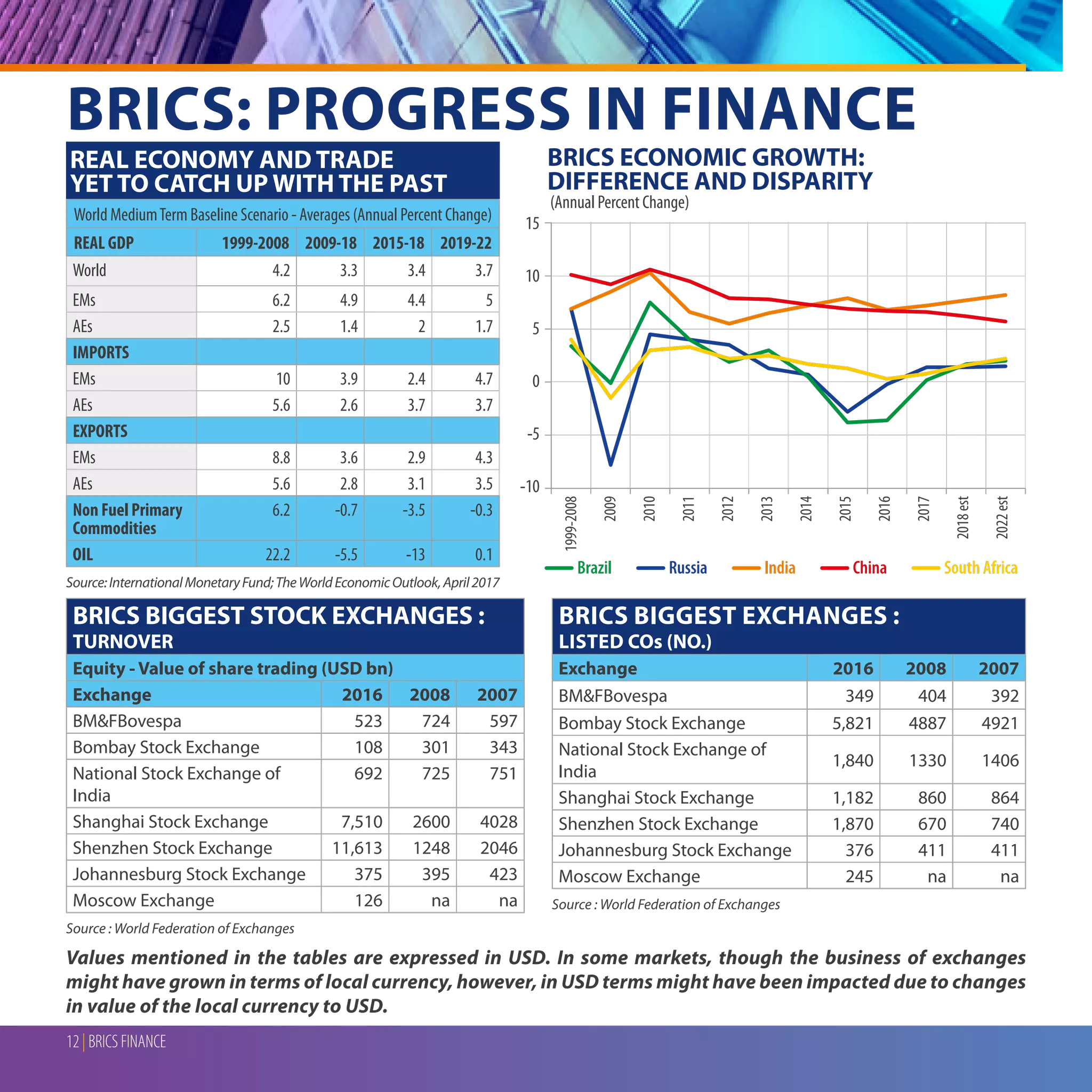

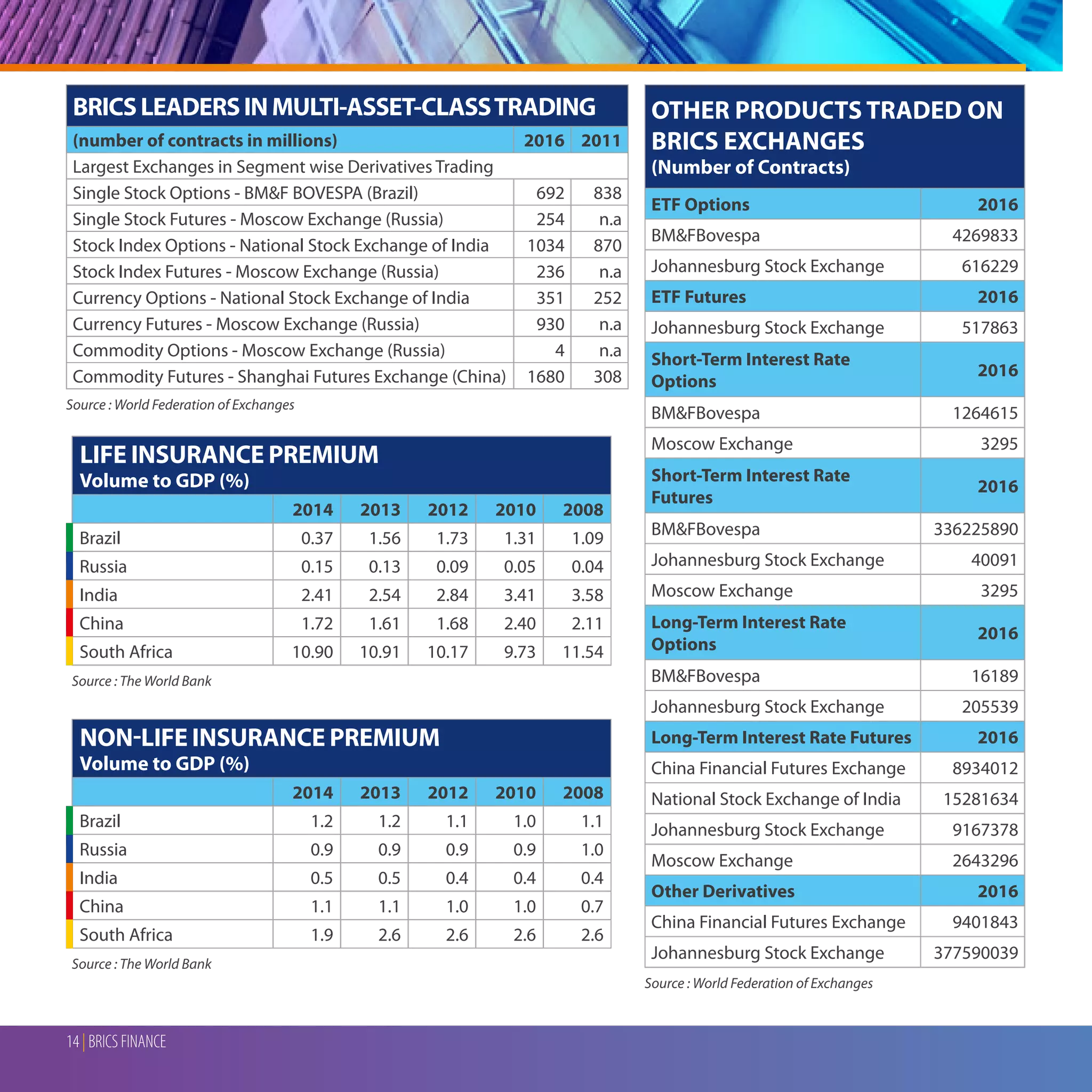

The document outlines the challenges and opportunities for cooperation among BRICS countries (Brazil, Russia, India, China, South Africa) during the 9th BRICS Academic Forum in 2017. It highlights key areas such as economic growth, trade issues, corporate debt, income inequality, governance challenges, sustainable development, and the importance of skill development and digital economy advancements. The author emphasizes the need for collaborative efforts in financial market development, startup ecosystems, and sustainable finance to foster mutual growth and stability among BRICS nations.