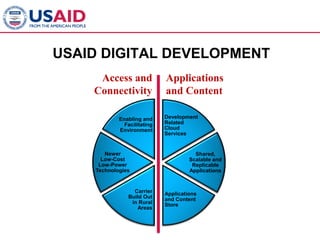

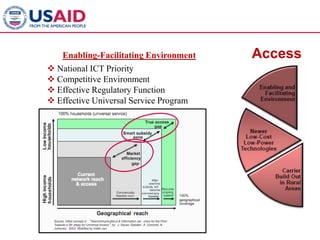

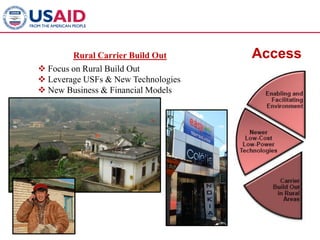

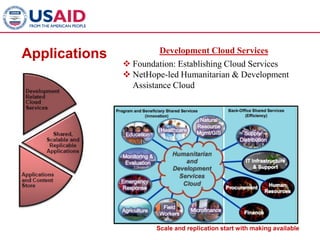

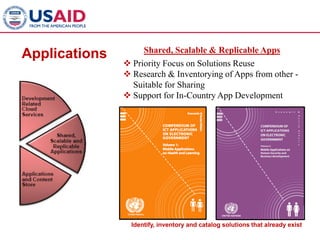

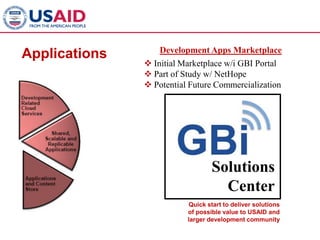

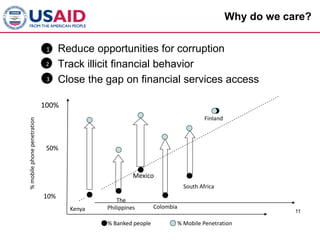

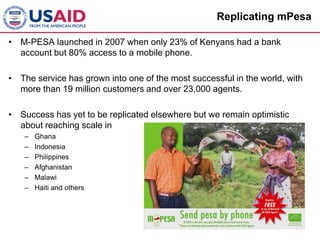

The document discusses USAID's digital development initiatives focused on expanding access to connectivity and mobile applications. It aims to extend rural access through low-cost mobile and broadband technologies. Key areas of focus include facilitating regulatory environments, universal access programs, and leveraging new technologies. USAID also supports the development and sharing of scalable, replicable mobile applications. This includes establishing cloud services and an applications marketplace. Mobile money programs are highlighted as a priority to increase financial inclusion through partnerships with governments, donors, and private sector actors. The goal is to replicate successes like M-Pesa in new countries through risk capital, enabling policies, and multi-sector collaboration.