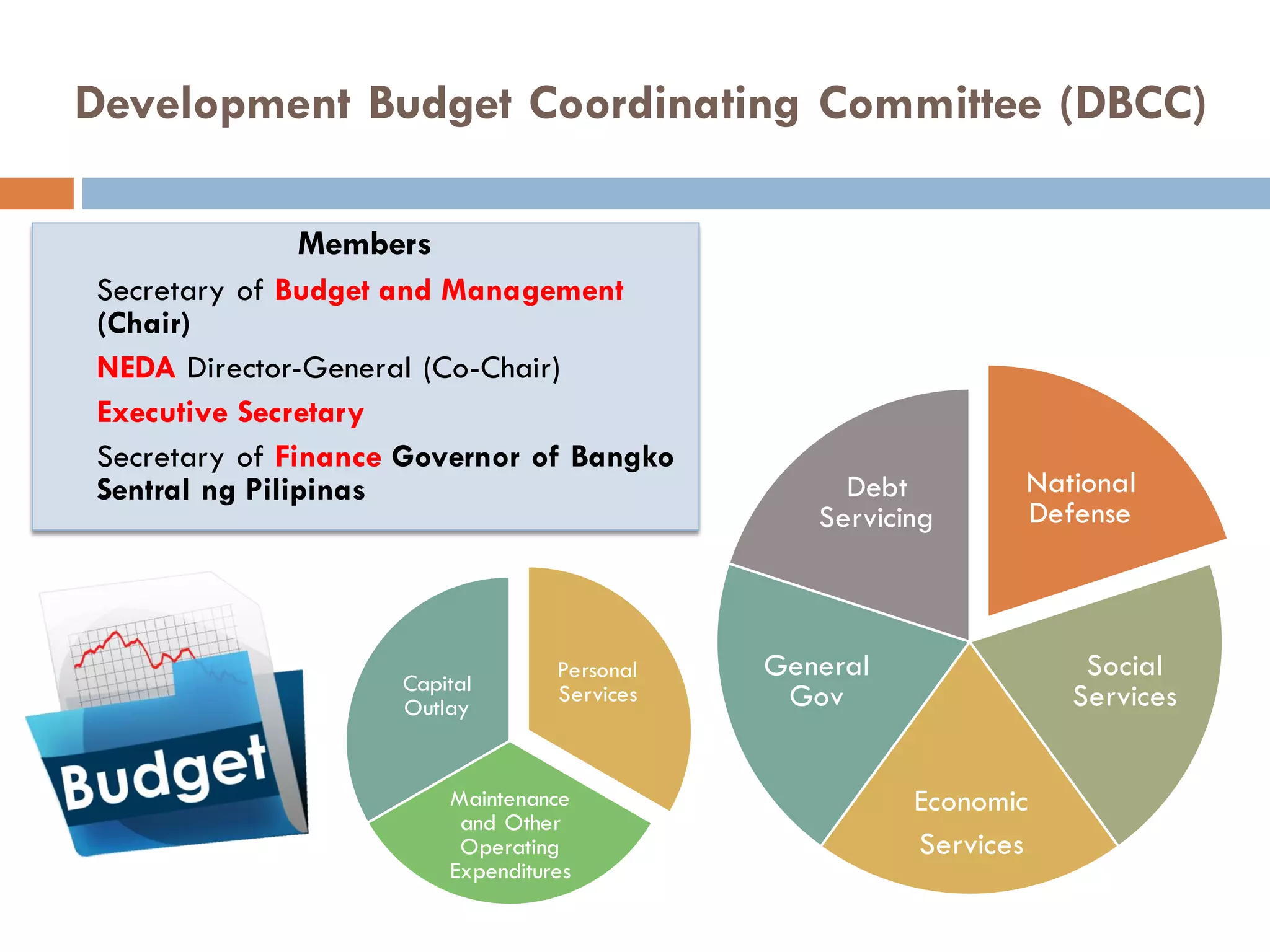

The Philippine government budgeting process involves 4 phases - budget preparation, budget authorization, budget execution, and budget accountability. During budget preparation, the DBCC determines economic targets and expenditure levels. Government agencies then submit their budget proposals. The President submits the proposed budget to Congress for authorization. Congress can amend the budget bill before passing it into law. The approved budget is then executed, with agencies implementing programs and projects. Budget accountability involves oversight to ensure proper use of funds.