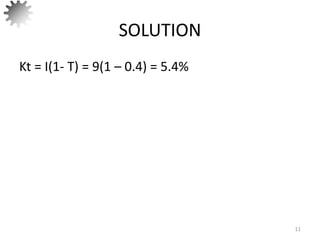

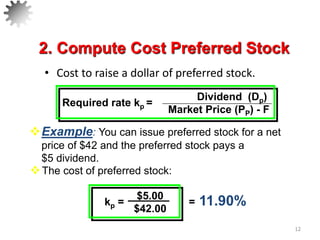

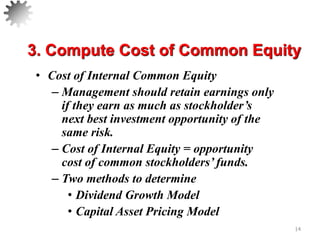

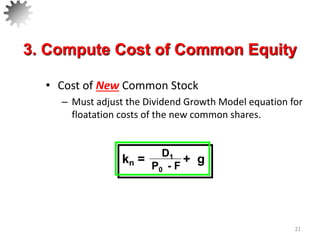

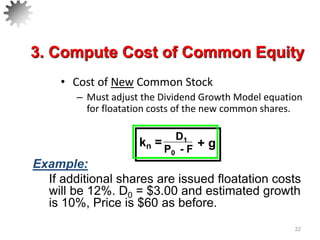

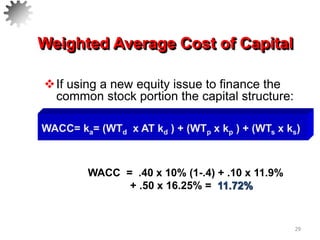

This document defines the cost of capital and how to calculate it. It explains that the cost of capital is affected by economic conditions, market factors, and financial decisions. It then provides formulas and examples for calculating the cost of different sources of capital, including debt, preferred stock, retained earnings, and new common stock. Lastly, it demonstrates how to compute the weighted average cost of capital based on a company's target capital structure.