This document discusses pricing options through the trinomial tree method. It begins with an introduction to option contracts and the Black-Scholes model for pricing options. It then describes binomial and trinomial lattice models as alternative methods to Black-Scholes that still assume stock prices follow geometric Brownian motion. The document uses a trinomial tree to price European, American, barrier, and double barrier knockout options. It also calculates the Greeks (Delta, Theta, Gamma) through Black-Scholes and the trinomial tree and discusses delta hedging strategies with comparisons across different companies.

![List of Figures

2.1 Non-Recombining Binomial Tree and a Recombining Binomial Tree . . . . . . 12

2.2 Multi Step Binomial Tree . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

2.3 Binomial to Trinomial Formulation . . . . . . . . . . . . . . . . . . . . . . . . 15

2.4 Implied Google Call Option prices through the trinomial tree compared with

market prices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

3.1 European Call and Put Option Prices against Share price . . . . . . . . . . . . 18

3.2 Barrier Option Prices with varying barrier value . . . . . . . . . . . . . . . . . 21

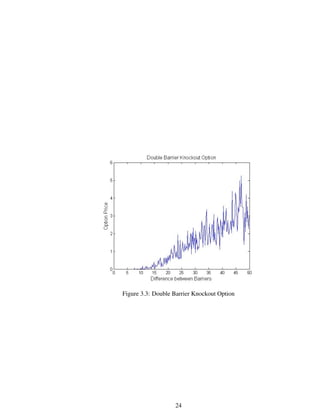

3.3 Double Barrier Knockout Option . . . . . . . . . . . . . . . . . . . . . . . . . 24

4.1 Delta, Theta and Gamma Greeks via the Black-Scholes model varying time till

maturity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

4.2 Delta, Theta and Gamma Greeks via the Black-Scholes model varying Strike Price 27

4.3 Delta, Theta and Gamma Greeks via the Black-Scholes model up to maturity . 28

4.4 Delta and Gamma Greeks via the Trinomial tree and the Black-Scholes model . 29

5.1 Delta-hedge rule, rebalancing every day . . . . . . . . . . . . . . . . . . . . . 32

5.2 Delta-hedging rule while varying Delta tolerance . . . . . . . . . . . . . . . . 34

7.1 Trinomial tree and an Implied trinomial tree ([22]) . . . . . . . . . . . . . . . 37

A.1 my impvol.m . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

B.1 t treesize.m . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40

C.1 tree barrier upcall.m (part a) . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

C.2 tree barrier upcall.m (part b) . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

D.1 t double bar.m, leaf vector discounted back through trinomial tree . . . . . . . 43

4](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-7-320.jpg)

![Chapter 1

Introduction

An option is a type of contract that gives the holder the right to, but not obligation to buy (call),

or sell (put) an underlying asset or instrument at a specified strike price on or before a specified

date. A European option can only be exercised at the maturity date while an American option

can be exercised at any point up to and including maturity. Pricing of these options, has been

around for a while, but in 1973 Fisher Black and Myron Scholes published a paper, ’The Pricing

of Options and Corporate Liabilities’([4]). They had an idea to hedge the option by buying or

selling the underlying asset in such a way to eliminate risk. With this they derived a stochastic

partial differential equation which estimates the price of the option over time. The Black-Scholes

equation led to a boom in finance and more specifically option trading around the world ([8]).

6](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-9-320.jpg)

![1.1 Geometric Brownian Motion (GBM)

A Geometric Brownian Motion is a continuous-time stochastic process where the logarithm of

the randomly varying quantity, follows a Wiener process with drift ([9]). A stochastic process St

is said to follow the GBM, if the process satisfies the following stochastic differential equation

(SDE);

dSt = µStdt +σStdWt, (1.1)

where,

• Wt is a Wiener process,

• σ is the percentage volatility,

• µ is the percentage drift,

solving equation (1.1) under It¯o’s interpretation leads to ([10]),

St = S0e(µ−σ2

2 )t+σWt

. (1.2)

The GBM assumes constant volatility when realistically in practice the volatility changes over

time, maybe stochastic ([13]). Further Extensions of the GBM are ”Stochastic Volatility models

in which the variance of a stochastic process is itself randomly distributed ([12]).” Below are

some stochastic volatility models ([13]);

• Heston Model.

• Constant Elasticity of Variance Model, CEV Model.

• Stochastic Alpha, Beta, Rho, (SABR Volatility model)

7](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-10-320.jpg)

![1.2 Black-Scholes Model

This model was first published by Fisher Black and Myron Scholes in their paper ”The Pricing

of Options and Corporate Liabilities”. (1973,[4]). Pricing of European options is based upon

there should not be any opportunities for risk-free profit in the market, (no-arbitrage principle).

Black and Scholes showed that ”it is possible to create a hedged position, consisting of a long

position in the stock and a short position in the option, whose value will not depend on the price

of the stock” ([4]). The Black-Scholes model is based upon the following assumptions;

• the stock price follows a Geometric Browian Motion,

• buying and selling any amount of stock with no transaction costs incurred,

• borrowing and lending takes place at the risk-free interest rate,

• non-dividend paying stock.

Under these assumptions the dynamic hedging strategy by Black and Scholes leads to the fol-

lowing partial differential equation;

∂V

∂t

+

1

2

σ2

S2 ∂2V

∂S2

+rs

∂V

∂S

−rV = 0. (1.3)

This equation is solved with boundary conditions depending on the characteristics of the options.

For the standard European vanilla options we find explicit solutions leading to the Black-Scholes

formulas. The values of the European vanilla call and put options, respectively, are:

C(S,t) = N(d1)S−N(d2)Ke−r(T−t)

, (1.4)

P(S,t) = Ke−r(T−t)

−S+C(S,t),

= N(−d2)Ke−r(T−t)

−N(−d1)S, (1.5)

where

d1 =

1

σ

√

T −t

[ln(

S

K

)+(r +

σ2

2

)(T −t)], (1.6)

d2 =

1

σ

√

T −t

[ln(

S

K

)+(r −

σ2

2

)(T −t)],

= d1 −σ

√

T −t. (1.7)

The quantities appearing in (1.4-1.7) are

8](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-11-320.jpg)

![1.2.1 Implied Volatility by the Black-Scholes Equation

The volatility of the market is a quantity difficult to measure. One possibility is to assume that

the market satisfies the Black-Scholes model, and so the value of the traded options satisfy the

Black-Scholes formulae (1.4,1.5). With all the other quantities known except for σ, we can

set-up an equation in σ using (1.4) where C is the known traded value of the European vanilla

call option. Solving for σ

F(σ) = C −SN(d1(σ))+Ke−r(T−t)

N(d2(σ)), (1.8)

we find the Implied Volatility ([5]).

Solving (1.8) can be done by using the following Newton’s iteration for finding the root of a

function,

σi = σi−1 −

F(σi−1)

F (σi−1)

, (for i > 0), (1.9)

”In practice this iteration would be halted once |F(σi)| < ε for some user-specified tolerance

ε.”[5] A function file my impvol.m was created in Matlab to solve for the implied volatility

with inputs, Appendix A;

• S - Stock price,

• C - Call option price,

• E - Exercise/Strike price,

• r - Risk-free rate (annual),

• T - Time till maturity (in years),

• eps - convergence tolerance,

• vol0 - Initial volatility (annual).

10](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-13-320.jpg)

![Chapter 2

Lattice models

Another method for pricing a stock option is, a lattice model. Which divides time from now up

to expiration into N discrete time points with each point going to two possible states (Binomial)

or three possible states (Trinomial) all the way up to expiration date where the expected payoffs

are calculated. Taking these payoffs and iteratively discounting the values back to the present by

the continuously discounted risk-free interest rate, applying risk-neutral probabilities through a

series of one-step trinomial trees until back with one node being the option price.

The first lattice model was the Binomial Option Pricing Model (BOPM) By Cox, Ross and

Rubinstein (CRR)(1979,[1]). From the source node the underlying asset either goes up with

probability p or down with probability 1− p. This process repeats until you reach the expiration

date with all the possible stock outcomes. The expected payoffs are then calculated at expiration

by:

Call Option = max{ST −K,0},

Put Option = max{K −ST ,0}.

ST being the stock price at expiration (T) with K being the strike price on the option. Expected

payoffs are then discounted back through the tree by risk-neutral probabilities until you are back

at the source node and reach the option price. Figure 2.1 below shows the Binomial Tree.

It is computationally efficient to have a recombining tree over a non-recombining tree, because

if the tree recombines, there are only N +1 nodes at stage N, whereas there will be 2N nodes at

stage N on a non-recombining tree. To make the tree recombine CRR ([1]) made ud = 1. There

are three parameters in Binomial model u,d, and p, we therefore need three equations to solve

uniquely for the parameters. First equation comes from matching the expectation of return on

11](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-14-320.jpg)

![Figure 2.1: Non-Recombining Binomial Tree and a Recombining Binomial Tree

http://www.mathworks.co.uk/help/fininst/overview-of-interest-rate-tree-models.html

the asset in a risk-neutral world. The second from matching the variance. We get

pu+(1− p)d = er∆t

,

pu2

+(1− p)d2

−(er∆t

)

2

= σ2

∆t.

The third equation comes from making the tree recombine ([1]),

u =

1

d

.

After some rearranging and solving for the three parameters in the three equations above, results

showed[3]:

p =

er∆t −d

u−d

,

u = eσ

√

∆t

,

d = e−σ

√

∆t

,

where σ is the assets volatility and r being the risk-free interest rate. When the Binomial tree

has been created shown in Figure 2.2[17] with the expected future payoffs (leaf nodes), these

need to be continuously discounted back to earlier nodes by the risk-free interest rate, taking

into account the risk-neutral probabilities.

The formula for calculating each node,

Cn,j = e−r∆t

(pCn+1,j+1 +(1− p)Cn+1,j−1).

12](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-15-320.jpg)

![2.1 Formulation of the Binomial Option Pricing Model by

replicating portfolios

Let a portfolio contain ∆ shares of the stock and an amount B invested in risk-free bonds with

a present value of ∆s+B. We want the option payoff equal to the portfolio payoff ([6]). Value

of replicating portfolio at time h with stock price Sh is ∆Sh + erhB. At the two possible states,

Su = uS and Sd = dS the replicating portfolio must satisfy ([7]):

(∆uSeδh

)+(Berh

) = Cu,

(∆dSeδh

)+(Berh

) = Cd,

with δ being the dividend yield, Cu being the upper option node and Cd being the lower option

node. Then solving for ∆ and B:

Cu −∆uSeδh

= Cd −∆dSeδh

,

∆ = eδh

(

Cu −Cd

uS−dS

), (2.1)

Berh

= Cu −∆uSeδh

, (2.2)

substituting (2.1) into (2.2) yields

Berh

= Cu −

uS(Cu −Cd)

uS−dS

,

B = e−rh

(

uCd −dCu

u−d

.

The cost of creating the option is the cash flow required to buy the shares and bonds ([7]):

∆S+B = e−rh

[

uCd −dCu

u−d

+e(r−δ)hCu −Cd

u−d

],

= e−rh

[Cu

e(r−δ)h −d

u−d

+Cd

u−e(r−δ)h

u−d

],

= e−rh

[Cu p+Cd(1− p)],

arriving at the required equation.

14](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-17-320.jpg)

![3.2 Pricing an American option through the Trinomial Tree

American option contracts can be exercised at any point up to and including maturity, therefore

the iteration sequence back to the present needs to be modified by re-defining the payoff at every

node of the tree ([14]);

Calloptionpayof f = max(Si,j −K,0),

Putoptionpayof f = max(K −Si,j,0),

where,

Si,j = S0uNu

dNd mNm

with Nu +Nd +Nm = n, n being the time level in between the present and maturity. Each node

for each time level is computed by,

Cn,j = max(optionpayof f,e−r∆t

[puCn+1,j+1 + pmCn+1,j + pdCn+1,j−1].

To solve for these changes we modify the matlab m file t treesize.m (Appendix B) by creating

a vector C the same size as vector A after transferring the values from vector B in the iteration.

The initial payoffs are calculated the same way, and then computing the stock prices for the

corresponding point in time by the up, middle and down jumps applied to the initial stock price.

This vector’s length will change with the point of time by 2(n−k)+1, with k representing the

point in time.

max(S0un−k −K,0)

max(S0un−k−1 −K,0)

...

max(S0u−K,0)

max(S0mn−k −K,0)

max(S0d −K,0)

...

max(S0dn−k−1 −K,0)

max(S0dn−k −K,0)

, (3.1)

the elements of vector A will be,

Ai = max(Ci,Ai).

The process repeats again one step closer to the present.

19](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-22-320.jpg)

![3.4 Pricing a Double Barrier Knockout option through the

Trinomial Tree

Extending the single barrier option to a double barrier can be beneficial for informed investors

betting on the price-movements of the security while still maintaining the same strike price on

a cheaper option[14]. A double barrier knockout option payoff is equal to that of a European

option payoff, if the maximum and the minimum of the underlying asset over the life of the

contract is between the two barriers. A slight modification on the calculation of the indicator

variables is needed to incorporate these double barriers. The payoffs are computed the same way

Table 3.2: Indicator Variables Double Barrier Knockout Option

Double Barrier Knockout Option

max<uB and min>lB I=1

else I=0

as before and then discounted back through the trinomial tree to the source node giving the price

of the option contract. Plotted below in Figure 3.3 are the option prices against the difference

between the two barriers on the knockout option with inputs,

• S0 = 50,

• n = 250,

• K = 50,

• σ = 0.2,

• T = 1,

• r = 0.005,

• dB = 0.1 up to 25 away from S0 in both directions.

Figure 3.3 shows as the difference between the two barriers is increasing from the initial stock

price, the option price is increasing. This would be expected as the maximum and minimum

of each of the simulated runs up to maturity, are not breaching either of the two barriers giving

the European option payoff. Matlab file t double bar.m computes the price of a double barrier

knockout, Appendix (D).

23](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-26-320.jpg)

![Chapter 4

The Greeks

The Greeks are partial derivatives with respect to the underlying parameter to see the sensitivity

of small changes in that parameter. Delta measures the rate of change of the option price with

respect to the underlying security ([15]), ∆ =

∂V

∂S

. Delta being between 0 and 1 for long position

and 0 and -1 for a short position, signifying the amount of stock to hold with respect to number

of option contracts in the portfolio. This idea is known as the Delta-Hedging rule. Delta can also

be seen as the probability of that option being ’in the money’ at maturity ([16]). Theta measures

the sensitivity of the value of option price given the passage of time, commonly divided by the

number of days in a year ([15]),θ =

∂V

∂t

. Gamma measures the rate of change in the delta with

respect to the underlying security, therefore being a second order derivative, Γ =

∂∆

∂S

=

∂2V

∂S2

([15]). Gamma is commonly used as an extension of the delta hedging rule allowing for a wider

range of movements in the underlying security, known as Delta-Gamma-Hedging rule.

25](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-28-320.jpg)

,

c(t,x) = xN(d+(T −t,x))−Ke−r(T−t)

N(d−(T −t,x)),

d±(τ,x) =

1

σ

√

τ

[log(

x

K

)+(r ±

σ2

2

)τ],

N(y) =

1

√

2π

y

−∞

e−Z2

2 dZ =

1

√

2π

∞

−y

e−Z2

2 dZ.

Taking partial derivatives of the above equation to show the value of the required Greek under

the input parameters of current stock price (x), time till expiration (τ), strike price (K), risk-free

interest rate (r) and the stocks volatility (σ).

Delta

Cx(t,x) = N(d+(T −t,x)),

Theta

Ct(t,x) = −rKe−r(T−t)

N(d−(T −t,x))−

σx

2

√

T −t

N (d+(T −t,x)),

Gamma

Cxx(t,x) = N (d+(T −t,x))

∂

∂x

d+(T −t,x),

=

1

σx

√

T −t

N (d+(T −t,x)).

Plotting the above equations in figure 4.1 for share prices between 0 up to 50 in increments of

0.1 and the time till maturity of a year in increments of 0.2. Strike price of 30 with a risk-free

interest rate of 0.005 and a σ of 0.2.

More than half of the shares are shown to be purchased when the share price crosses the strike

price, with holding all the shares with a delta of 1 when the option contract is ’deep in the

money’. Reflecting a less riskier portfolio and incurring a cheaper cost of buying shares if

the share price holds around the strike price, reflecting an uncertainty of the option maintain-

ing ’in the money’. Theta showing the option looses more value per the passage of time the

closer the option reaches maturity around the share price equalling the strike price. While loos-

ing less value as time reaches maturity with the option being ’in the money’ or ’out of the

money’. Gamma showing the rate of range of Delta being the greatest nearer maturity concen-

trated around the strike price on the option. This is seen with Delta’s biggest change when the

26](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-29-320.jpg)

,

∆ =

f(S+dS,n,K,σ,T,r)− f(S,n,K,σ,T,r)

dS

,

Γ =

f(S+dS,n,K,σ,T,r)−2 f(S,n,K,σ,T,r)+ f(S−dS,n,K,σ,T,r)

dS2

,

dS = Sσ

√

T,

• dS is chosen such that the amount is proportional to the volatility and the current share

price, while taking into consideration time till maturity.

Plotted in Figure 4.4 are the Delta and Gamma values against share price, via the trinomial tree

and the Black-Scholes model. From the figure we can clearly see the trinomial tree approxi-

mately follows the same values as the Black-Scholes model. This would be expected as both

methods are built on the assumption the stock price follows the Geometric Brownian Motion

(GBM), with assumed constant volatility up to maturity.

Figure 4.4: Delta and Gamma Greeks via the Trinomial tree and the Black-Scholes model

Done using matlab file g com.m, Appendix (E).

29](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-32-320.jpg)

. Fixing this error will allow for larger

price jumps in the share price, making the portfolio less riskier than just the delta-hedging rule,

extending on to the delta-gamma-hedging rule.

30](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-33-320.jpg)

![5.1 Delta-hedging rule

To begin the delta-hedging rule, an initial cost is incurred of setting up the portfolios positions.

Going long on the shares with a short European call option (lot size being a 100 shares), therefore

borrowing the initial cost minus the cost of the option contracts,

C0 = ∆0N100S0,

B0 = C0 −N f0.

C and B being the cost an amount borrowed respectively, N the number of option contracts

and f being the price of the call option with ∆ being calculated via the trinomial tree. At each

rebalancing point (i) the cumulative cost and borrowed money being ([21]),

Ci = Ci−1e

r

252 +N100(∆i −∆i−1)Si,

Bi = N100∆iSi −N fi.

At maturity the option can be exercised if ST ≥K giving the replication cost,

repcost = CT −N100K,

leading on to the gain after taking in to account the initial price of the option contracts,

netgain = f0Ne

rx

252 −repcost,

x being number days between initial purchase of option contract and maturity.

Call Option price data and stock price data was taken from the Bloomberg Terminals for Mi-

crosoft (MSFT) between 19/08/2013 up to 20/12/2013 with a strike price of 34, the delta-hedge

rule was applied to the data while rebalancing every day. The volatility used for the calculations

was the average of all the Implied Volatilities leading up to maturity. 10 option contracts were

purchased with a lot size of a 100 and a risk-free interest rate of 0.005, plotted in Figure 5.1 is

the cumulative cost, delta, stock price and the amount of money needed to borrow up to maturity

on the contract. Matlab file delta rebalance.m was used for calculations, Appendix (F).

The option matured in the money with a final stock price of 36.8 making the European call op-

tion ’in the money’, therefore exercisable with a strike price of 34. The cumulative cost of the

hedge was 34011 resulting in a replication cost of 11.0826. Giving final net value of -2.77. Such

a small loss in size, in comparison to the cost showing the delta-hedge rule eliminates more risk,

but in turn giving a lower return.

31](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-34-320.jpg)

![5.3 Delta-hedging including Transaction Costs

Buying and selling stocks on the market to rebalance the portfolio incurs transaction costs.

Either a fixed charge per share, a percentage of shares bought or sold, or just a flat fee regardless

of the number of shares ([20]). At each rebalancing point, additional charges are included in the

cumulative cost of the delta-hedge,

Ci = Ci−1e

r

252 +N100(∆i −∆i−1)Si + pSiN100(∆i −∆i−1),

where (p) is the percentage charge of the transaction, only being applied to number of shares

purchased keeping the portfolio delta-neutral. More additional costs occur in practice, the dif-

ference between buying and selling from the broker, known as the bid-ask spread. Stamp duty,

tax and other over night financing costs occur with the holding of your securities. More so-

phisticated pricing techniques of these options are required to give a more accurate and realistic

option price, with additional extension on to allowing the volatility to vary up to maturity on the

option contract.

35](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-38-320.jpg)

![Chapter 7

Recommendations and Further Work

7.1 Implied Trinomial Tree

The trinomial tree assumes constant volatility throughout, an extension of this being the implied

trinomial tree. Where the implied volatilities are computed through the market prices, and the

volatility smile is interpolated across the tree varying the size of the jumps and time between the

jumps. Figure 7.1 shows a constant trinomial tree and an implied trinomial tree.

Figure 7.1: Trinomial tree and an Implied trinomial tree ([22])

37](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-40-320.jpg)

![7.2 Further Hedging Techniques

Delta-Gamma hedging rule rebalances the holding of option contracts between the delta-rebalance

points. ”What is required is a position in an instrument such as an option that is not linearly de-

pendent on the underlying asset” ([19],p363). Letting Γ being the Gamma of a delta-neutral

portfolio and Γτ be the Gamma of a traded option, then the the overall Gamma of the portfolio

with wτ holding of the option contract being ([19],p363),

wτΓτ +Γ (7.1)

holding − Γ

Γτ

of the option contract will in turn make the portfolio gamma-neutral, but the port-

folio may not be delta-neutral anymore, so a rebalancing of the underlying asset is needed.

Vega is an another partial derivative of the Black-Scholes equation with respect to volatility,

ν = ∂V

∂σ ([15]). Having a holding of − ν

ντ

in a traded option will make the portfolio Vega neu-

tral, a portfolio cant be gamma and Vega neutral unless another traded option is bought into the

portfolio ([19],p365). Solving simultaneously the amount of options to hold for the Gamma and

Vega making the respective partial derivative equal to zero on the portfolio. Correspondingly

buying or selling the underlying asset to maintain delta neutrality, in turn made the portfolio

delta-gamma-vega neutral.

38](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-41-320.jpg)

![the price of the same option calculated by the Black-Scholes equation from the Mathematical

Finance (MA3667) module. The family of option greeks will be covered and a few of them

calculated through the trinomial tree.

I will then extend from the Black-Scholes equation and trinomial tree which assumes constant

volatility to the Implied Trinomial Tree by Derman, Kani, and Chriss (1996). Relevant option

price data will also need to be collected either via the Bloomberg terminals or Datastream termi-

nals for the calculation of the implied volatility at different time points throughout the implied

trinomial tree, not all option price data will be available therefore interpolation will be required

to match the volatilities to the volatility smile.

Gant Chart showing the project layout is in Appendix 1.

Background

Introduction

An option is a type of contract that gives the holder the right to, but not obligation to buy (call)

or sell (put) an underlying asset or instrument at a specified strike price on or before a specified

date.

• European option can only be exercised at the expiration date.

• American option can be exercised at any time between the purchase date and the expiration

date.

• Bermuda option can only be exercised at certain times leading up to expiration date, which

are discussed in the option contract.

Pricing of these options has been around for a while, but in 1973, Fisher Black and Myron

Scholes published a paper, ’The Pricing of Options and Corporate Liabilities’.[1] They had an

idea to hedge the option by buying or seeling the underlying asset in such a way to eliminate

risk. With this they derived a stochastic partial differential equation which estimates the price of

the option over time.The Black-Scholes equation let to a boom in finance and more specifically

option trading around the world.[8]

Overiew

50](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-53-320.jpg)

![In the following I cover a brief overview of where I’m taking my project and what areas of

option pricing I’ll be covering. Firstly looking at the binomial option pricing model which was

the first of its kind by Cox, Ross and Rubinstein (CRR)(1979)[1], followed by the formulation

of the model by replicating portfolios. With an extension of the model to 3 states (trinomial)

first introduced by Boyle (1986)[5]. Concluding on Implied Trinomial Trees which is a further

extension by allowing for changing volatility over the time period of the asset by matching the

implied volatilities with the volatility smile.[10]

Binomial Option Pricing Model

Another method for a pricing a stock option is a lattice model, which divides time from now up

to expiration into N discrete time periods with each point going to 2 possible states (Binomial)

or 3 possible states (Trinomial) all the way up to expiration date where the expected payoff’s are

calculated. Then discounting yourself back through the tree until you reach the option price at

the source node.

The first lattice model was the Binomial Option Pricing Model (BOPM) By Cox, Ross and

Rubinstein (CRR)(1979)[1]. From the source node the underlying asset either goes up with

probability p or down with probability 1− p. This process repeats until you reach the expiration

date with all the possible stock outcomes. The expected payoffs are then calculated at expiration

by:

CallOption = max{ST −K,0},

PutOption = max{K −ST ,0}.

ST being the stock price at expiration (T) with K being the strike price on the option. Expected

payoffs are then discounted back through the tree by risk-neutral probabilities until your back at

the source node and reached the option price. Figure 1 below shows the Binomial Tree.

Figure 1 shows a non-recombining tree and a recombining tree. It is computationally efficient to

have a recombining tree over a non-recombining tree, because if the tree recombines, there are

only N + 1 nodes at stage N, whereas there will be 2N nodes at stage N on a non-recombining

tree. To make the tree recombine CRR[1] made ud = 1, making an up jump followed by a down

jump equal to your original position. There is 3 parameters in Binomial model u,d, and p, we

therefore need 3 equations to solve for the parameters. First equation comes from matching

the expectation of return on the asset in a risk-neutral world. The Second from matching the

51](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-54-320.jpg)

![Figure H.1: Non-Recombining Binomial Tree(Left) and a Recombining Binomial Tree(Right)

http://www.mathworks.co.uk/help/fininst/overview-of-interest-rate-tree-models.html

variance.

pu+(1− p)d = er∆t

,

pu2

+(1− p)d2

−(er∆t

)

2

= σ2

∆t.

The third equation comes from making the tree recombine,(CRR)(1979)[1]

u =

1

d

.

After some rearranging and solving for the 3 parameters in the 3 equations above, results

showed[3]:

p =

er∆t −d

u−d

,

u = eσ

√

∆t

,

d = e−σ

√

∆t

,

where σ is the assets volatility and r being the risk-free interest rate. When the Binomial tree

has been created (Figure 2) with the expected future payoffs (leaf nodes), these need to be

continuously discounted back to earlier nodes by the risk-free interest rate, taking into account

the risk-neutral probabilities. The formula is

Cn,j = e−r∆t

(pCn+1,j+1 +(1− p)Cn+1,j−1).

Where Cn,j is the current option price for tier n with Cn+1,j+1 being the upper node and Cn+1,j−1

being the lower node at the next point in time. This process repeats until your back at the source

node with the option price.

52](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-55-320.jpg)

![Figure H.2: Multi-Step Binomial Tree

http://investexcel.net/binomial-option-pricing-excel/

Formulation of the Binomial Option Pricing Model by replicating portfolios

Let a portfolio contain ∆ shares of the stock and an ammount B invested in risk-free bonds with

a present value of ∆s+B. We want the option payoff = portfolio payoff.[6] Value of replicating

portfolio at time h with stock price Sh is ∆Sh + erhB. At Sh = uS and Sh = dS the replicating

portfolio must satisfy[7]:

(∆uSeδh

)+(Berh

) = Cu,

(∆dSeδh

)+(Berh

) = Cd,

with δ being the dividend yield, Cu being the upper option node and Cd being the lower option

node. Then solving for ∆ and B:

Cu −∆uSeδh

= Cd −∆dSeδh

,

∆ = eδh

(

Cu −Cd

uS−dS

), (H.1)

Berh

= Cu −∆uSeδh

, (H.2)

substituting eq(1) into eq(2) yields:

Berh

= Cu −

uS(Cu −Cd)

uS−dS

,

B = e−rh

(

uCd −dCu

u−d

.

53](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-56-320.jpg)

![The cost of creating the option is the cash flow required to buy the shares and bonds[7]:

∆S+B = e−rh

[

uCd −dCu

u−d

+e(r−δ)hCu −Cd

u−d

],

= e−rh

[Cu

e(r−δ)h −d

u−d

+Cd

u−e(r−δ)h

u−d

],

= e−rh

[Cu p+Cd(1− p)].

Trinomial Model

The Trinomial model is an extension of the Binomial model. but taking an additional path at

each node of the stock price staying the same. This was first introduced by Boyle (1986) [5].

The foundations of the model are similar in the fact that the first two moments are matched

but with the first two moments of the Geometric Brownian Motion (GBM)[14], which behaves

similar to stock price movements.

E[S(ti+1)|S(ti)] = er∆t

S(ti),

Var[S(ti+1)|S(ti)] = ∆tS(ti)2

σ2

,

ud = 1.

The last constraint is needed to make the tree recombine, solving for the above equations

yields[14]:

u = eσ

√

2∆t

,

v = e−σ

√

2∆t

,

with the transition probabilities being:

pu = (

e

r∆t

2 −e

−σ ∆t

2

e

σ ∆t

2 −e

−σ ∆t

2

)2

,

pd = (

e

σ ∆t

2 −e

r∆t

2

e

σ ∆t

2 −e

−σ ∆t

2

)2

,

pm = 1− pu − pd.

The same discounting method is used from the Binomial model just extended to the trinomial

model:

Cn,j = e−r∆t

(puCn+1,j+1 + pmCn+1,j + pdCn+1,j−1).

54](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-57-320.jpg)

![Figure H.3: Trinomial Tree Example

http:

//www.24-something.com/2011/03/07/how-to-create-trinomial-option-pricing-trees-with-excel-applescripts/

This process keeps repeating until back at the source node just like the Binomial Model. Figure

3 below shows an example of a trinomial tree with the blue being the stocks price with the option

price beneath.

Implied Trinomial Trees (ITT)

Implied trees allows for changing volatility between nodes by extracting an implied evolution

for the stock prices in equilibrium from market prices of liquid standard options on the underly-

ing stock.[2] Making implied trees an extension to the Black-Scholes equation which assumes

volatility is constant. A couple of new concepts are needed for the calculation of ITT, Arrow-

Debreu prices and the volatility smile.

Arrow-Debreu prices are the sum of the product of the risklessly discounted transition proba-

bilities over all paths starting in the root of the tree and leading to node (n,i), with n being the

nth time level and i being the highest node on that level. [10]

The Volatility Smile is the plot of implied volatility against varying strike prices as shown in

figure 4 below. ‘In the money’ meaning the option is worth something, ‘at the money’ being the

option is at the strike price and ‘out of the money’ meaning the option is worthless.

There is also a reverse skew and forward skew also known as the volatility smirk. In the reverse

skew pattern the implied volatility’s are higher at lower strike prices than the implied volatility at

higher strike prices. More frequently appears for longer term equity options and index options.

[11] In the forward skew pattern, the implied volatility for lower strike prices are lower than the

implied volatility at higher strike prices, commonly seen for options in the commodities market.

55](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-58-320.jpg)

![Figure H.4: Volatility Smile

http://www.investopedia.com/terms/v/volatilitysmile.asp

[11]

The Implied trinomial tree desires the following properties to model the underlying price cor-

rectly [10].

1. Reproduces correctly the volatility smile.

2. Is risk neutral.

3. Uses transition probabilities from the interval (0,1).

The study of implied trinomial trees is currently a work in progress.

56](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-59-320.jpg)

![Bibliography

[1] Black, Fischer; Myron Scholes (1973). The Pricing of Options and Corporate Liabilities.

Journal of Political Economy 81 (3): 637654. doi:10.1086/260062. [1] (Black and Scholes’

original paper.)

[2] MacKenzie, Donald (2006). An Engine, Not a Camera: How Financial Models Shape

Markets. Cambridge, MA: MIT Press. ISBN 0-262-13460-8.

[3] John C. Cox, Stephen A. Ross, and Mark Rubinstein. 1979. Option Pricing: A Simplified

Approach. Journal of Financial Economics 7: 229-263.

[4] http://www.goddardconsulting.ca/option-pricing-binomial-index.html

[5] P. Boyle, Option Valuation Using a Three-Jump Process, International Options Journal 3,

7-12 (1986).

[6] Professor P.A.Spindt Binomial Option Pricing

[7] https://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=

3&ved=0CDgQFjAC&url=http%3A%2F%2Fwww2.fiu.edu%2F~dupoyetb%2FAdvanced_

Risk_Mgt%2Flectures%2Fweek%25201.ppt&ei=IPWDUu-gMMXIhAev8oCQDg&usg=

AFQjCNEOr7-1rmnXwdsiVze2JeAMszww2A&bvm=bv.56343320,d.ZG4&cad=rja

[8] P. Clifford, O. Zaboronski. Pricing Options Using Trinomial Trees (2008)

[9] E. Derman, I. Kani, N.Chriss. Implied Trinomial Trees of the Volatility Smile (1996)

[10] P.Cizek, K.Komorad Implied Trinomial Trees SFB 649 Discussion Paper (2005-007)

[11] http://www.theoptionsguide.com/volatility-smile.aspx

57](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-60-320.jpg)

![Bibliography

[1] John C. Cox, Stephen A. Ross, and Mark Rubinstein. 1979. Option Pricing: A Simplified

Approach. Journal of Financial Economics 7: 229-263.

[2] E. Derman, I. Kani, N.Chriss. Implied Trinomial Trees of the Volatility Smile (1996)

[3] http://www.goddardconsulting.ca/option-pricing-binomial-index.html

[4] F.Black and M.Scholes. The Pricing of Options and Corporate Liabilities The Journal of

Political Economy, Vol. 81, No. 3 (May - Jun., 1973), pp. 637-654

[5] P.Date and S.Virmani MA3667:Mathematical and Computational Finance Assignment

[6] Professor P.A.Spindt Binomial Option Pricing

[7] https://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=

3&ved=0CDgQFjAC&url=http%3A%2F%2Fwww2.fiu.edu%2F~dupoyetb%2FAdvanced_

Risk_Mgt%2Flectures%2Fweek%25201.ppt&ei=IPWDUu-gMMXIhAev8oCQDg&usg=

AFQjCNEOr7-1rmnXwdsiVze2JeAMszww2A&bvm=bv.56343320,d.ZG4&cad=rja

[8] MacKenzie, Donald (2006). An Engine, Not a Camera: How Financial Models Shape

Markets. Cambridge, MA: MIT Press. ISBN 0-262-13460-8.

[9] Ross, Sheldon.M (2007). ”10.3.2”. Introduction to Probability Models

[10] http://en.wikipedia.org/wiki/Geometric_Brownian_motion

[11] Wilmott, Paul (2006). ”16.4”. Paul Wilmott on Quantitative Finance (2 ed.).

[12] Gatheral, J, (2006). The volatility surface: a practitioners guide, Wiley.

[13] http://en.wikipedia.org/wiki/Stochastic_volatility

59](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-62-320.jpg)

![[14] P. Clifford, O. Zaboronski. Pricing Options Using Trinomial Trees (2008)

[15] Haug, Espen Gaardner (2007). The Complete Guide to Option Pricing Formulas. McGraw-

Hill Professional. ISBN 9780071389976. ”ISBN 0-07-138997-0”

[16] http://en.wikipedia.org/wiki/Greeks_(finance)

[17] http://investexcel.net/binomial-option-pricing-excel/

[18] Shreve, Steven.E Stochastic Calculus for Finance 2, Continious Time models

[19] John.C.Hull Options, Futures, and other derivatives, (7th ed.)

[20] Chi Lee Option Pricing in the Presence of Transaction Costs

[21] Prof. Yuh-Dauh Lyuu, National Taiwan University (2007) Delta Hedge

[22] E. Derman, I. Kani and N. Chriss Implied Trinomial Trees of the Volatility Smile (1996).

60](https://image.slidesharecdn.com/6ac080af-d1cb-4676-8c78-0b52f10c2cda-150519113542-lva1-app6891/85/disso-final-63-320.jpg)