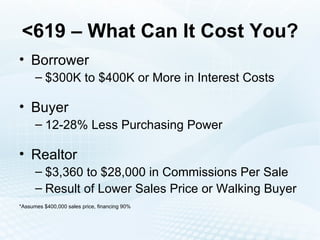

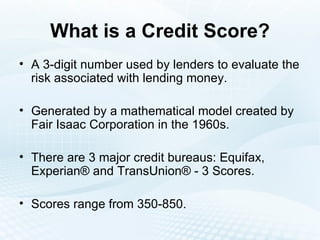

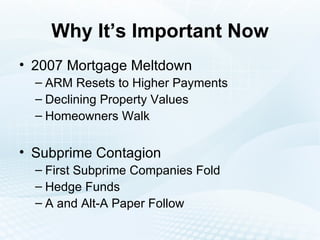

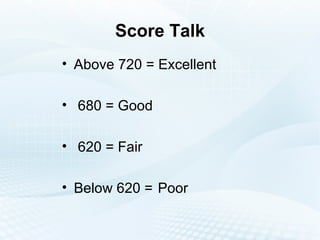

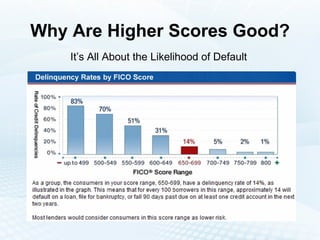

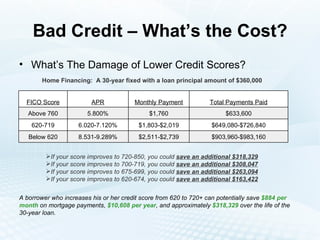

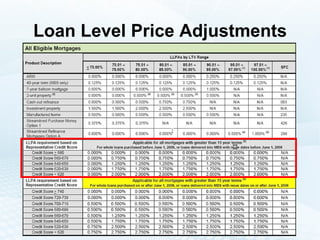

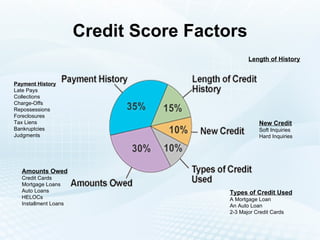

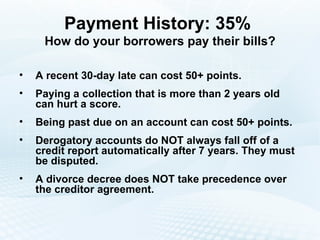

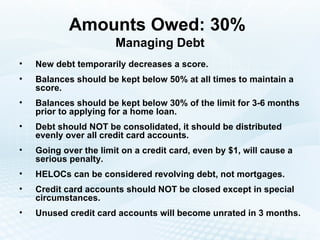

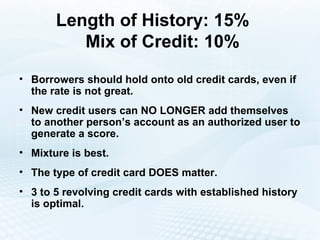

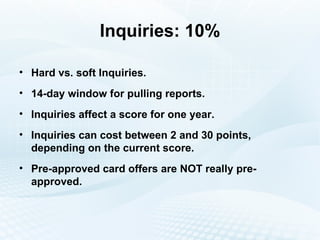

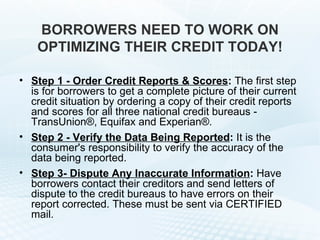

This document discusses the importance of good credit and the costs of poor credit. It explains that a credit score is a 3-digit number that evaluates lending risk, and that scores above 720 are considered excellent while scores below 620 are poor. Borrowers with lower credit scores will pay significantly more over the life of a loan, with some paying over $300,000 more in interest for a 30-year mortgage. The document provides tips for improving credit scores by carefully managing payment history, credit utilization, credit mix, and inquiries.