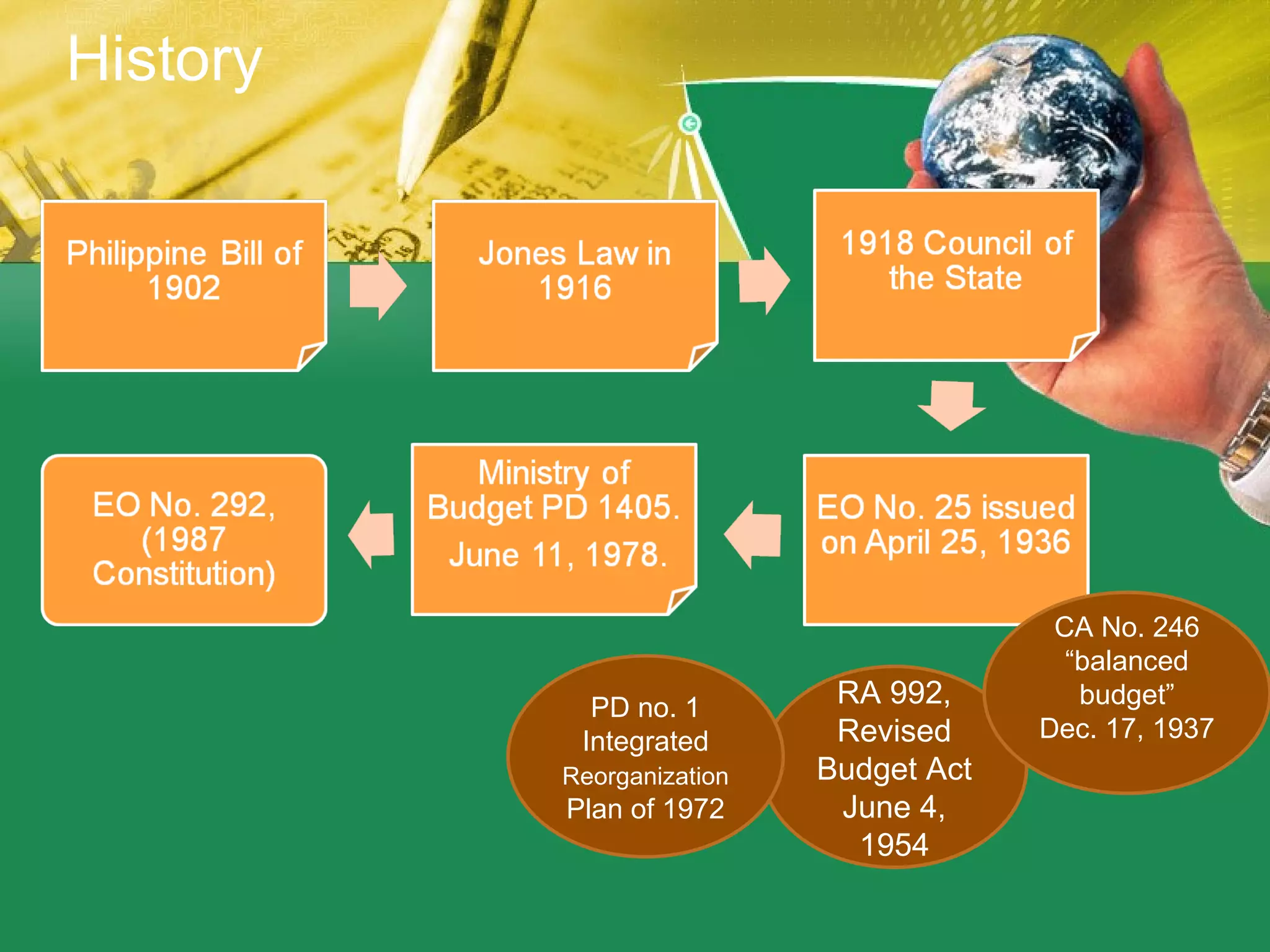

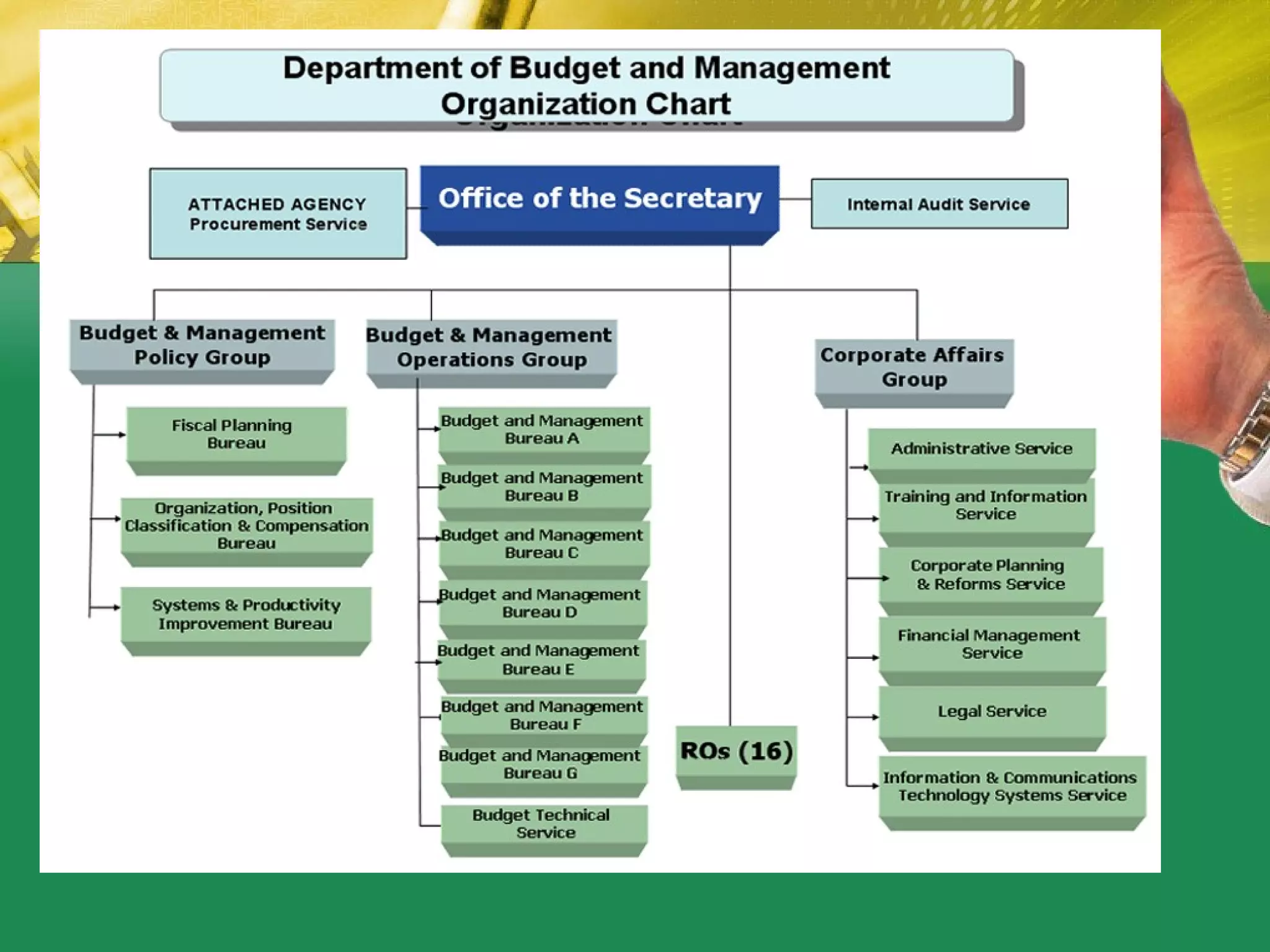

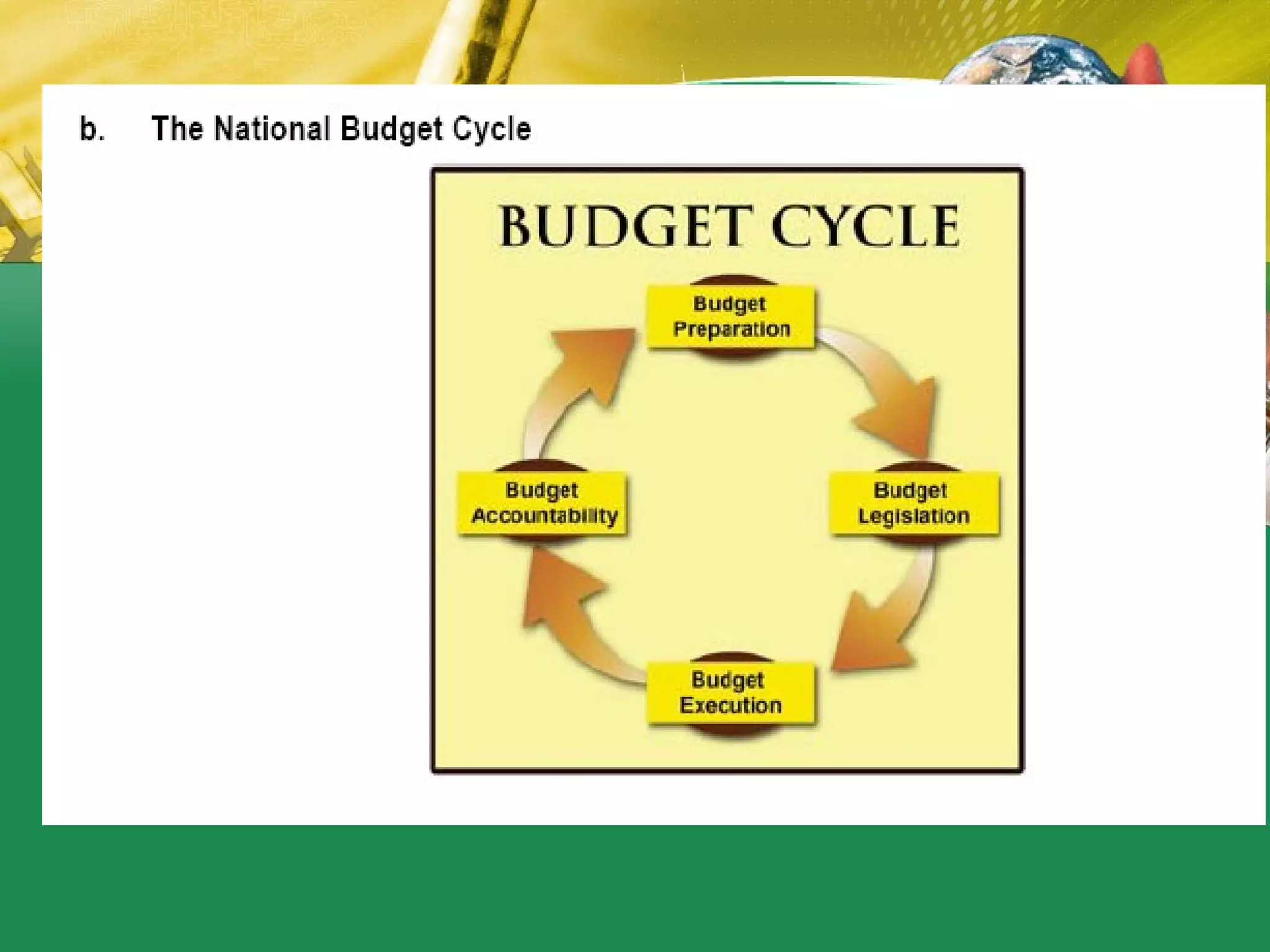

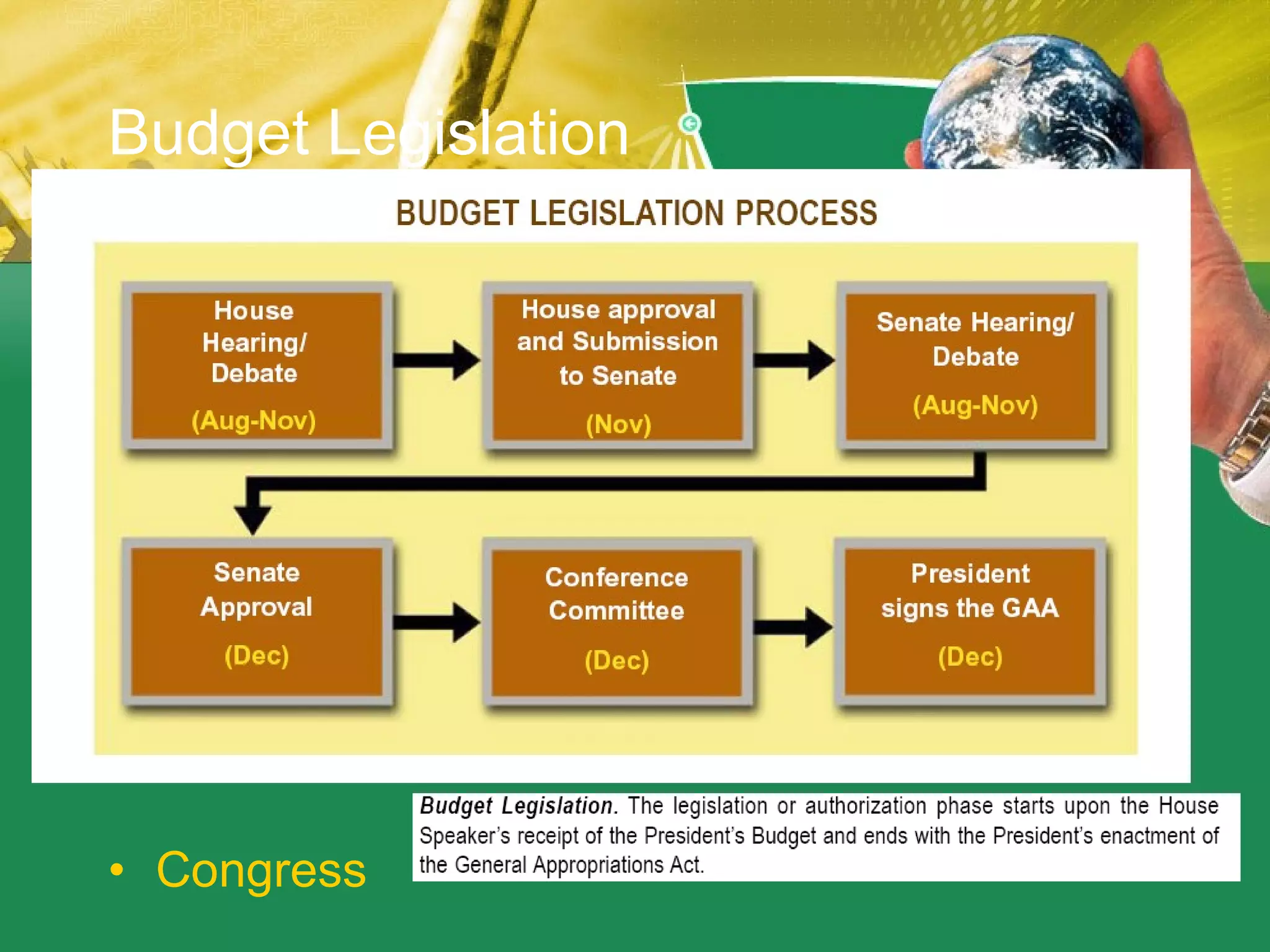

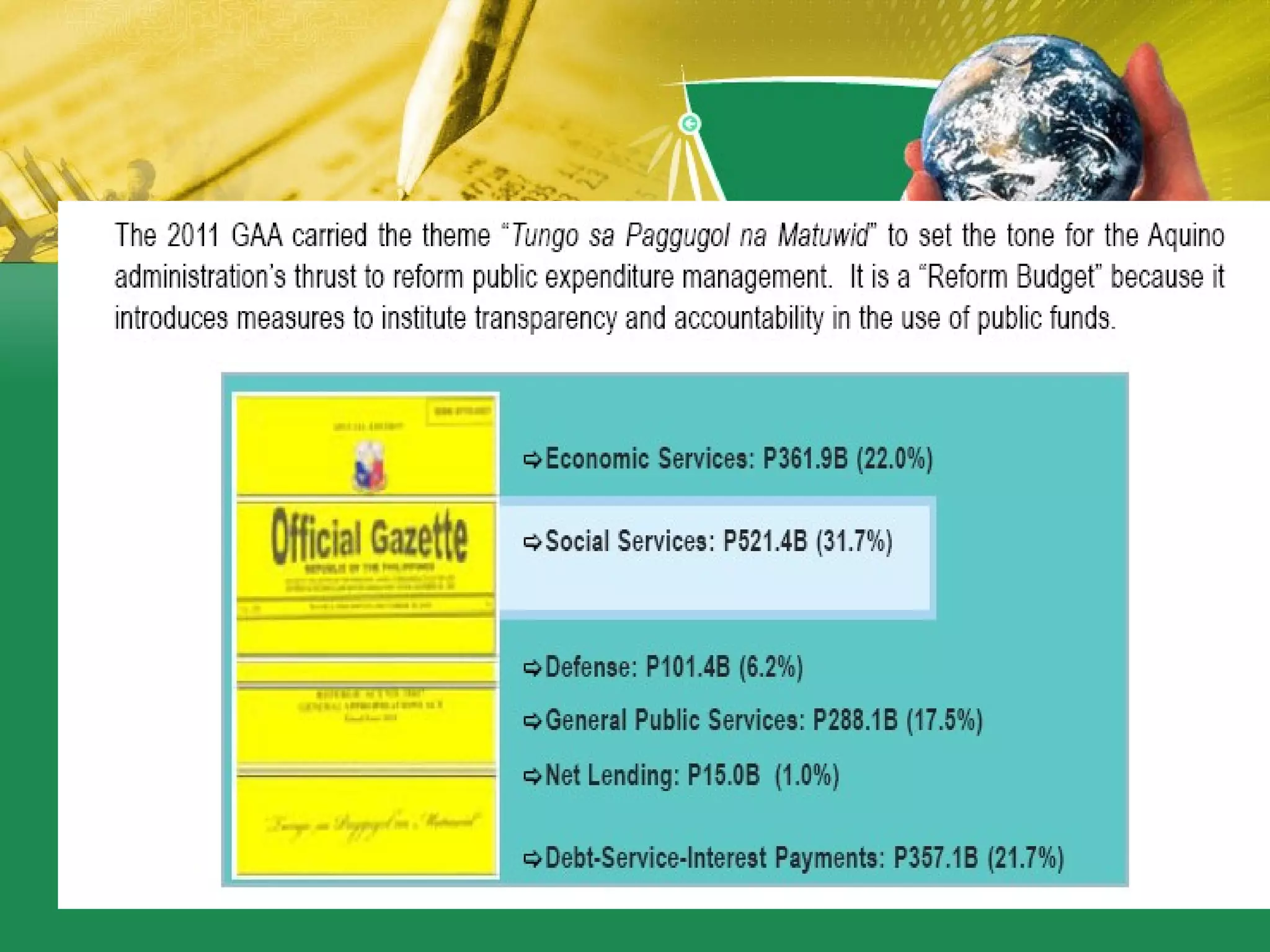

The document discusses the history and functions of the Budget and Management Bureau (DBM) in the Philippines. It outlines how the DBM was established through executive orders and laws to promote effective management of government resources. The DBM formulates resource allocation strategies, prepares expenditure plans, and develops and administers the national accounting system. It also monitors local governments and government-owned corporations. The document further explains the budget process, from preparation and legislation to execution and accountability.