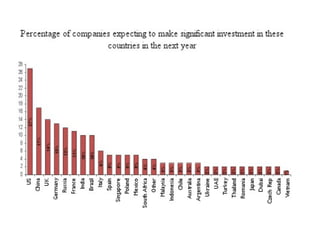

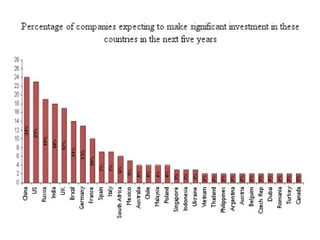

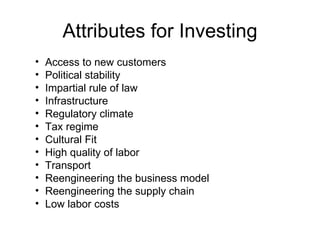

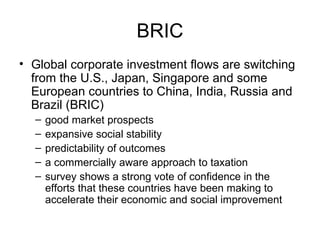

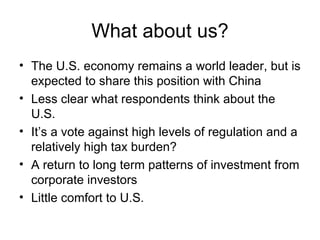

According to a survey of over 300 corporate investment strategists, China is expected to surpass the United States as the top destination for foreign direct investment in the next 5 years due to its large population and strong economic growth. The survey also found that the BRIC countries (Brazil, Russia, India, China) are attracting more global corporate investment than traditional destinations like the US, Japan, and Europe due to attributes like market access, political stability, infrastructure development and low labor costs. While the US remains an important market, its relatively high taxes and regulations could cause some corporate investment to shift to emerging economies that are making efforts to accelerate economic and social development.