Debt market review

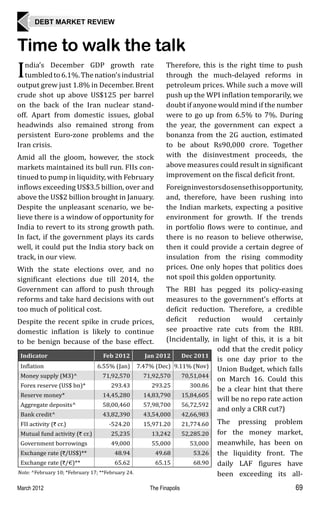

- 1. f DEBT MARKET REVIEW Time to walk the talk I ndia’s December GDP growth rate tumbled to 6.1%. The nation’s industrial output grew just 1.8% in December. Brent Therefore, this is the right time to push through the much-delayed reforms in petroleum prices. While such a move will crude shot up above US$125 per barrel push up the WPI inflation temporarily, we on the back of the Iran nuclear stand- doubt if anyone would mind if the number off. Apart from domestic issues, global were to go up from 6.5% to 7%. During headwinds also remained strong from the year, the government can expect a persistent Euro-zone problems and the bonanza from the 2G auction, estimated Iran crisis. to be about Rs90,000 crore. Together Amid all the gloom, however, the stock with the disinvestment proceeds, the markets maintained its bull run. FIIs con- above measures could result in significant tinued to pump in liquidity, with February improvement on the fiscal deficit front. inflows exceeding US$3.5 billion, over and Foreign investors do sense this opportunity, above the US$2 billion brought in January. and, therefore, have been rushing into Despite the unpleasant scenario, we be- the Indian markets, expecting a positive lieve there is a window of opportunity for environment for growth. If the trends India to revert to its strong growth path. in portfolio flows were to continue, and In fact, if the government plays its cards there is no reason to believe otherwise, well, it could put the India story back on then it could provide a certain degree of track, in our view. insulation from the rising commodity With the state elections over, and no prices. One only hopes that politics does significant elections due till 2014, the not spoil this golden opportunity. Government can afford to push through The RBI has pegged its policy-easing reforms and take hard decisions with out measures to the government’s efforts at too much of political cost. deficit reduction. Therefore, a credible Despite the recent spike in crude prices, deficit reduction would certainly domestic inflation is likely to continue see proactive rate cuts from the RBI. to be benign because of the base effect. (Incidentally, in light of this, it is a bit odd that the credit policy Indicator Feb 2012 Jan 2012 Dec 2011 is one day prior to the Inϐlation 6.55% (Jan) 7.47% (Dec) 9.11% (Nov) Union Budget, which falls Money supply (M3)^ 71,92,570 71,92,570 70,51,044 on March 16. Could this Forex reserve (US$ bn)* 293.43 293.25 300.86 be a clear hint that there Reserve money* 14,45,280 14,83,790 15,84,605 will be no repo rate action Aggregate deposits^ 58,00,460 57,98,700 56,72,592 and only a CRR cut?) Bank credit^ 43,82,390 43,54,000 42,66,983 FII activity (` cr.) -524.20 15,971.20 21,774.60 The pressing problem Mutual fund activity (` cr.) 25,235 13,242 52,285.20 for the money market, Government borrowings 49,000 55,000 53,000 meanwhile, has been on Exchange rate (`/US$)** 48.94 49.68 53.26 the liquidity front. The Exchange rate (`/€)** 65.62 65.15 68.90 daily LAF figures have Note: ^February 10; *February 17; **February 24. been exceeding its all- March 2012 The Finapolis 69

- 2. IIIIIIIIII DEBT MARKET REVIEW time highs of Rs1.8 lac crore. This is Corporate bonds Feb 2012 Jan 2012 Dec 2011 despite the CRR cut and the weekly open AAA paper (spread in bps) market operations (OMOs). The weekly 1-yr 123 139 102 OMOs of Rs12,000 crore have been too 5-yr 104 109 93 inadequate and the advance tax outflow 10-yr 86 79 85 in mid-March is likely to exacerbate the AA+ (spread in bps) matter. Bond yields were range-bound 1-yr 137 153 116 for most of February in the absence of 5-yr 123 124 108 any clues. The WPI inflation for January 10-yr 101 94 100 AA (spread in bps) came in lower than expected, at 6.55%. 1-yr 162 167 130 A directionless market saw volumes 5-yr 157 143 127 taking a dip to Rs14,676 crore per day 10-yr 133 111 117 in February against Rs20,549 crore for the month earlier. Conclusion The next cue for the bond markets, of G-Secs: Key trends course, will be from the credit Particulars Feb 2012 Jan 2012 Dec 2011 policy and the Union Budget. Average total value (` cr.) 14,676 20,549 17,522 If there is any credible deficit Average no. of trades 1,909 2,716 2,314 reduction by the government, 1-year (%) 8.10% 8.45% 8.36% then bonds should see a sharp 5-year (%) 8.33% 8.26% 8.54% rally. However, if the government 10-year (%) 8.22% 8.27% 8.56% continues on its current path of Money market yields continued to harden, profligacy, we could be in an unenviable with T-bills and CD rates moving up signifi- position. We could see the budding rally cantly. There was very little activity in the in the stock markets peter out as FIIs CP market. head for the door. While bond yields could remain supported by the RBI’s OMOs, the T Bills, CDs, CPs: Key trends already evident “crowding-out Particulars* Feb 2012 Jan 2012 Dec 2011 effect” (where the government T-Bill primary issuance 52,000 40,000 32,000 borrowing crowds out private 91 days 8.92 8.61 8.49 credit) would aggravate. The 182 days 8.66 8.49 8.39 slowing growth, in turn, would 364 days 8.51 8.33 8.31 reduce revenues further, and, Commercial paper 3 month 10.30 10.35 9.95 God forbid, we could slide on 6 month 10.25 10.35 10.00 the path trodden by the likes 1 year 10.12 10.40 9.90 of Zimbabwe. We only wish Certiϔicates of deposit the government will rise to Primary 27,158 14,163 60,683 the occasion and do the right Note: *Until February 22. thing! Corporate bond spreads narrowed over the G-Secs and yields were supported by - K. P. Jeewan limited issues and healthy FII appetite. for queries, contact feedback@karvy.com March 2012 The Finapolis 70