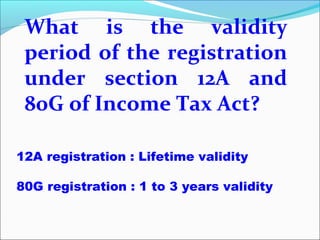

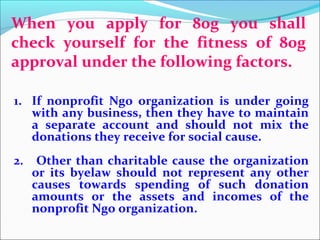

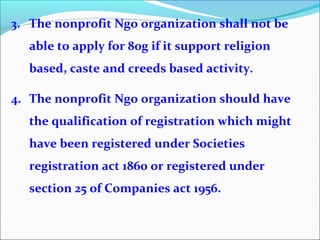

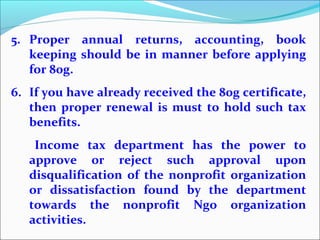

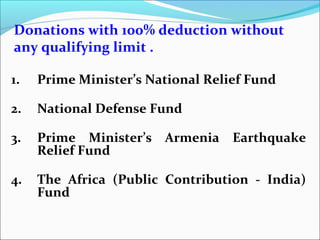

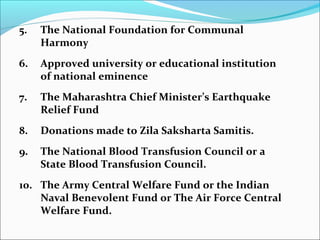

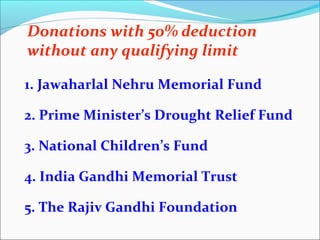

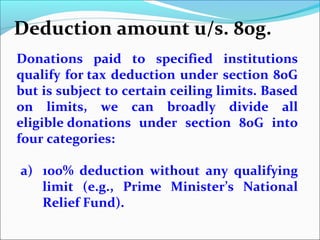

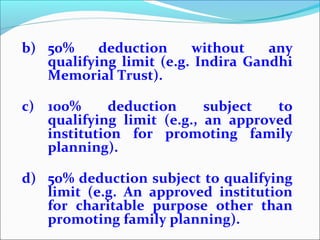

The document outlines the Section 80G tax deduction for donations to eligible NGOs, providing a 50% tax benefit to donors. It describes the requirements for NGOs to obtain 12A and 80G certifications, emphasizing the need for proper accounting and the exclusive focus on charitable activities. Additionally, it lists various charitable funds that qualify for 100% and 50% tax deductions under Section 80G.