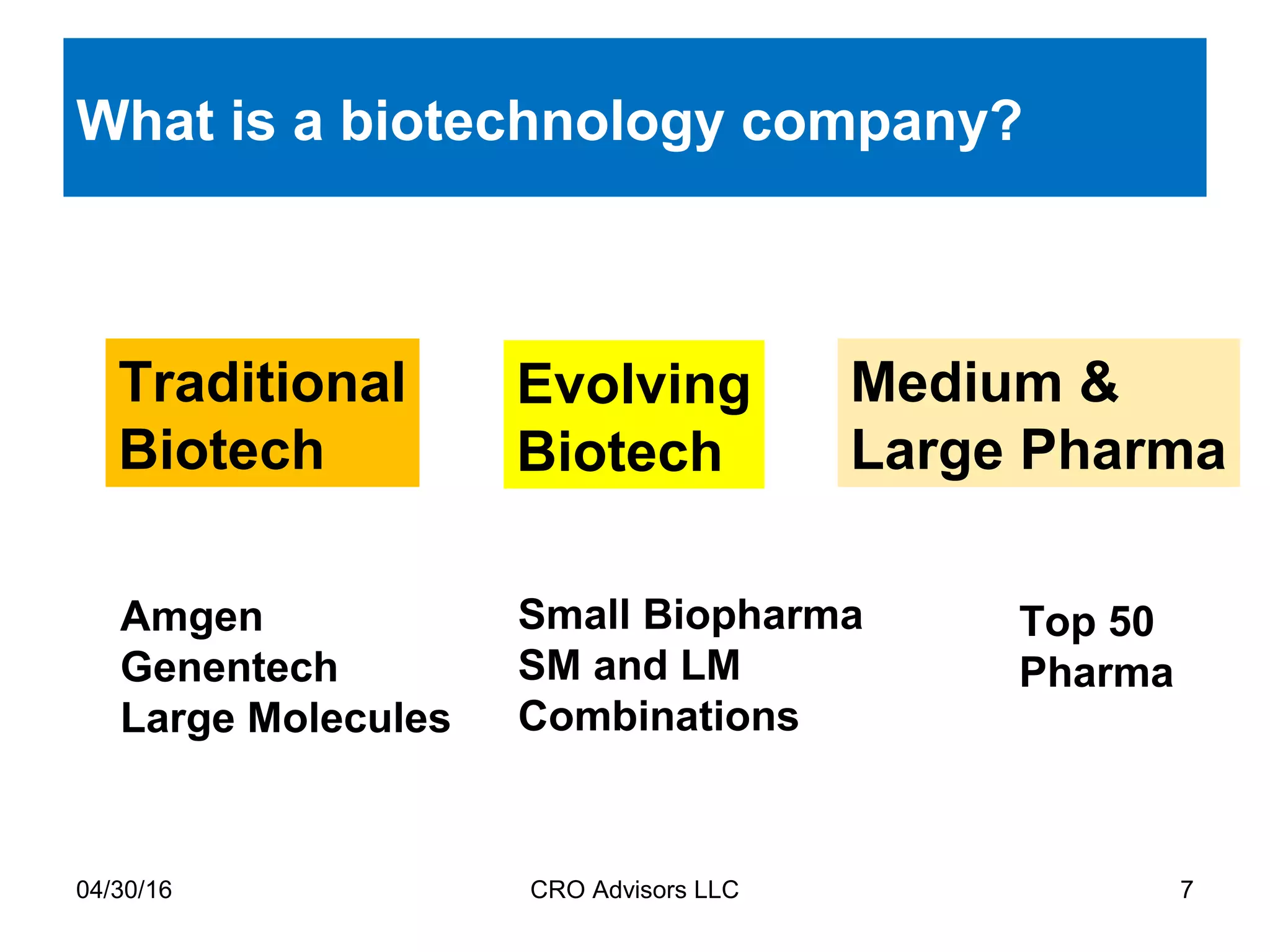

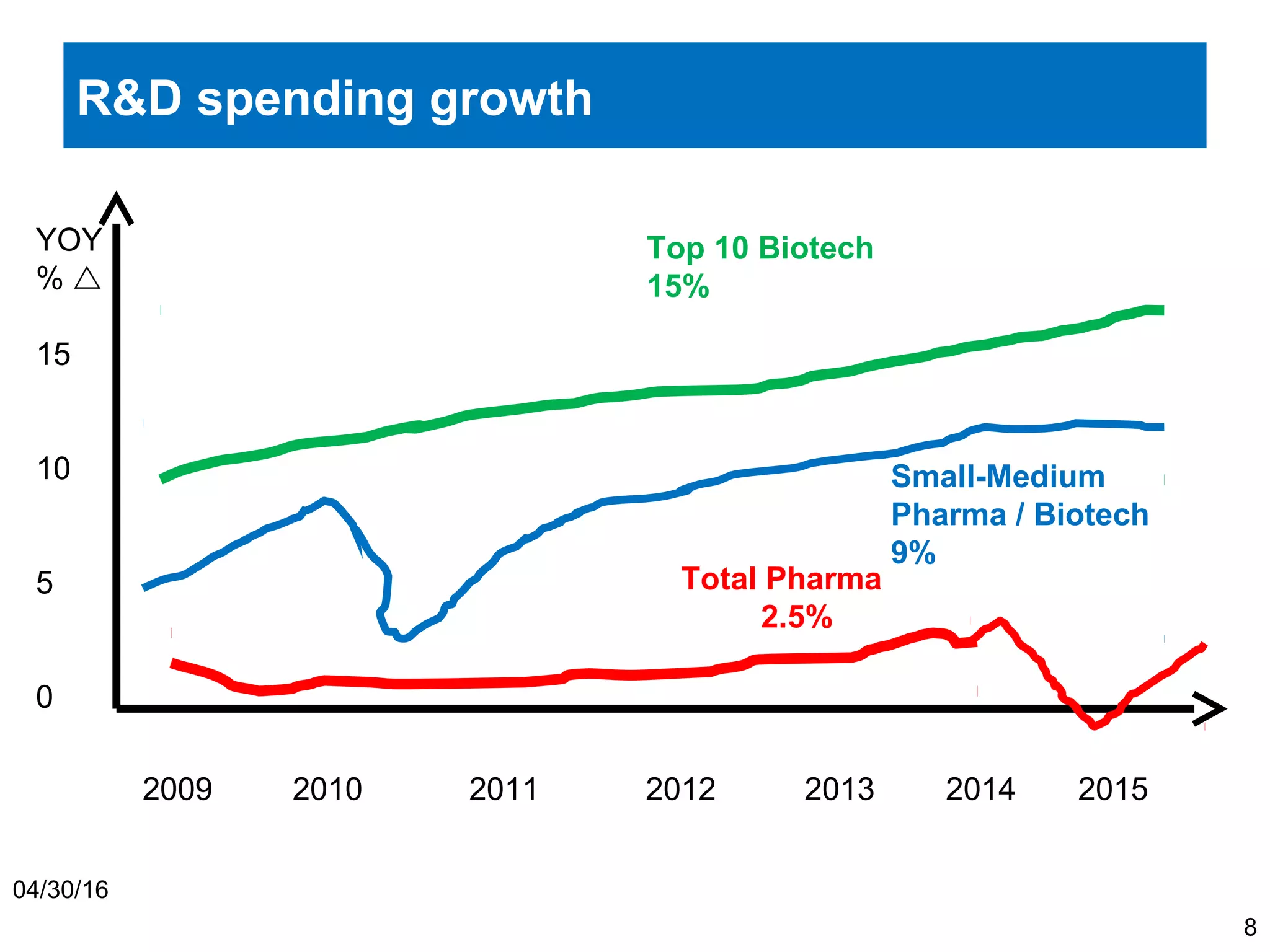

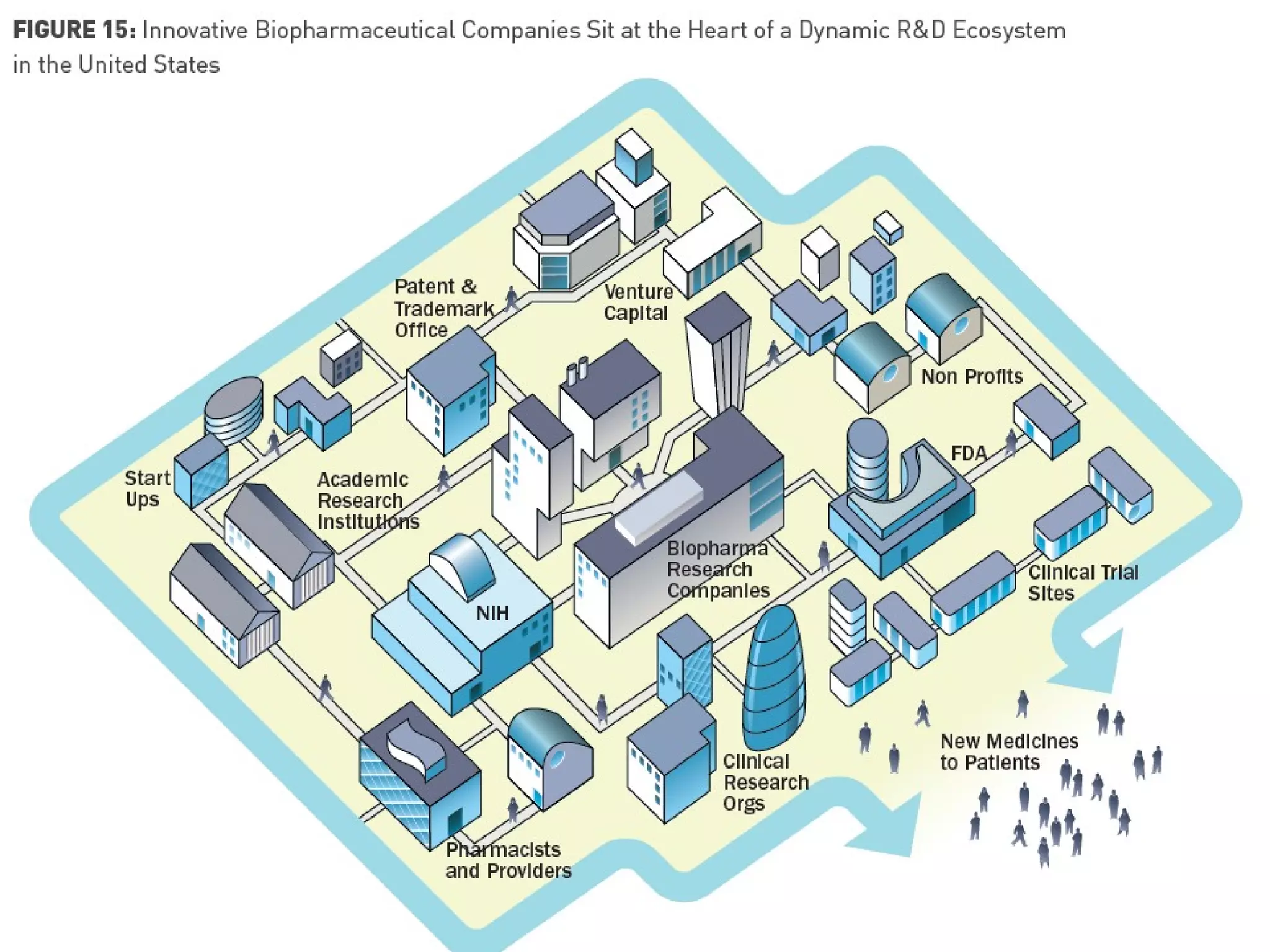

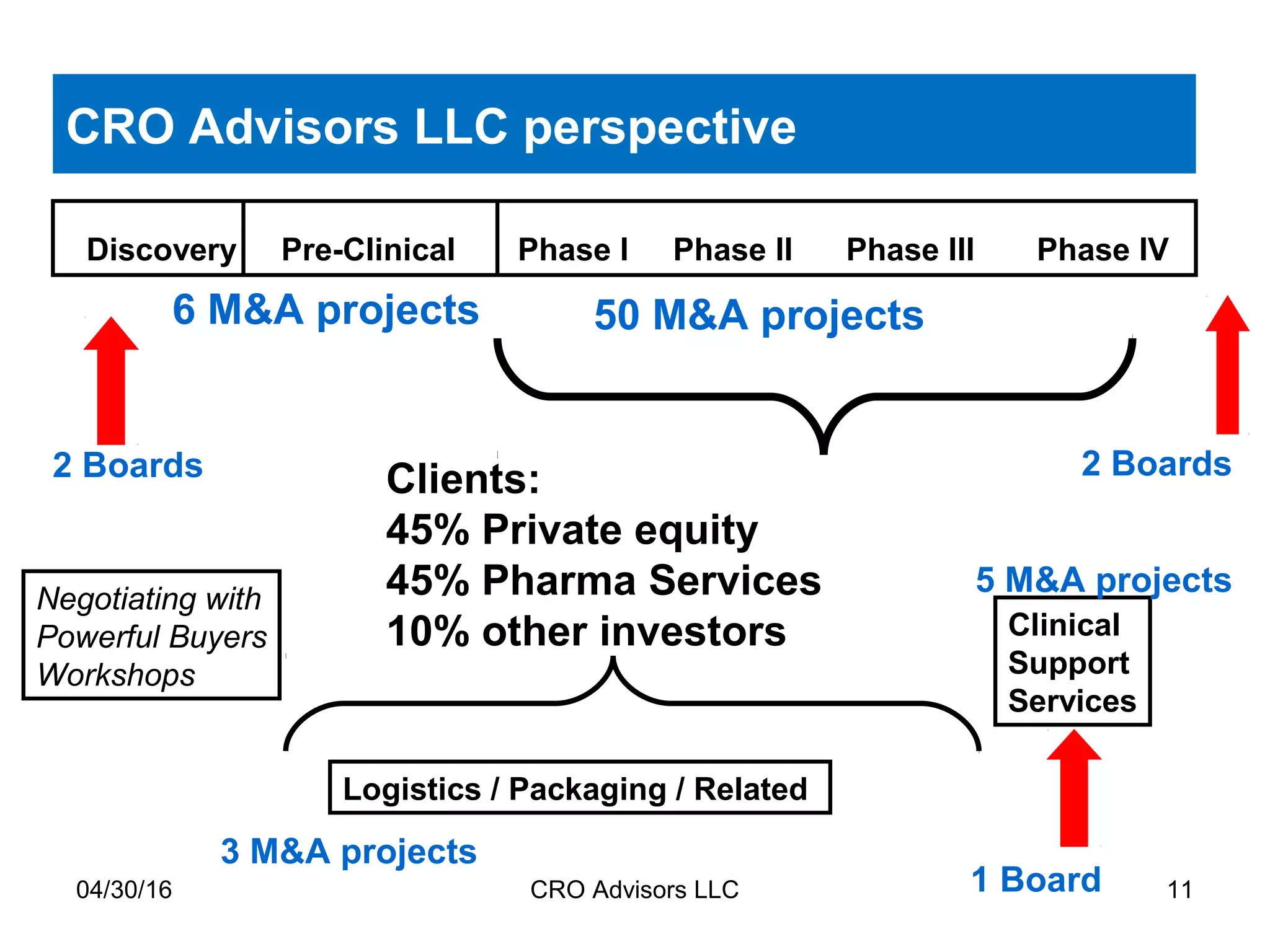

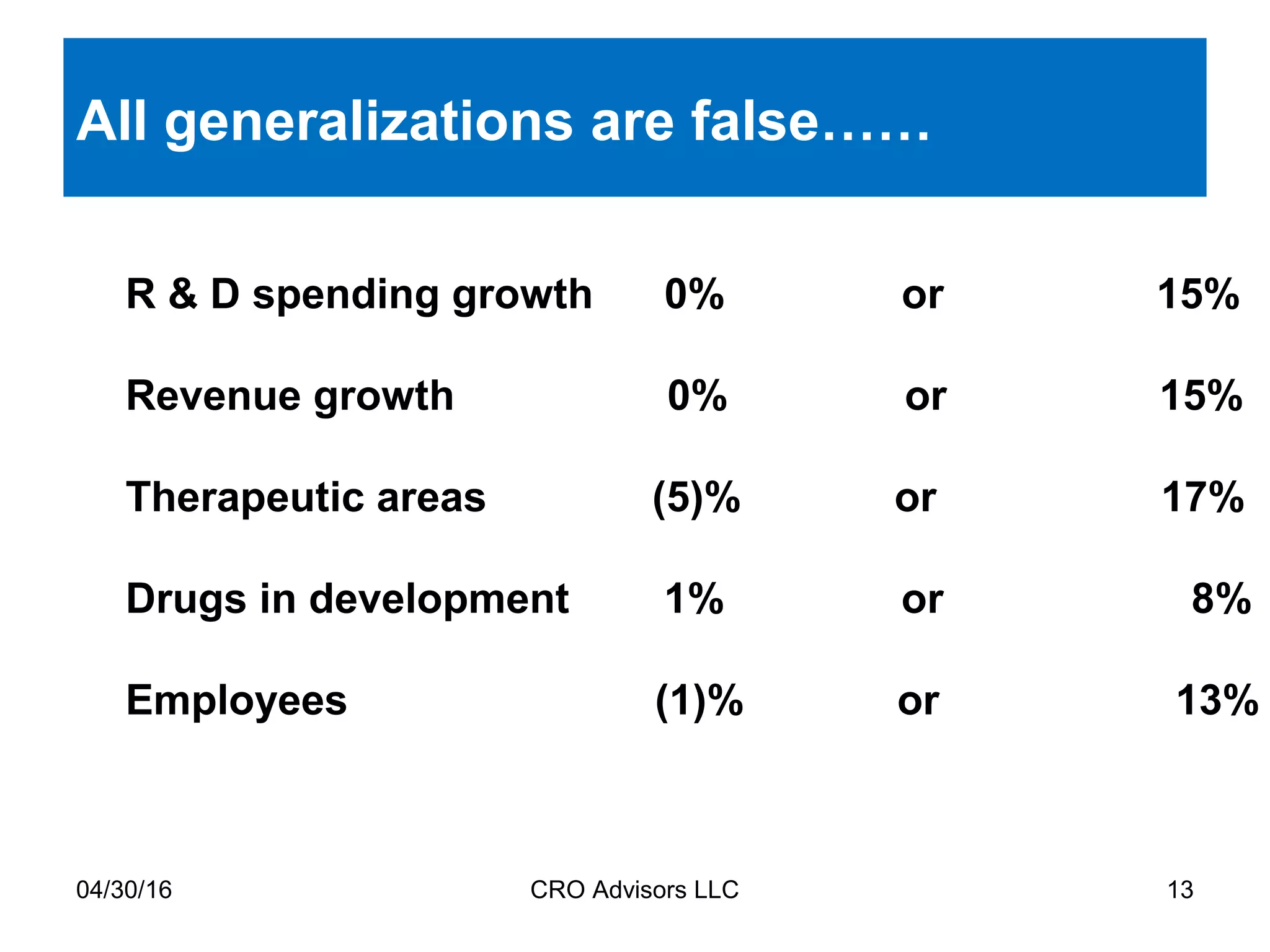

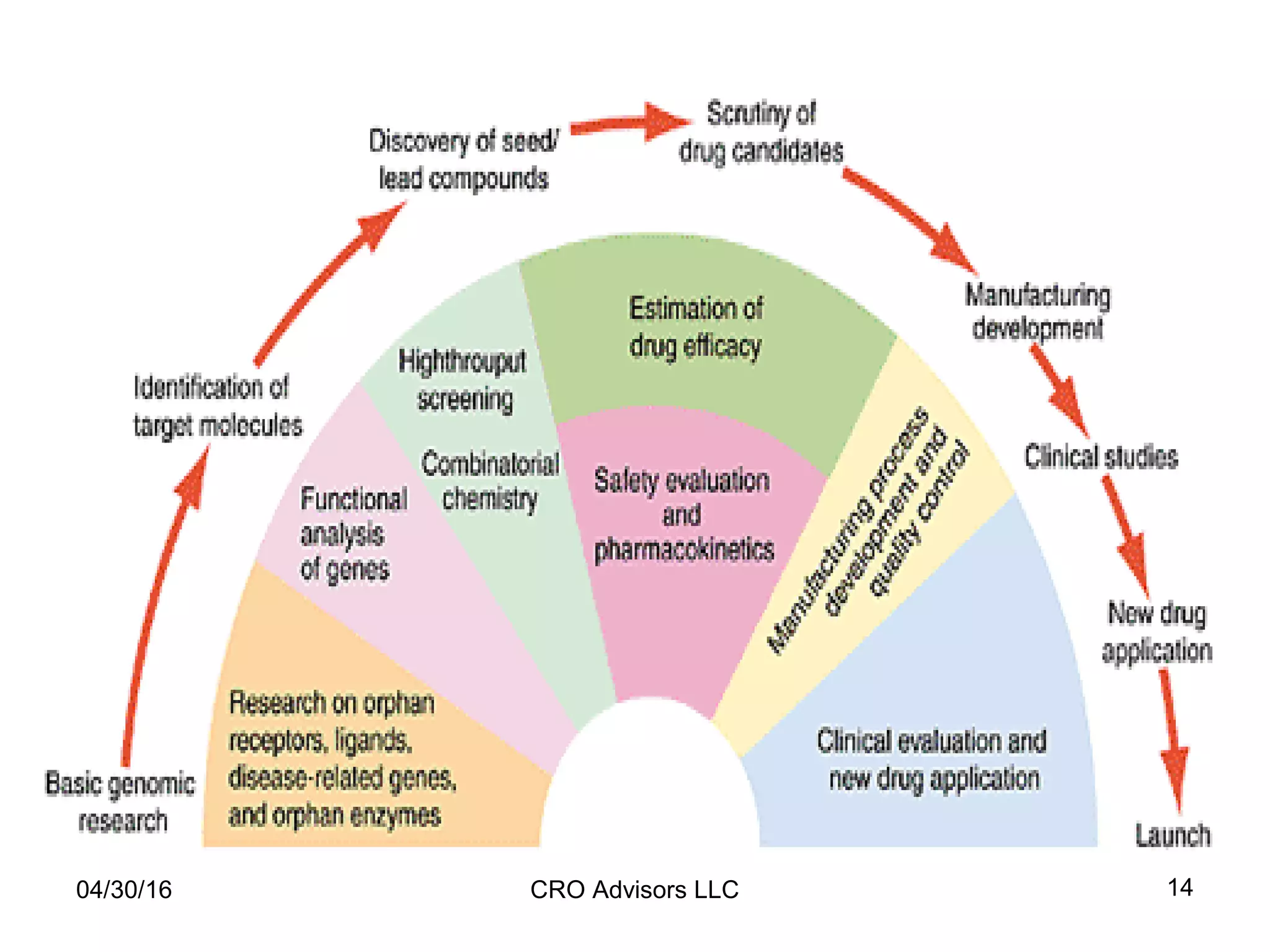

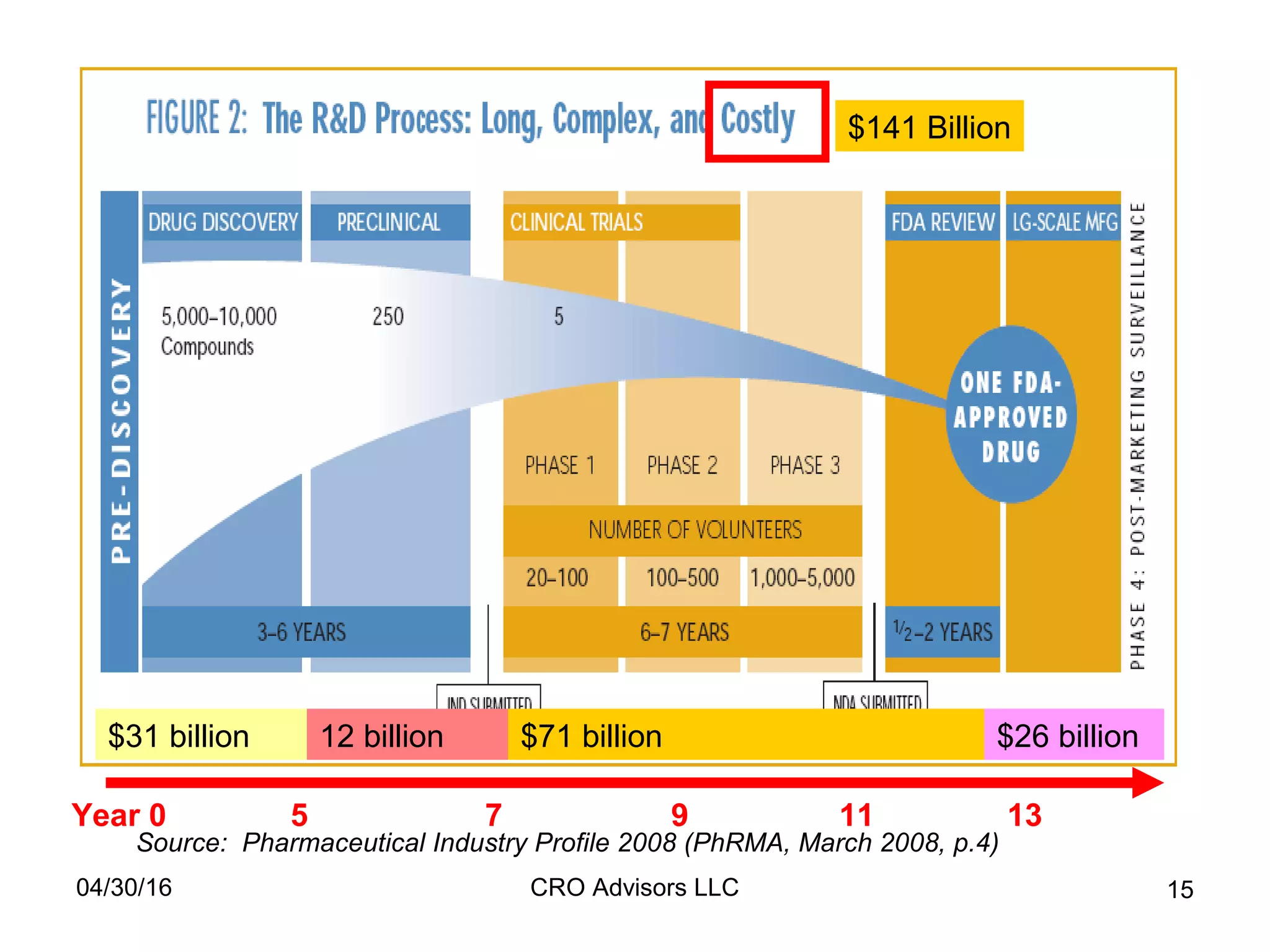

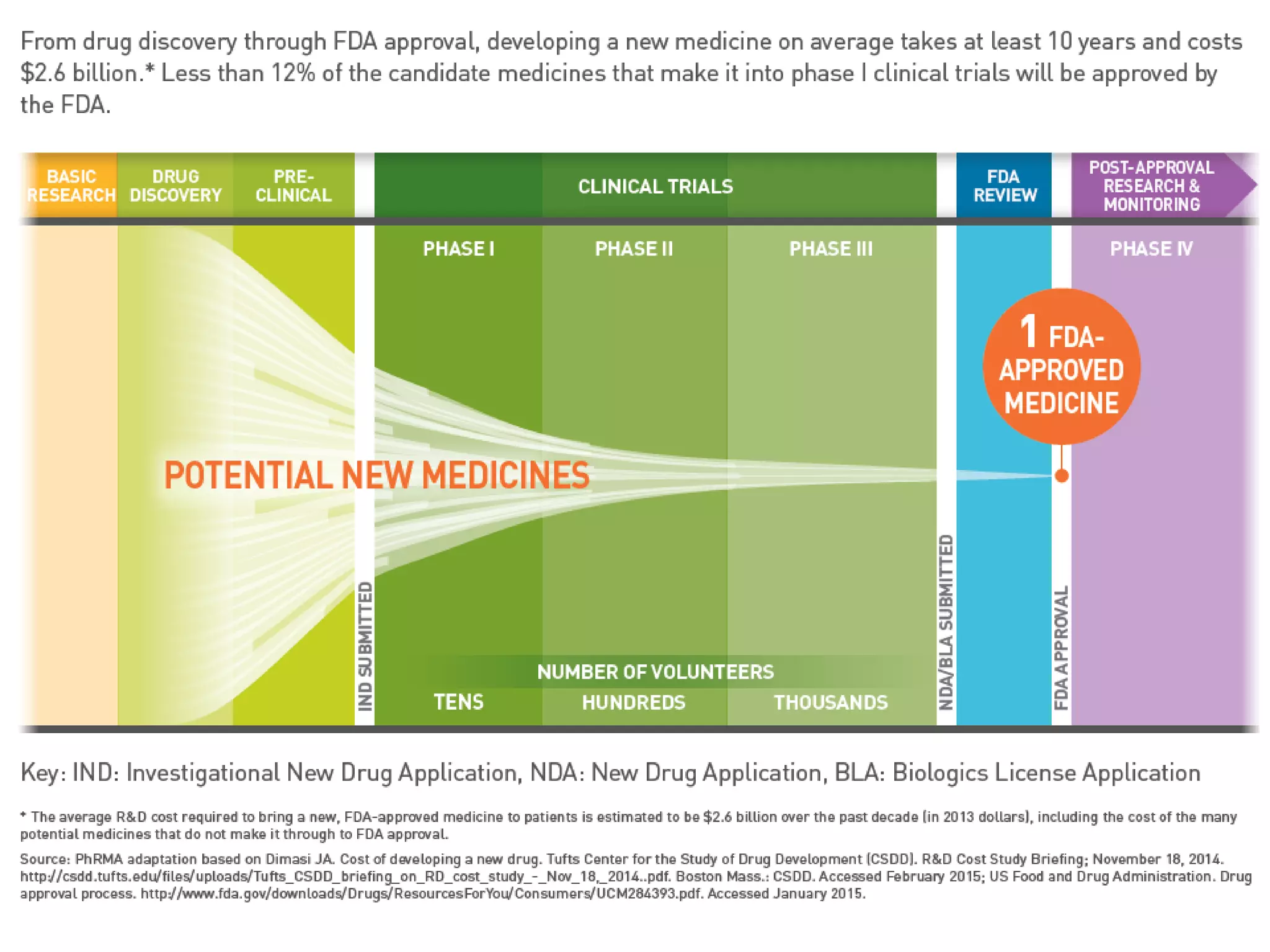

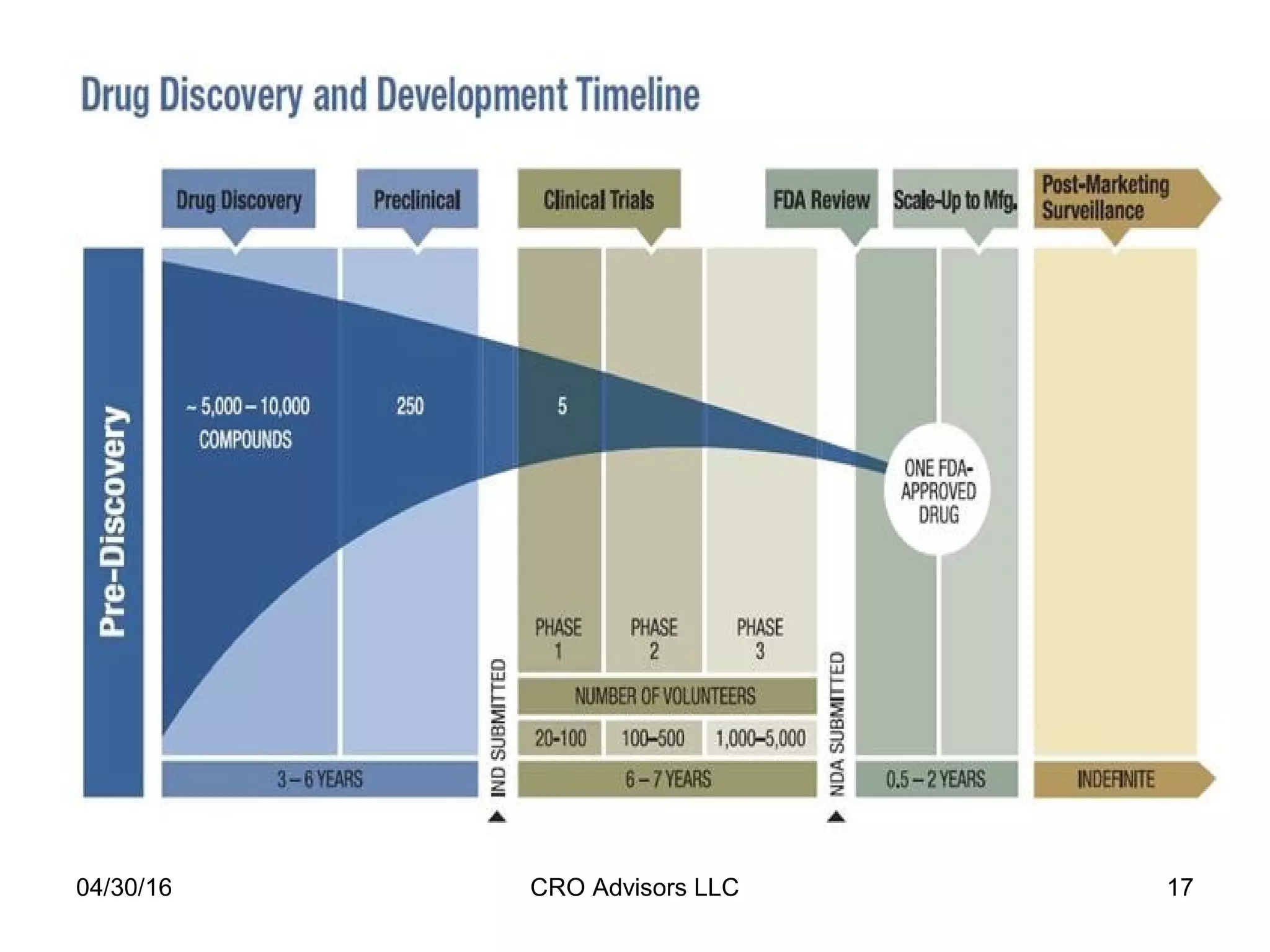

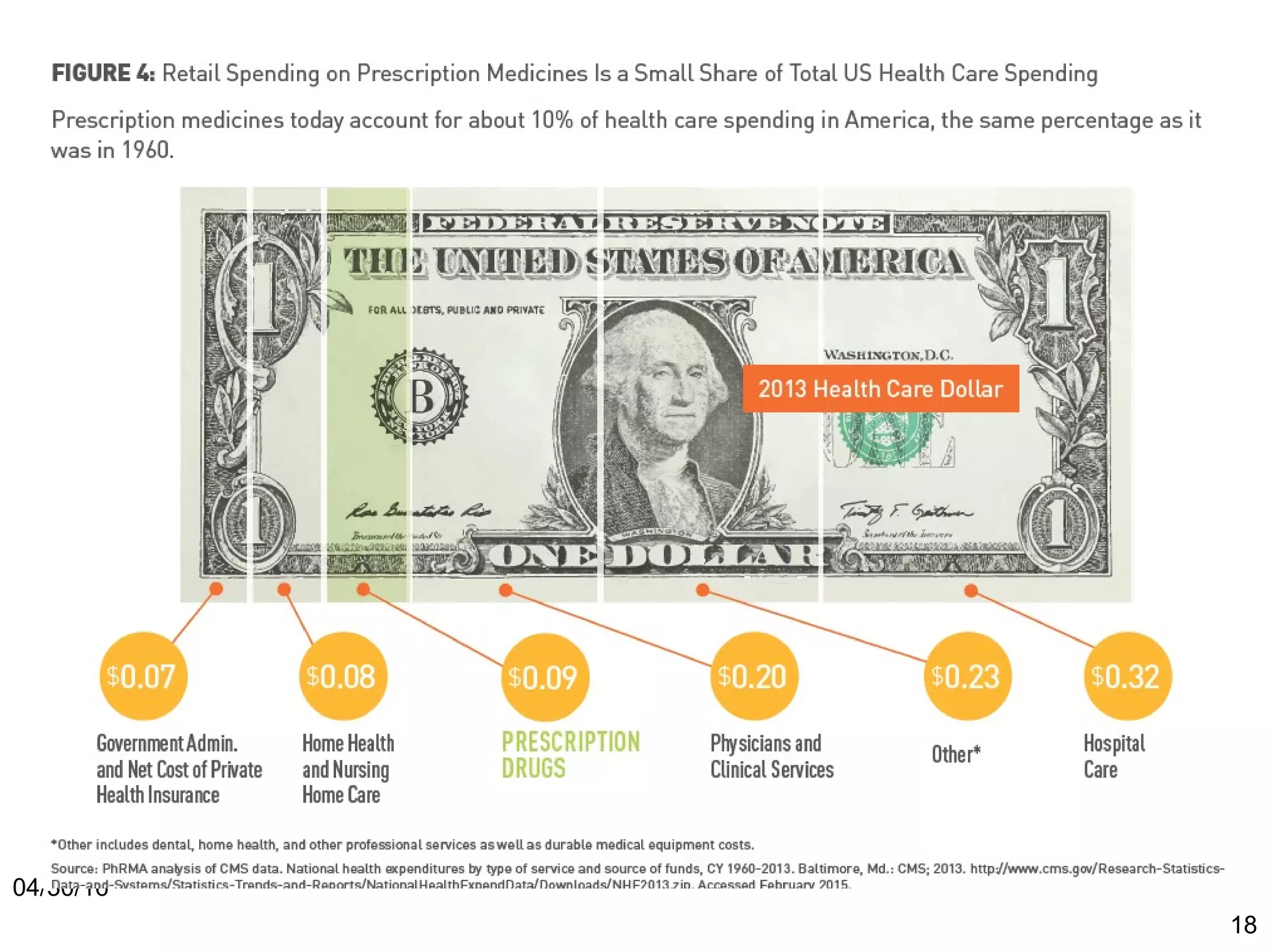

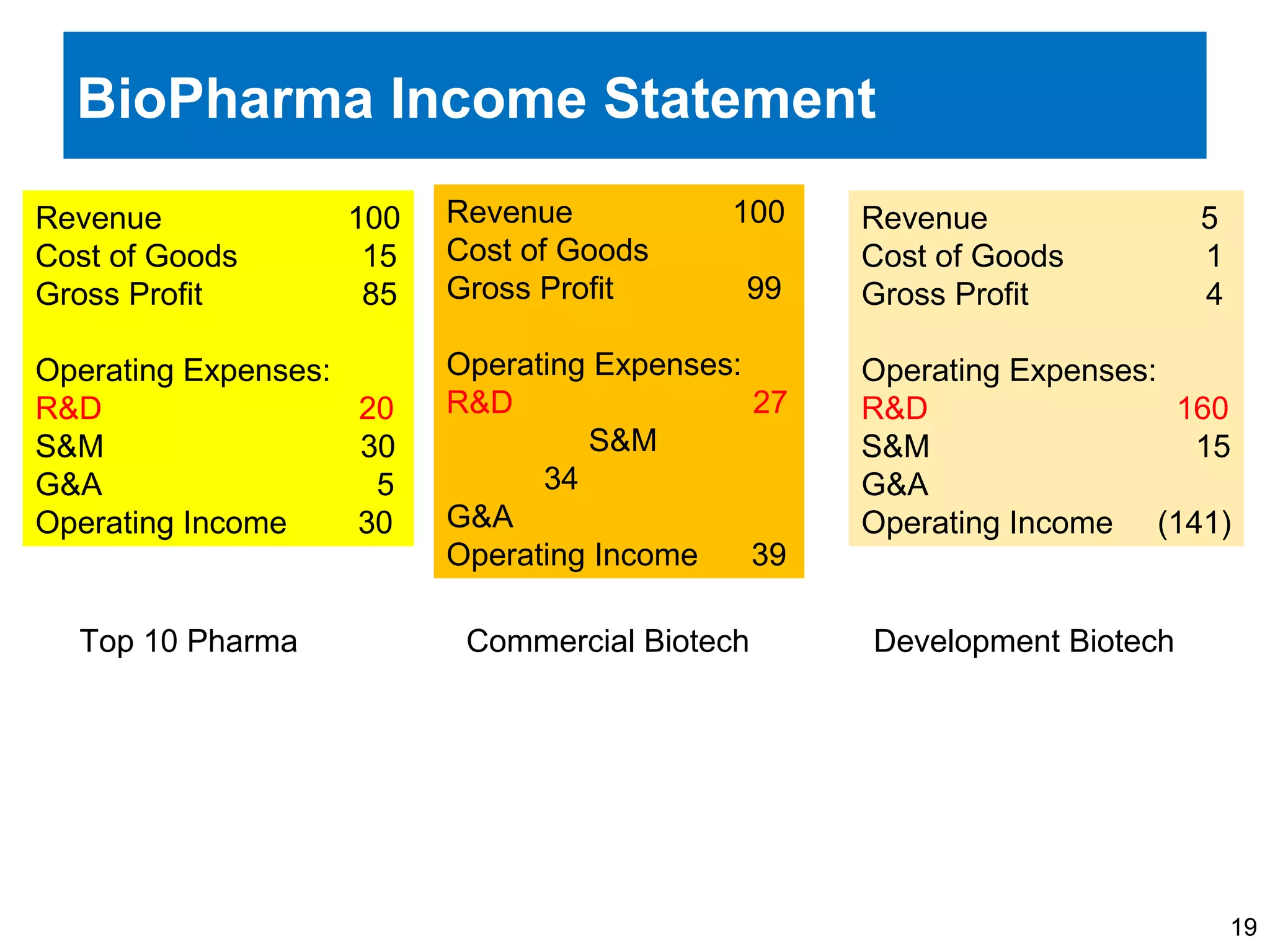

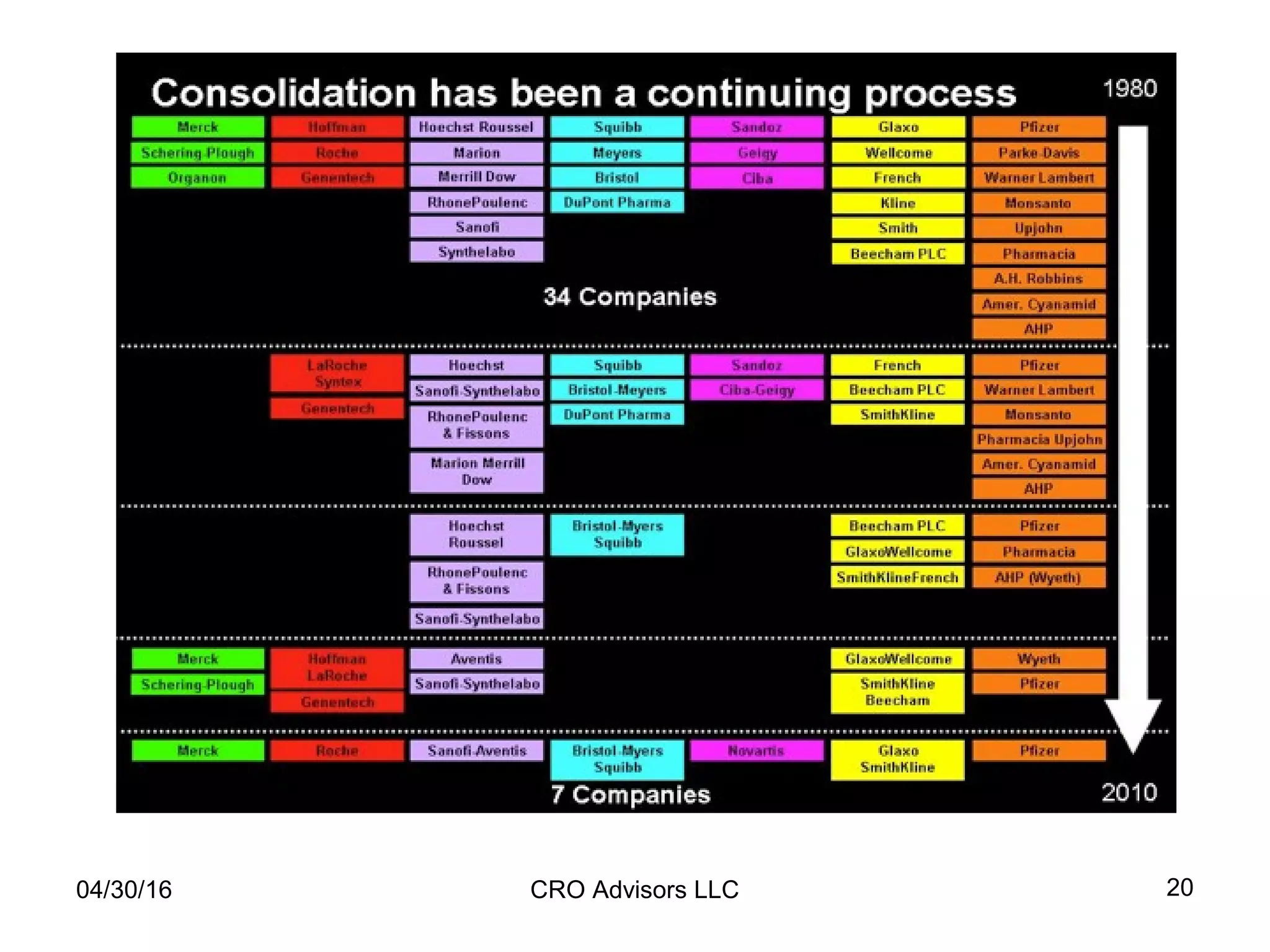

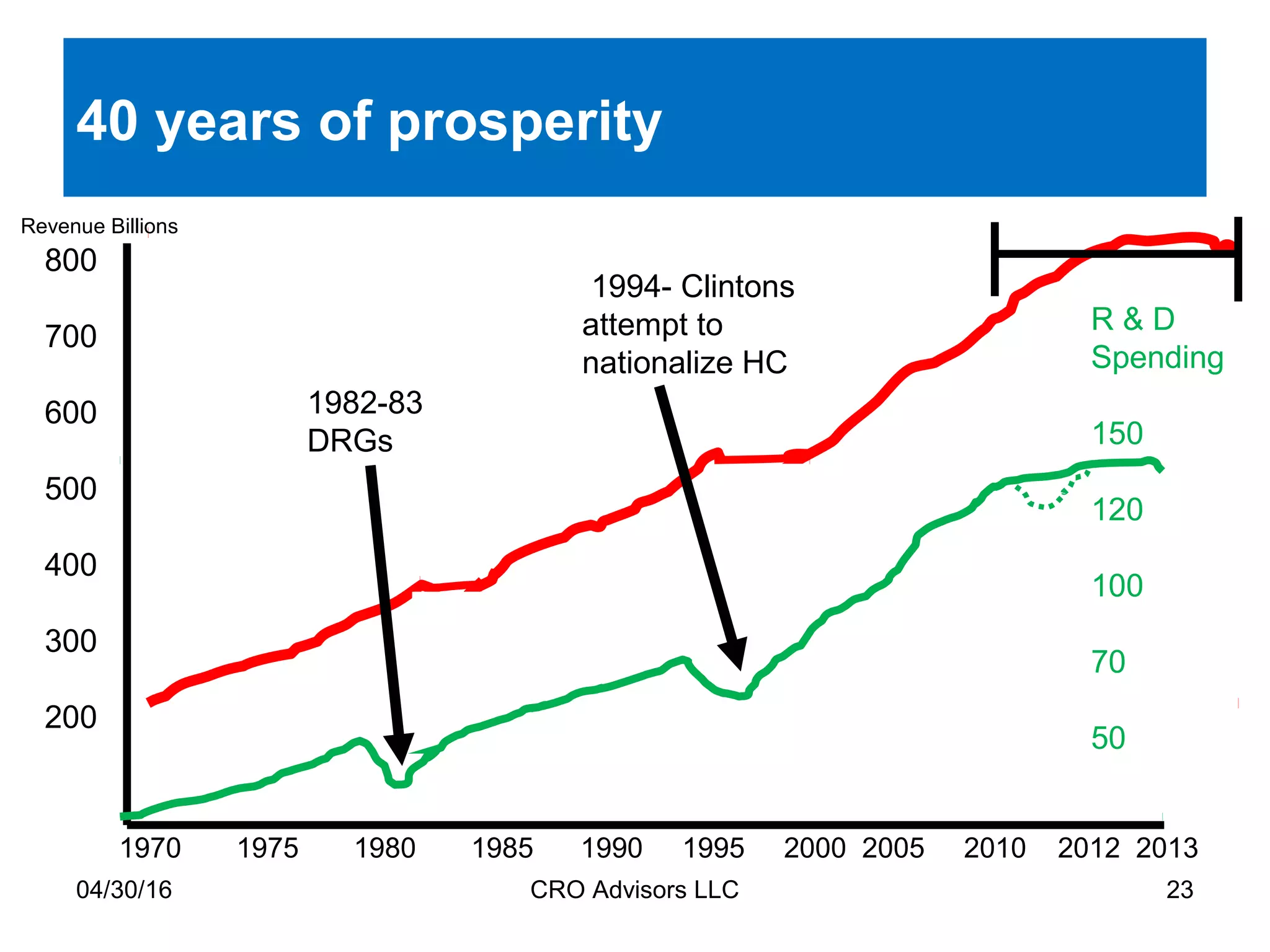

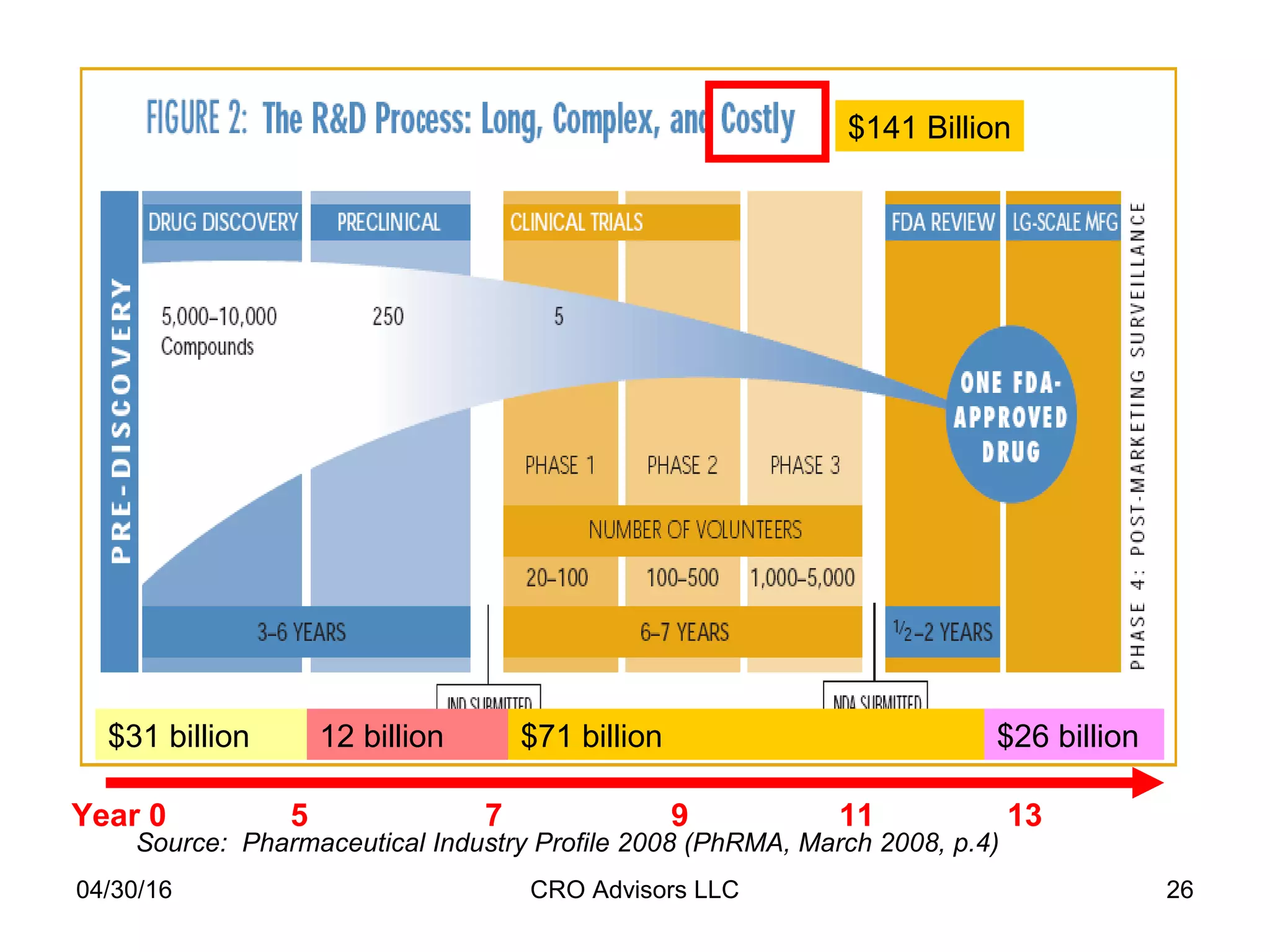

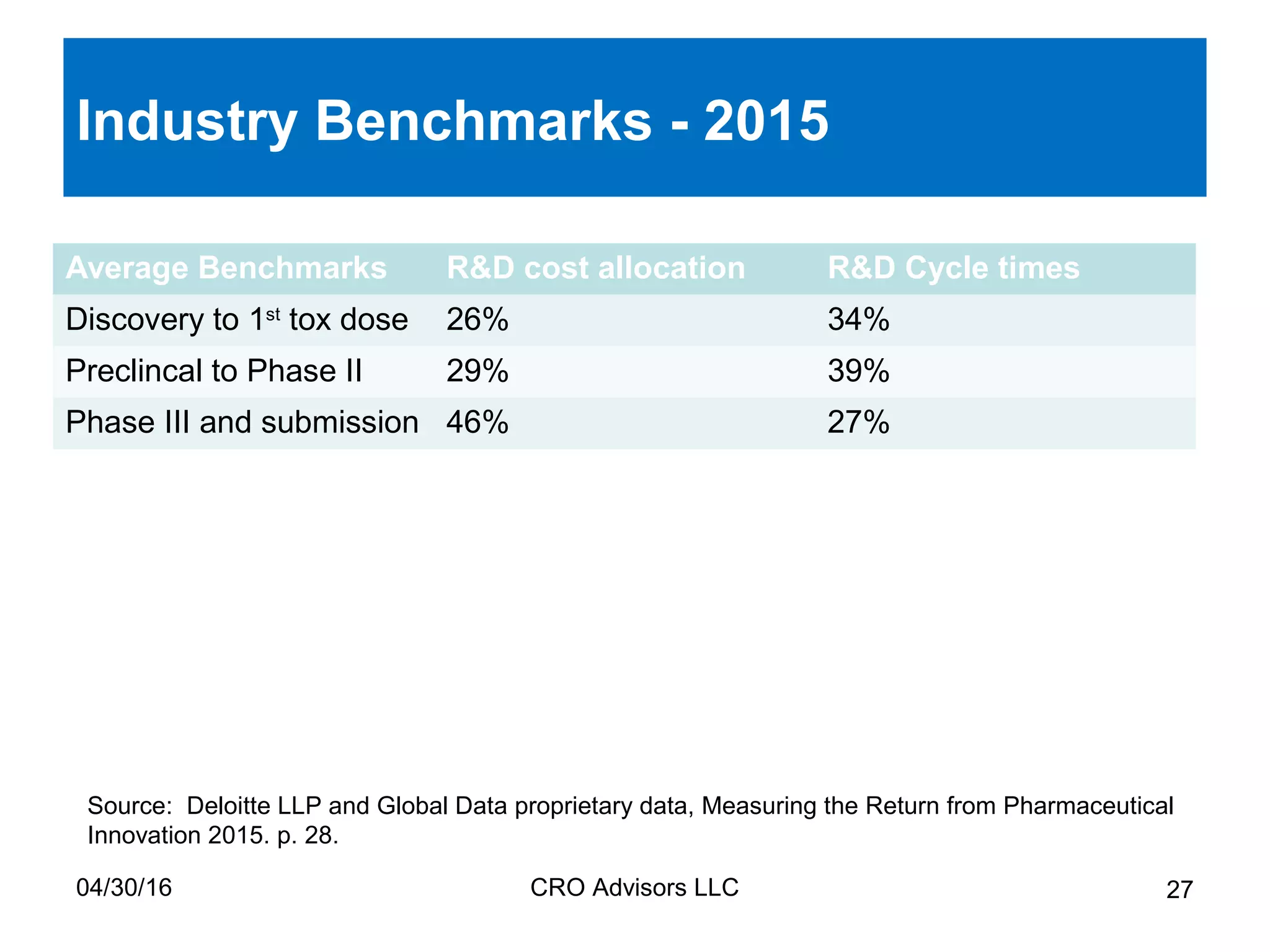

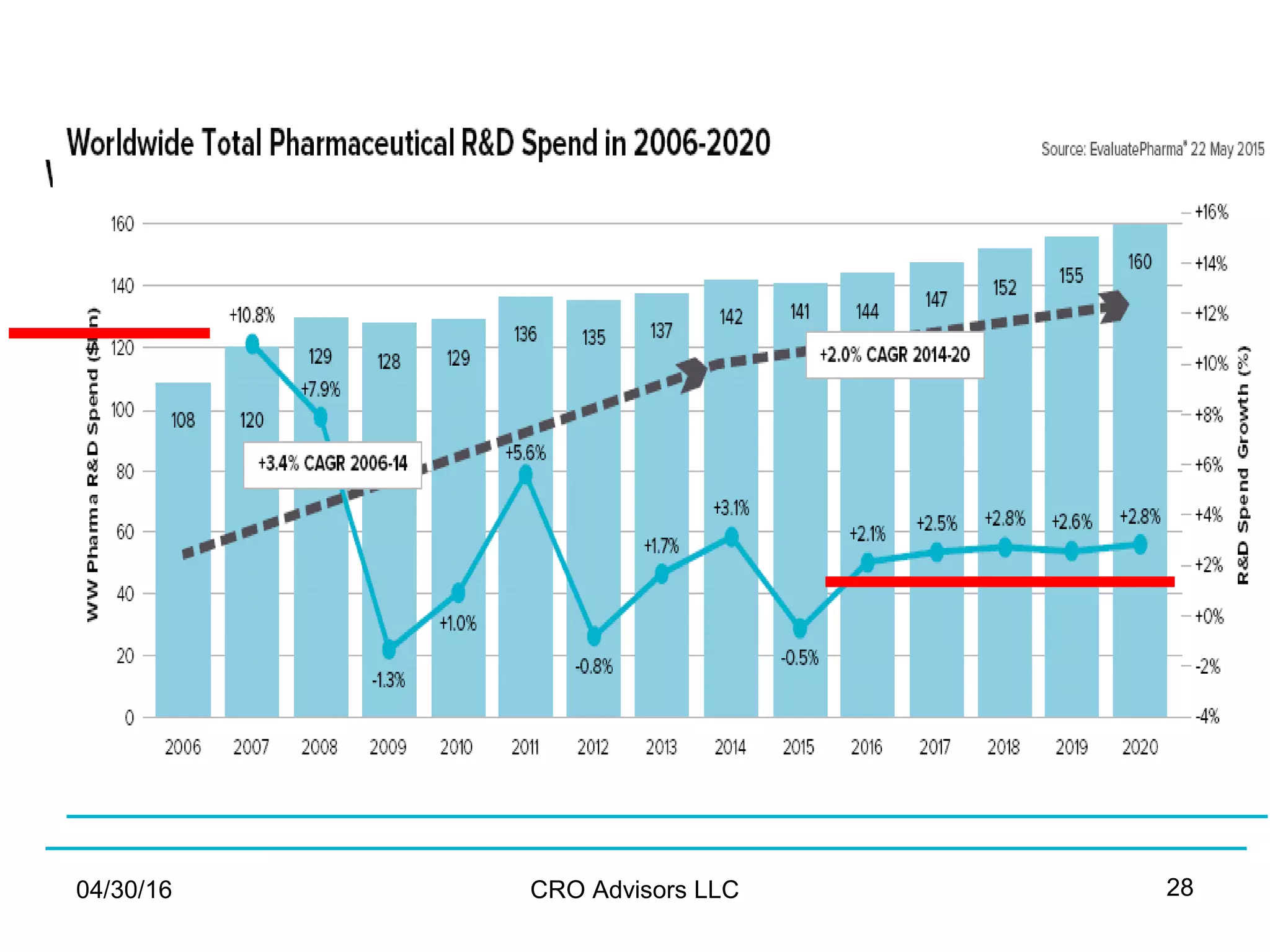

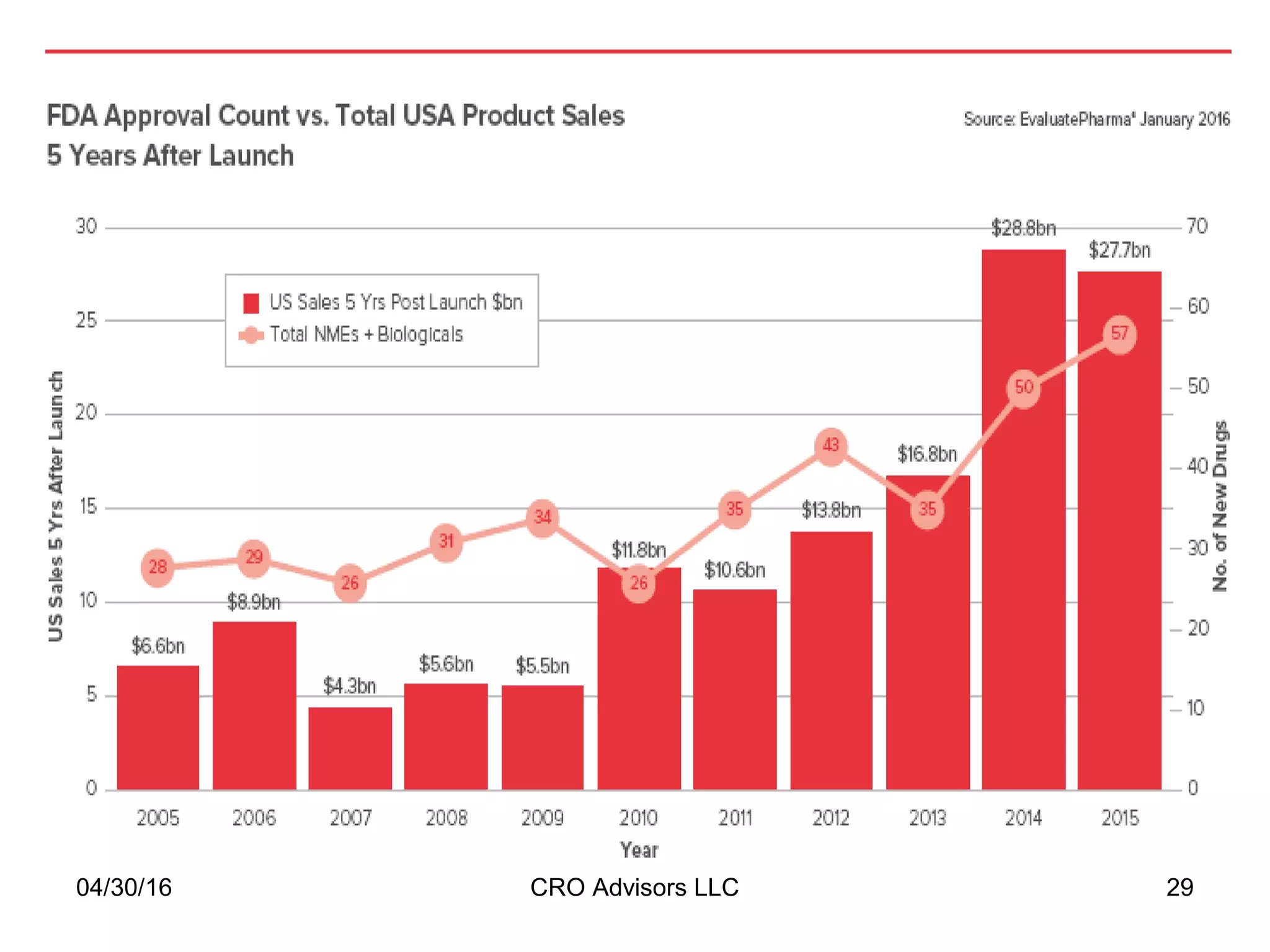

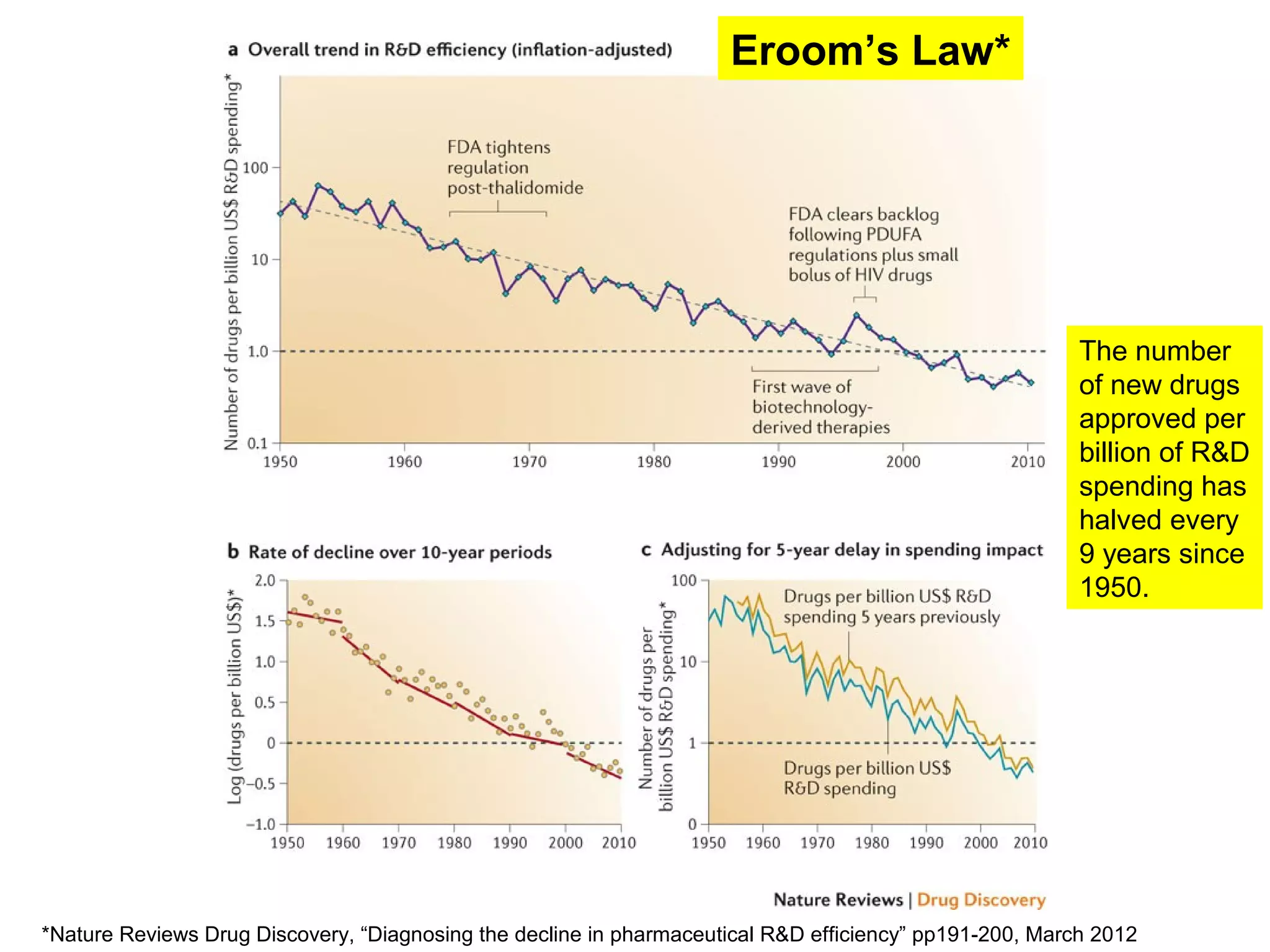

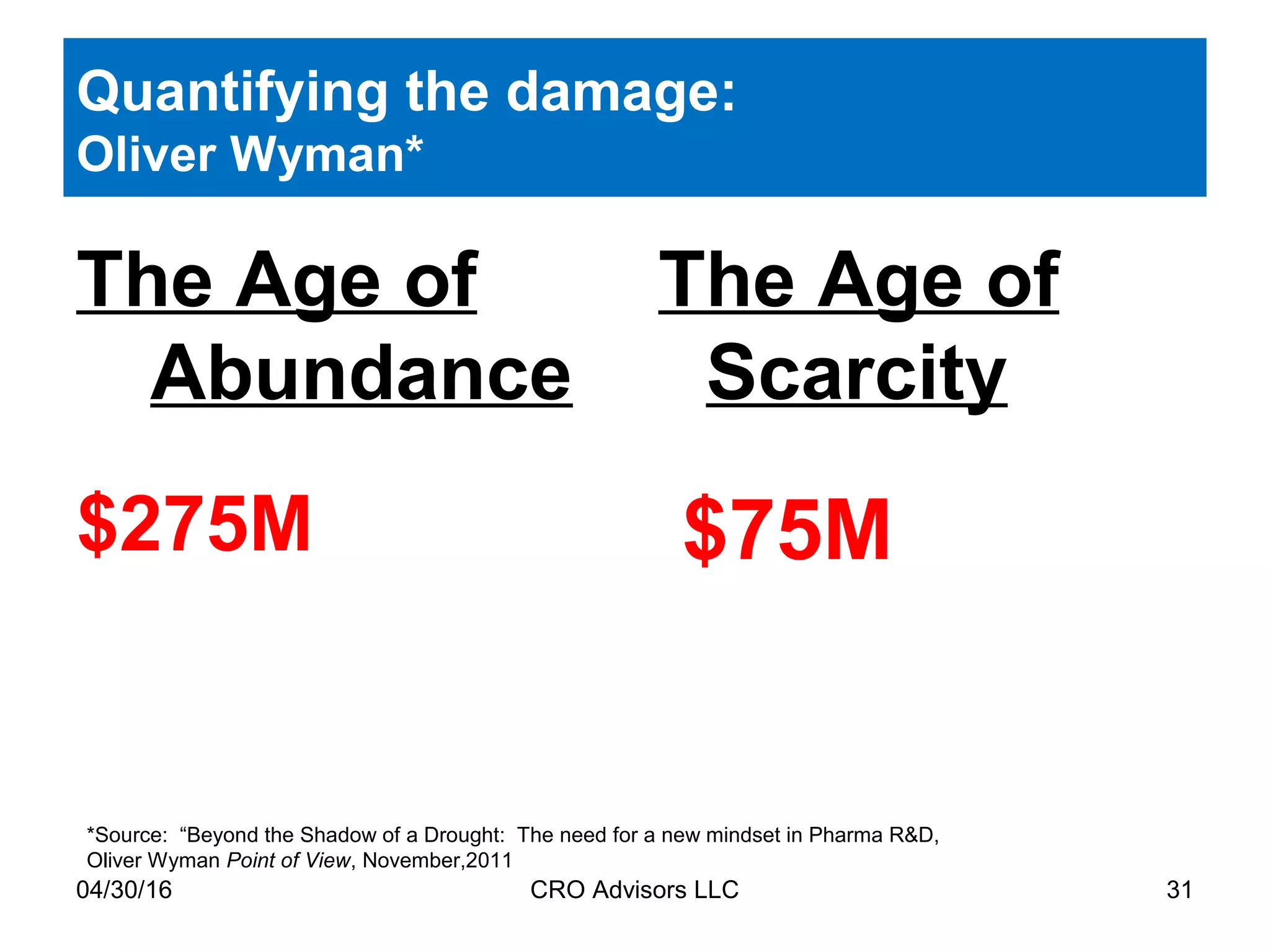

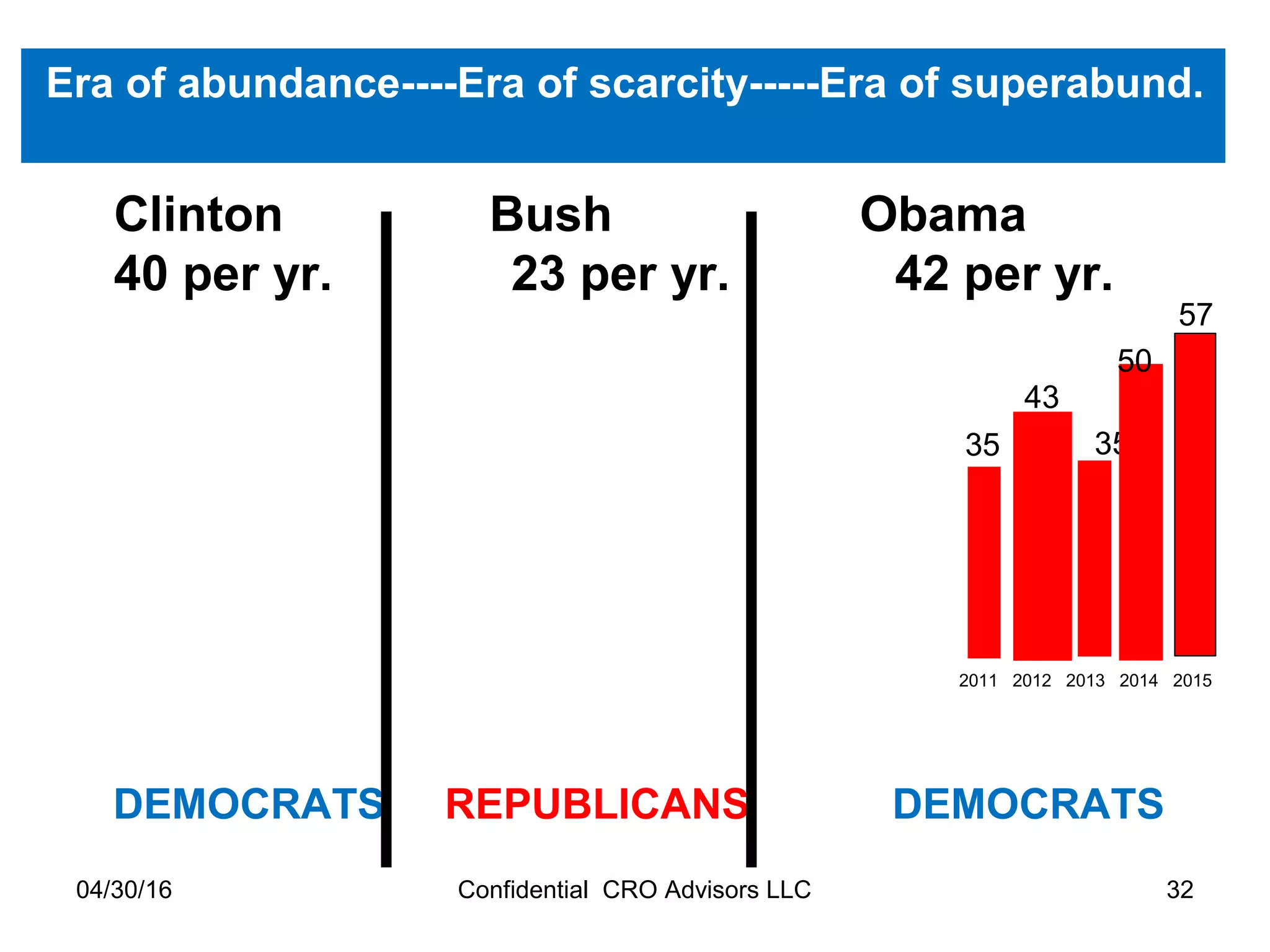

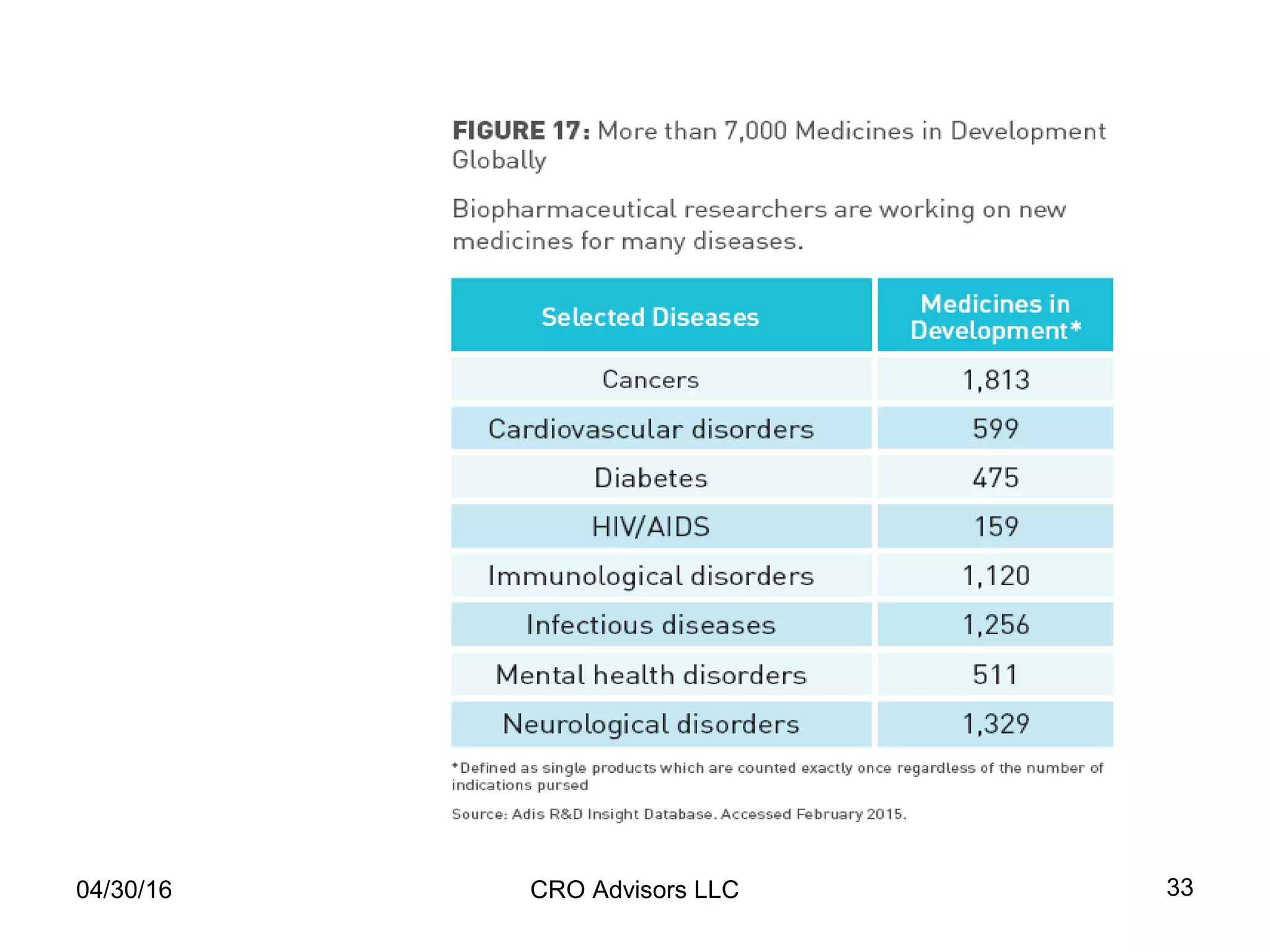

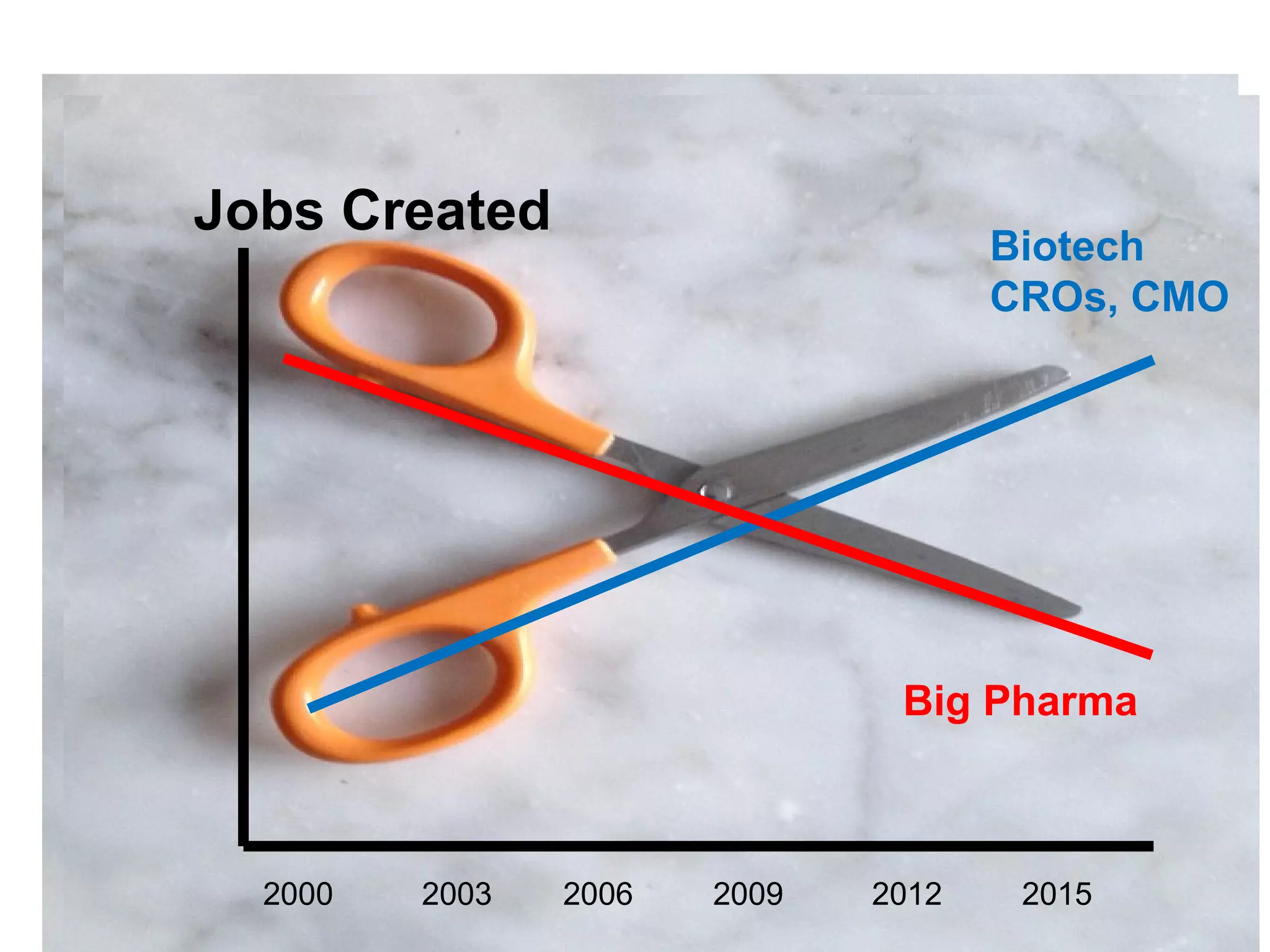

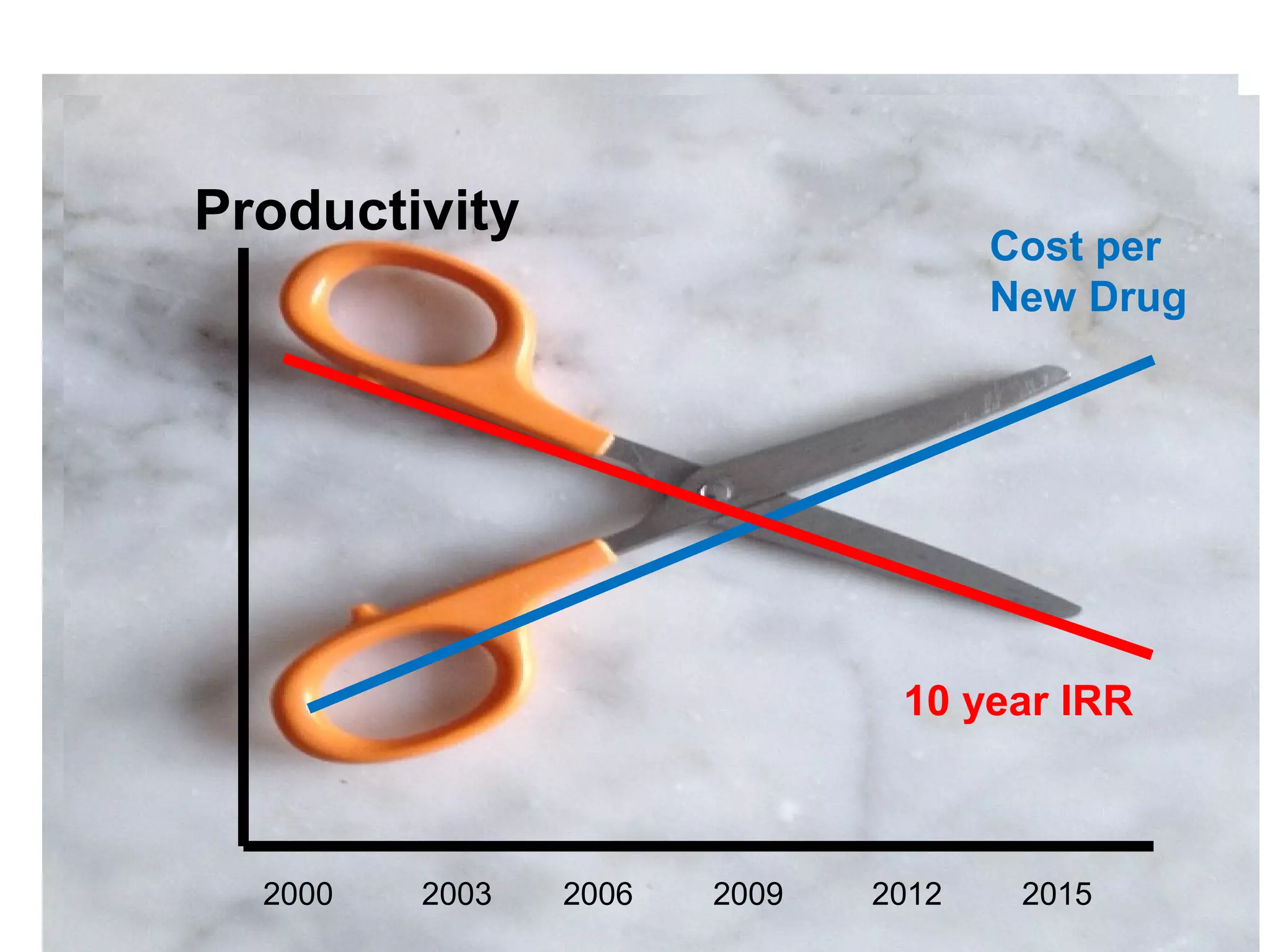

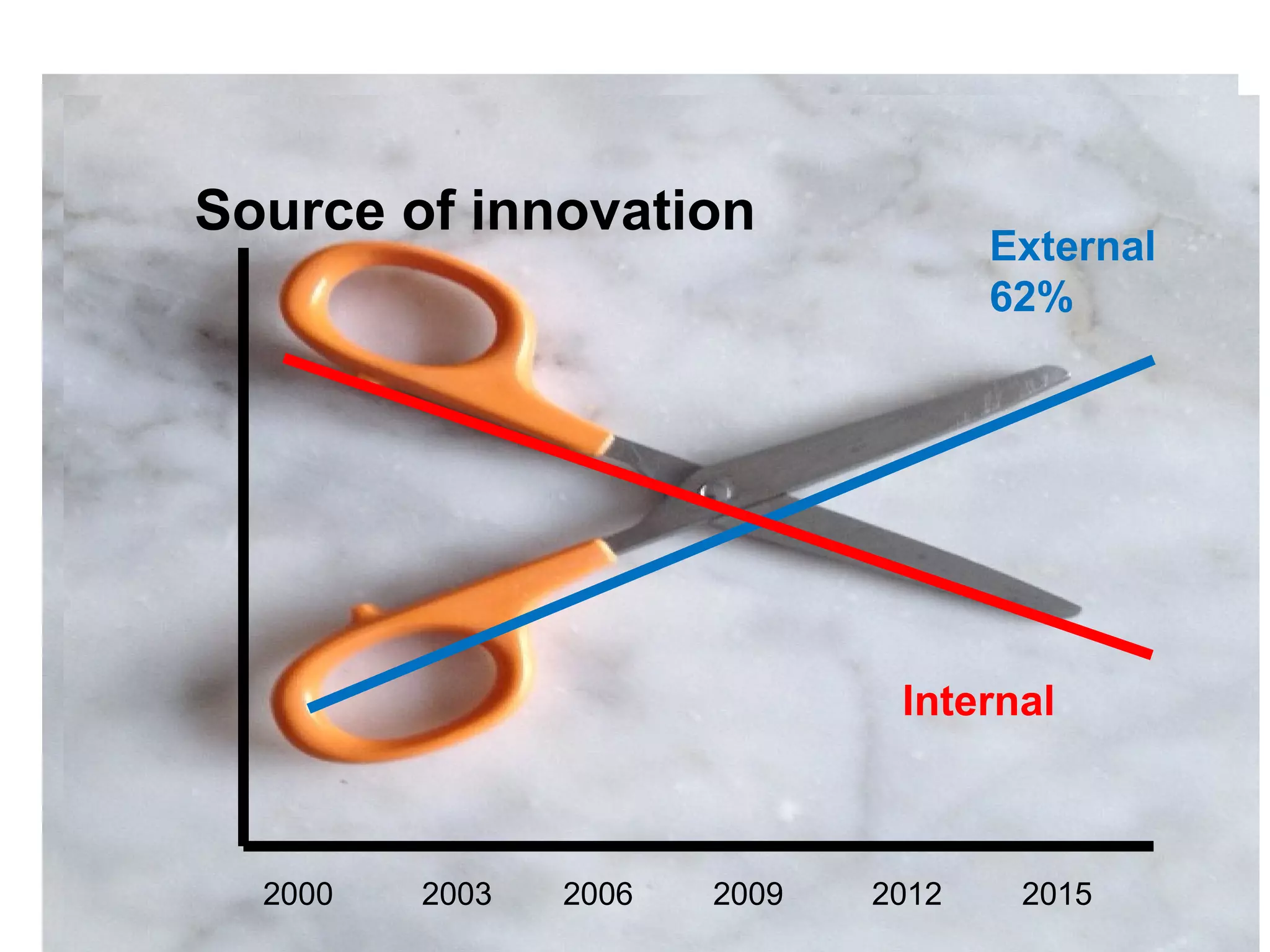

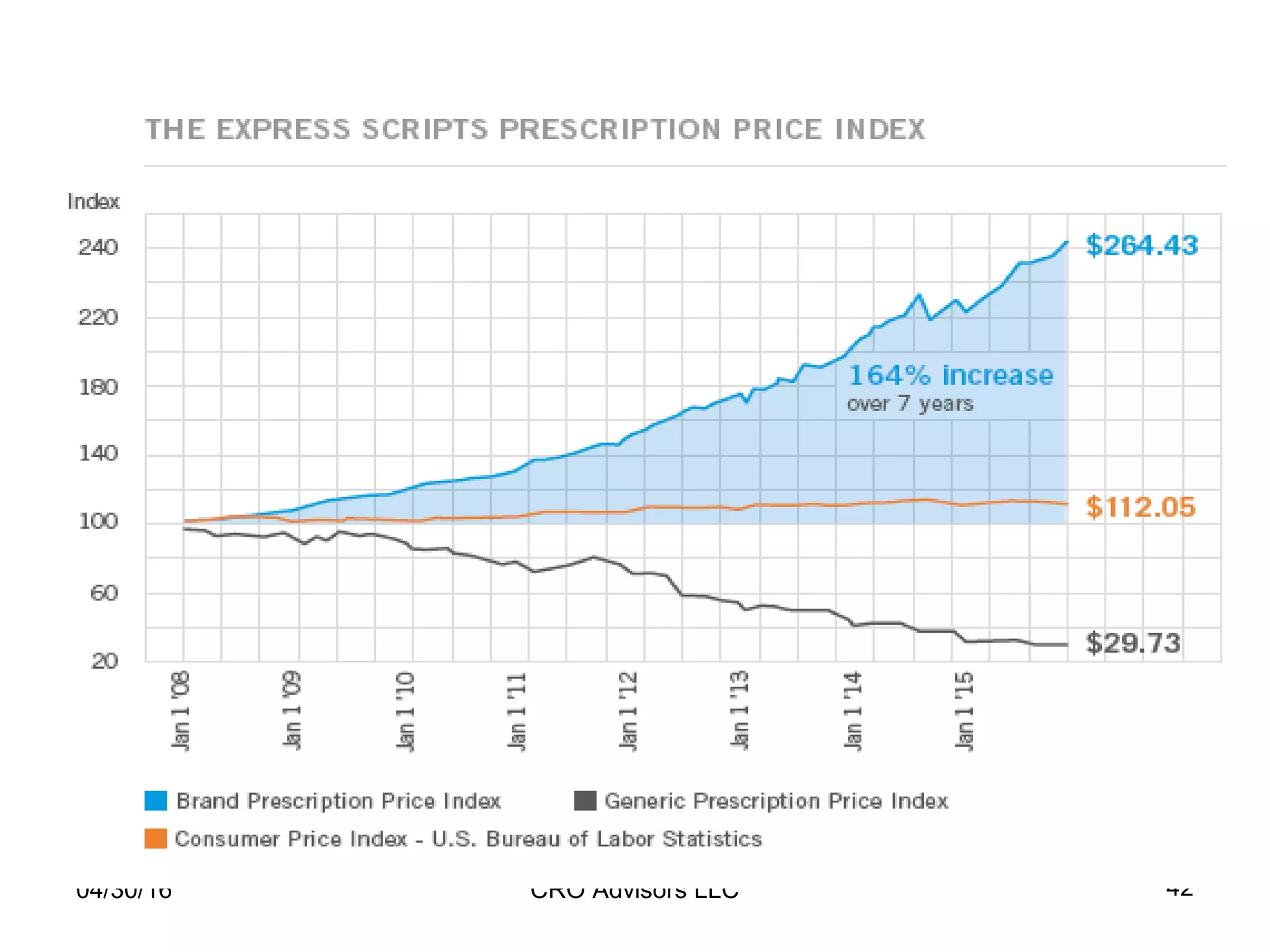

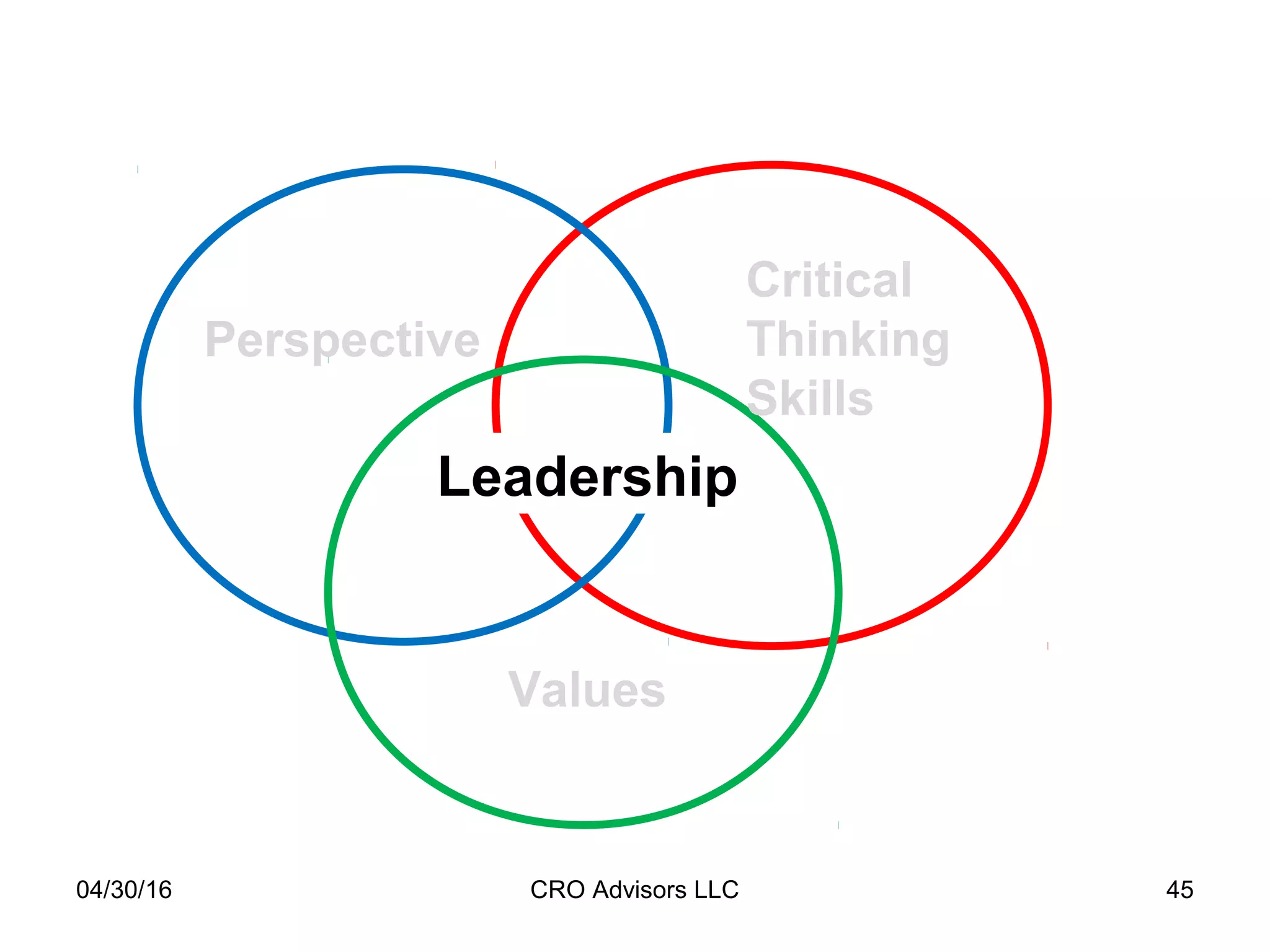

The document provides an overview of drug development, covering the entire process from discovery to post-approval, with course objectives that aim to equip participants with knowledge crucial for future contributions in the pharmaceutical industry. It highlights key challenges such as declining R&D productivity and rising specialty drug prices, alongside defining drug classifications and discussing the landscape of biotech and pharma. The course also addresses the importance of soft skills and insights necessary for effective participation in the drug industry.