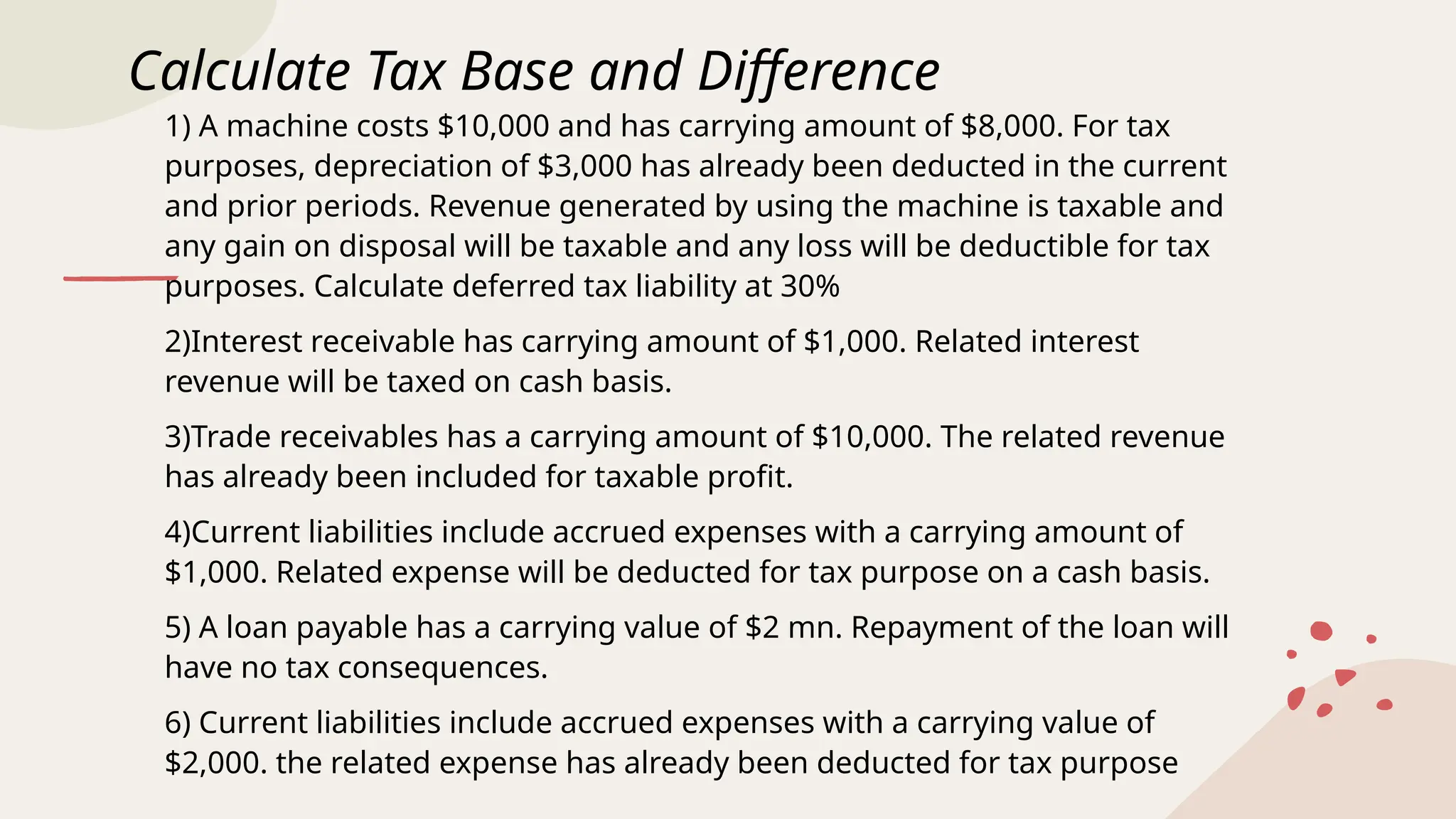

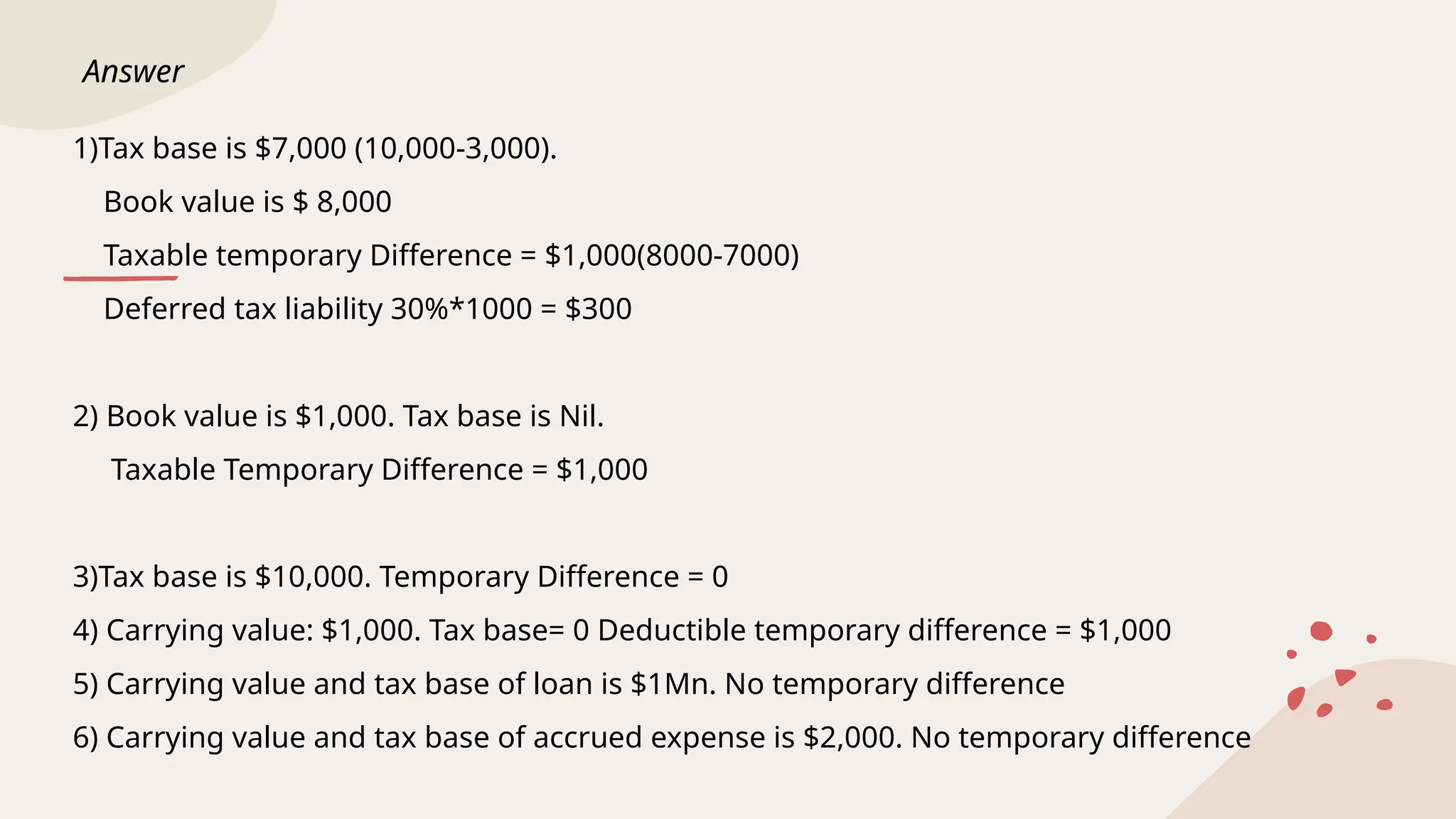

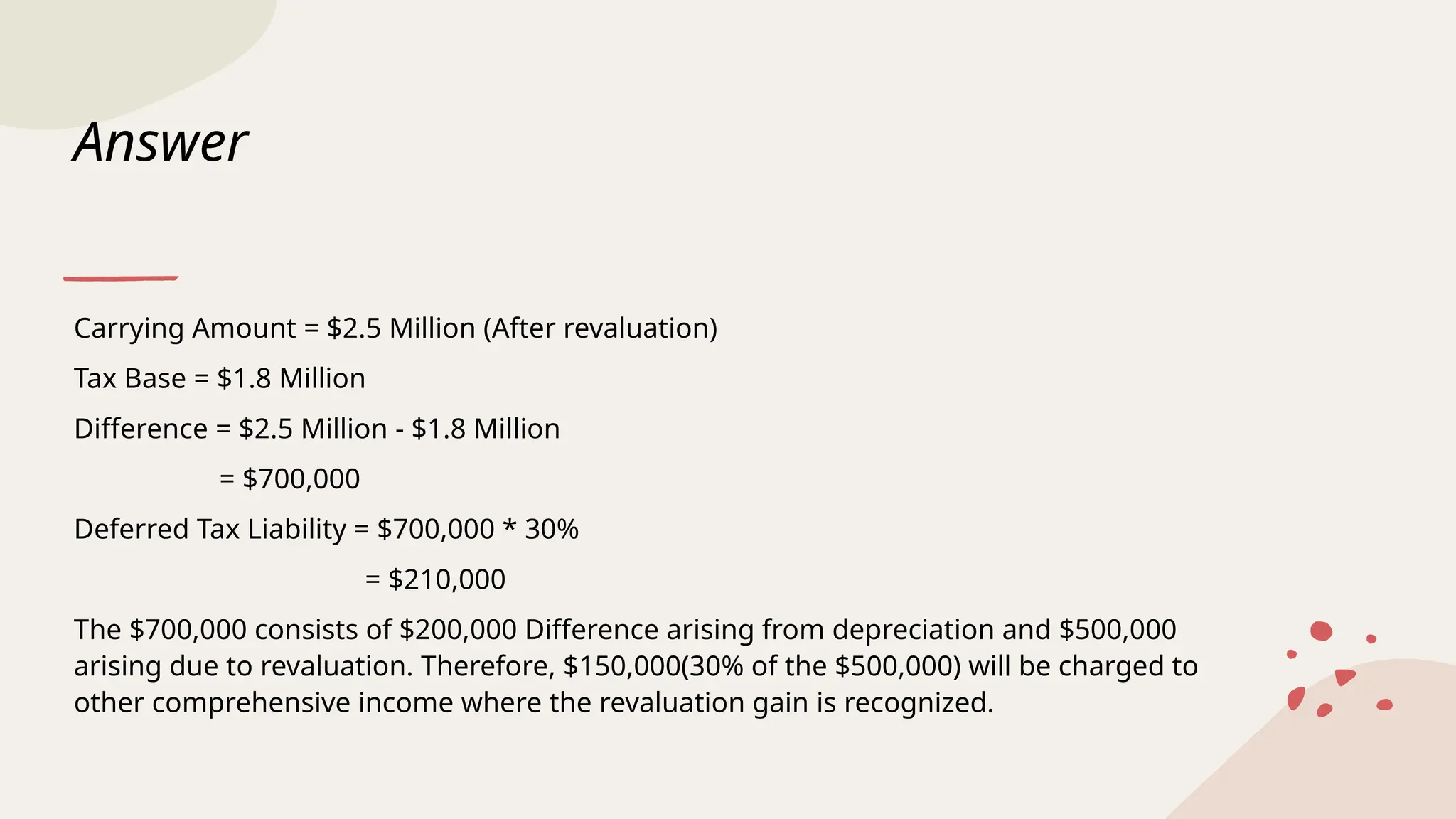

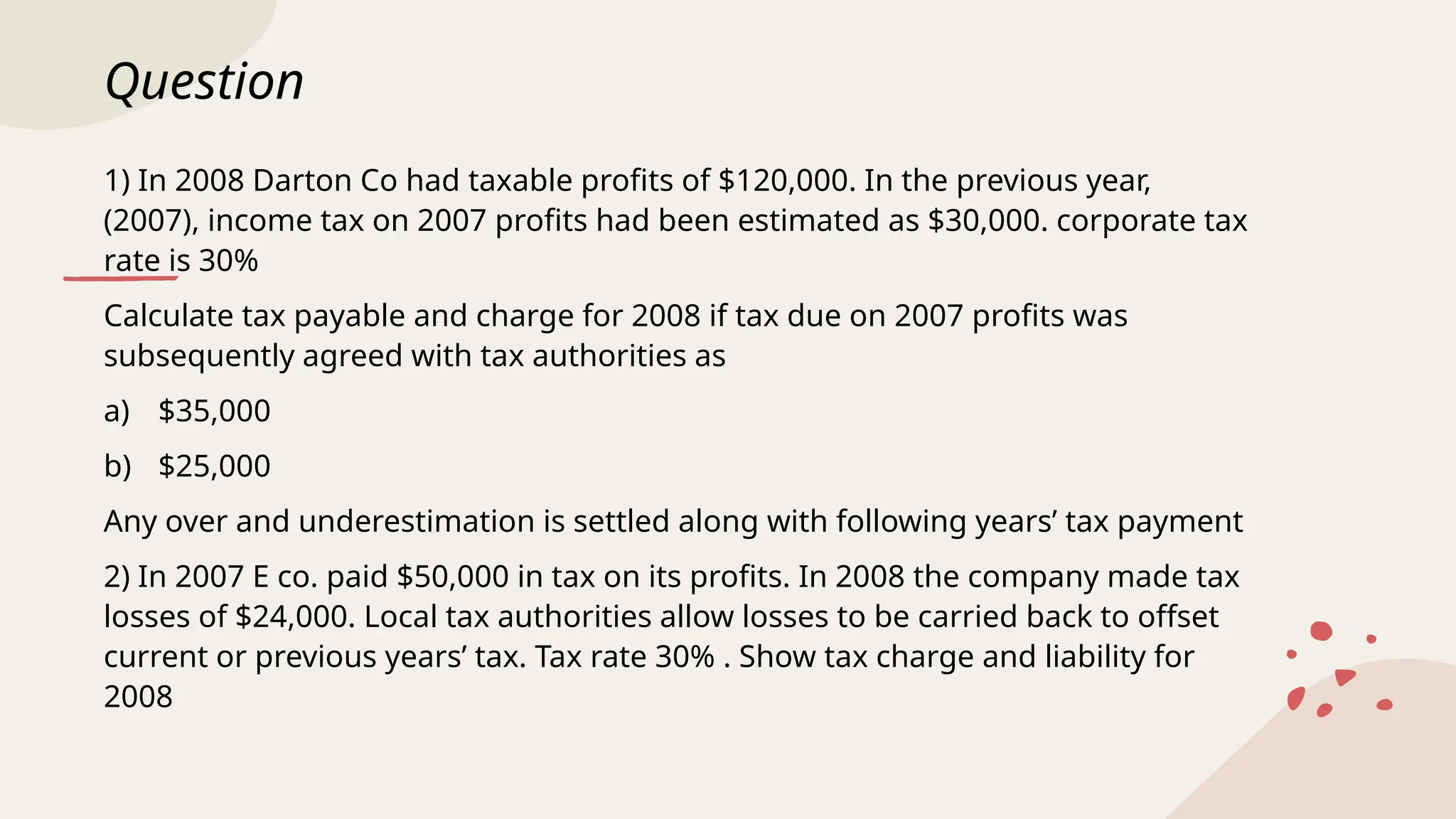

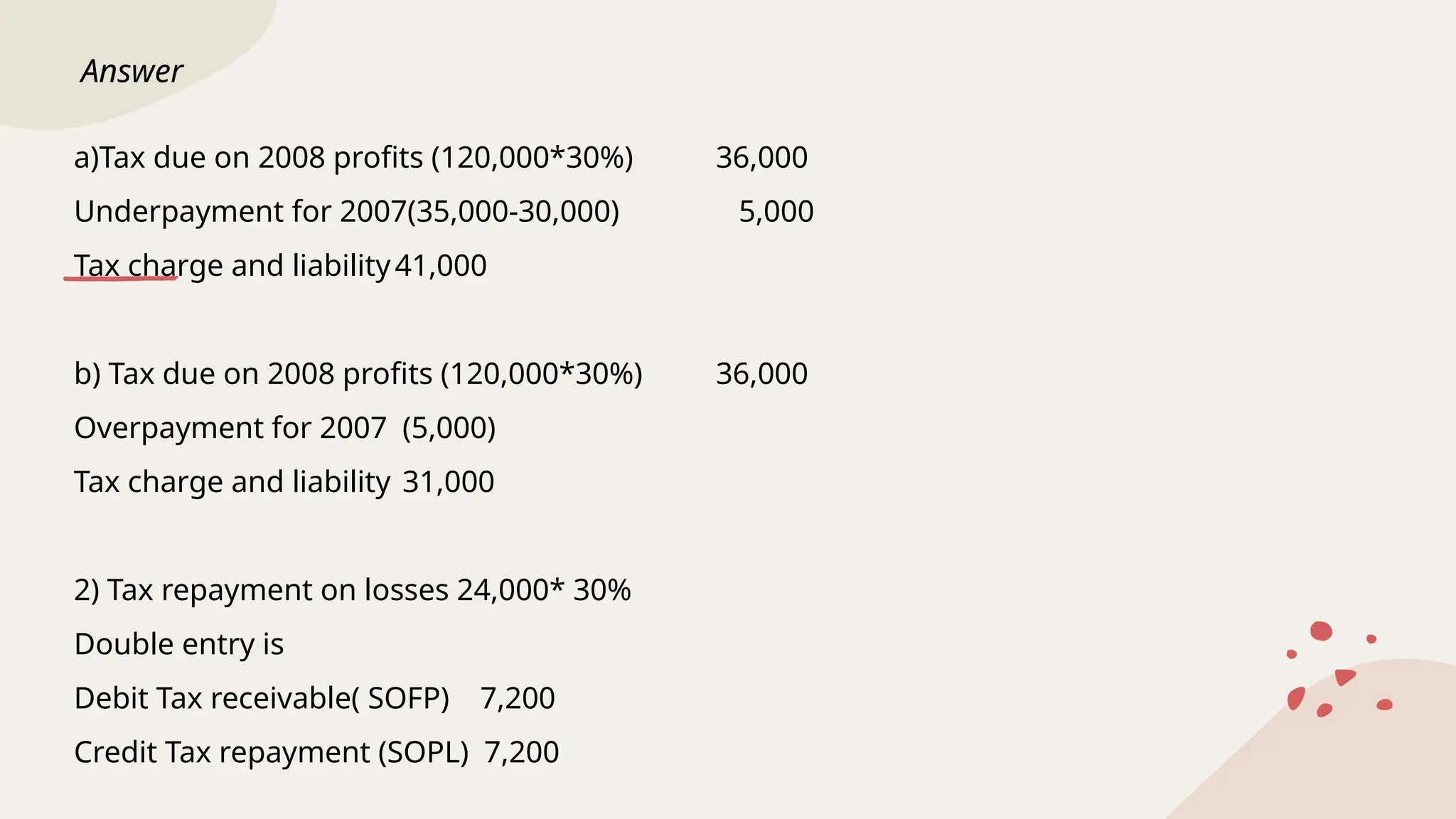

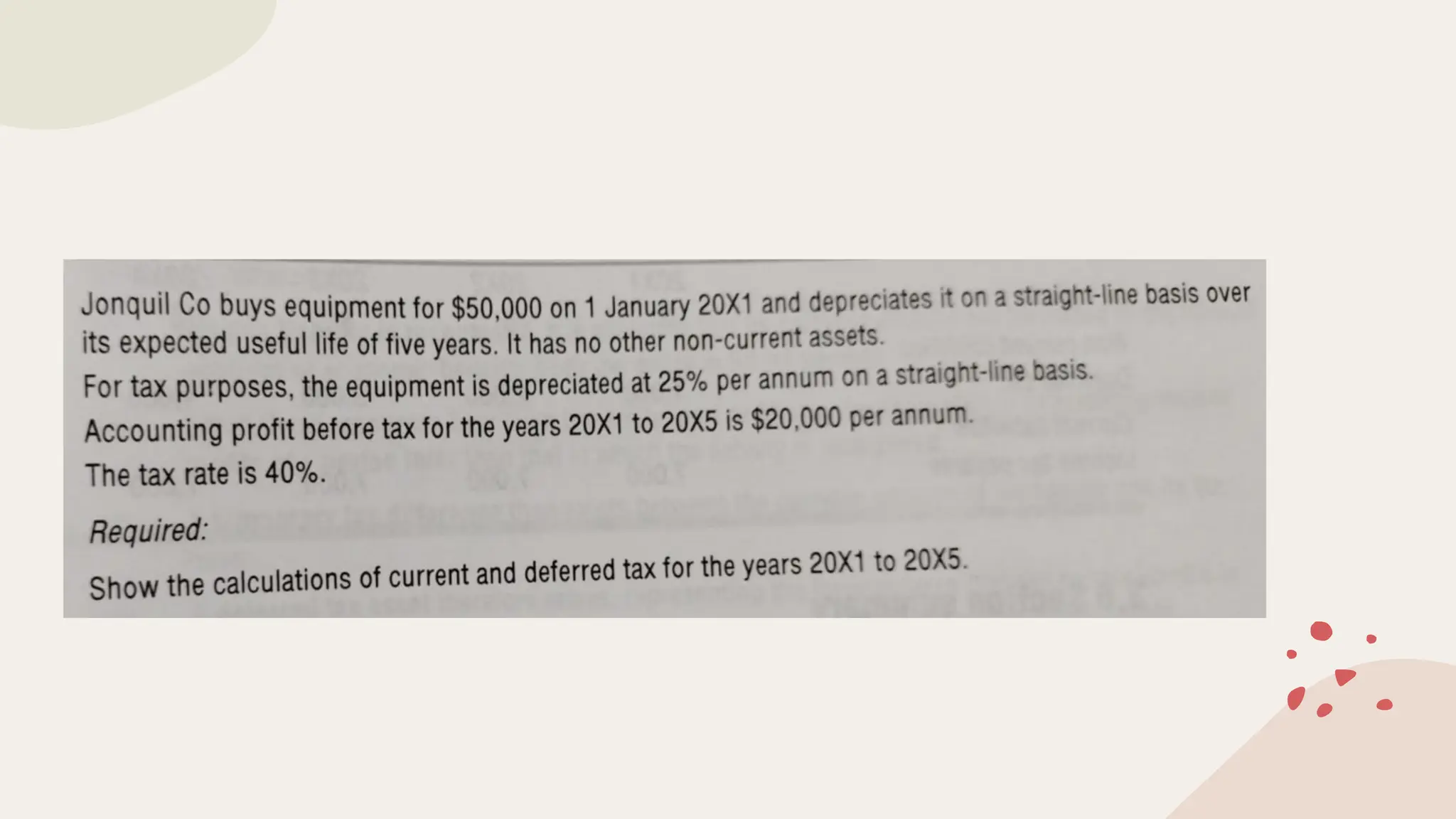

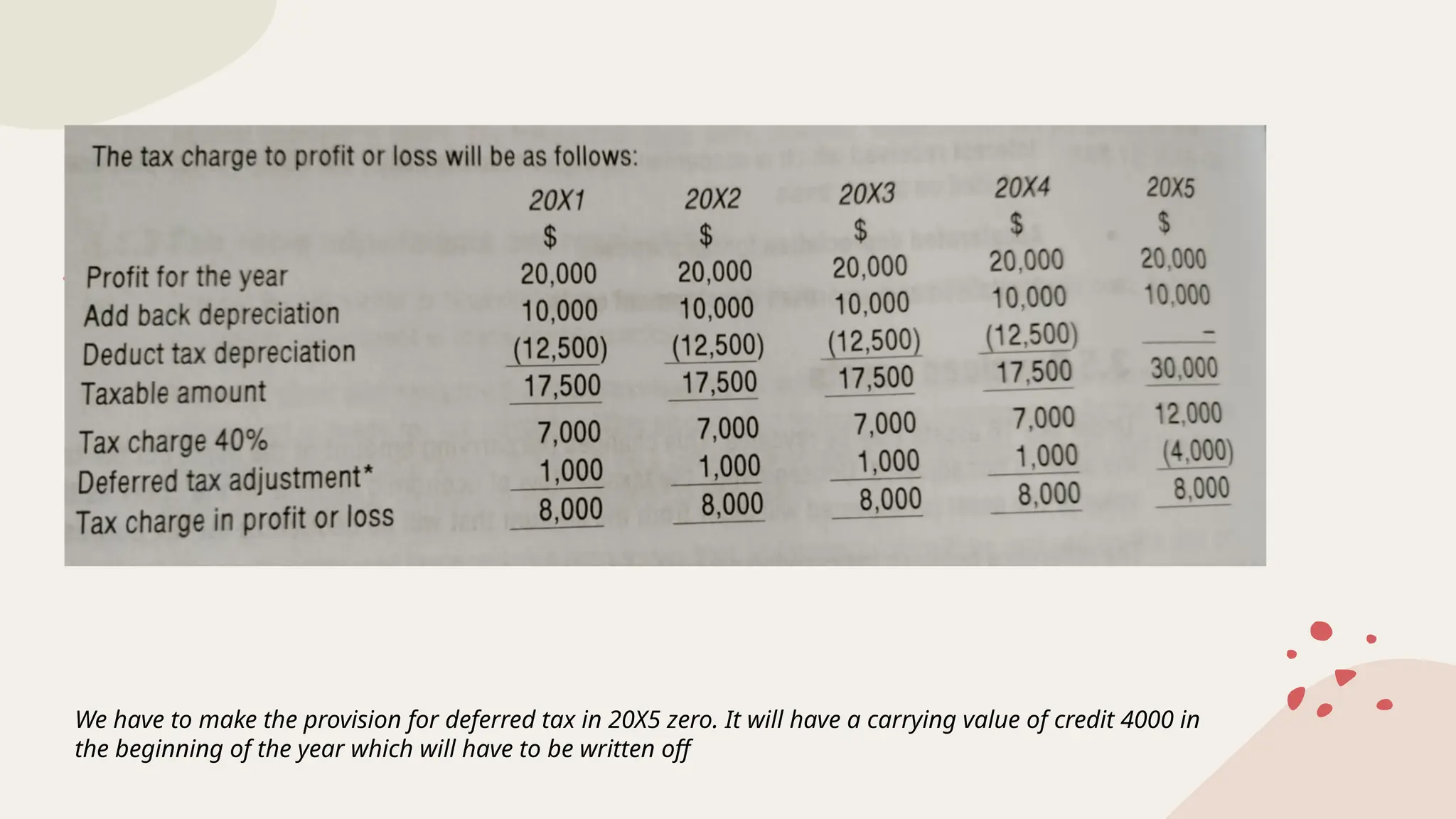

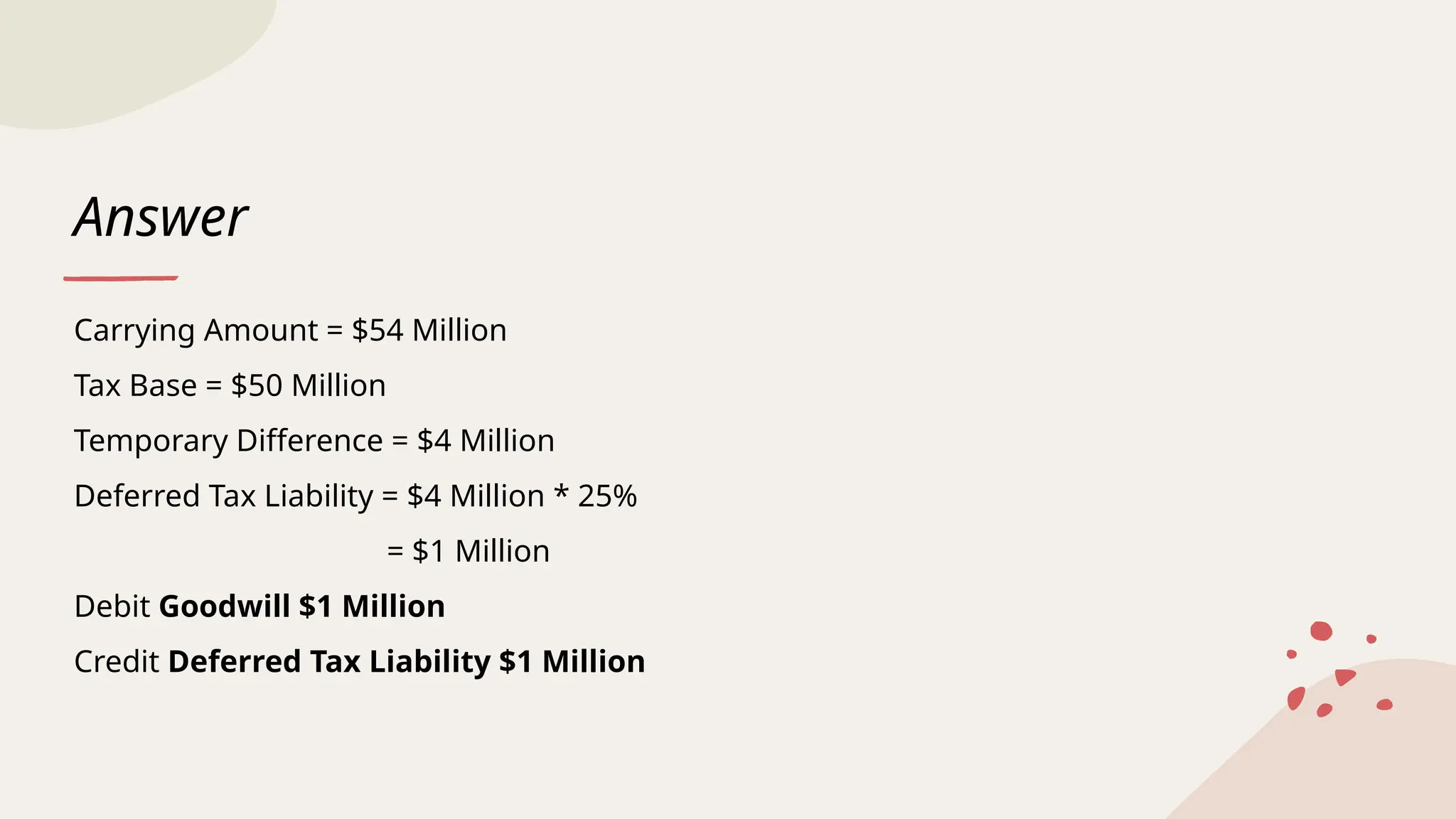

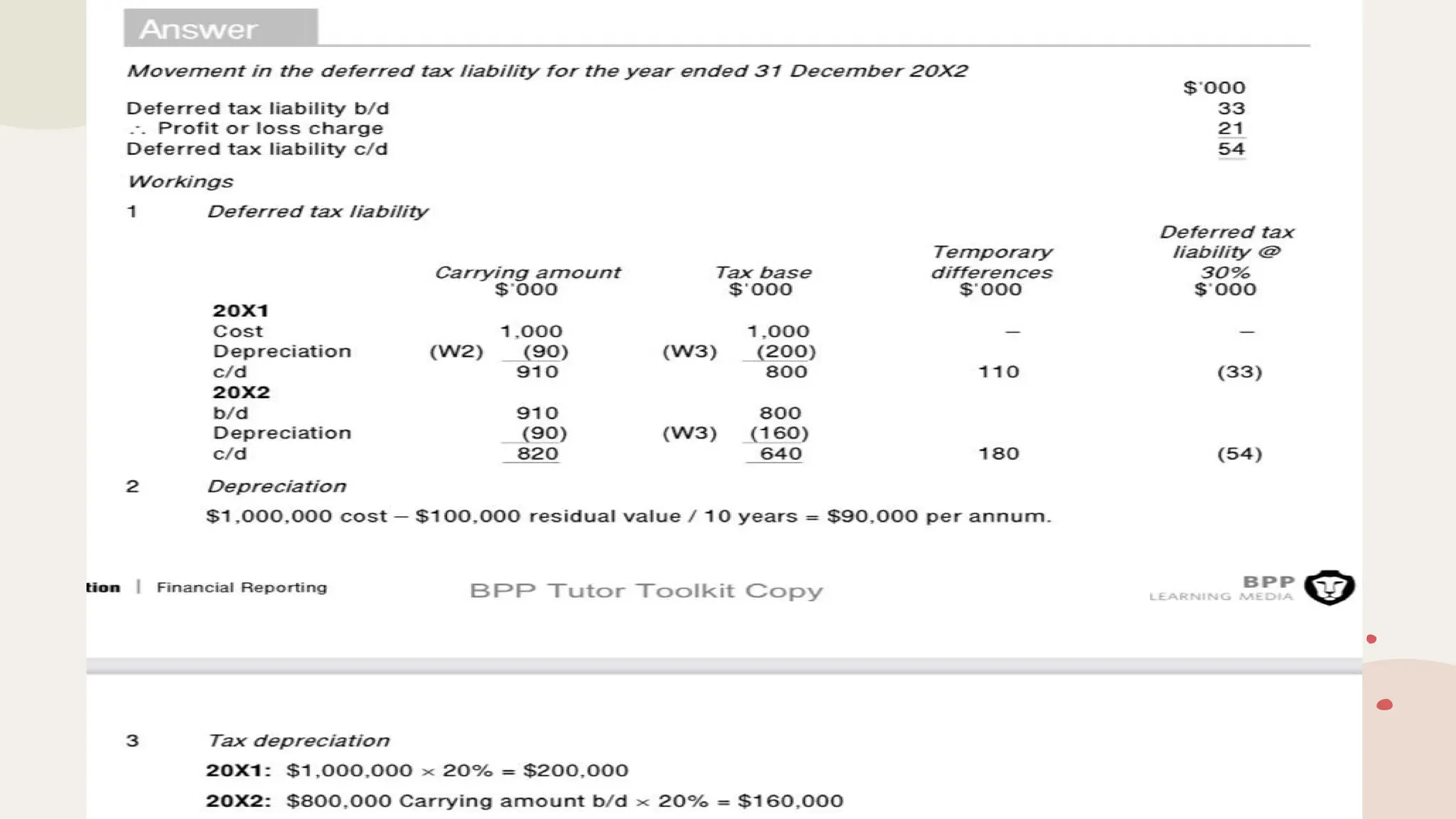

The document outlines key concepts and accounting principles related to income tax, focusing on definitions such as accounting profit, taxable profit, current and deferred tax. It describes temporary and permanent differences in taxation, how deferred tax liabilities and assets arise, and provides examples of calculating tax bases and liabilities. Additionally, it discusses implications of tax adjustments in business combinations and revaluations of assets, highlighting the treatment of deferred tax in these scenarios.