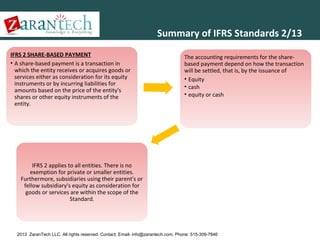

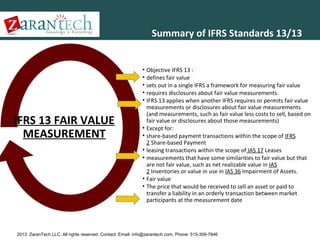

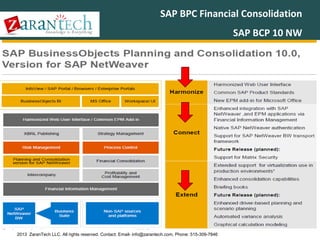

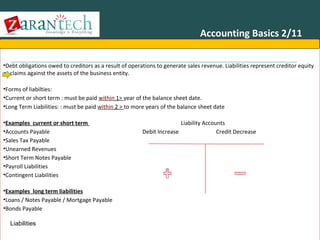

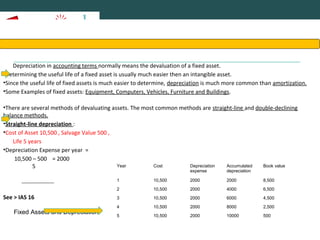

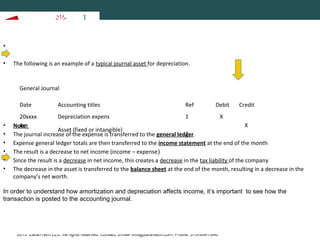

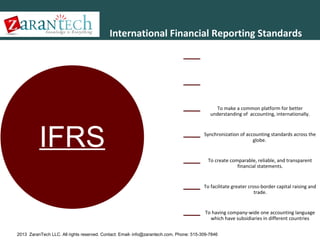

The document covers the basics of accounting, focusing on key concepts like assets, liabilities, and equity, along with the accounting processes of depreciation and amortization. It outlines the importance of International Financial Reporting Standards (IFRS) and includes specific standards like IFRS 1, 2, and 3 related to financial reporting and business combinations. Additionally, it emphasizes the accrual basis of accounting and the significance of matching revenues with incurred expenses.

![Summary of IFRS

Standards 1/13

IFRS 1 First-time Adoption of International Financial Reporting Standards sets out the procedures that an entity must follow when it adopts

IFRSs for the first time as the basis for preparing its general purpose financial statements

A first-time adopter is an entity that, for the

first time, makes an explicit and unreserved

statement that its general purpose financial

statements comply with IFRSs. (IFRS 1.3)

An entity may be a first-time adopter if, in

the preceding year, it prepared IFRS

financial statements for internal

management use, as long as those IFRS

financial statements were not made

available to owners or external parties such

as investors or creditors.

An entity can also be a first-time adopter if,

in the preceding year, its financial

statements: [IFRS 1.3] asserted compliance

with some but not all IFRSs, or included

only a reconciliation of selected figures

from previous GAAP to IFRSs. (Previous

GAAP means the GAAP that an entity

followed immediately before adopting to

IFRSs.)

However, an entity is not a first-time adopter if, in the preceding year, its financial statements asserted:

Compliance with IFRSs even if the auditor's report contained a

qualification with respect to conformity with IFRSs.

Compliance with both previous GAAP and IFRSs.

2013 ZaranTech LLC. All rights reserved. Contact: Email- info@zarantech.com, Phone: 515-309-7846](https://image.slidesharecdn.com/sapbpc10-131128194712-phpapp01/85/SAP-BPC-10-0-Training-from-ZaranTech-19-320.jpg)