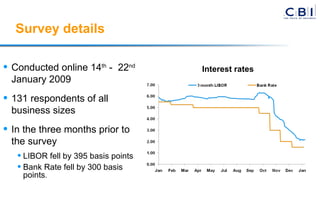

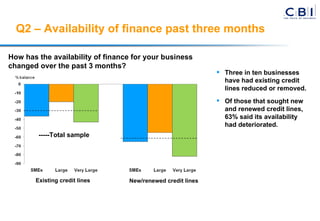

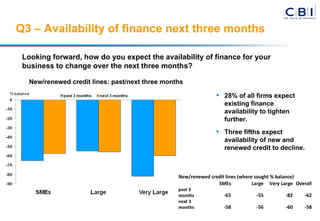

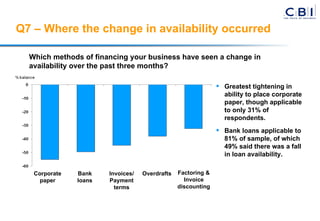

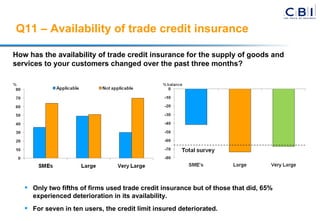

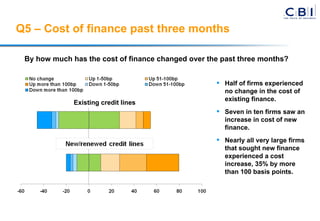

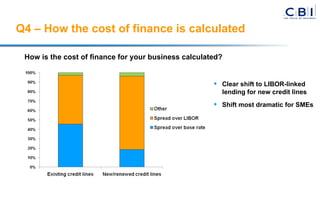

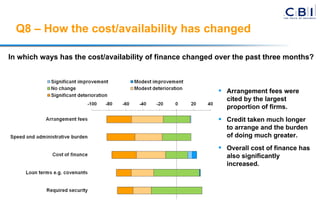

The CBI Access to Finance Survey from January 2009 indicates worsening conditions for corporate credit, with 63% of businesses observing a decline in the availability of new and renewed credit lines. Companies forecast that finance availability will tighten further in the next quarter, particularly affecting capital investment and large firms. The survey also highlights a significant increase in the cost of new credit and a shift towards LIBOR-linked lending.