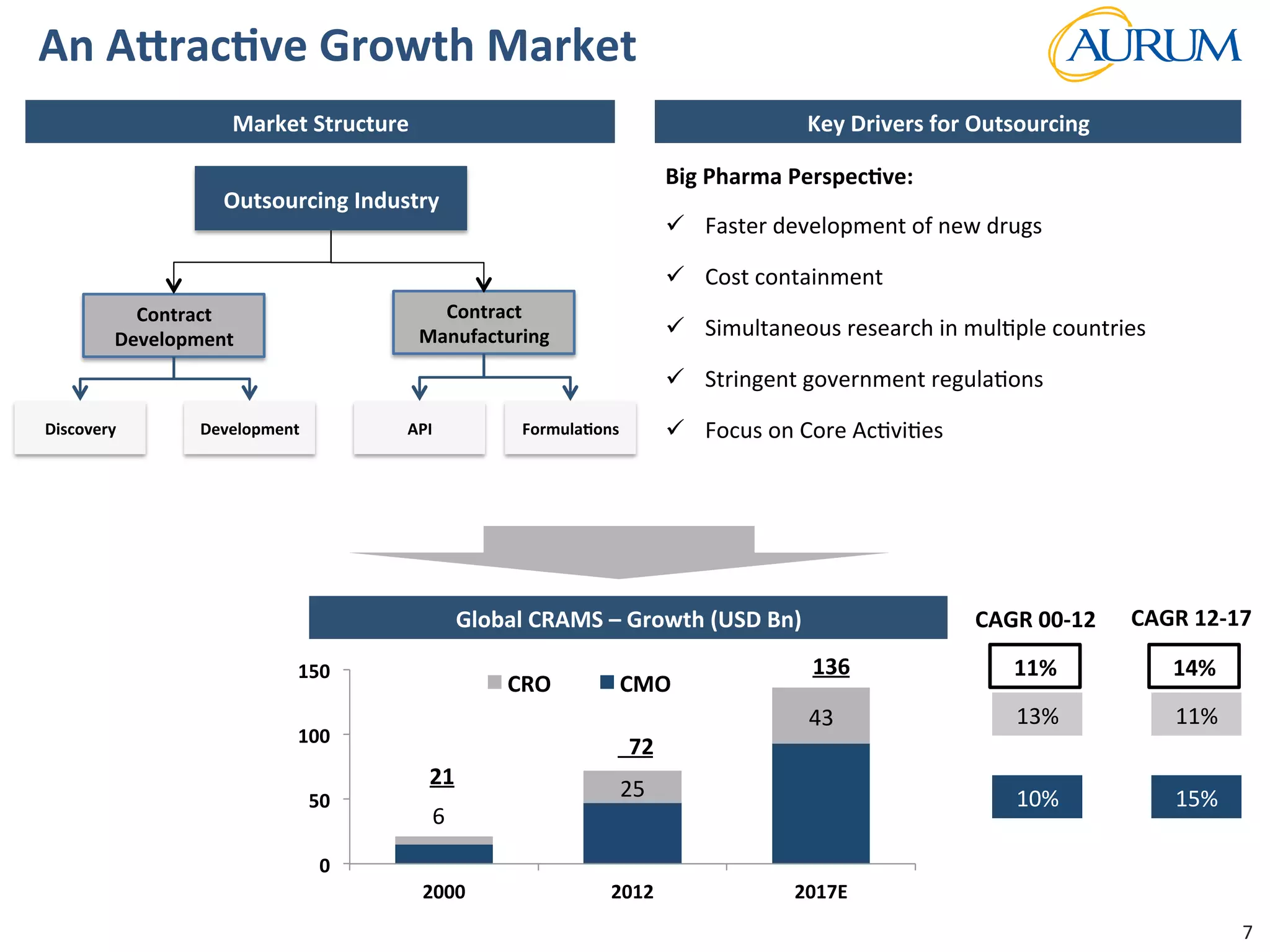

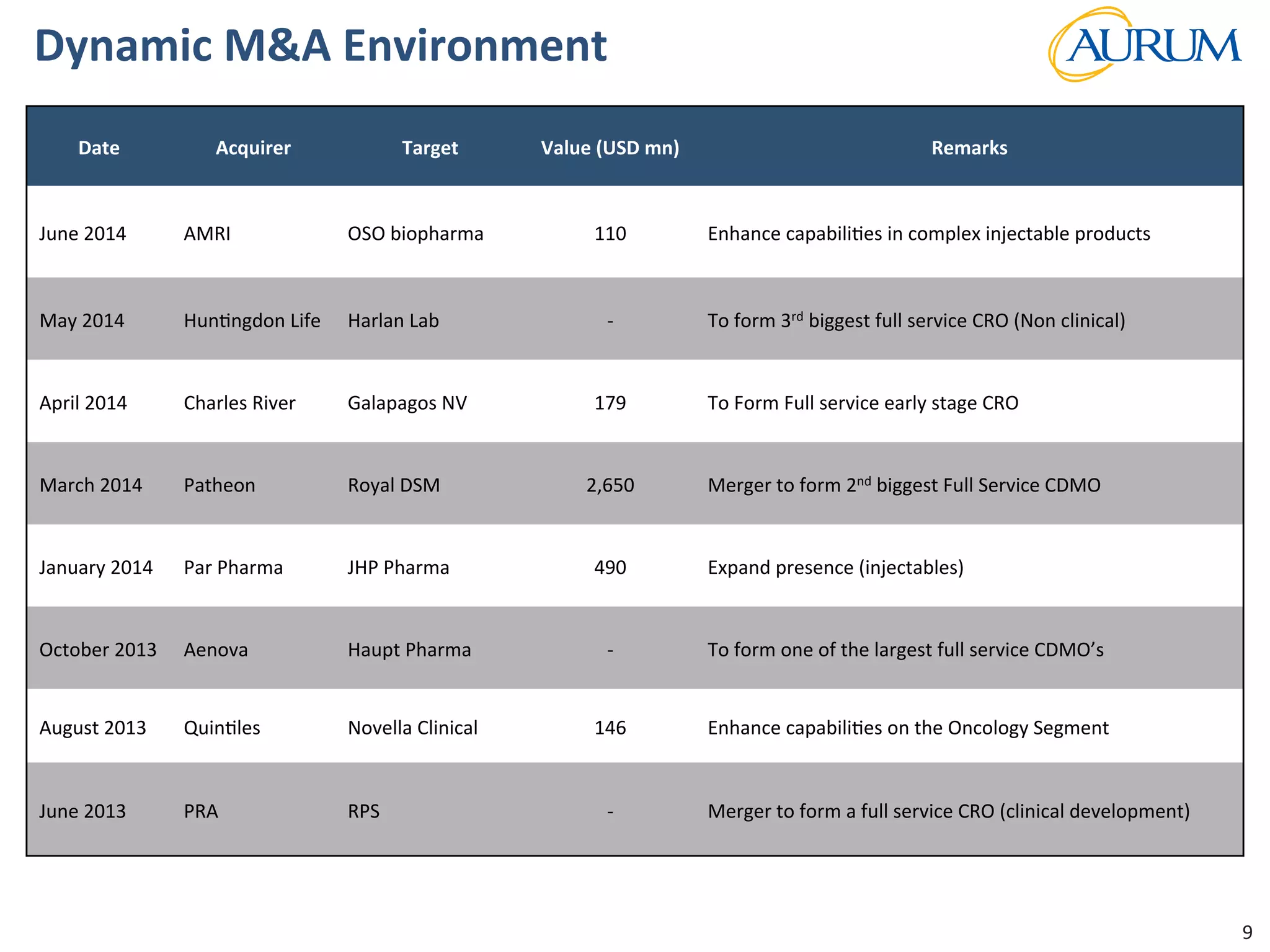

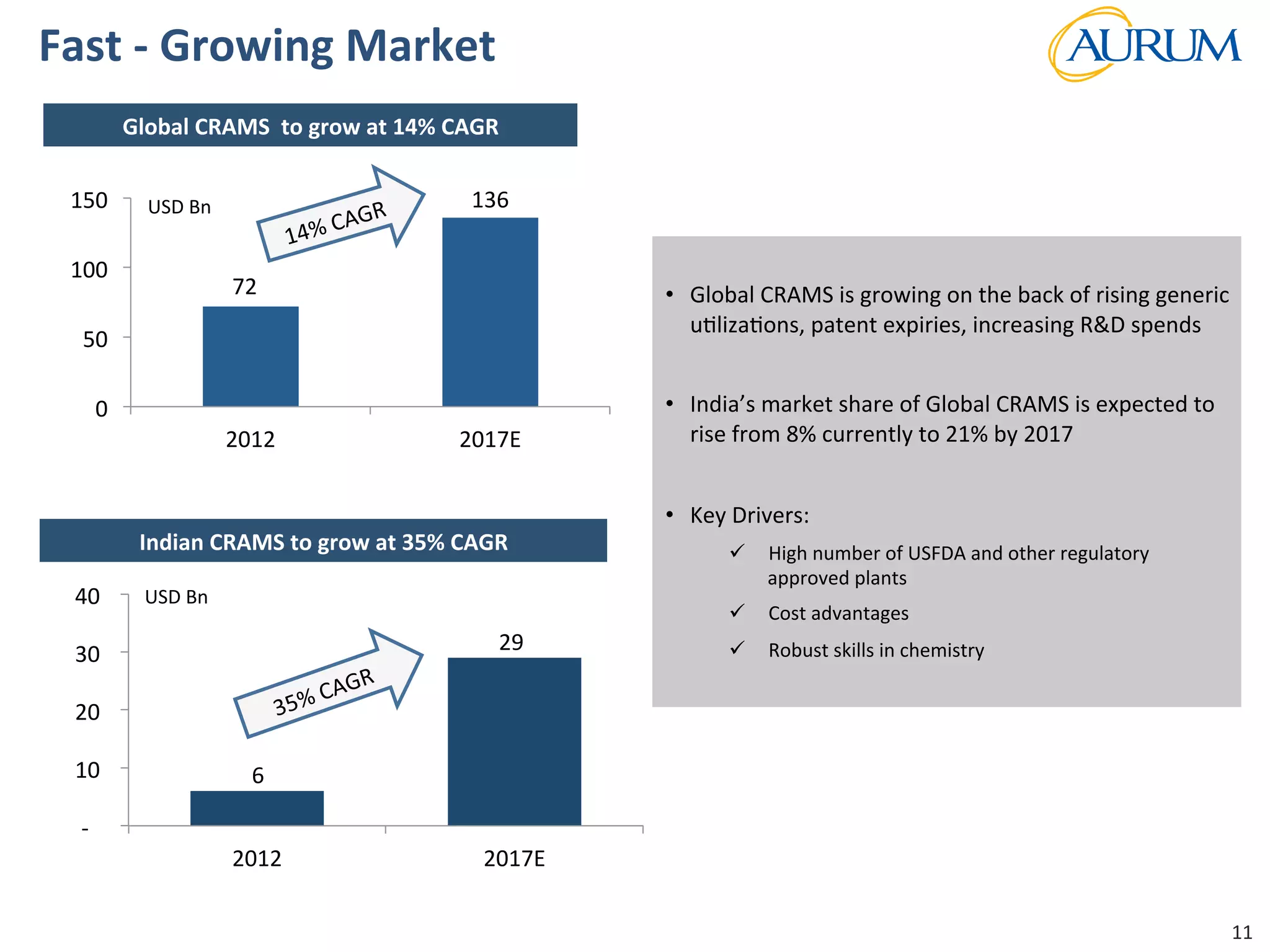

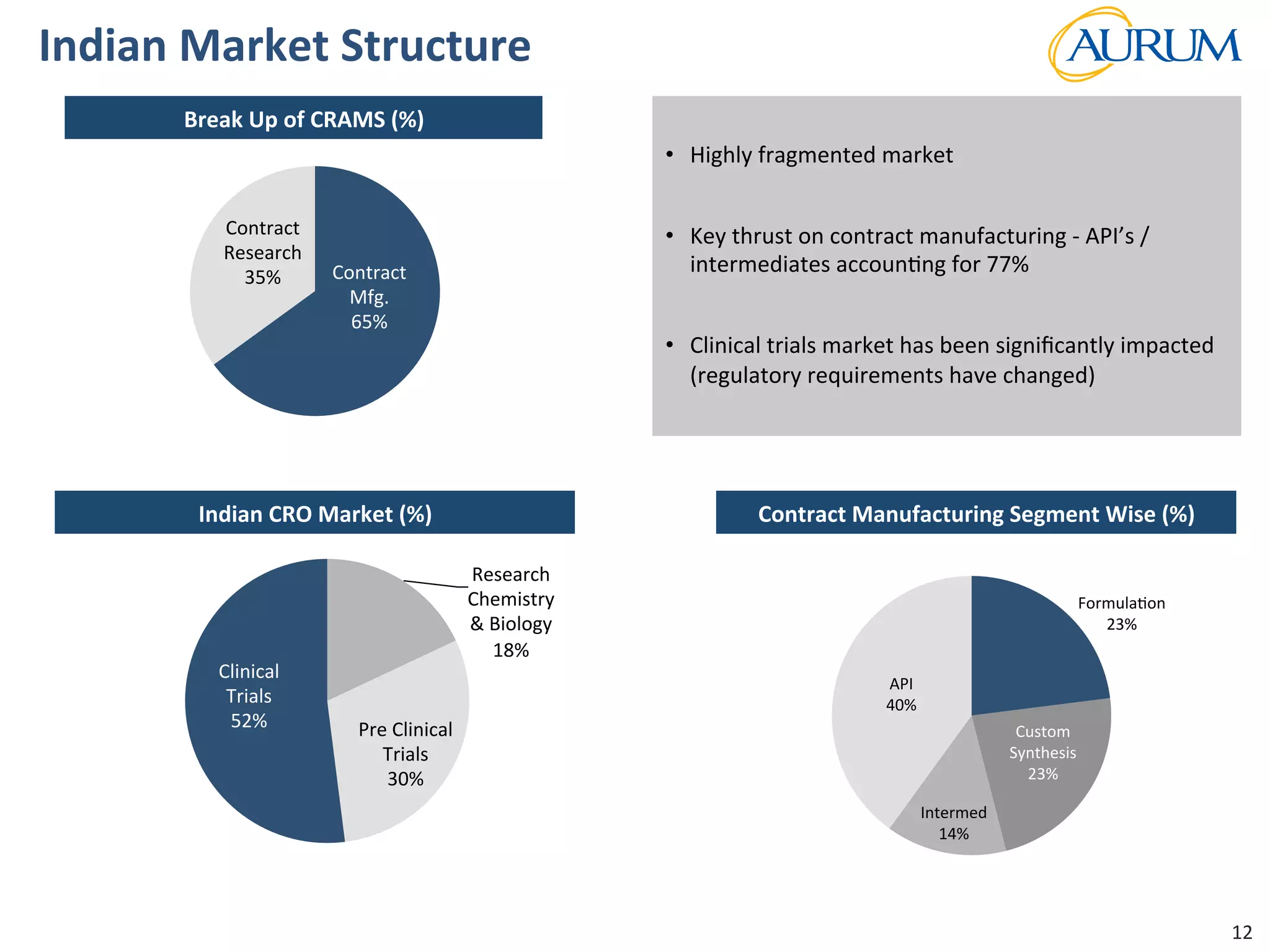

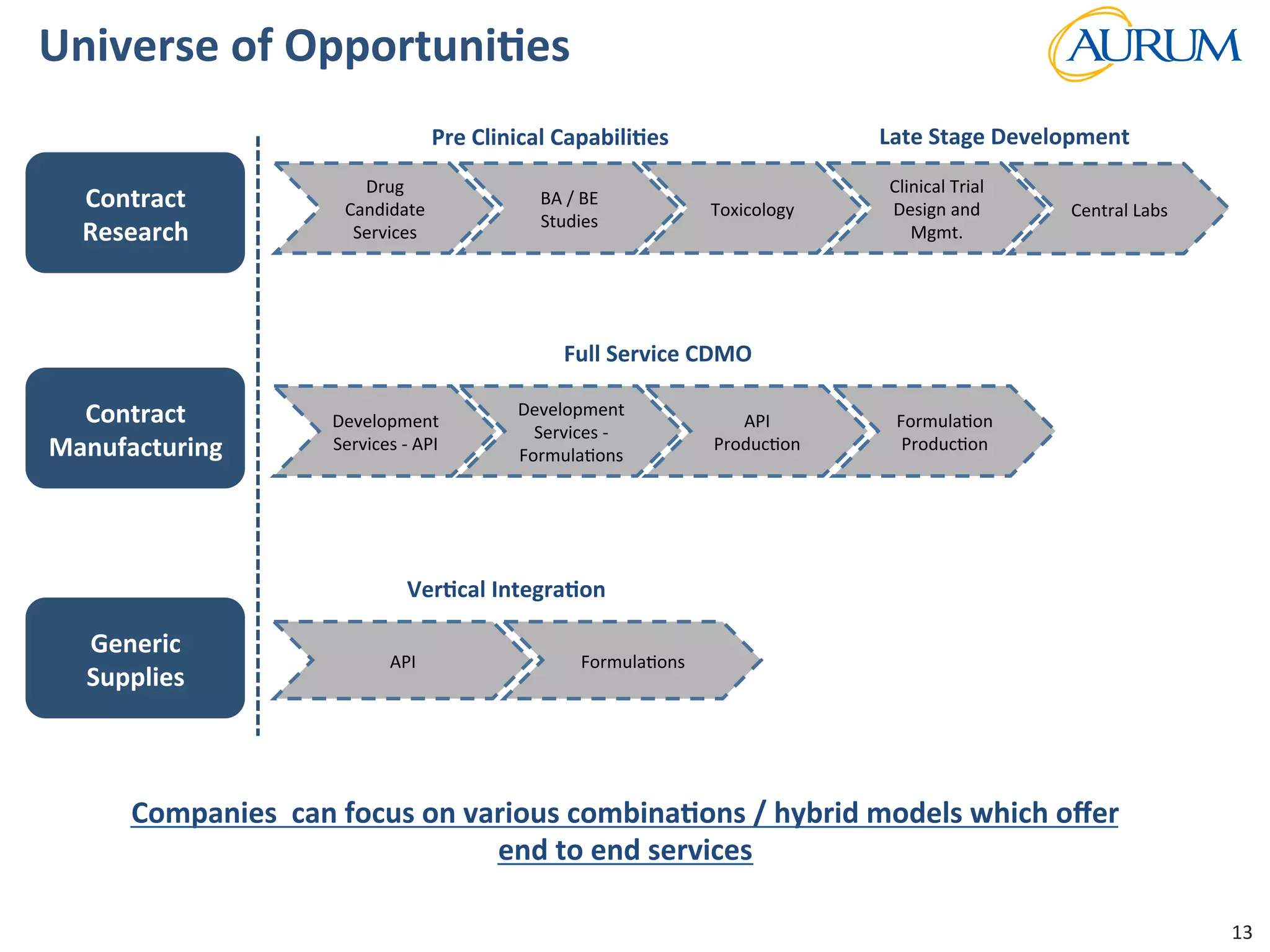

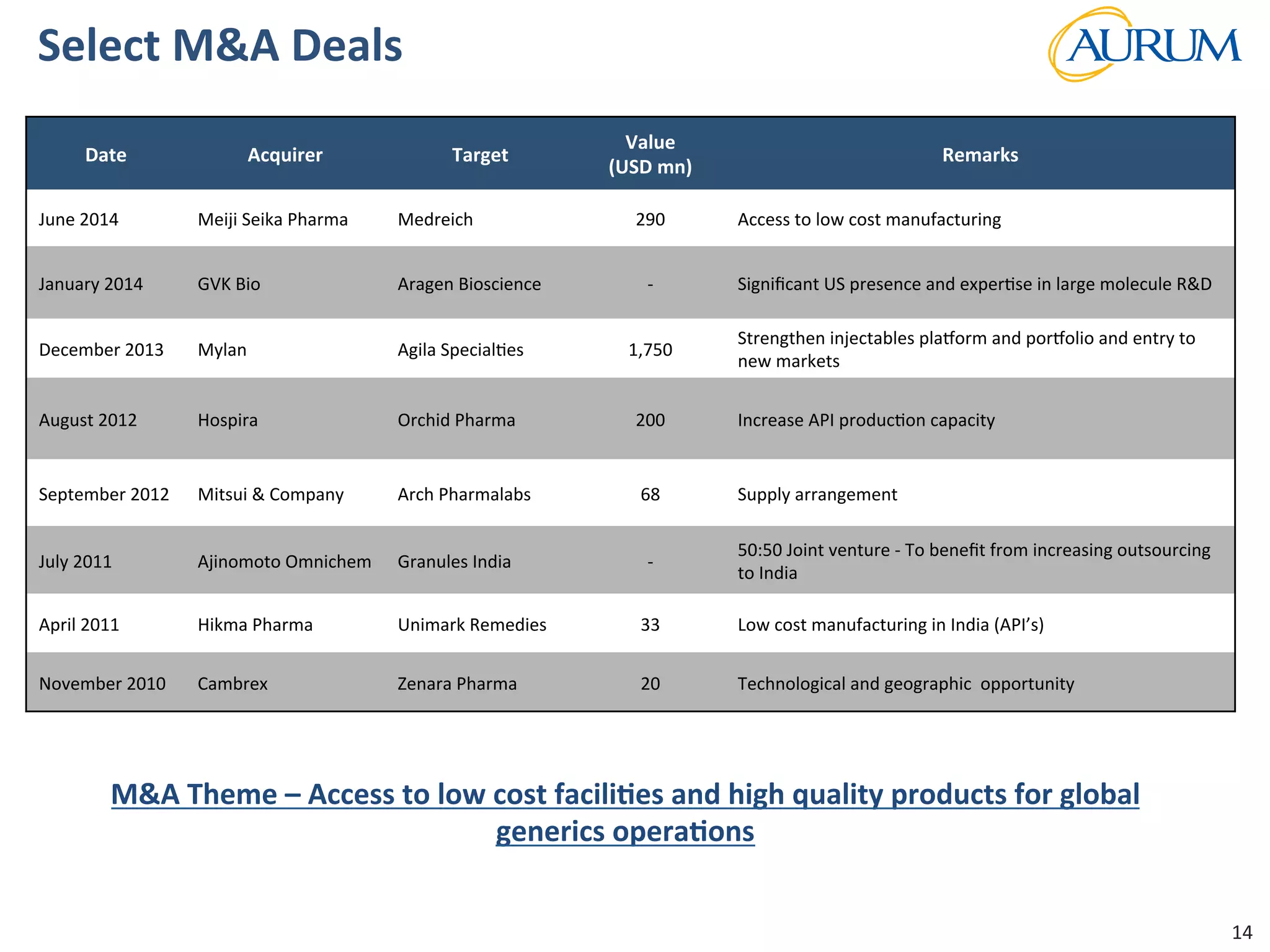

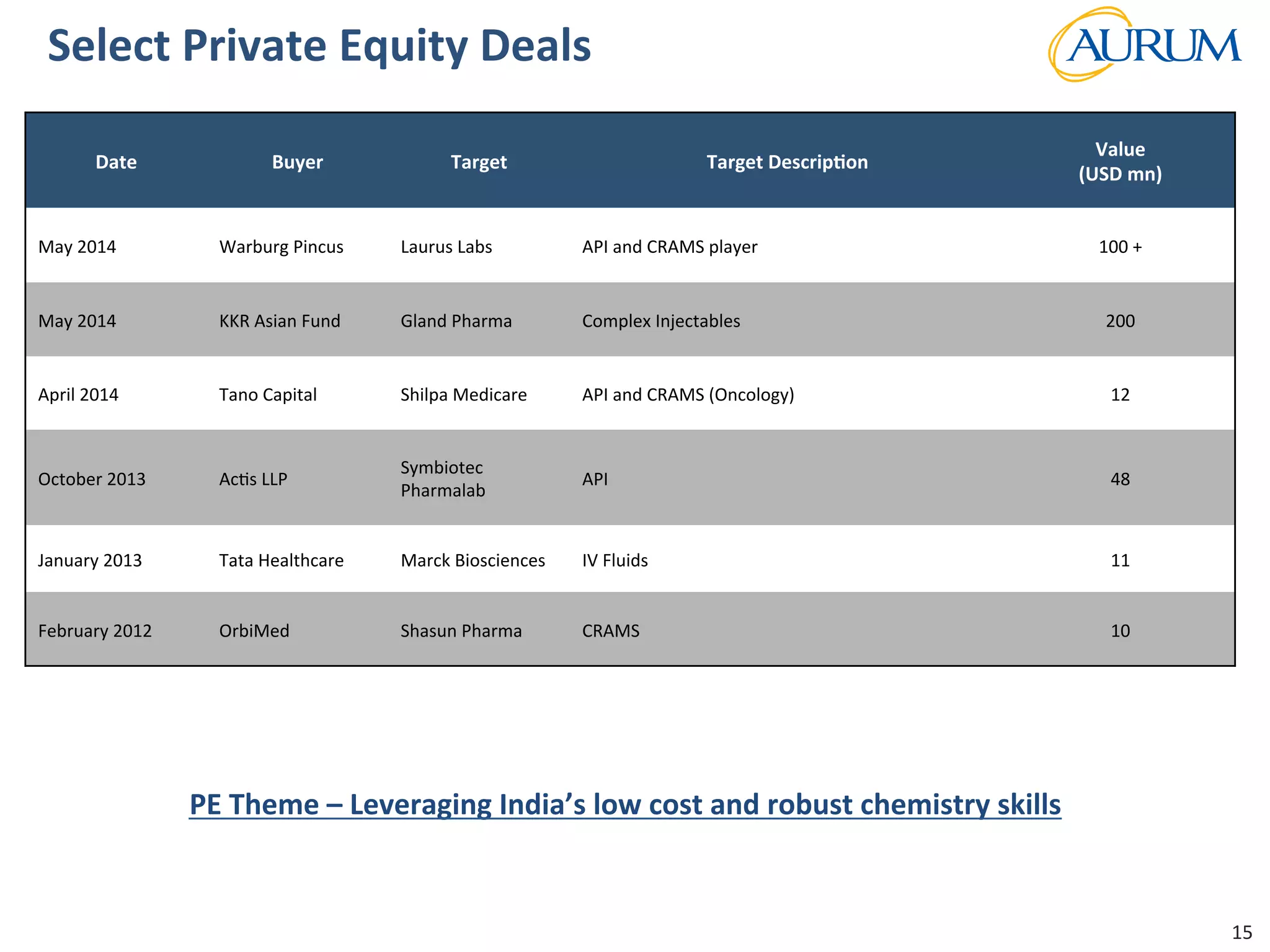

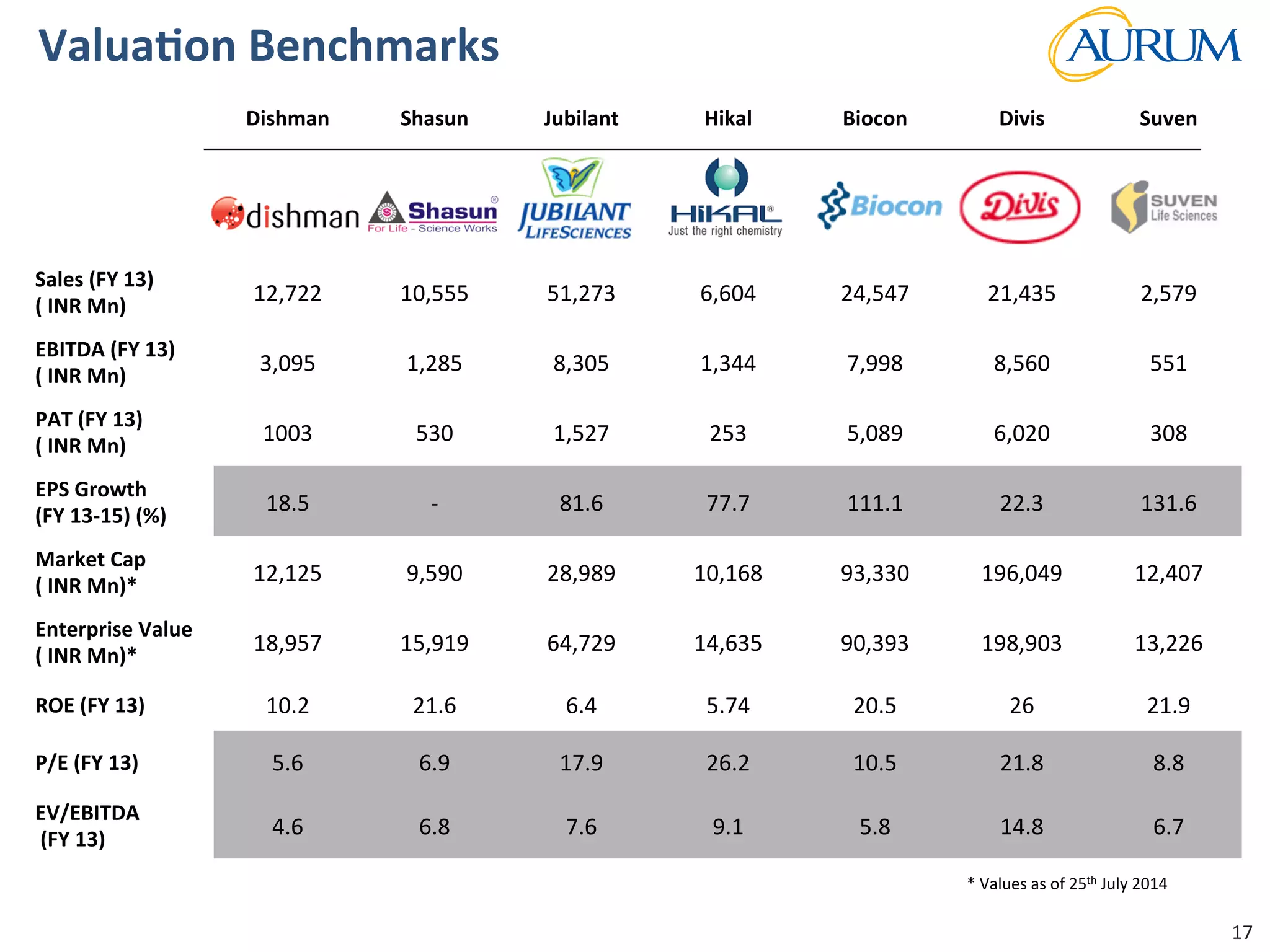

This document provides an overview of the contract research and manufacturing services (CRAMS) sector. It notes that the global CRAMS market is expected to grow significantly between 2000 and 2017, driven by outsourcing trends in the pharmaceutical industry. The market is divided between contract research organizations (CROs) and contract manufacturing organizations (CMOs). The document also outlines the favorable market dynamics and consolidation trends in the CRAMS industry.