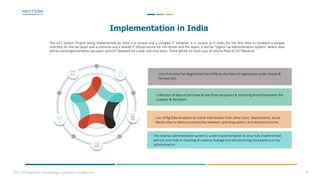

The document discusses the transition to digital tax administration systems around the world. It notes that many countries are implementing requirements for electronic tax filing, invoicing, and accounting. This allows tax authorities to collect real-time transaction data from taxpayers and better analyze that data using tools like data matching, analytics, and artificial intelligence. The benefits of digital tax systems include improved timeliness, transparency, and control over revenue leakage. However, challenges include setting up the necessary IT infrastructure and ensuring all taxpayers can submit data in the required format.