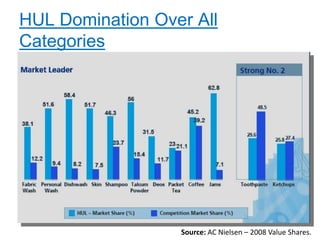

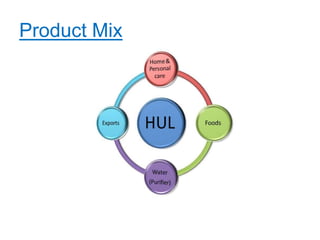

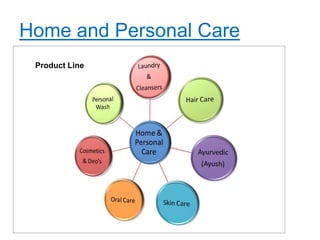

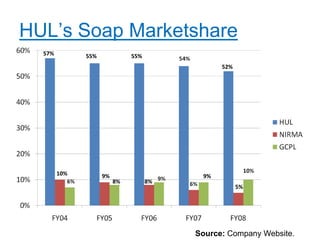

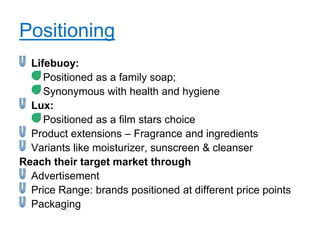

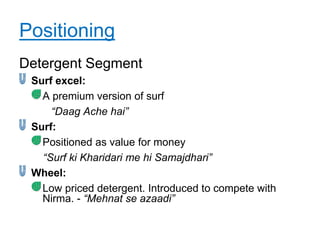

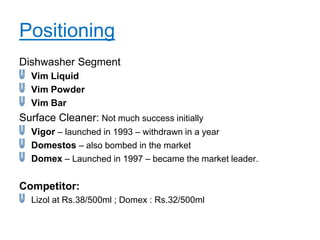

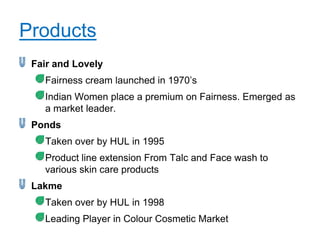

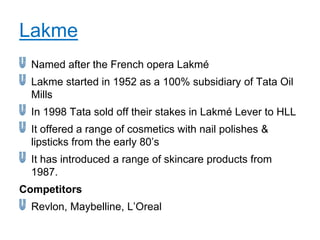

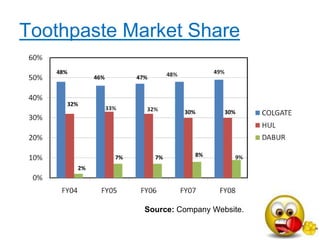

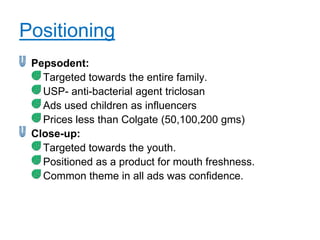

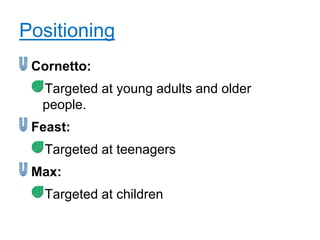

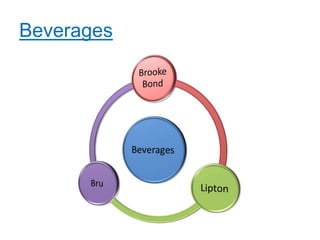

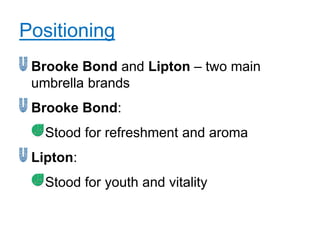

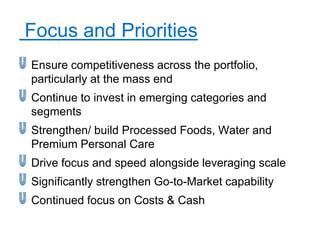

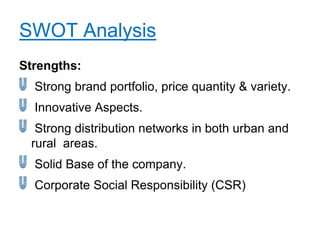

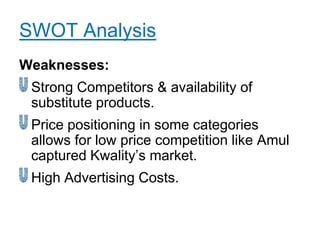

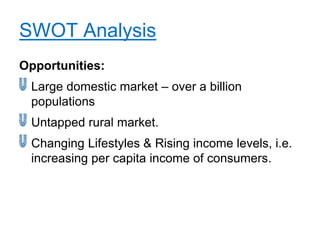

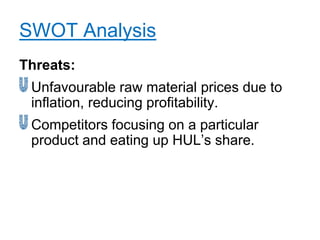

HUL is India's largest FMCG company that owns many leading brands in home and personal care, beauty, and foods and refreshments. It dominates various product categories with market shares over 50%. HUL positions its brands differently based on target segments - Fair & Lovely targets fairness, Dove promotes natural beauty. Pepsodent is for families while Close-Up builds confidence in youth. HUL faces competition but has strengths in its brand portfolio, distribution network, and social responsibility programs. Opportunities exist in India's growing population and changing lifestyles.