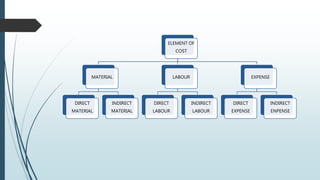

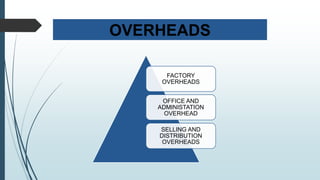

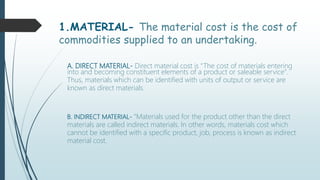

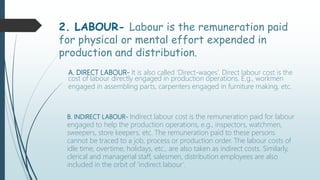

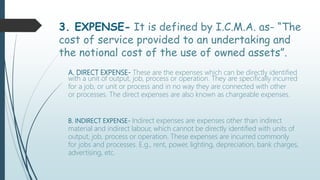

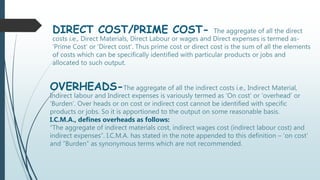

The document defines the different elements of cost, including direct and indirect materials, labor, and expenses. Direct costs can be traced to a specific product or service, while indirect costs cannot. Prime cost refers to the direct costs of materials, labor, and expenses. Overheads are the indirect costs, including indirect materials, labor, and expenses. Overheads are allocated to products and services. The document also defines different types of overheads, such as factory overhead, office and administration overhead, and selling and distribution overhead.