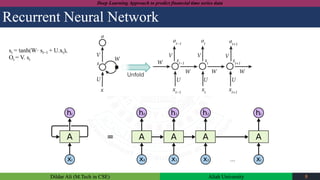

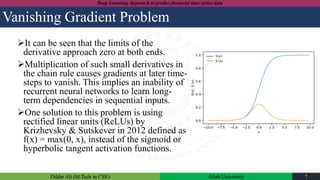

Dildar Ali wrote a paper on using deep learning approaches like recurrent neural networks (RNNs) and long short-term memory (LSTM) networks to predict financial time series data. The document provides an introduction to time series forecasting in financial markets. It reviews past work applying RNNs and LSTMs to stock price prediction. It also describes issues with standard RNNs like vanishing gradients and explains how LSTMs address this by incorporating memory cells and gates. The paper proposes using RNNs and LSTMs to predict financial data and improve on standard RNN accuracy and stability.

![Dildar Ali (M.Tech in CSE) Aliah University 8

Deep Learning Approach to predict financial time series data

LSTM

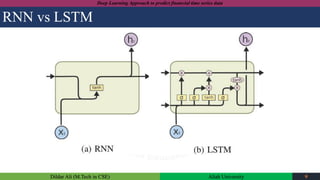

LSTMs were originally introduced by Hochreiter and Schmidhuber and

further improved by Gers, Schmidhuber, and Cummins [6]. Recurrent

neural networks with LSTMs share the same structure as well as the

learning algorithm (backpropagation through time); the difference is in

the hidden units

ft = σ (uf · xt + wf · Ot-1 + bf ).

it = σ (ui · xt + wi · Ot-1 + bi ).

Bt = tanh(ub · xt + wb · Ot-1 + bb ).

Ct = it · Bt + ft · Ct−1.

ht = σ (uh · xt + wh · Ot-1 + bh ).

ot = σ(ht · tanh(Ct)).](https://image.slidesharecdn.com/dltoftsd-190705142958/85/Deep-Learning-Approach-to-Predict-Financial-Time-Series-Data-8-320.jpg)

![Dildar Ali (M.Tech in CSE) Aliah University 12

Deep Learning Approach to predict financial time series data

References

[1] J. Heaton, N. Polson, and J. Witte, “Deep learning in finance,” arXiv preprint arXiv:1602.06561, 2016.

[2] H. Jia, “Investigation into the effectiveness of long short term memory networks for stock price prediction,”

arXiv preprint arXiv:1603.07893, 2016.

[3] Y. Bengio, I. J. Goodfellow, and A. Courville, “Deep learning,” Nature, vol. 521, pp. 436–444, 2015.

[4] J. Roman and A. Jameel, “Backpropagation and recurrent neural networks in financial analysis of multiple

stock market returns,” in System Sciences, 1996., Proceedings of the Twenty-Ninth Hawaii International

Conference on,, vol. 2. IEEE, 1996, pp. 454–460.

[5] E. W. Saad, D. V. Prokhorov, and D. C. Wunsch, “Comparative study of stock trend prediction using time

delay, recurrent and probabilistic neural networks,” IEEE Transactions on neural networks, vol. 9, no. 6, pp.

1456–1470, 1998.

[6] S. Hochreiter and J. Schmidhuber, “Long short-term memory,” Neural computation, vol. 9, no. 8, pp. 1735–

1780, 1997.

[7] Gers, F. A.; Schmidhuber, J. Recurrent nets that time and count. In Neural Networks, 2000. IJCNN 2000,

Proceedings of the IEEE-INNSENNS International Joint Conference on, volume 3, IEEE, 2000, pp. 189–194

[8] Lin, B.-S., Chu, W.-T., & Wang, C.-M. (2018). Application of Stock Analysis Using Deep Learning. 2018

7th International Congress on Advanced Applied Informatics (IIAI-AAI).](https://image.slidesharecdn.com/dltoftsd-190705142958/85/Deep-Learning-Approach-to-Predict-Financial-Time-Series-Data-12-320.jpg)