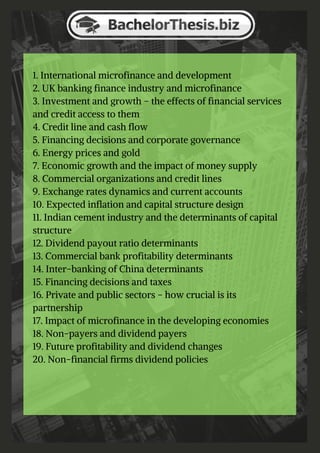

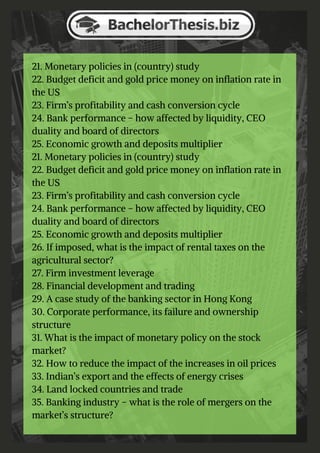

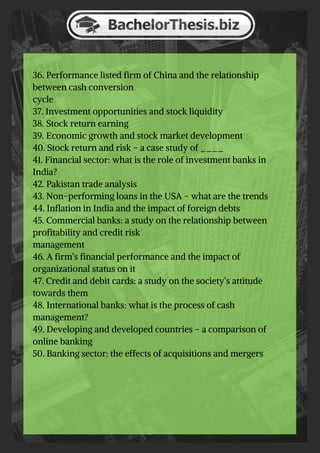

This document lists 50 potential topics for an MBA thesis in finance. The topics cover a wide range of issues related to finance including international microfinance, UK banking, investment and growth, credit lines, financing decisions, economic growth, exchange rates, inflation, capital structure, dividend payouts, bank profitability, monetary policy, and the impact of various factors on industries, economies, and financial markets.