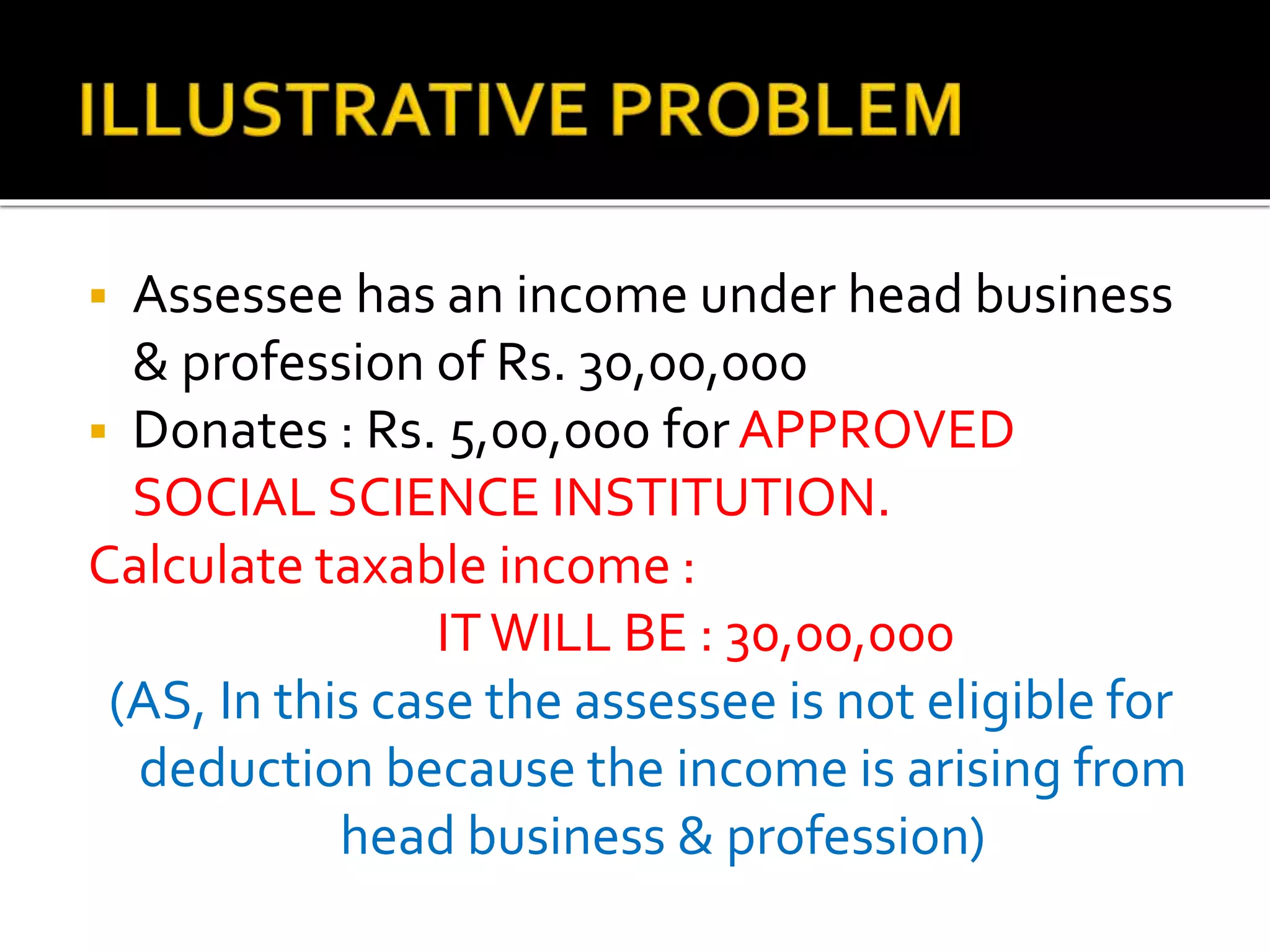

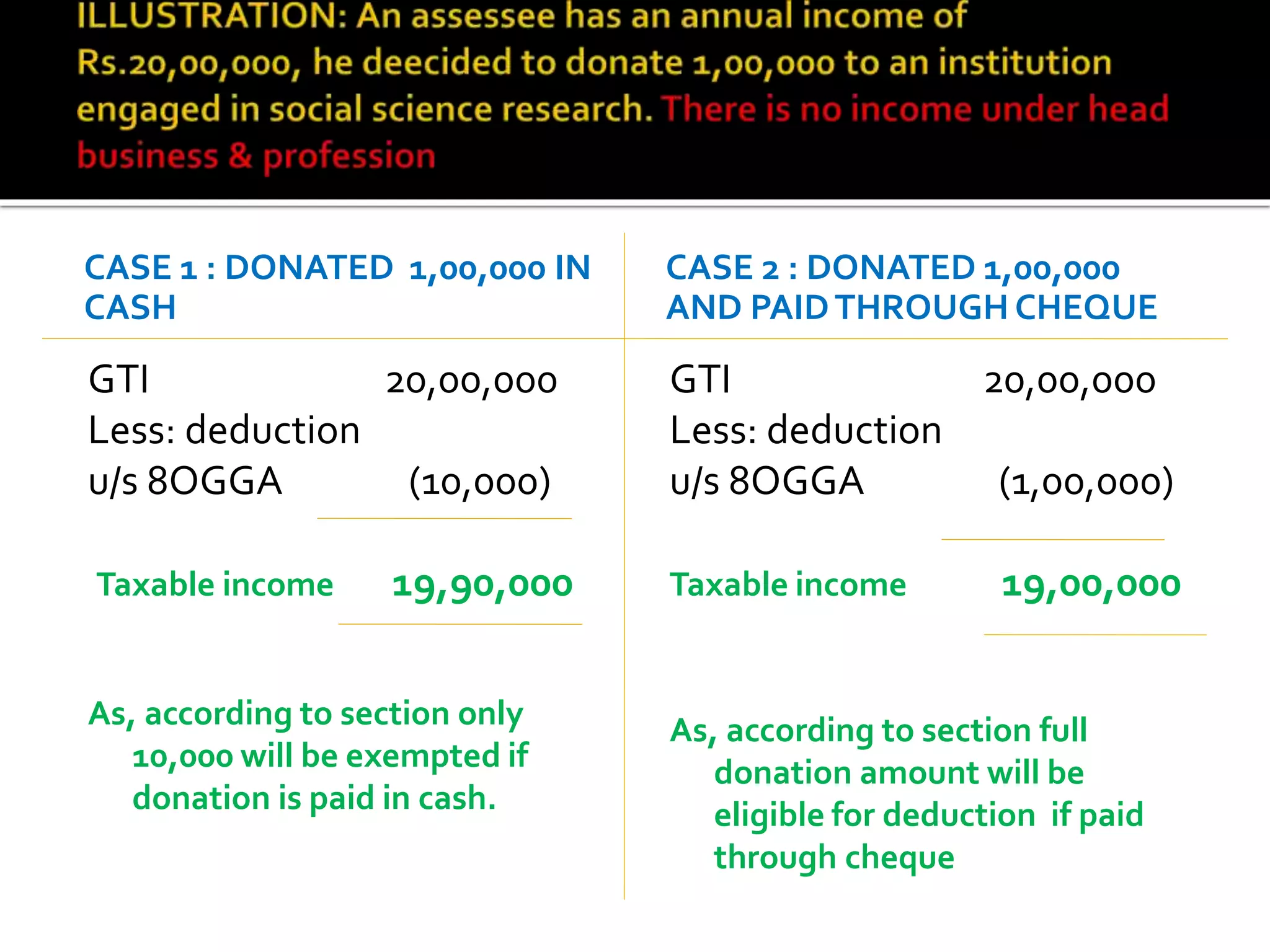

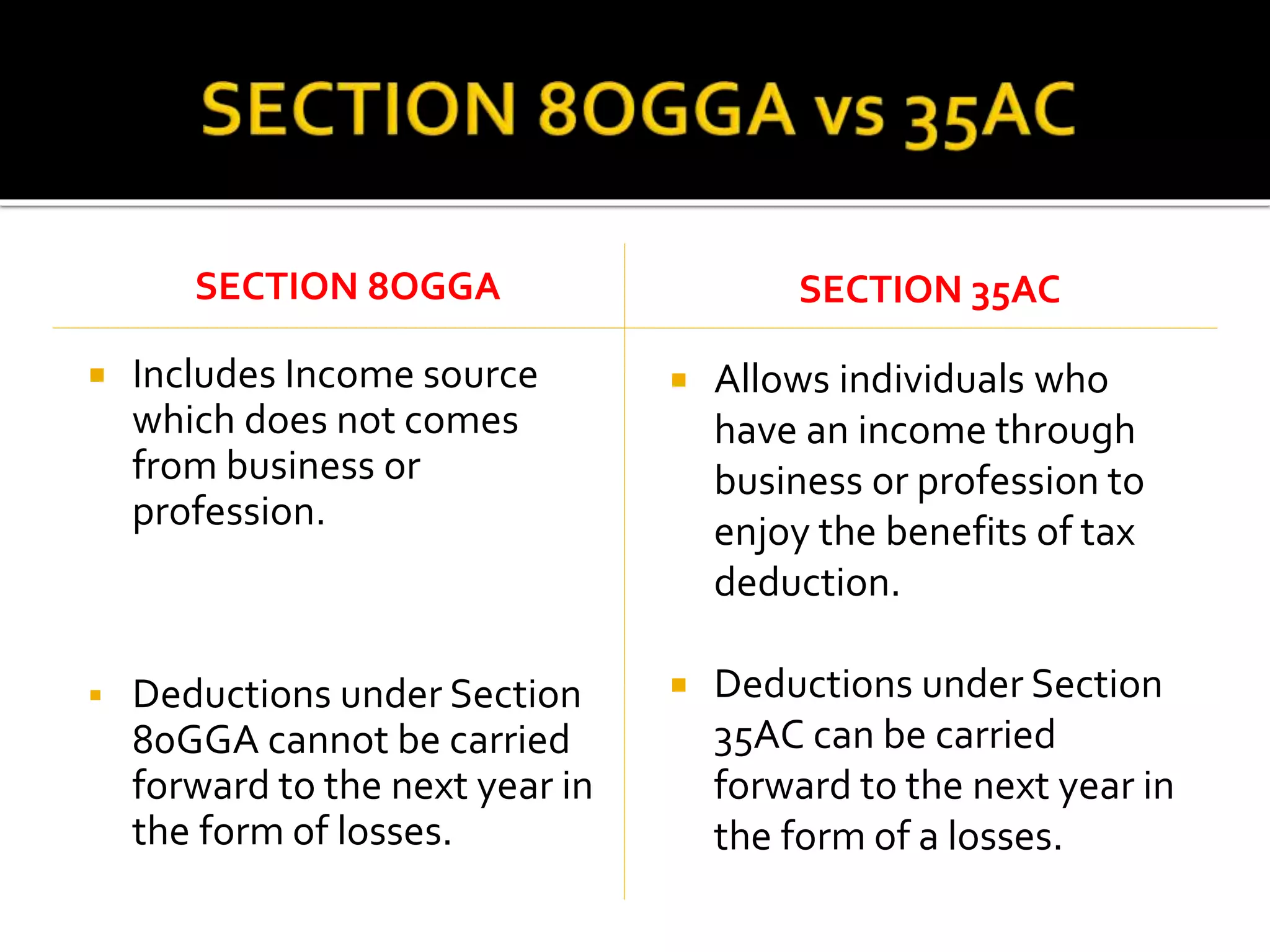

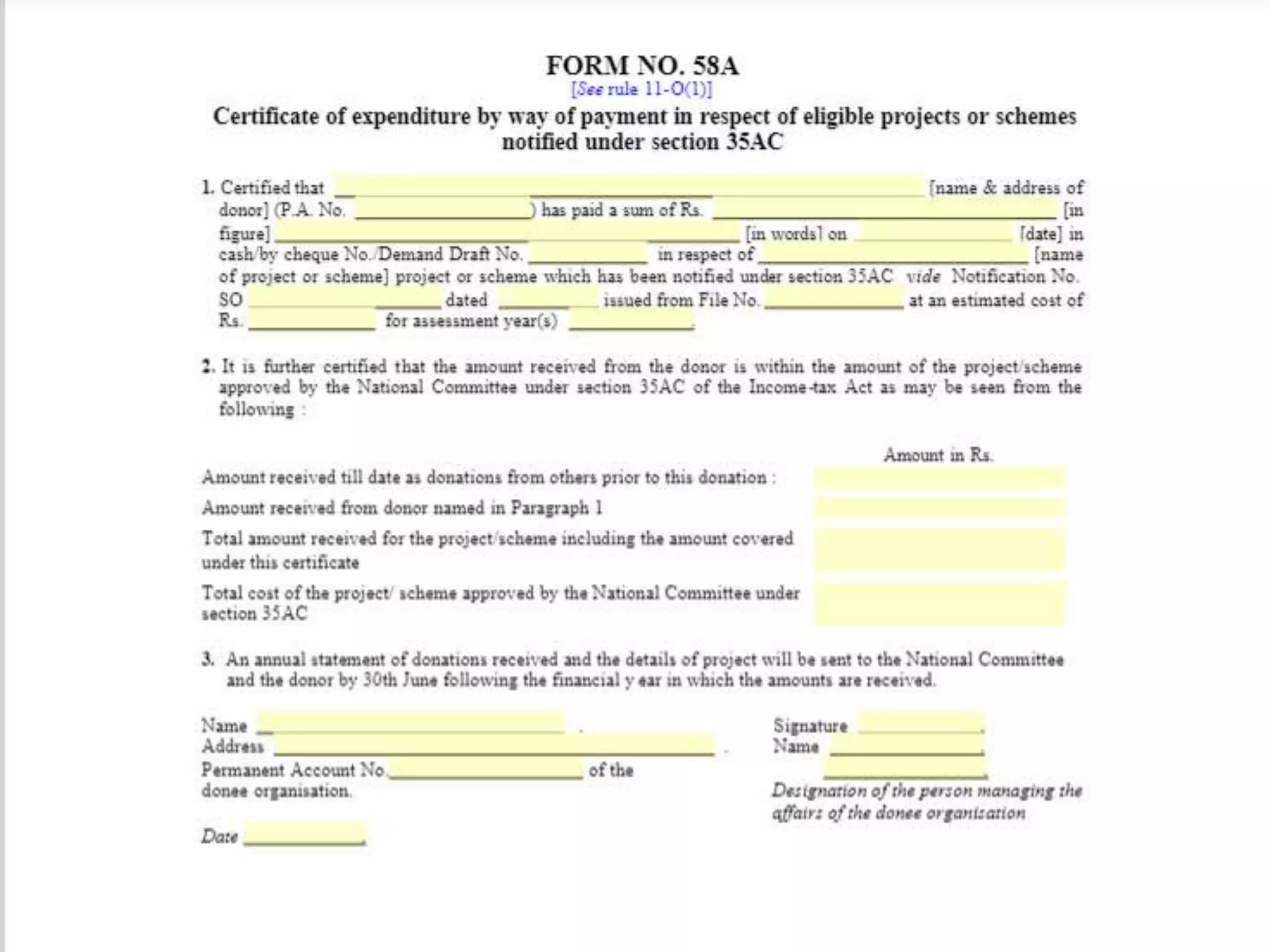

Section 80GGA of the Income Tax Act provides 100% tax deductions for donations made towards scientific research or rural development, incentivizing philanthropy in these areas. The deductions are available to all individuals except those with income from business professions, and payments must be made via cheque or draft, with cash donations over Rs 10,000 not eligible. Donors should verify the registration of institutions before donating, as only approved institutions qualify for deduction, and only one deduction is permitted per assessment year.