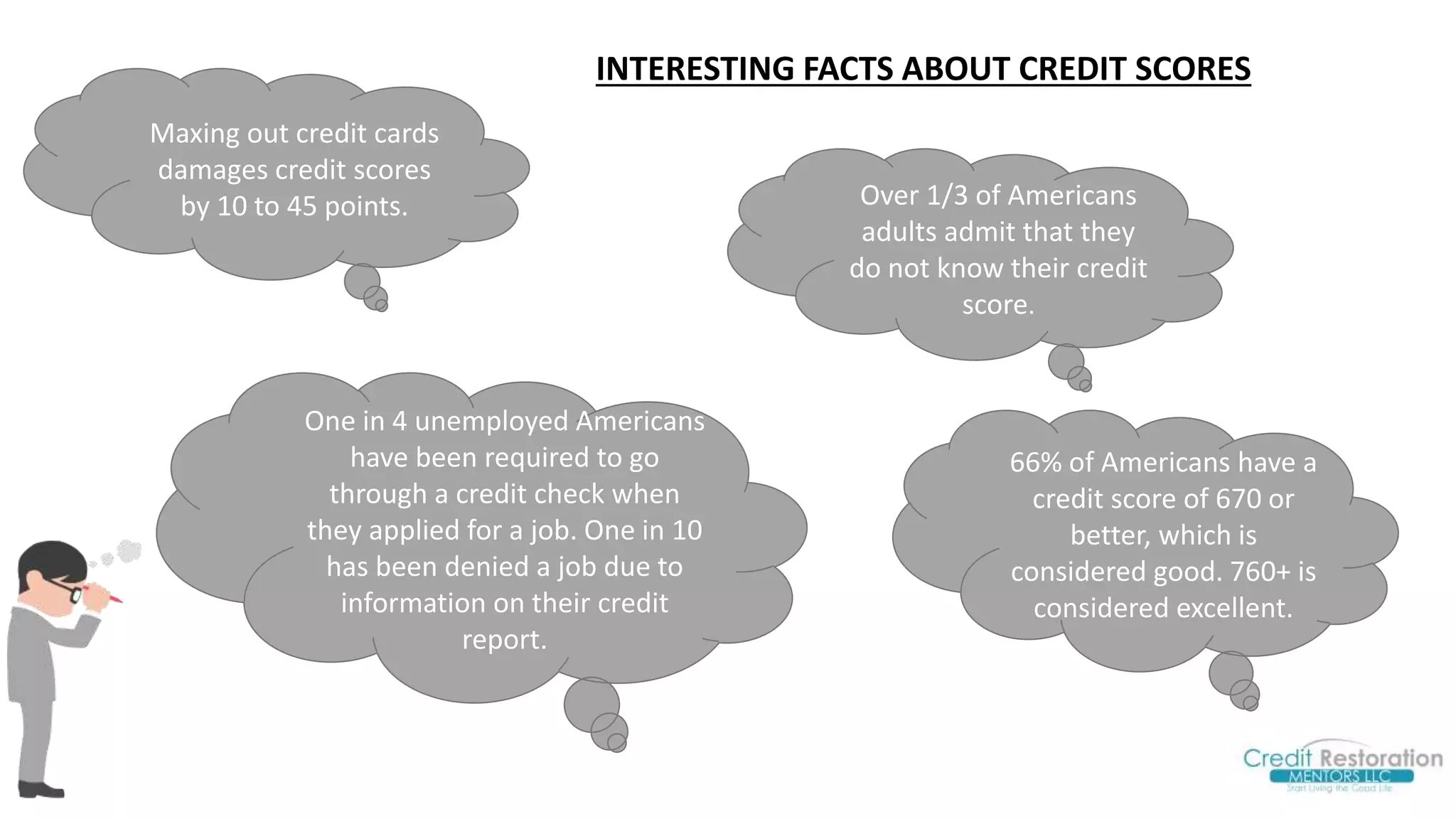

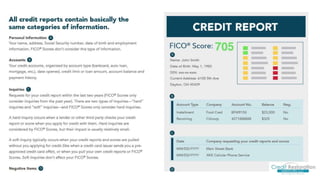

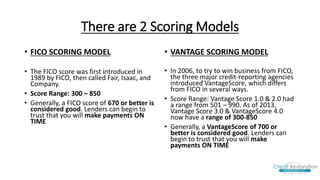

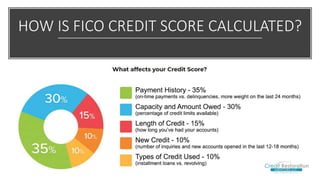

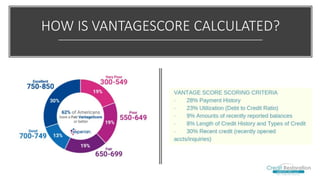

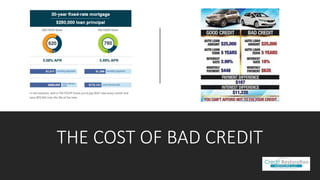

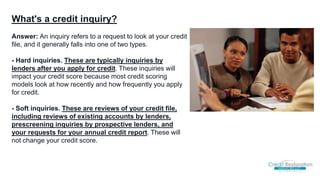

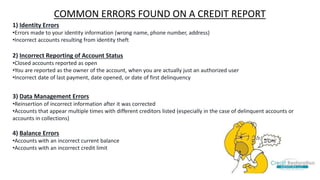

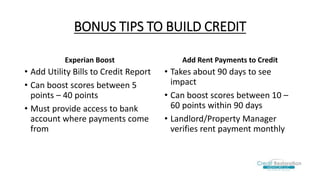

Maxing out credit cards can damage credit scores by 10 to 45 points, and a significant portion of Americans are unaware of their credit scores. Two primary scoring models, FICO and VantageScore, assess creditworthiness based on various factors, with scores of 670 and above generally considered good. The document offers tips for improving credit scores, such as timely bill payments and maintaining low credit card balances, and emphasizes the importance of understanding and managing credit reports.