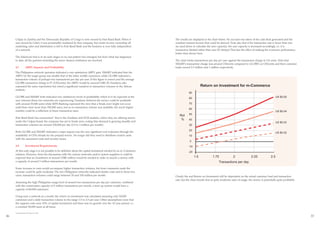

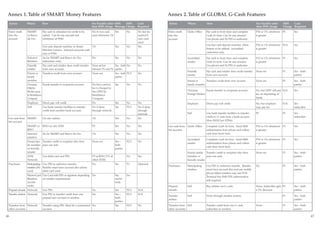

This document summarizes a report on micro-payment systems and their application to mobile networks. It discusses two successful mobile commerce (m-commerce) services in the Philippines provided by GLOBE Telecom and SMART Communications. These services allow customers to load prepaid airtime credits and transfer cash and airtime credits in small increments, which matches the purchasing behaviors of their target markets. The report identifies the key success factors of these services as offering low-value transactions and the ability to load airtime credits and transfer funds between customers. It raises questions about who the users are and how they benefit from these m-commerce services that will be explored in future research.