0 0 3.1 3.6 1.9 2.1 2.5 3.8 2.2 1.3 3.3 6.8 1.3 1.6 2.3 2.0 1.8 0.9 0.6 0.4 0.4 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 Launch(msf) Sales volume (msf) Source: Company, MOSL Weak presales trend 5 14 20 18 15 1313 15 19 11 6 11 24 6 6 1313 24 7 6 3 3 0 4 8 12 16 0 8 16 24 32 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 Sales value (INR b) Average realization('000 INR/sf) Source: Company, MOSL Leasing velocity posted better trend 0.1 0.4 0.7 1.0 1.6 1.6 0.1 0.7 0.2 0.2 0.3 0.3 0.2 0.4 0.2 0.4 0.6 0.1 0.5 0.7 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 Source: Company, MOSL

- 3. 1 August 2014 3 DLF Core FCFE negative INR7.7b; net debt up INR5.3b QoQ Sustained weakness in presales and lack of fresh launch has resulted in deterioration in core operating cash flow. We calculate core FCFE negative at INR7.7b (post-dividend) v/s negative INR13.1b in 4Q (-INR25b in FY14). DLF received ~INR2.4b of divestment proceeds in 1QFY15, leading to net rise in net debt by INR5.3b to INR200b (0.7x), unadjusted for JV partners’ stakes. Trend in divestments (INR b) Source: Company, MOSL Trend in net debt 131 136 145 162 198 208 220 226 227 237 237 236 235 240 221 227 214 208 211 195 200 199 200 0.6 0.6 0.6 0.5 0.8 0.8 0.9 0.9 0.9 0.9 0.9 0.92 0.91 0.92 0.84 0.88 0.77 0.74 0.76 0.70 0.71 0.72 0.67 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 FY15E FY16E Net debt (INR b) Net DER (x) Source: Company, MOSL FCFE remains negative, increasing the gearing once again (INR b) -3.7 -5.6 -3.6 -5.8 -7.9 0.3 -5.9 -13.1 -7.7 3.7 5.6 22.3 0.0 20.7 6.6 2.5 29.5 2.40.0 0.0 18.7 -5.8 12.8 6.8 -3.4 16.3 -5.3 1QFY13 2QFY13 3QFY13 4QFY13 1QFY14 2QFY14 3QFY14 4QFY14 1QFY15 Core FCFE Divestments Net debt reduction Source: Company, MOSL Valuation and views: Play on improvement in operating leverage Management has been portraying a cautious outlook over near-term with expectation of operational normalcy over next 18 months. It believes governments budgetary steps to benefits the real estate sector in broader way, albeit the impact is likely to percolate gradually. On the back of adversity in NCR market and DLF’s strategy to go slow on fresh launches (to focus more on selling mature inventories), we expect no major uptick in operational cash flows in FY15 (over FY14). However with concerns on gearing subsiding coupled with improving macro outlook and various positive developments in policy front (REIT, CMBS, possible rate cut), we believe the stock to be biggest beneficiary on leverage play. We will revisit our estimates post further clarity from management. The stock trades at 1.2x FY16 BV and 33.7x FY16 EPS. Asset based valuation keeps us Buy on the stock with target price of INR252, albeit (a) delay in revival of operations, and (b) unfavorable verdicts on CCI penalty, tax litigations etc remain overhangs.

- 4. 1 August 2014 4 DLF DLF: an investment profile Company description DLF, one of the largest and most respected real estate companies in India, has developed many well known urban colonies in Gurgaon, Delhi including South Extension, Greater Kailash, Kailash Colony and Hauz Khas. Since inception, DLF has developed ~230msf, including 22 urban colonies and an integrated 3,000- acre township in Gurgaon, called DLF City. Key investment arguments DLF is a major beneficiary of recent policy reforms and favorable macro trends. Expect meaningful improvement in operating cash deficit (break-even by FY14) on the back of (1) realigning core operations to premium business mix, (2) focus on margin protection, and (3) execution ramp-up. Success in large divestments implies higher potential to de-leverage, making DLF a strong play on rate downcycle. Key investment risks Monetization of high super luxury projects in Gurgaon at desired pace. Negative development on ITA claims, CCI penalty and subdued incremental leasing at commercial vertical. Recent developments Placed India's first Commercial Mortgage Backed Security (CMBS) issuance of INR5.25b, with a coupon rate of 10.90% p.a. and legal Maturity of 7.5 years, against DLF Emporio mall (0.3msf) in New Delhi. Valuation and view On the back of adversity in NCR market and DLF’s strategy to go slow on fresh launches (to focus more on selling mature inventories), we expect no major uptick in operational cash flows in FY15 (over FY14). However with concerns on gearing subsiding coupled with improving macro outlook and various positive developments in policy front (REIT, CMBS, possible rate cut), we believe the stock to be biggest beneficiary on leverage play. We will revisit our estimates post further clarity from management. The stock trades at 1.2x FY16 BV and 33.7x FY16 EPS. Asset based valuation keeps us Buy on the stock with target price of INR252, albeit (a) delay in revival of operations, and (b) unfavorable verdicts on CCI penalty, tax litigations etc remain overhangs. . Comparative valuations DLF Prestige Oberoi P/E (x) FY15E 48.8 21.1 20.3 FY16E 33.7 14.7 9.7 P/BV (x) FY15E 1.2 2.5 1.4 FY16E 1.2 2.2 1.3 EV/Sales (x) FY15E 6.2 3.6 7.6 FY16E 5.9 3.0 3.6 EV/EBITDA (x) FY15E 17.7 12.5 13.9 FY16E 16.0 9.5 6.0 EPS: MOSL forecast v/s consensus (INR) MOSL Forecast Consensus Forecast Variation (%) FY15 4.1 5.4 -24.4 FY16 5.9 8.0 -26.4 Target price and recommendation Current Price (INR) Target Price (INR) Upside (%) Reco 198 252 27.3 Buy Shareholding pattern (%) Jun-14 Mar-14 Jun-13 Promoter 74.9 74.9 75.0 DII 0.5 0.4 0.5 FII 19.9 19.9 19.7 Others 4.7 4.8 4.8 Notes: FII includes depository receipts Stock performance (1-year)

- 5. 1 August 2014 5 DLF Financials and valuation Income statement (INR Million) Y/E March 2014 2015E 2016E 2017E Net Sales 82,980 87,309 92,027 107,645 Change (%) 6.8 5.2 5.4 17.0 EBITDA 24,852 29,445 71,922 87,137 EBITDA Margin (%) 29.9 33.7 78.2 80.9 Depreciation 6,629 6,075 6,599 6,731 EBIT 18,223 23,371 65,323 80,407 Interest 24,633 22,104 21,159 20,604 Other Income 14,916 7,000 8,000 8,000 Extraordinary items 0 0 0 0 PBT 8,506 8,266 52,164 67,803 Tax -836 2,367 3,978 7,344 Tax Rate (%) -9.8 28.6 7.6 10.8 Reported PAT 9,342 5,900 48,186 60,459 Adjusted PAT 6,462 7,241 10,471 18,222 Change (%) -9.2 12.1 44.6 74.0 Min. Int. & Assoc. Share 418 141 241 242 Adj Cons PAT 6,462 7,241 10,471 18,222 Balance sheet (INR Million) Y/E March 2014 2015E 2016E 2017E Share Capital 3,559 3,559 3,559 3,559 Reserves 270,386 273,462 279,769 293,933 Net Worth 291,939 295,016 301,322 315,486 Debt 223,340 216,550 215,260 213,983 Deferred Tax -10,178 0 0 0 Total Capital Employed 517,302 513,589 518,605 531,492 Gross Fixed Assets 193,955 197,955 201,955 205,955 Less: Acc Depreciation 38,319 44,393 50,992 57,723 Net Fixed Assets 155,636 153,561 150,963 148,232 Capital WIP 80,943 86,943 92,943 96,943 Investments 8,912 8,912 8,912 8,912 Current Assets 377,801 382,678 388,867 422,771 Inventory 184,886 193,754 197,921 207,621 Debtors 16,123 17,223 18,153 20,939 Cash & Bank 24,420 13,827 11,431 18,735 Loans & Adv, Others 152,371 157,874 161,362 175,475 Curr Liabs & Provns 127,722 140,651 145,226 167,513 Curr. Liabilities 121,904 133,954 138,671 160,730 Provisions 5,818 6,698 6,555 6,783 Net Current Assets 250,079 242,026 243,641 255,258 Total Assets 517,302 513,589 518,605 531,492 E: MOSL Estimates Ratios Y/E March 2014 2015E 2016E 2017E Basic (INR) EPS 3.6 4.1 5.9 10.2 Cash EPS 7.4 7.5 9.6 14.0 Book Value 164.0 165.8 169.3 177.3 DPS 2.0 2.0 2.0 2.0 Payout (incl. Div. Tax.) 64.4 57.5 39.8 22.3 Valuation(x) P/E 54.6 48.8 33.7 19.4 Cash P/E 27.0 26.5 20.7 14.2 Price / Book Value 1.2 1.2 1.2 1.1 EV/Sales 6.8 6.5 6.2 5.2 EV/EBITDA 22.8 19.3 7.9 6.5 Dividend Yield (%) 1.0 1.0 1.0 1.0 Profitability Ratios (%) RoE 3.3 2.0 16.2 19.6 RoCE 3.5 4.5 12.7 15.3 Turnover Ratios (%) Asset Turnover (x) 0.2 0.2 0.2 0.2 Debtors (No. of Days) 70.9 72.0 72.0 71.0 Inventory (No. of Days) 813.2 810.0 785.0 704.0 Creditors (No. of Days) 0.0 0.0 0.0 0.0 Leverage Ratios (%) Net Debt/Equity (x) 0.8 0.7 0.7 0.7 Cash flow statement (INR Million) Y/E March 2014 2015E 2016E 2017E OP/(Loss) before Tax 5,207 9,466 14,208 25,323 Depreciation 6,629 6,075 6,599 6,731 Others 0 0 0 0 Interest 24,633 22,104 21,159 20,604 Direct Taxes Paid -836 2,367 3,978 7,344 (Inc)/Dec in Wkg Cap -13,520 -2,541 -4,011 -4,313 CF from Op. Activity 22,245 32,879 34,217 41,242 (Inc)/Dec in FA & CWIP 18,414 -10,414 -10,000 -8,000 (Pur)/Sale of Invt 4,425 0 0 0 Others 0 0 0 0 CF from Inv. Activity 22,839 -10,414 -10,000 -8,000 Inc/(Dec) in Net Worth 14,363 0 0 0 Inc / (Dec) in Debt -24,673 -6,790 -1,290 -1,277 Interest Paid 24,633 22,104 21,159 20,604 Divd Paid (incl Tax) 4,165 4,165 4,165 4,058 CF from Fin. Activity -39,107 -33,059 -26,613 -25,939 Inc/(Dec) in Cash 5,977 -10,594 -2,396 7,304 Add: Opening Balance 18,443 24,420 13,827 11,431 Closing Balance 24,420 13,826 11,431 18,735

- 6. 1 August 2014 6 DLF Disclosures This research report has been prepared by MOSt to provide information about the company(ies) and sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies). This report is for personal information of the select recipient and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur. MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a significant percentage of the companies covered by our Research Department Our research professionals provide important input into our investment banking and other business selection processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may participate in the solicitation of such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting market information. Our research professionals are paid in part based on the profitability of MOSt which include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all o the foregoing, among other things, may give rise to real or potential conflicts of interest . MOSt and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Disclosure of Interest Statement Company Analyst ownership of the stock DLF Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues. Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.K. This report is intended for distribution only to persons having professional experience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by persons who are not investment professionals. Any investment or investment activity to which this document relates is only available to investment professionals and will be engaged in only with such persons. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email:anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com Contact(+65)68189232 Contact: (+65) 68189233 / 65249115 Office Address:21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com