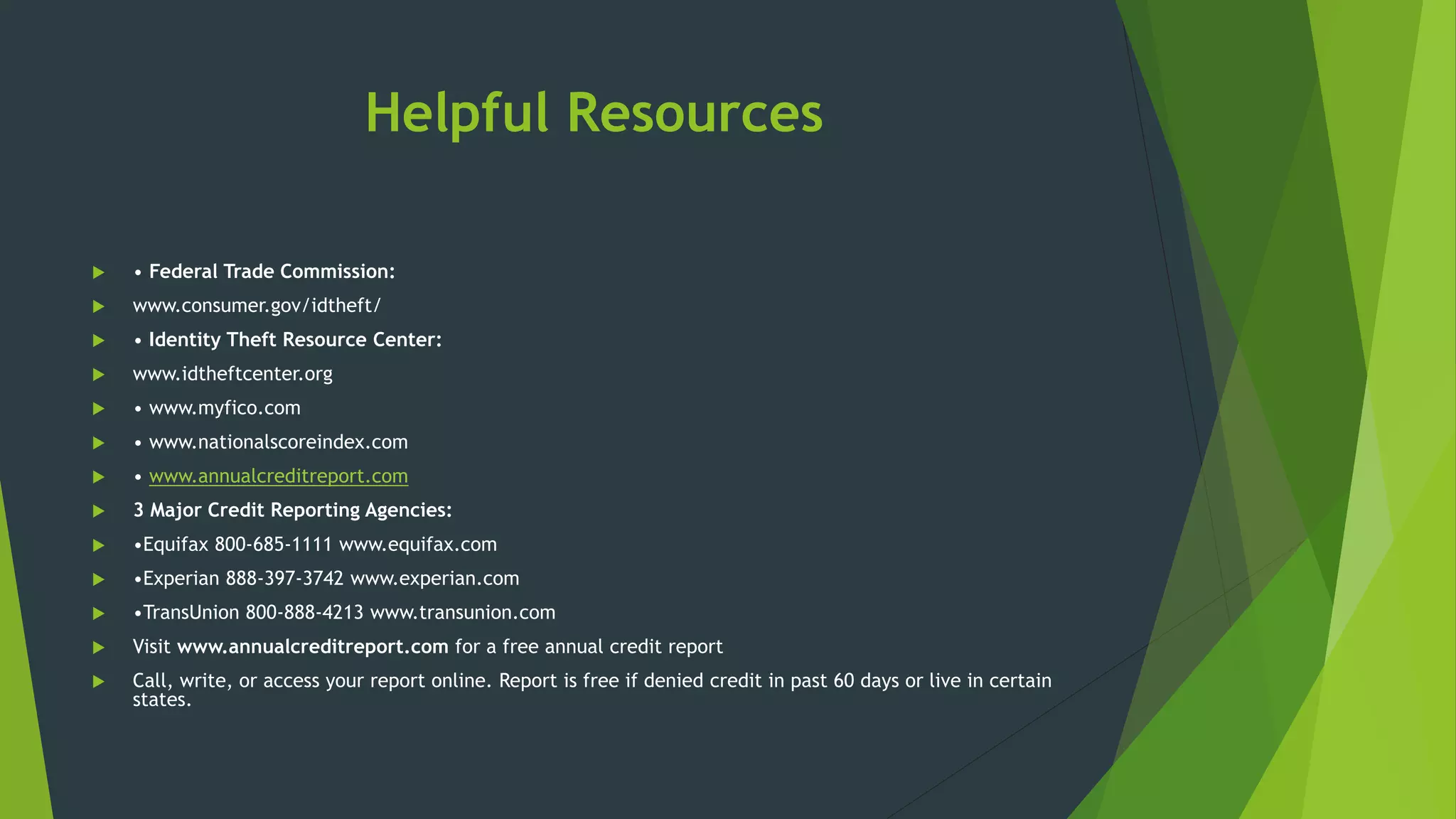

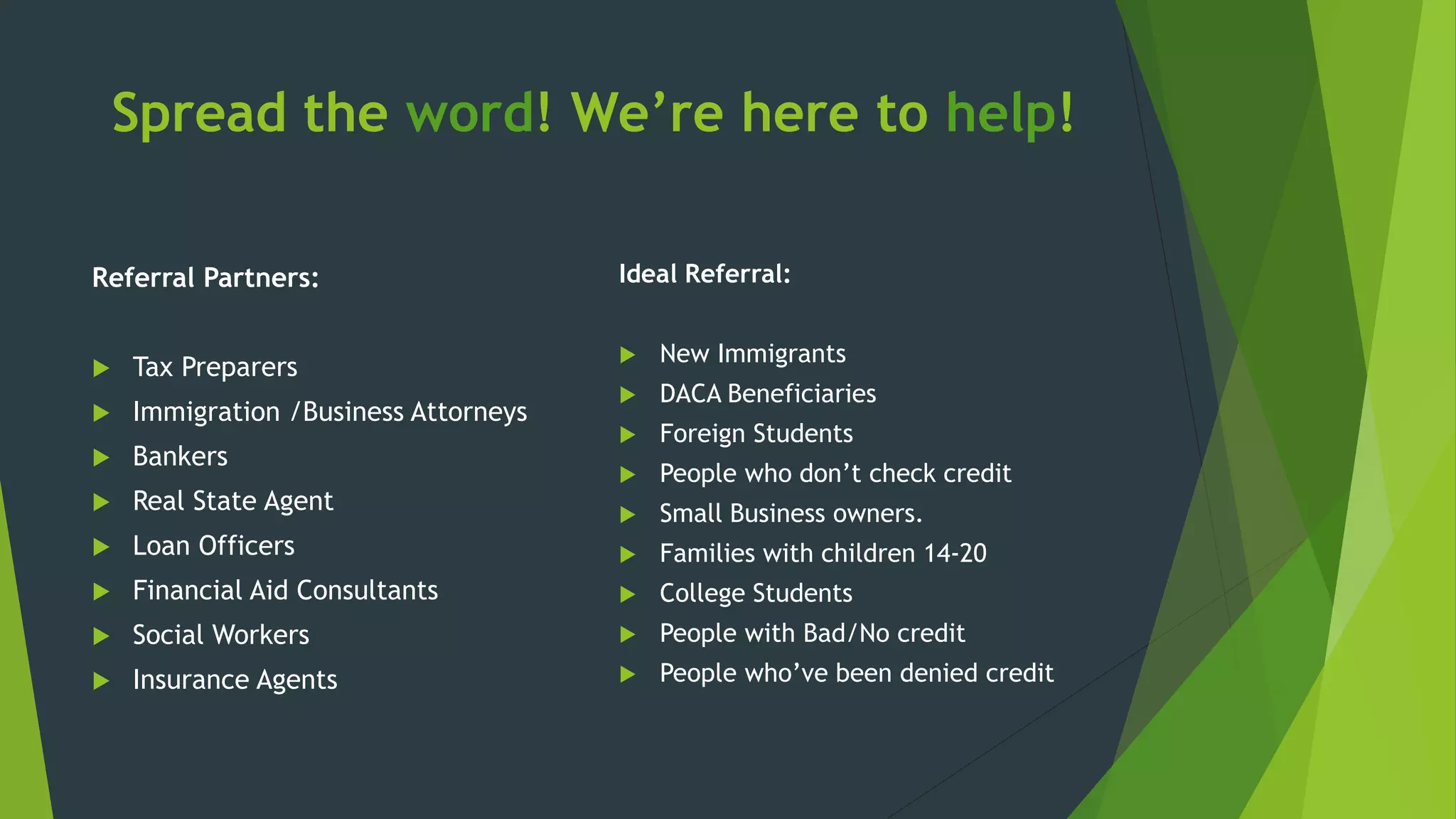

The document explains the importance of understanding credit reports and scores, detailing the information included in a credit report, how credit scores are calculated, and factors affecting them. It emphasizes the significance of maintaining good credit habits, such as timely payments and responsible credit use, while also providing recommendations for building or improving credit. Additionally, it highlights the need for identity protection and offers resources for further assistance in credit management.