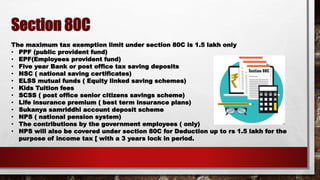

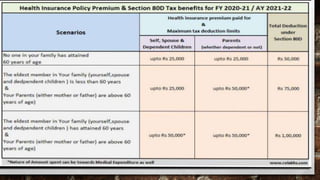

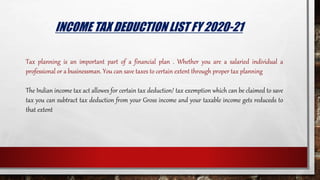

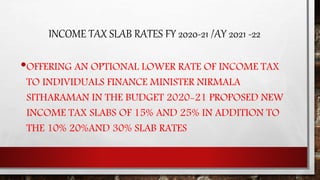

This document discusses various tax deductions available under Sections 80C and 80D of the Indian Income Tax Act. Section 80C allows deductions up to Rs. 1.5 lakh for contributions to specified savings instruments like PPF, EPF, life insurance premiums, NPS, etc. Section 80D allows a deduction of up to Rs. 25,000 for health insurance premiums and Rs. 5,000 for medical checkups. The document provides details of the new income tax slabs introduced in the FY 2020-21 budget and explains how taxpayers can reduce their taxable income and tax liability by claiming deductions under Sections 80C and 80D.

![NEW INCOME TAX SLAB AND RATES FY 2020-21 [AY2021-22]

INCOMESLABE INCOMETAXRATES

UPTO RS 250000 NILL

RS250000 TO RS 500000 5% [WITH TAX REBATE U/S87A]

RS 500001 TO 750000 10%

RS 750001 TO 1000000 15%

RS 1000001 TO 1250000 20%

RS 1250001 TO 1500000 25%

ABOVE RS 1500000 30%](https://image.slidesharecdn.com/yamunagpresentationtax-211119091157/85/Deduction-Under-Section-80C-and-80D-4-320.jpg)