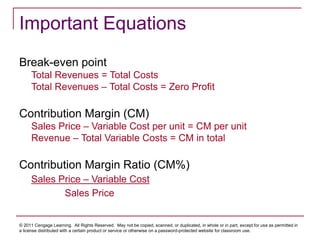

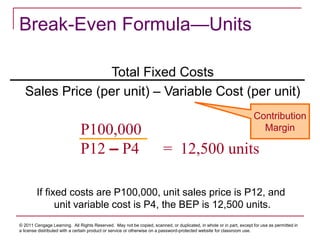

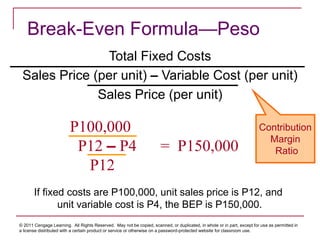

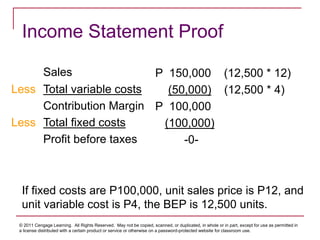

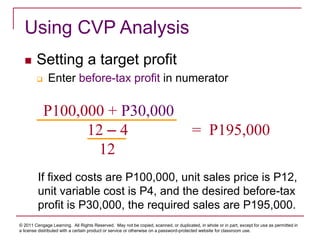

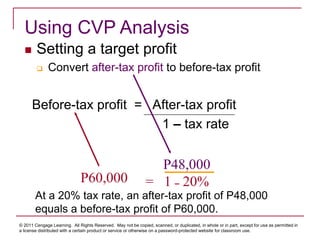

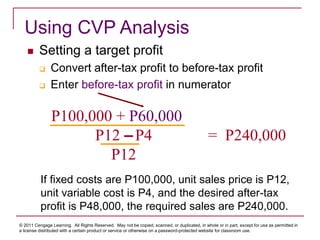

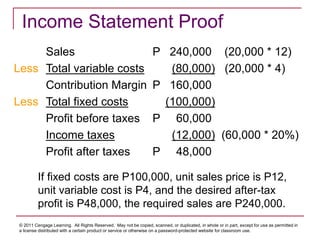

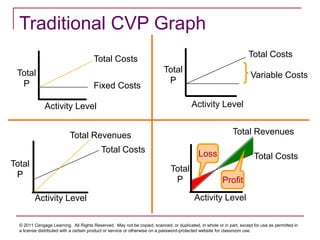

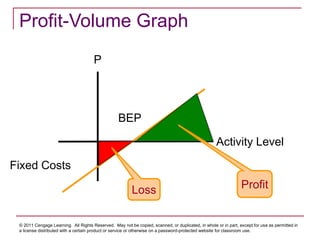

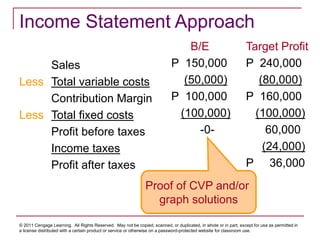

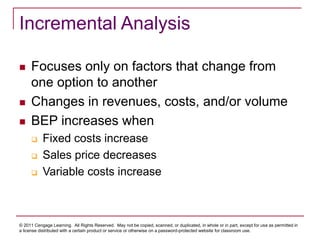

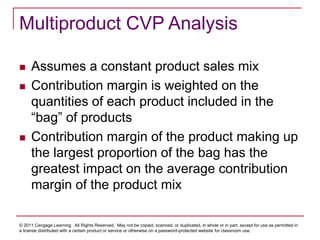

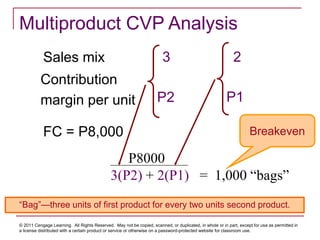

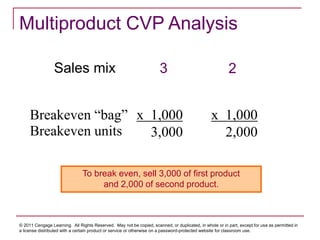

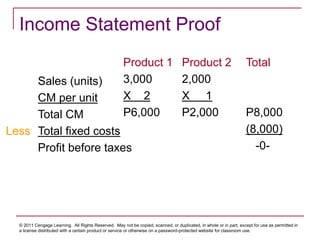

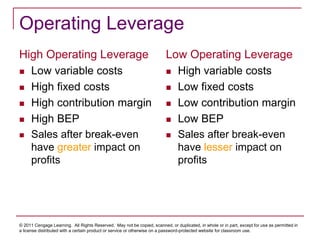

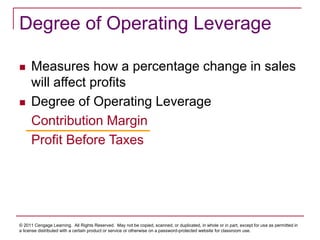

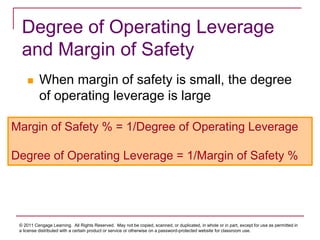

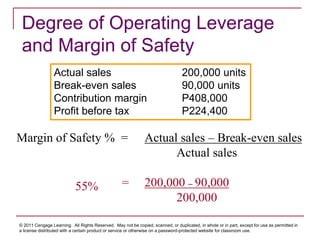

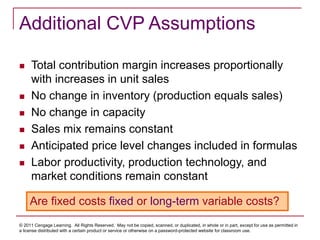

This document discusses cost-volume-profit (CVP) analysis and break-even point analysis. It defines key terms like contribution margin, variable costs, fixed costs, and break-even point. It also presents the formulas and calculations for determining break-even point in units and sales dollars. Graphs are presented to illustrate the relationships between costs, revenues, profits and activity levels. CVP analysis is used to set target profits, calculate required sales levels, and answer "what-if" questions.