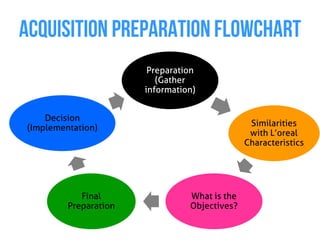

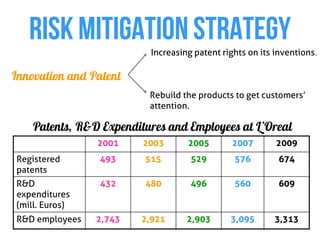

L'Oreal is the 1st cosmetic group worldwide with over a century of expertise. It has diversified through acquisitions like The Body Shop and Galderma Laboratories. L'Oreal pursues acquisitions to strengthen its portfolio, satisfy local needs, and quickly acquire new resources. It implements a risk mitigation strategy including increasing patents and R&D expenditures. L'Oreal's most recent acquisition was Pacific Bioscience Laboratories in 2011 for its expertise in sonic skin care devices.