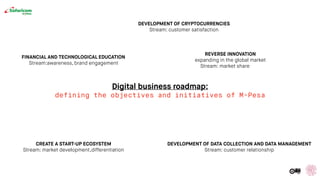

M-Pesa is a mobile money transfer service launched in Kenya in 2007 by Safaricom. It allows users to deposit, withdraw, and transfer money, and pay for goods and services using a mobile phone. M-Pesa has expanded to other countries and added new services like M-Ledger, M-Shwari, and Lipa na M-Pesa. It makes money through fees on money transfers, withdrawals, and microcredit services. M-Pesa collects large amounts of customer data and partners with other companies to offer an integrated digital platform and expand its services and customer base internationally through reverse innovation.