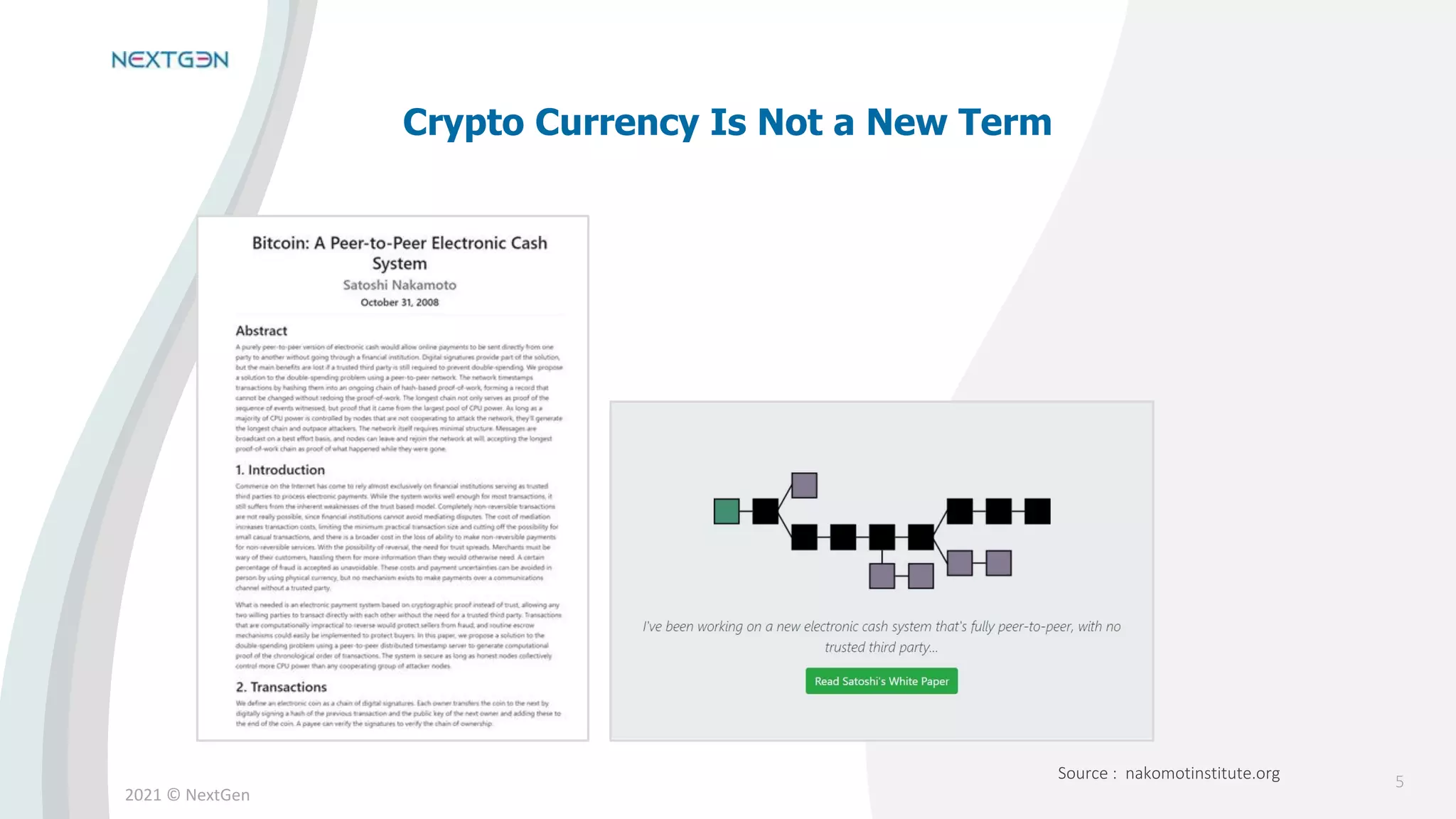

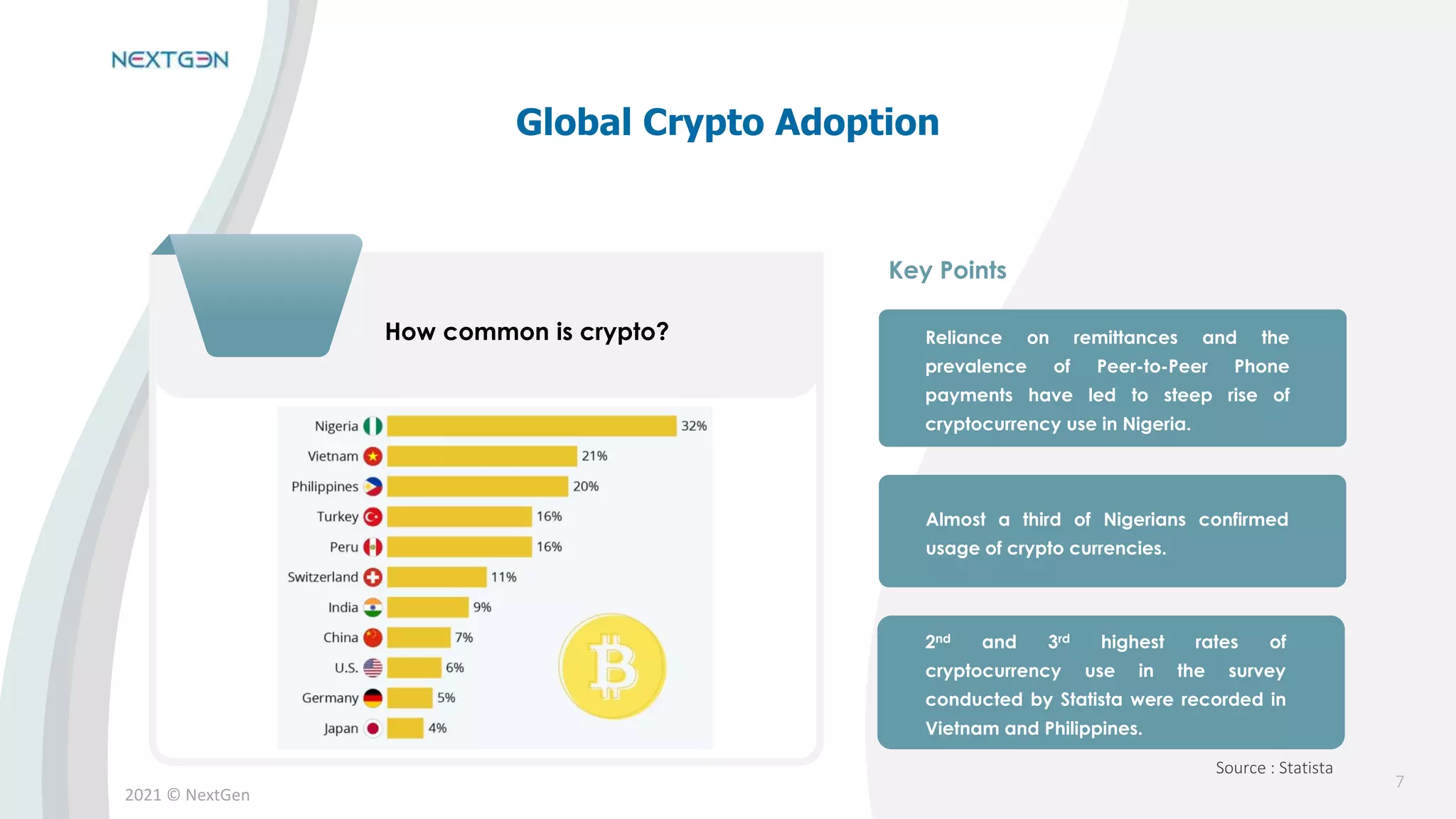

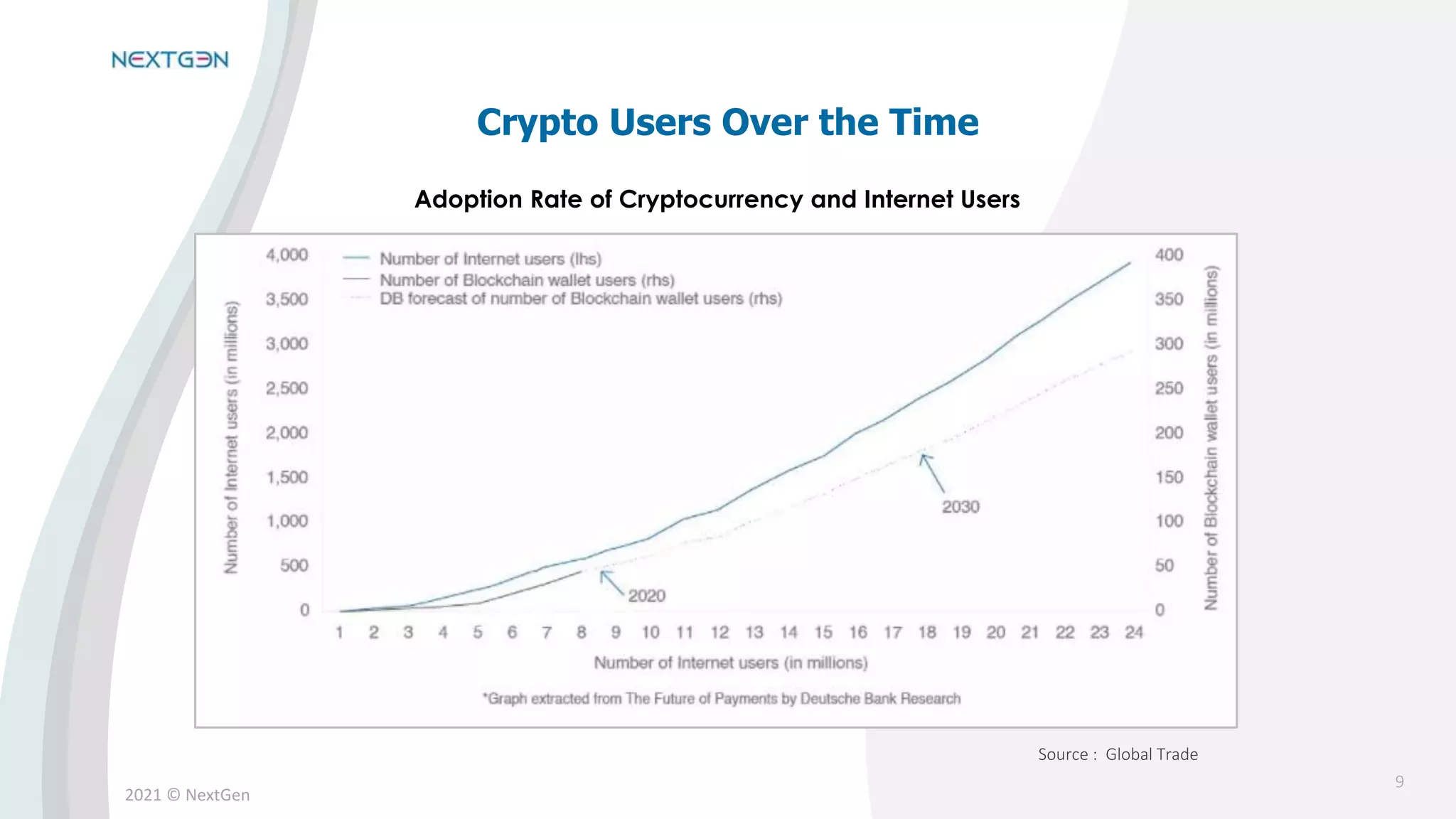

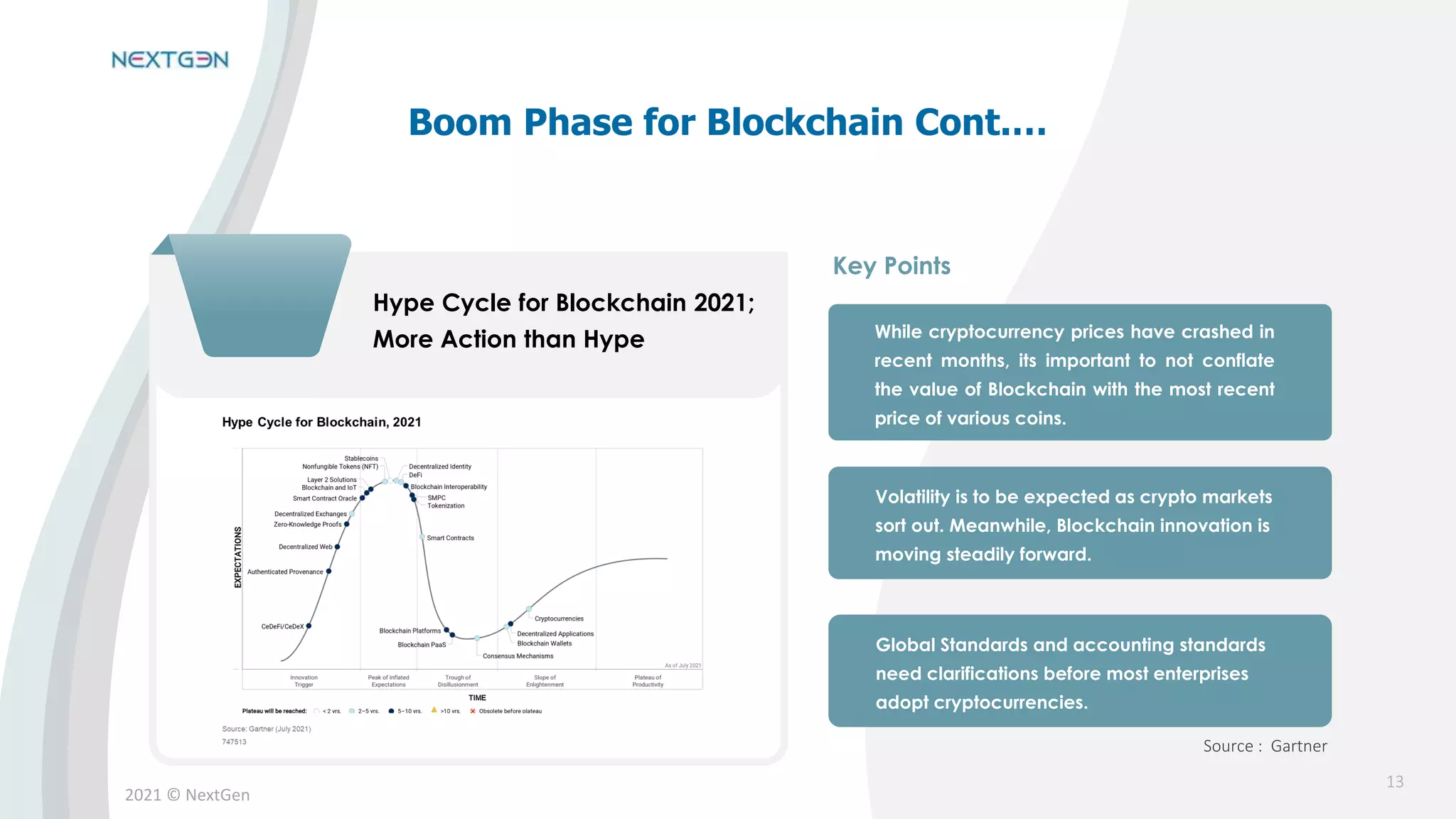

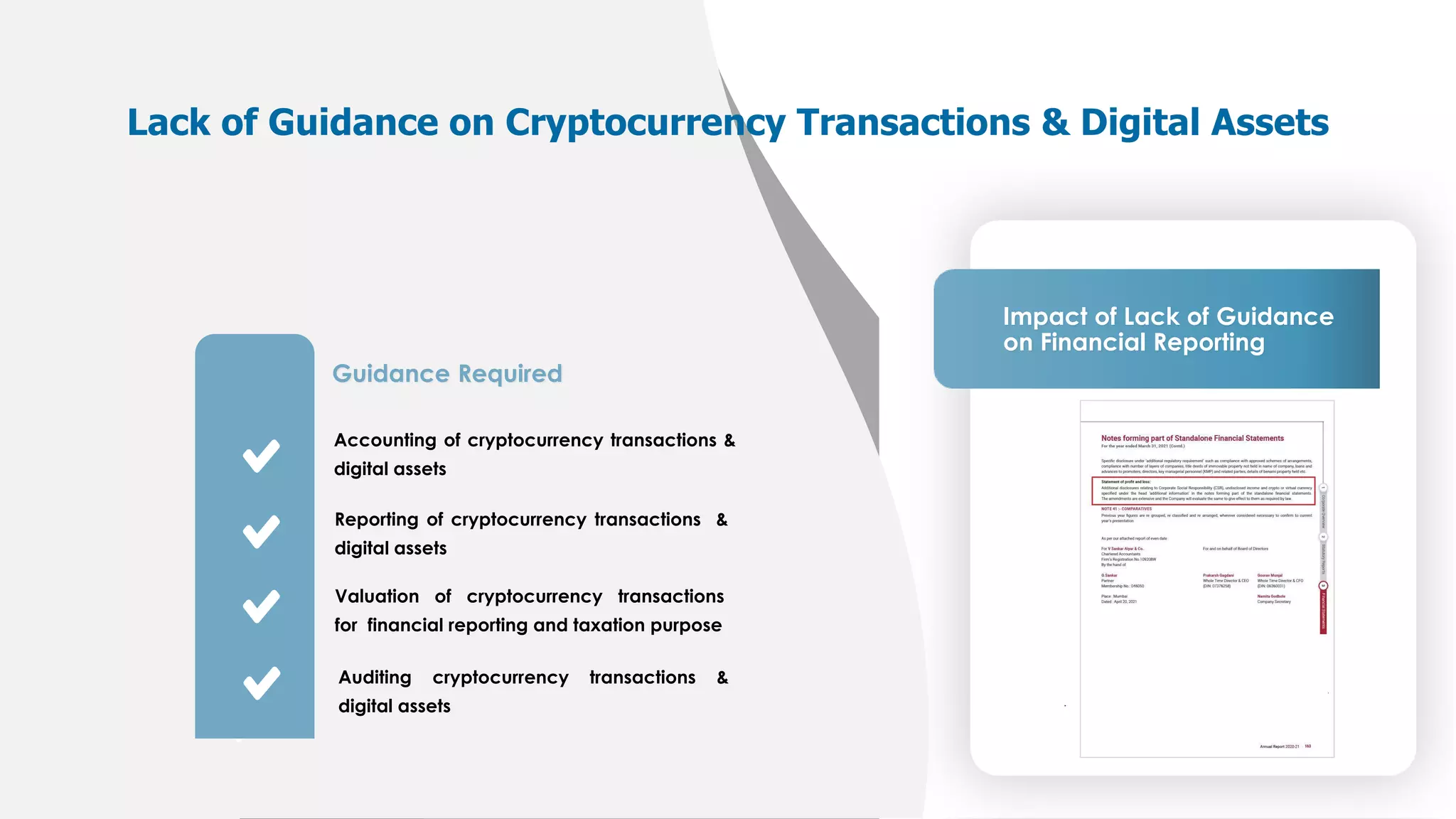

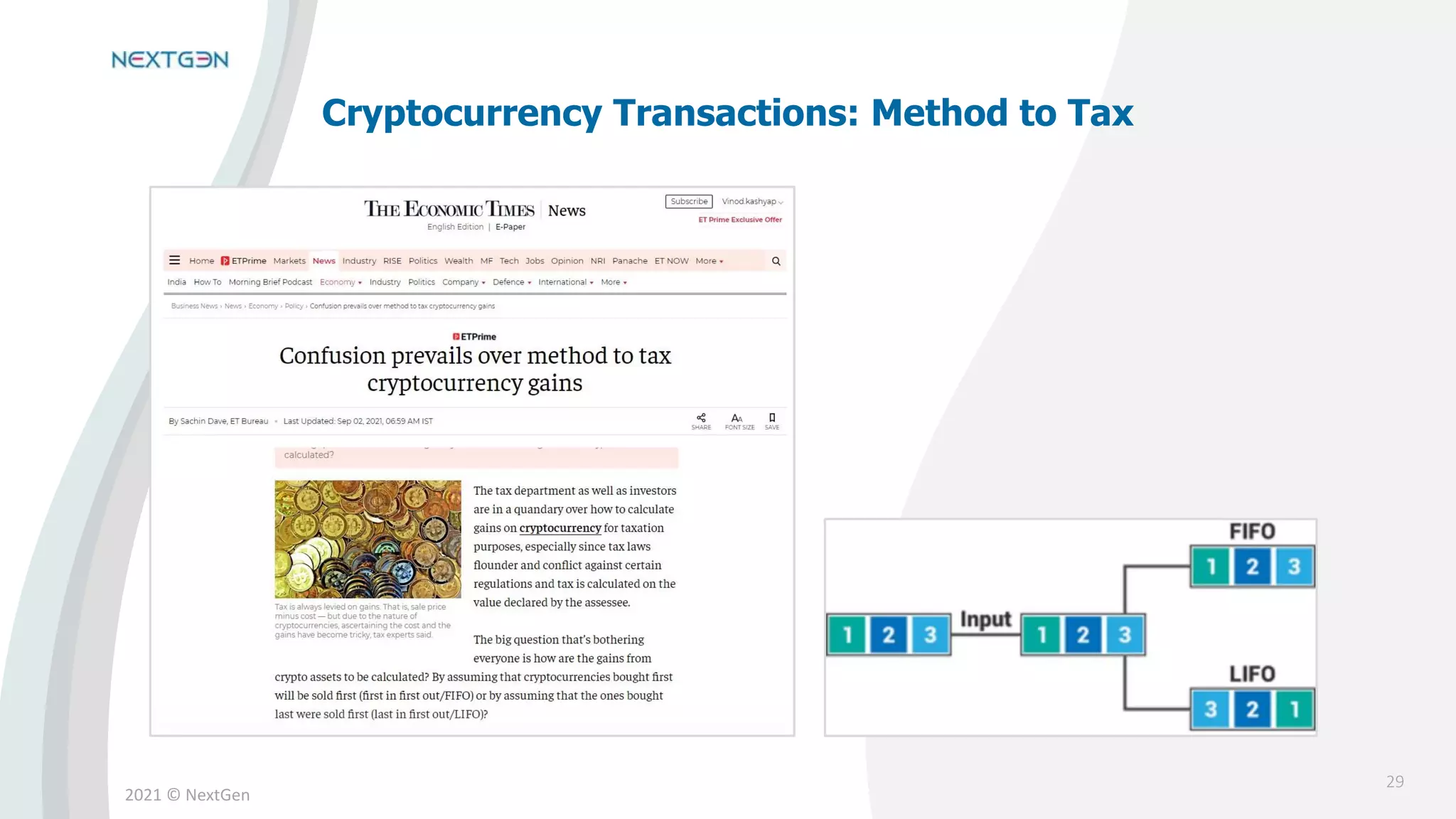

The document presents an overview of the issues and challenges faced by cryptocurrencies, including a lack of regulation, a poor public image, and difficulties in usage and adoption. It emphasizes the growing global adoption of cryptocurrencies but highlights that they face significant hurdles, including technological limitations and legislative barriers. The way forward includes the establishment of a regulatory framework, international standards, and guidance on accounting and auditing for digital assets.