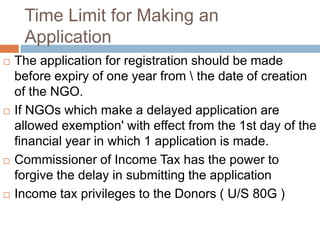

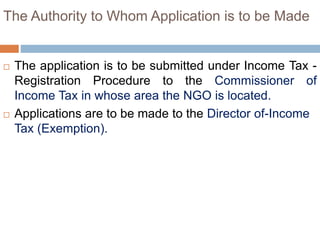

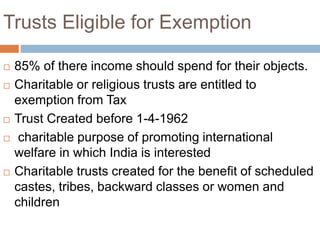

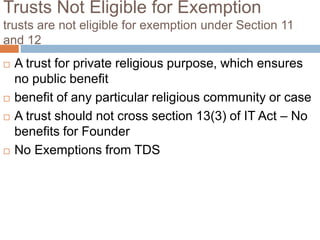

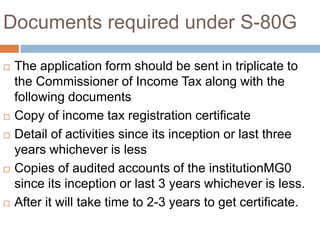

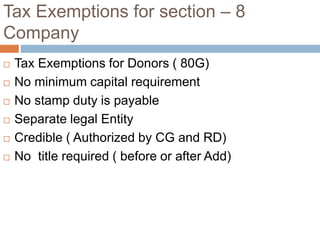

This document discusses tax reliefs for non-governmental organizations (NGOs) like societies, trusts, and section 8 companies under the Income Tax Act of 1961 in India. It outlines that NGOs involved in poverty alleviation, education, healthcare, and community development are eligible for tax exemptions if they apply for registration and meet certain criteria. Key points covered include the application process for income tax exemption, time limits for applications, eligibility of trusts, documents required for donors to claim tax deductions, and exemptions available to section 8 companies. The overall aim is to support NGOs' social and economic work in India through the tax concessions provided.