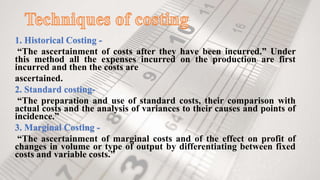

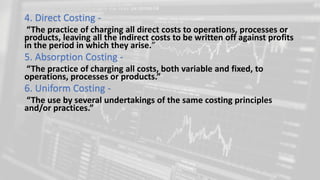

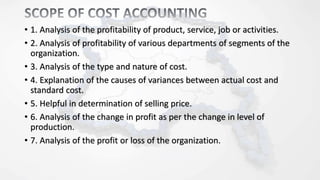

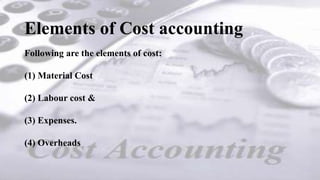

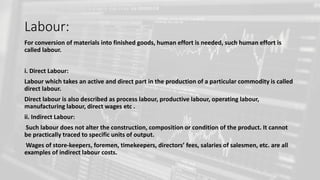

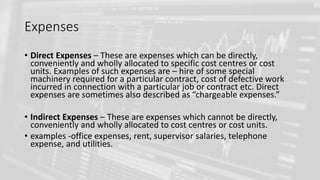

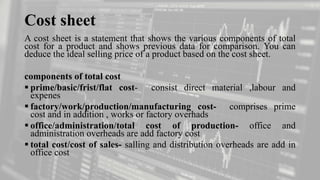

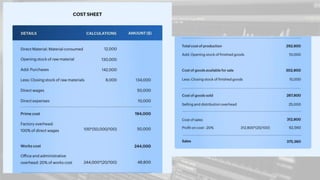

The document discusses various cost accounting methods like standard costing, marginal costing, and absorption costing that are used to record, classify, and summarize costs to determine product or service costs. It also outlines different costing techniques like job costing, process costing, and contract costing. Finally, it defines the key elements of cost accounting like direct and indirect materials, direct and indirect labor, expenses, and overheads.