This document provides an overview of various probability distributions including discrete and continuous distributions. It defines key probability distributions such as binomial, Poisson, exponential, gamma, Weibull, beta, and log-normal distributions. Examples are given for how each distribution can be used to model different types of random variables and calculate probabilities. Applications of several distributions are demonstrated through examples in finance, healthcare, and engineering to show how the distributions can be used to model real-world scenarios.

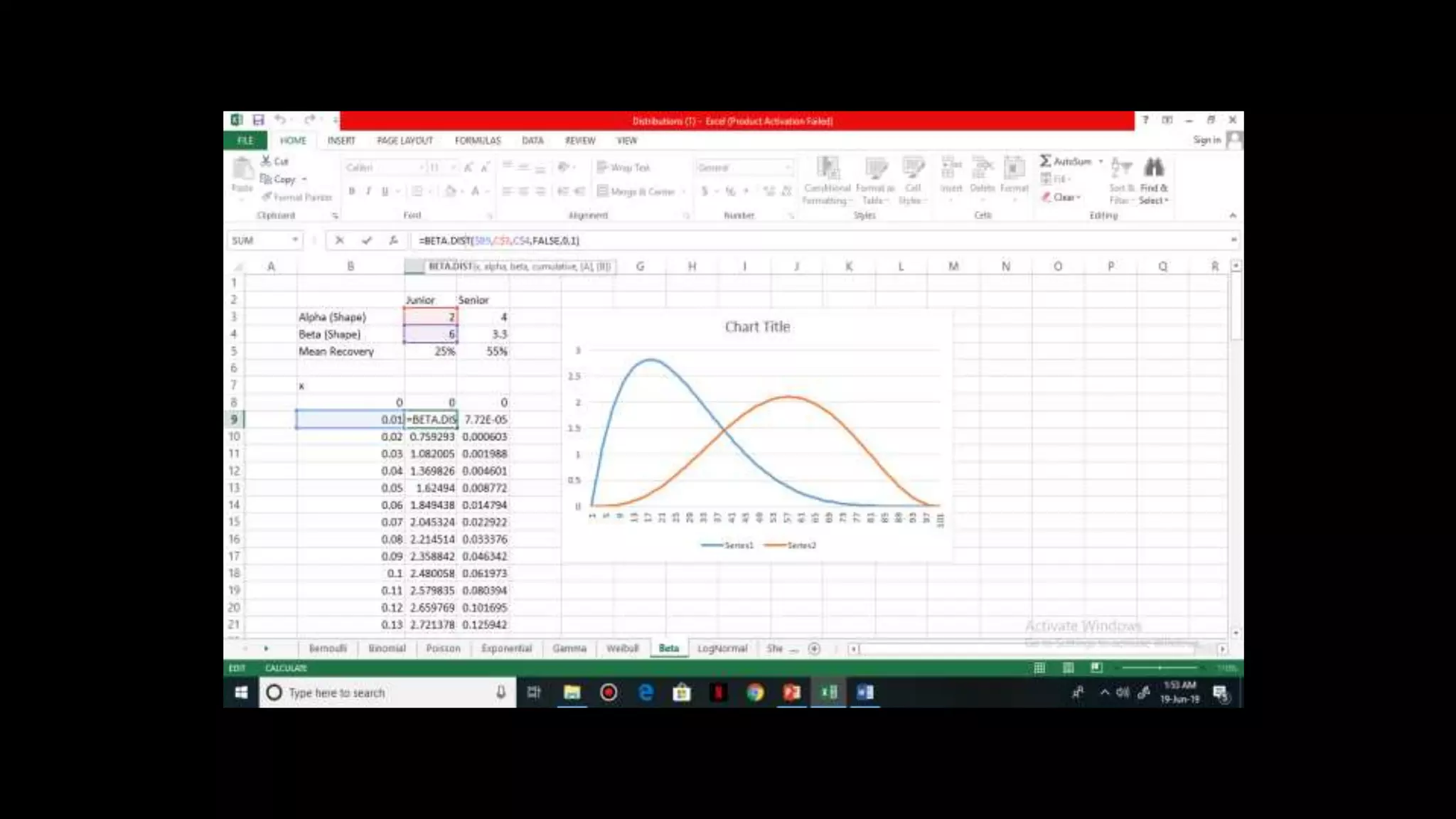

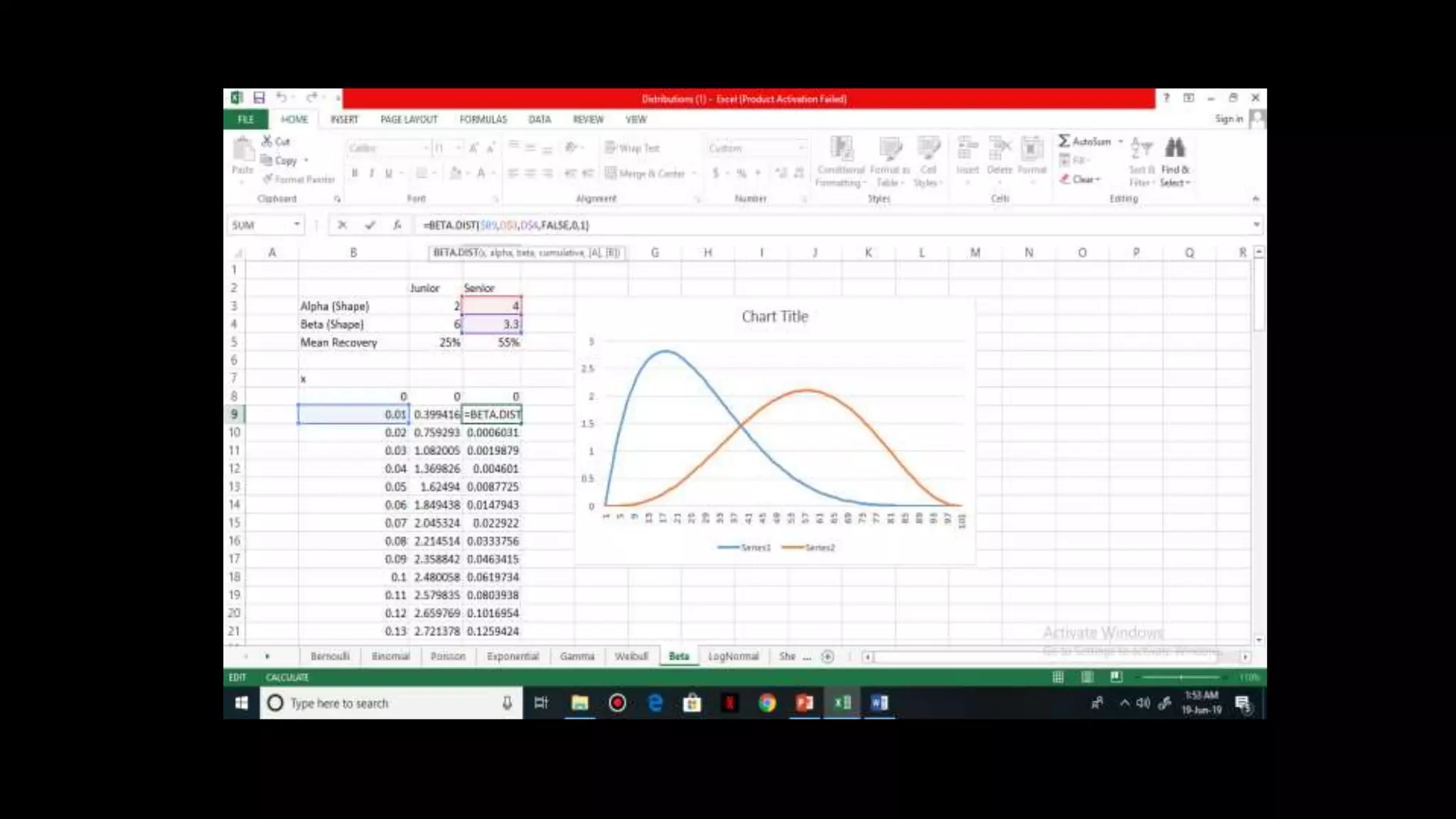

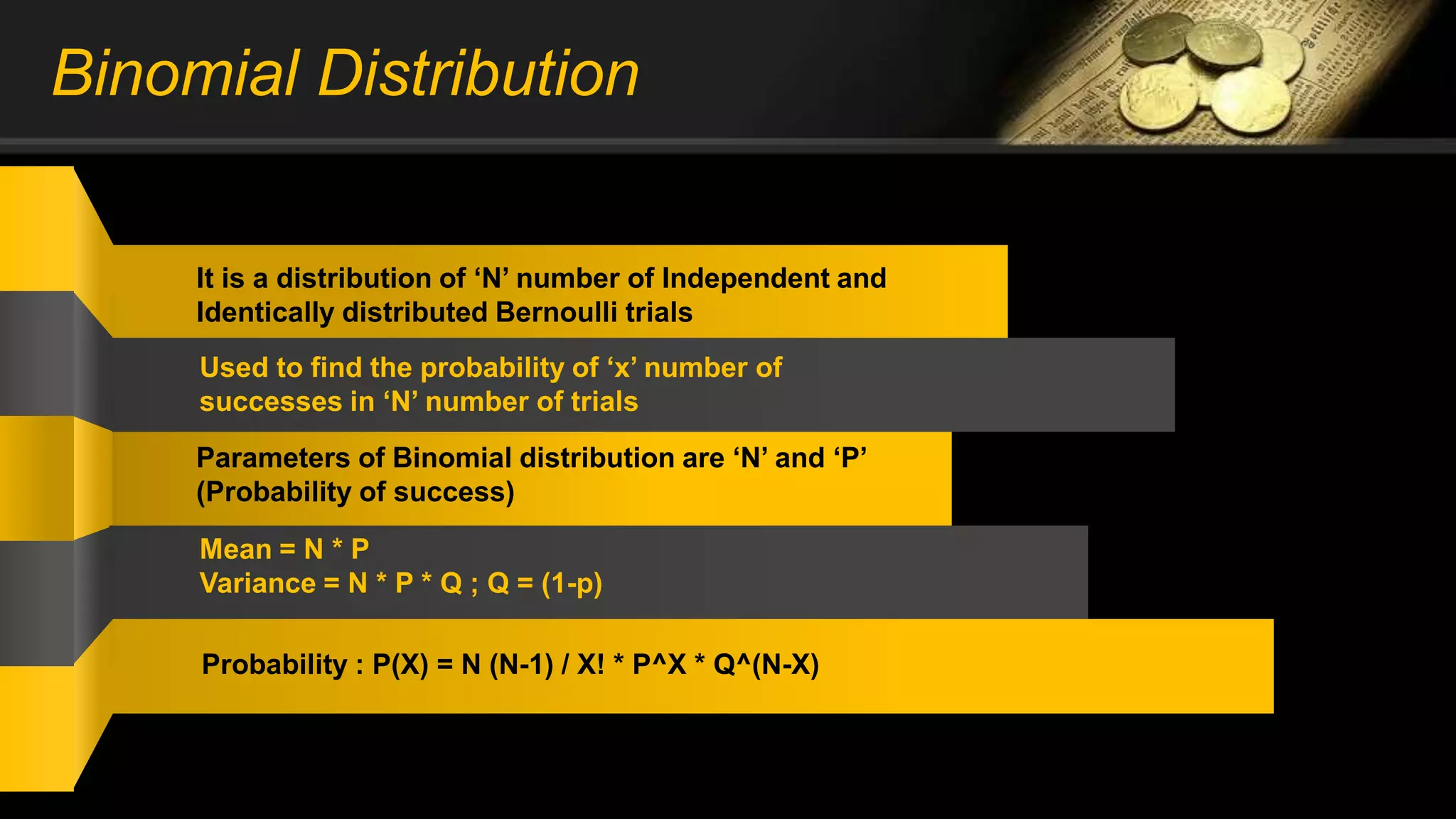

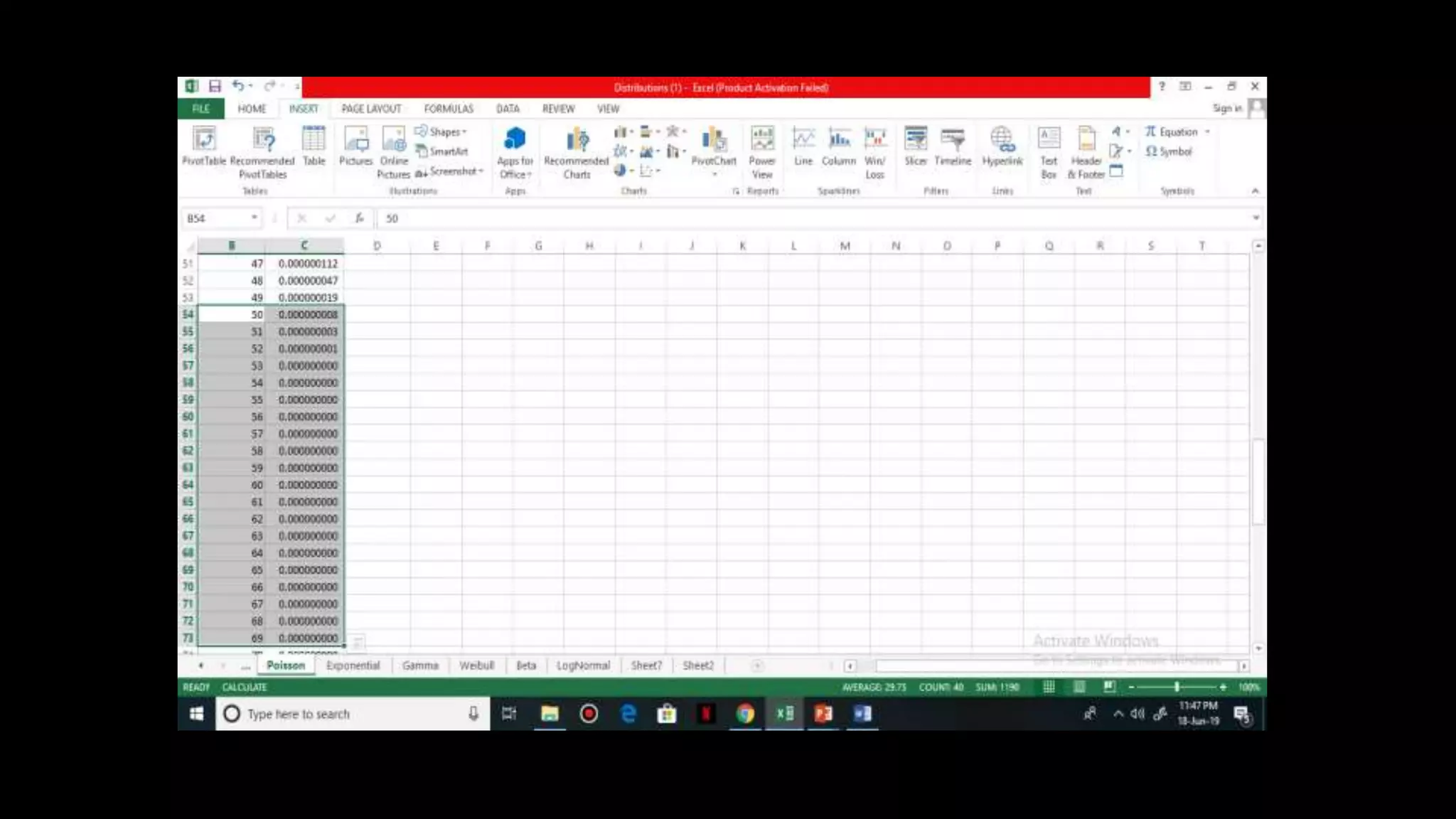

![Exponential Distribution

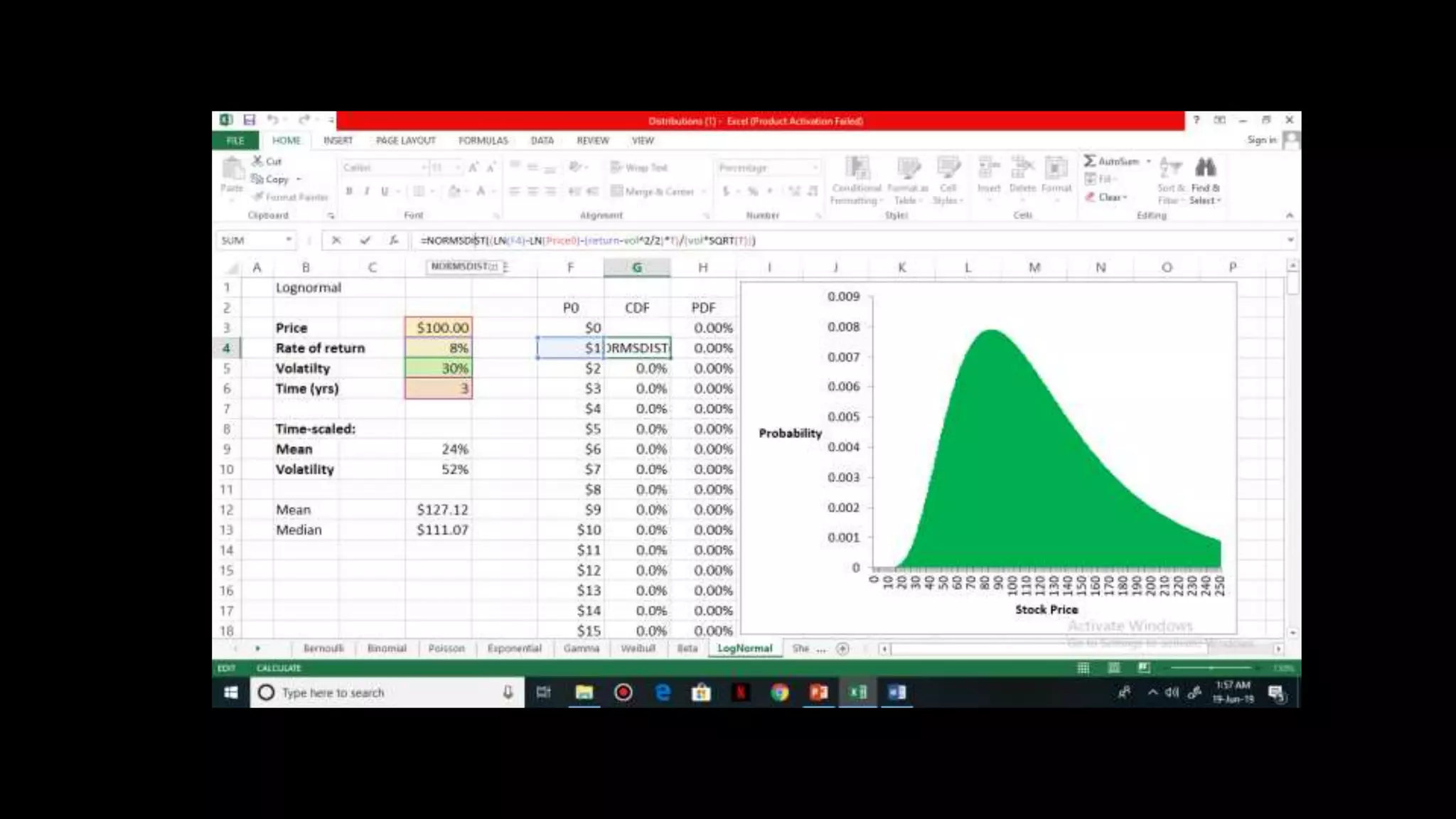

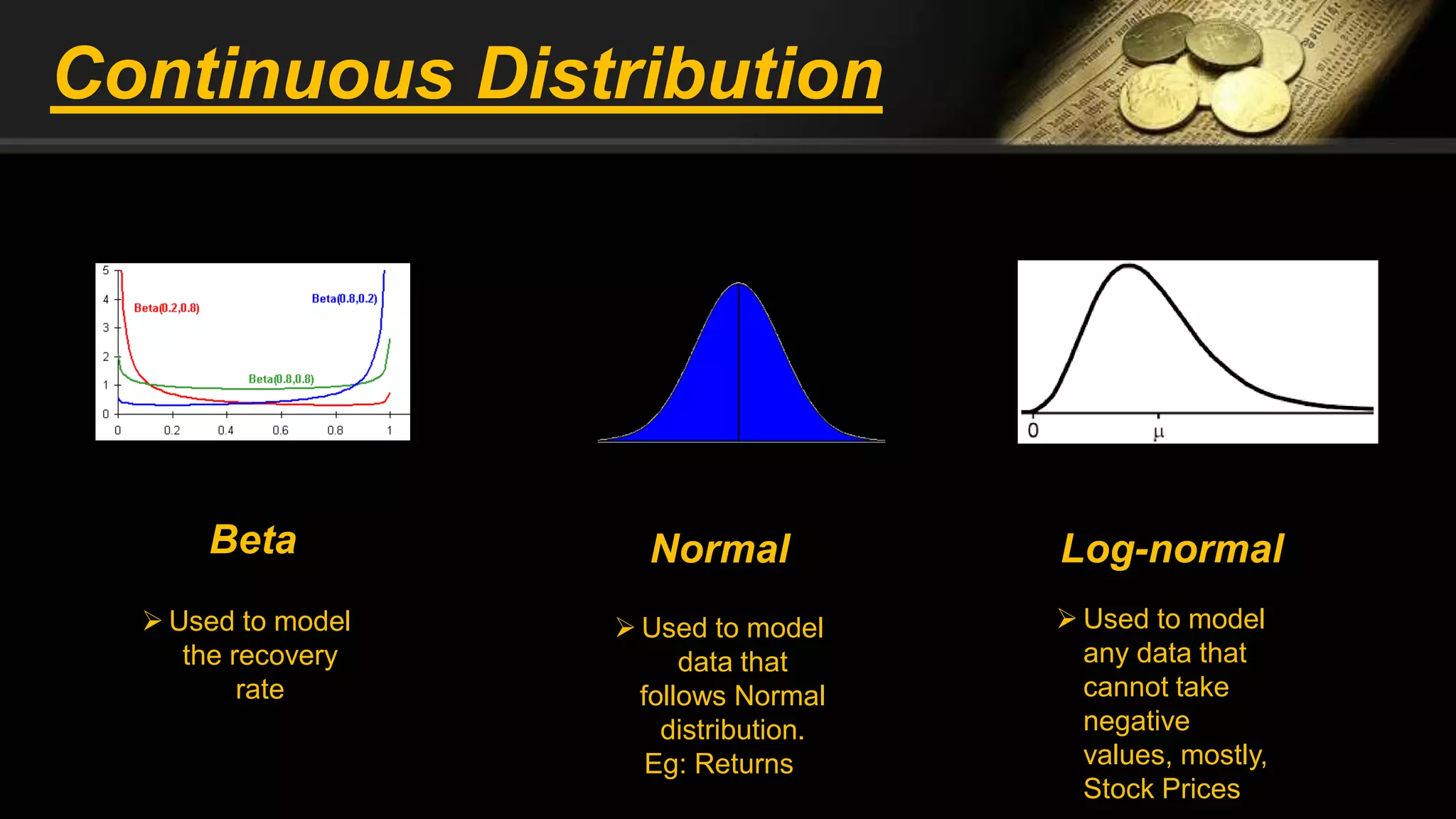

It is a continuous distribution and is used to model

average waiting time

Parameter of Exponential distribution = lambda

Mean = 1 / lambda

Variance = 1 / lambda^2

CDF , F(X) = 1 – e^ [(-lambda) * X]

PDF, f (X) = lambda * e^ [(-lambda) * X]

Survival probability = e^ [(-lambda) * X]](https://image.slidesharecdn.com/distributionppt-190701102145/75/Probability-Distribution-Modelling-19-2048.jpg)

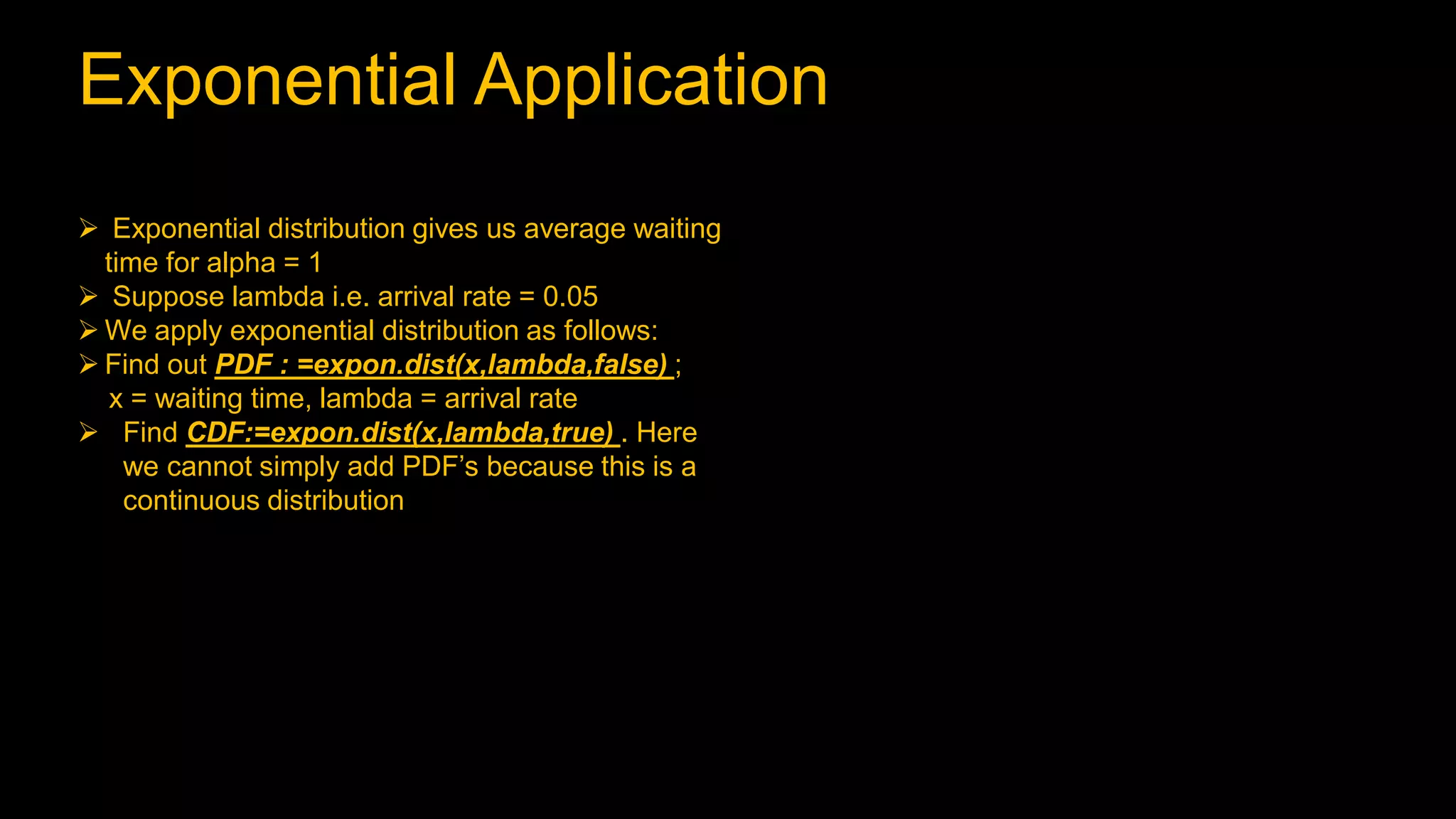

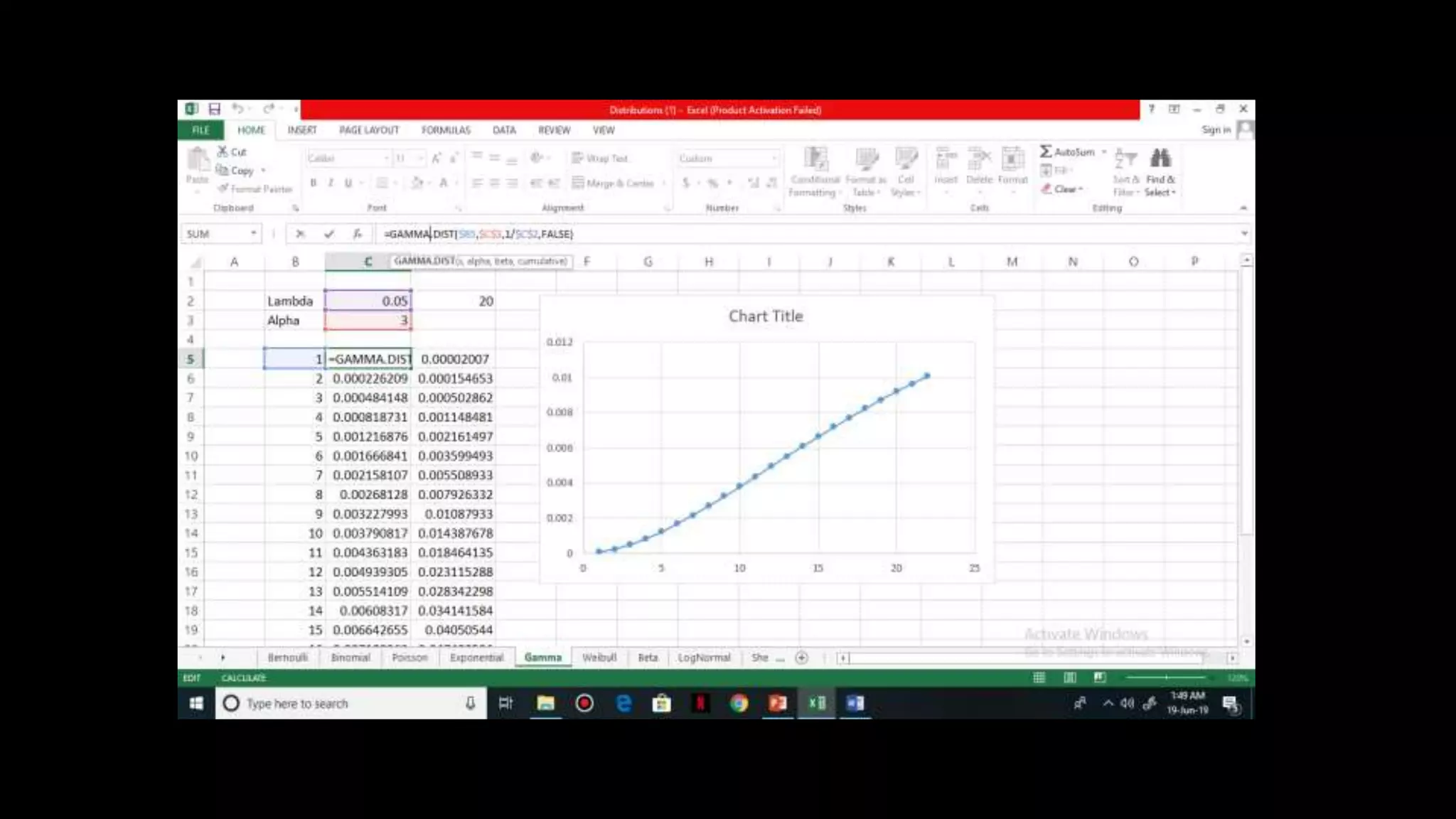

![Gamma Distribution

It is a continuous distribution and is used to model

average waiting time for alpha = >1

Parameter of Gamma distribution = alpha & lambda

Mean = alpha / lambda

Variance = alpha / lambda^2

CDF , F(X) = 1 – e^ [(-lambda) * X]

PDF, f (X) = lambda * e^ [(-lambda) * X]

Practically used in Credit Default Swaps to model the

time it will take for triggering event to occur](https://image.slidesharecdn.com/distributionppt-190701102145/75/Probability-Distribution-Modelling-22-2048.jpg)

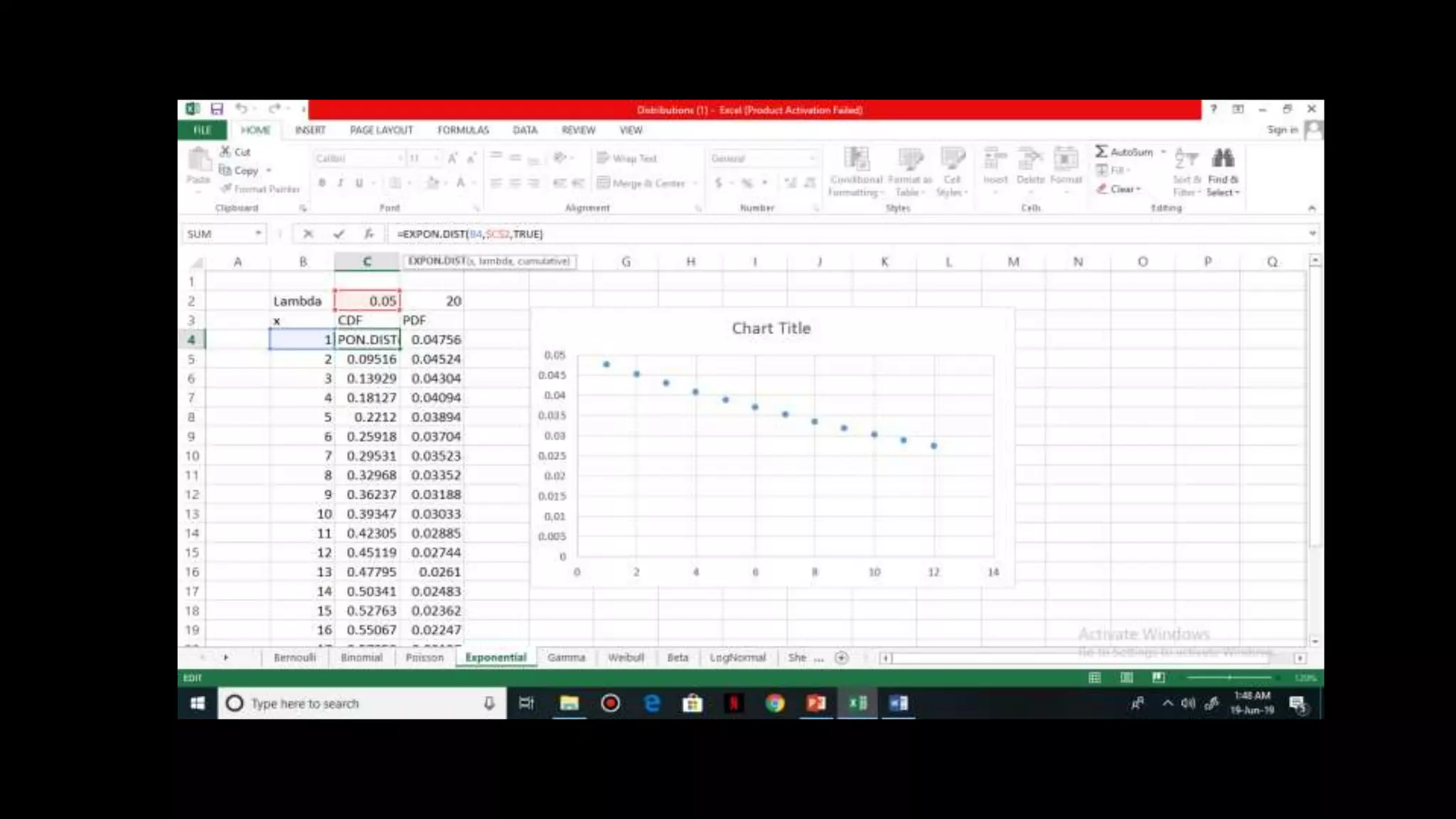

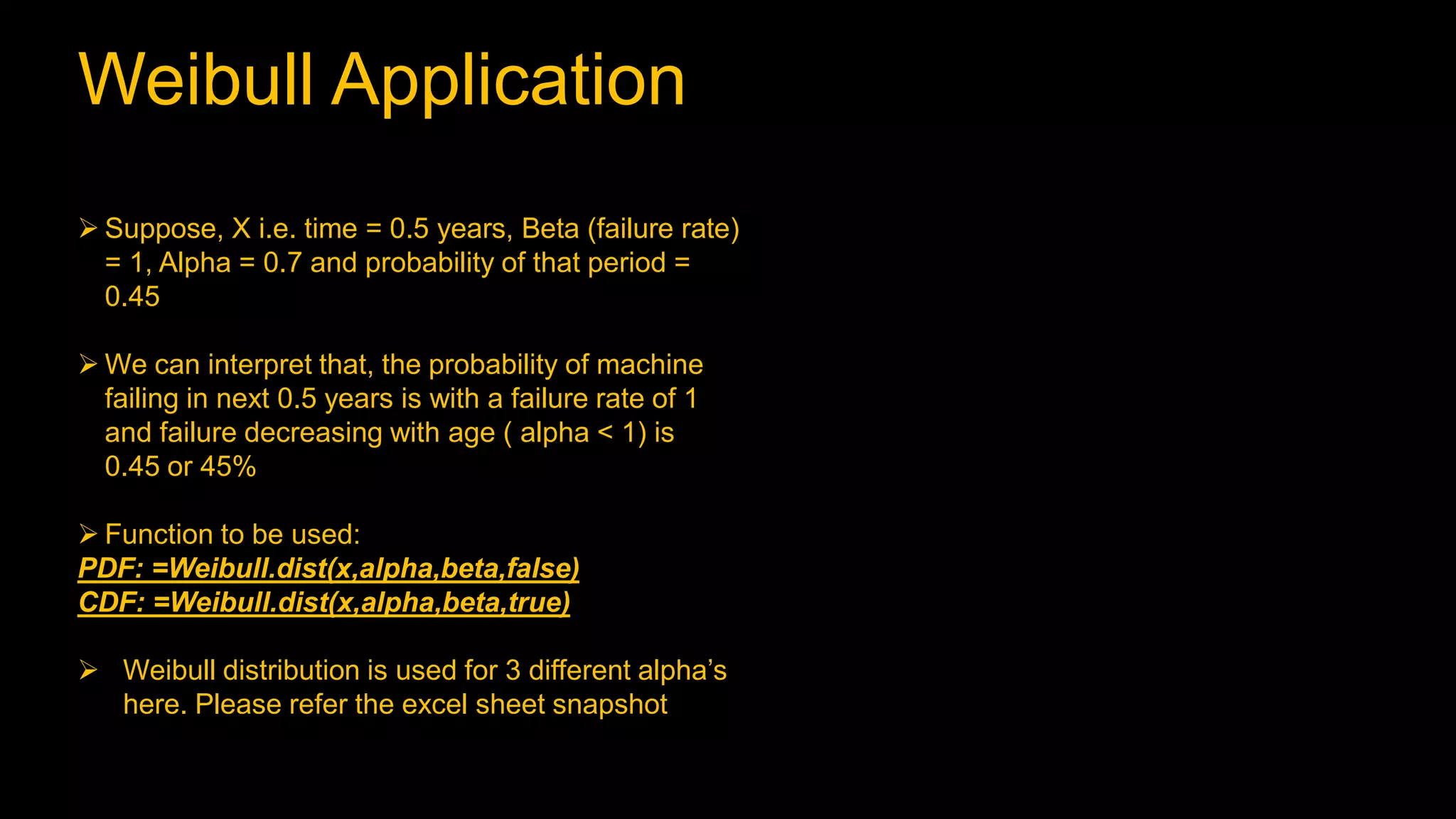

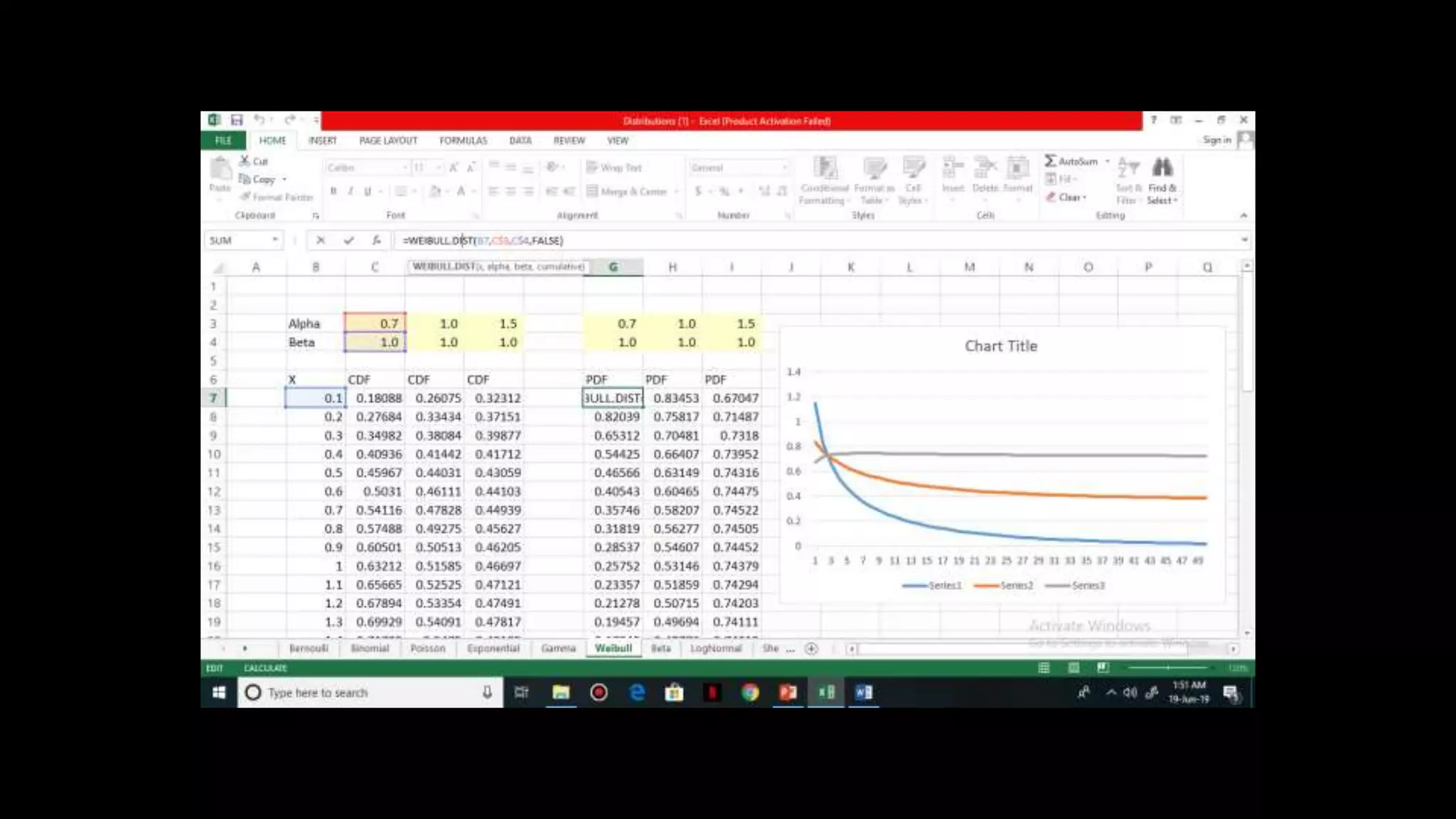

![Weibull Distribution

Used to model the time it will take for the machine to

fail given the failure rate of lambda

Change in failure rate (Constant/Increase/Decrease)

is captured by Alpha

If failure rate is constant, alpha = 0 exponential

If failure rate increases, alpha>1 Ageing problem

If failure rate decreases, alpha<1 Teething problem

CDF, F(X) = 1 – e^{[(-lambda) * x]^alpha}

Beta = 1 / alpha](https://image.slidesharecdn.com/distributionppt-190701102145/75/Probability-Distribution-Modelling-25-2048.jpg)

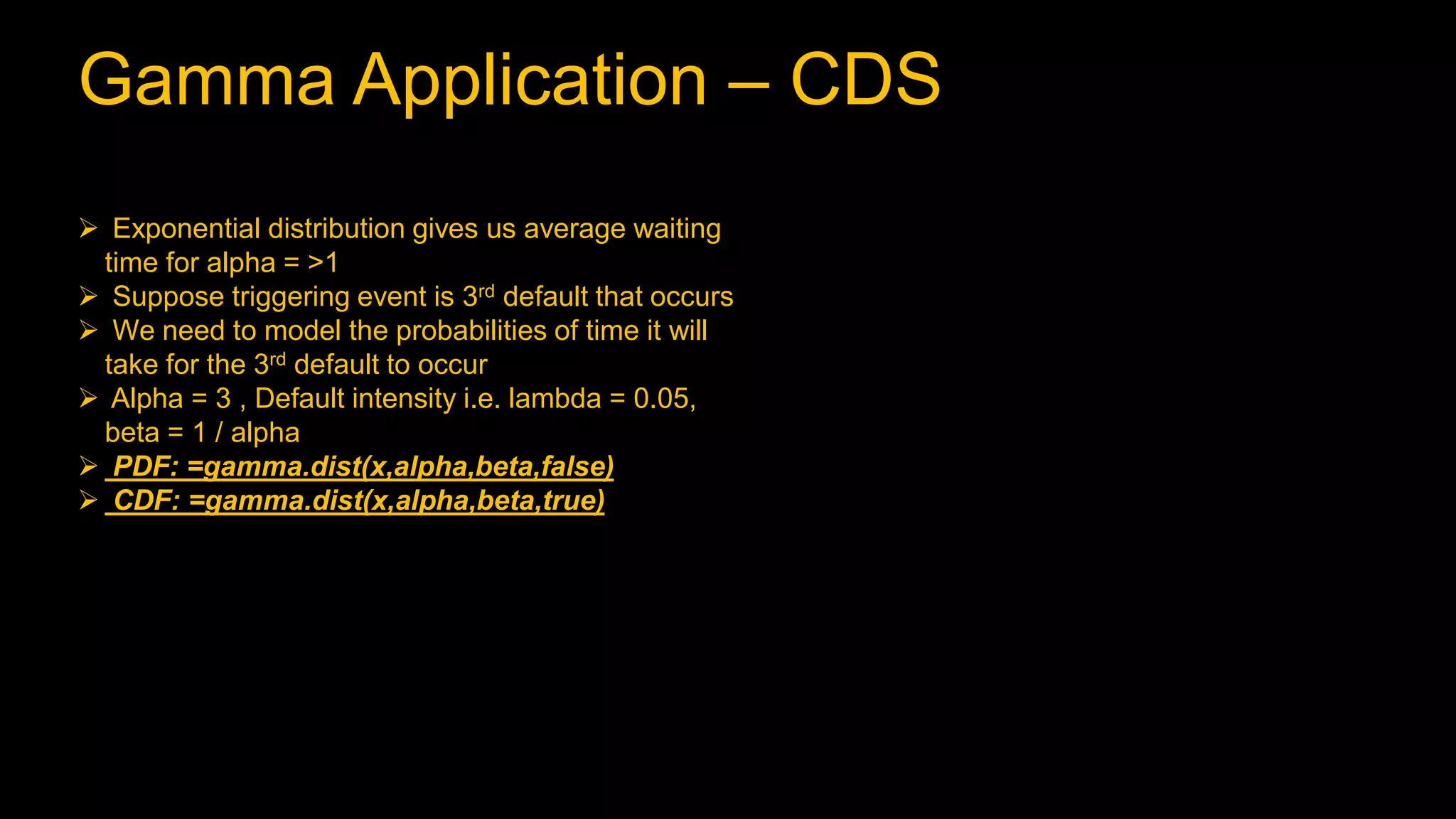

![Beta Distribution

It is a continuous distribution and is used to model

recovery rate

Parameters of beta distribution = alpha & beta

Mean = alpha / alpha + beta

CDF, F(X) = 1 – e^{[(-lambda) * x]^alpha}

Beta = 1 / alpha](https://image.slidesharecdn.com/distributionppt-190701102145/75/Probability-Distribution-Modelling-28-2048.jpg)